Chapter 3 ... Problems of Timing

advertisement

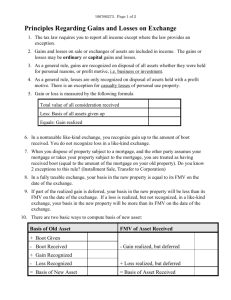

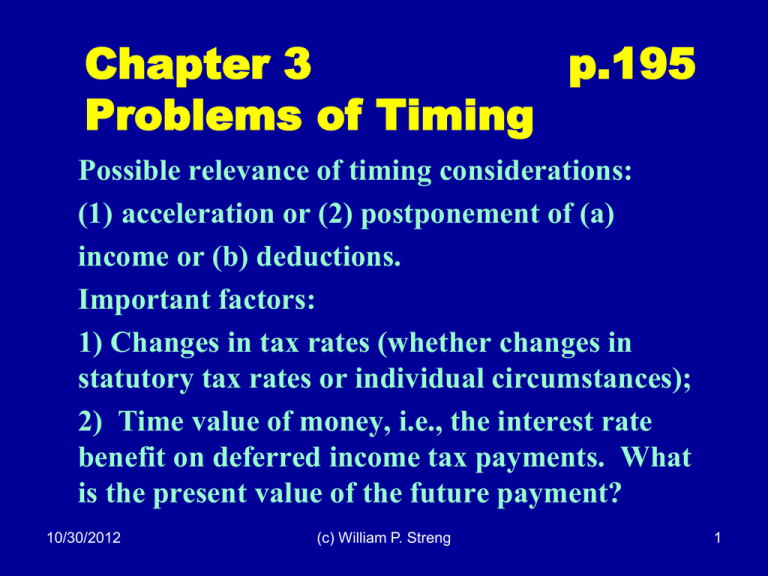

Chapter 3 p.195 Problems of Timing Possible relevance of timing considerations: (1) acceleration or (2) postponement of (a) income or (b) deductions. Important factors: 1) Changes in tax rates (whether changes in statutory tax rates or individual circumstances); 2) Time value of money, i.e., the interest rate benefit on deferred income tax payments. What is the present value of the future payment? 10/30/2012 (c) William P. Streng 1 The “Realization” Doctrine p.196 See IRC §1001(a) concerning realization required to have an income event from a property disposition transaction. I.e, more than an economic increase in the value of the property owned must occur. Cf., Haig-Simons definition of income (not necessitating a “realization” event). Does the 16th Amendment require a “realization event” for gain recognition on property? No. 10/30/2012 (c) William P. Streng 2 Eisner v. Macomber p.197 Does the 16th Amendment permit taxation of a “stock dividend” distributed by a corporation. Thus, a U.S. constitutional inquiry: Does U.S. Congress have power to require income recognition for a distributed stock distribution? After the distribution the total value of each shareholder’s shares remained unchanged. USG says GI inclusion is required to the extent of par value (not fmv) of new shares. Majority: income is “gain derived from.” cont. 10/30/2012 (c) William P. Streng 3 Eisner v. Macomber, cont. Majority opinion: Reference to the 16th Amend. Income “from whatever source derived.” A stock dividend represents a capitalization of accumulated profits. But, here nothing is received from the corp. in the manner of recognizable income. Held: 16th Amend. precludes this taxation. Dissent: This proposed taxation does not violate 16th Amendment requirements. 10/30/2012 (c) William P. Streng 4 Include in GI Unrealized Appreciation? P.205 A constitutional requirement for a realization event? Or, permit “mark to market”? See §305 re corporate stock distributions. Cf., Glenshaw Glass permitting inclusion in gross income of a “windfall.” 10/30/2012 (c) William P. Streng 5 Bruun p.208 Tenant constructs (in 1929) 50 year life building on owner’s land. Term of lease is 99 years. Tenant defaults and lease is cancelled in 1933. Did owner realize income at lease cancellation when owner has possession of the building? Held: yes, gain realized in 1933. Cf., Blatt case (p. 209): income from improvements each year of lease until expiration. 10/30/2012 (c) William P. Streng 6 Timing Choices & Leasehold Improvements 1) Time lease is agreed, with lessee promise to build improvement. 2) When building built – to extent of anticipated FMV at end of lease. 3) Each year as lease is getting shorter. 4) When lease expires (Bruun) 5) When land and building are subsequently sold. §§109 and 1019. 10/30/2012 (c) William P. Streng 7 Nonrecourse Borrowing Exceeding Basis p.212 Remember Tufts: Original nonrecourse purchase debt is included in basis. Cf., later debt incurred when borrowing exceeds tax basis for collateralized property. Woodsam Associates, p. 213: Taxpayer borrowing nonrecourse in excess of tax basis. Argues that was a gain event & basis then stepped-up – to avoid gain treated as realized on a mortgage foreclosure. Held: gain at later disposition, and not when recourse borrowing. 10/30/2012 (c) William P. Streng 8 Cottage Savings Assn.Loan Package Swap p.166 Facts: Financial institution exchanges one group of residential mortgage loans for another institution’s mortgage loan package. A swap of “participation interests” occurs. Long-term low interest existing mortgage obligations had declined in value due to a significant increase in market interest rates. Seller did not want to record losses on its “books”, i.e. for regulatory and financial accounting (i.e., shareholder) purposes. Cont. 10/30/2012 (c) William P. Streng 9 Cottage Savings Association, cont. Issue: Did a tax disposition event occur? Were the properties “materially different”? Holding: This exchange does cause losses to be realized for federal income tax purposes (even though not for regulatory purposes). Cf., Memo R-49. An exchange occurred of “materially different” properties. Cf., inclusion in gross income when based merely on property appreciation in value, i.e., an economic accretion to wealth. 10/30/2012 (c) William P. Streng 10 Cottage Savings Association, cont. Consider the IRS litigating position in Cottage Savings. What was achieved by IRS losing this case? Should the Cottage Savings tax litigation result have been controlled by the reporting for financial accounting purposes (particularly when accounting is dictated by another government agency)? Consider that this transaction was done “solely” for a tax avoidance purpose (i.e. no business purpose – except to survive with reduced tax 10/30/2012 (c) William P. Streng liability). 11 Debt Modification as a “Disposition” p.224 Is the modification of a debt a realization event? Reg. §1.1001-3 states that a “significant modification” of a debt instrument is an “exchange” for FIT purposes. Consider a change in (1) length of term, (2) interest rate, (3) another element (e.g., priority). Exception from realization treatment for a “unilateral option” or a change in an “index rate” where a variable rate obligation. 10/30/2012 (c) William P. Streng 12 Nonrecognition Treatment p.227 Code §1001(c) provides that “except as otherwise provided in this subtitle” gain or loss shall be recognized. How retain the future potential for recognition of that gain? Answer: Preservation of the unrecognized gain (or loss) in determining tax basis for replacement property. See §1031(d). Why provide for nonrecognition in certain situations? A concern about illiquidity and/or valuation? Mitigation of a “lock-in effect”? 10/30/2012 (c) William P. Streng 13 Like-Kind Exchanges p.228 Code §1031 provides that no gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment if exchanged solely for property of a like kind. But, gain recognition treatment required if “boot” is received (gain is limited to extent of boot). §1031(b). Basis is shifted to the replacement property, except a FMV basis for the boot. §1031(d). 10/30/2012 (c) William P. Streng 14 PLR 200203033 p.229 Private letter ruling request re §1031 tax free exchange eligibility for a swap of a conservation easement in Property A for a fee interest in real estate (also subject to a conservation easement). Treated as “like kind” real estate – assuming held for productive use in business or for investment. 10/30/2012 (c) William P. Streng 15 Identifying “Like Kind” Property P.232 Is like-kind treatment permitted for: 1) Different types of real estate? Cf., TICs; saleleasebacks (how long a lease?); oil and gas properties? 2) Auto/truck trade-ins? Low tax basis when prior tax depreciation; not for personal auto. 3) Professional athlete contract swaps? 4) Partnership interest swaps? See limits in §1031(a)(2). Liquid securities and inventory are not eligible. Coins? 10/30/2012 (c) William P. Streng 16 How is the Gain Potential Kept for Tax Purposes? Tax basis for the replacement property is: 1) Same as the tax basis for the property transferred; 2) Decreased by the boot received; 3) Increased by the gain recognized on the exchange. See §1031(d) providing the rules for a transferred tax basis for the replacement property. 10/30/2012 (c) William P. Streng 17 Like Kind Exchange with No “Boot” Received Example 1: Client owns property A. Exchange of Property A worth 10x, basis 4x, for like-kind property B, also fmv 10x. Taxable inclusion of 6x gain is postponed. Tax basis for the replacement property is 4x (to preserve the income tax potential on the 6x deferred gain). §1031(d). 10/30/2012 (c) William P. Streng 18 Like Kind Exchange with “Boot” Received Example 2: Client transfers Property A worth 10x (basis 4x, accrued gain 6x) for like-kind property B, fmv 8x, plus 2x cash received (“boot”) by transferor. §1031(b) - 6x gain is realized. Gain to be recognized to the extent of the 2x “boot.” Tax basis for the replacement Property B (fmv 8x) is 4x (to preserve the 4x deferred gain). Tax basis for 2x cash received is (obviously) 2x. 10/30/2012 (c) William P. Streng 19 Like Kind Exchange with “Boot” Received Example 3: Client transfers Property A worth 10x (basis 4x, accrued gain 6x) for like-kind property B, fmv 3x, plus 7x cash received (“boot”) by transferor. §1031(b) - 6x gain (not 7x cash amount) is realized and recognized. Tax basis for the replacement Property B is 3x (fmv). Tax basis for 7x cash received is (obviously) 7x. 10/30/2012 (c) William P. Streng 20 Loss - Like Kind Exchange Provision is Not Elective Example 4: Client transfers Property A worth 10x (basis 12x, accrued loss 2x) for like-kind property B, fmv 10x (same fmv). No loss can be recognized. §1031(a) . Tax basis for the replacement Property B is 12x (the 2x potential loss is retained in the replacement property for possible future loss recognition, unless subsequent appreciation occurs). 10/30/2012 (c) William P. Streng 21 Loss - Like Kind Exchange Provision is Not Elective Example 5 (boot received): Transfer of Property A worth 10x (basis 12x, accrued loss 2x) for (1) like-kind property B, fmv 8x and (2) 2x cash boot received by the “seller.” No loss can be recognized. §1031(a) . Tax basis for the replacement Property B is 10x (the basis of the transferred property, as reduced by the 2x cash); 2x potential loss is retained in replacement property (8x fmv); 2x basis for the cash received. 10/30/2012 (c) William P. Streng 22 Like Kind Exchange with “Boot” Received in Kind Example 6: Client transfers Property A worth 10x (basis 4x, accrued gain 6x) for (1) like-kind property B, fmv 8x, plus (2) other property (e.g., listed stock) worth 2x. §1031(b) - 6x gain is realized; recognition only to the extent of the boot. Tax basis for the replacement Property B is 4x (& remaining 4x gain potential). Tax basis for the other property is 2x. 10/30/2012 (c) William P. Streng 23 Like Kind Exchange & Taxpayer Adds Cash Boot Example 7: Client transfers (1) Property A worth 10x (basis 4x, accrued gain 6x) and (2) 5x cash for replacement property B with a 15x fmv. §1031(a) - 6x gain is realized; no gain recognition is required. Tax basis for the replacement Property B (fmv 15x) is 9x (4x old basis plus 5x new cash paid to other party). 10/30/2012 (c) William P. Streng 24 Multiparty Transactions p.234 How arrange a tax-free swap when only one party wants a tax-free swap? Consider a three-party (or more) transaction. Consider the potential applicability of the federal income tax doctrine of “substance over form.” What other possibilities exist for intermediaries (e.g., exchange agents)? 10/30/2012 (c) William P. Streng 25 Like-Kind Exchange Deferred Property Receipt “Starker” exchange – p. 237. Delayed receipt of the exchange property – by relying on the creditworthiness of the other exchanging party. Does this qualify as a §1031 exchange (when initially receiving a promise)? See §1031(c) specifying 45 day (identification) and 180 day (completion) limitations. What if an interest charge equivalent is credited to the replacement property purchase? 10/30/2012 (c) William P. Streng 26 Involuntary Conversion Gains & &1033 Deferral P.232. Postponement of realized gain occurs if: 1) A gain is derived from an involuntary conversion, e.g., theft, casualty, seizure, or eminent domain (or a taking “threat”?). Consider: proceeds received from insurance. 2) An acquisition occurs within the required time period (before the close of the 2nd taxable year of gain) of a replacement property “similar or related in service or use.” Cf., the more expansive §1031 “like kind” property concept. 10/30/2012 (c) William P. Streng 27 §1033 Example: Business Property Destroyed Building destroyed by fire is business property. Taxpayer receives 350x insurance proceeds; 200x tax basis for the old property and 325x reinvestment in the replacement property. Under §1033(a)(2)(A) the 150x of realized gain is included in GI only to the extent of 25x (350x insurance proceeds less the 325x reinvestment). The 125x of unrecognized gain reduces the tax basis for the replacement property to 200x. Unrecognized gain is preserved for the future 10/30/2012 (c) William P. Streng with this tax basis adjustment. 28 Corporate Transaction Nonrecog. Rules p.238 Note §1001(c). Consider the formation of a corporation (a separate taxable entity): 1) Transfer occurs of appreciated assets into corporation in exchange for stock of corp. Gain recognition required? §351. 2) §1032 – corporation does not recognize gain on exchange of shares for shareholder’s assets. 3) What about multiple individuals contributing various assets (e.g., traded shares) to a corporate investment fund? Cont. 10/30/2012 (c) William P. Streng 29 Corporate Transaction Nonrecog. Rules cont. 4) What tax basis to the shareholder for stock received? See §358 re substituted basis. 5) What tax basis to the corporation for the assets received from the shareholder? §362(a) . Consider the effect of two levels of gain now. 6) Property subject to debt is transferred to corporation in §351 transaction. See §357(c) for gain recognized when liabilities exceed tax basis. 7) What if services are rendered to the corp. in exchange for shares? Percentage limit? 10/30/2012 (c) William P. Streng 30 Tax-free Reorganizations p.240 1) Change place of corp. organization from California to Delaware. Why? How? Taxable? Nonrecognition occurs and substituted tax basis applies for the replacement shares. 2) What if a merger occurs of A corp into B corp and the A shareholders receive shares of B Corp.? Is gain recognition required to A shareholders? Not if a tax-free reorganization. See §§354 and 368. 10/30/2012 (c) William P. Streng 31 Deemed Realization – Constructive Sales P.241 How to (1) raise cash, (2) protect against downside, and (3) postpone tax realization? E.g., “sale against the box” – sell borrowed shares (possible?) - assuming the loan of the borrowed shares can be subsequently closed (e.g., when appreciation has disappeared with a §1014 tax basis step-up at death). §1259 – gain is to be recognized on a constructive sale of an “appreciated financial position.” Similar- futures or forward contracts. 10/30/2012 (c) William P. Streng 32 Original Issue Discount P.245 Debt instrument does not provide for (1) any current interest or (2) adequate (i.e., market) interest. Then, interest income must be accrued – whether for a cash basis or an accrual basis taxpayer, i.e., treated as “original issue discount” (or “OID”, the unstated interest). OID is the difference between the (1) issue price and (2) the redemption price. §1273. Tax policy objective: To avoid interest income postponement while enabling a current interest expense deduction (c) (for an accrual basis obligor). 10/30/2012 William P. Streng 33 Debt Obligation Issued for Property p.246 No a readily determinable issue price. Therefore, apply a discount (interest) rate to the anticipated payments. What is the appropriate interest rate for this purpose? – the “applicable federal rate” (AFR). What is the present value of the imputed principal amount – based on the current AFR? Any difference will be OID – to be reported on a current basis (though not actually received). See Table, p. 247. (c) William P. Streng 10/30/2012 34 Maturity of the OID Obligation What is the tax treatment on the receipt of proceeds of the OID obligation at the time of its maturity? Capital gain? However, all OID has previously been included in gross income, and this inclusion enables an addition to the tax basis of the debt instrument. At maturity the basis and the proceeds are the same – producing no realized gain. Before the OID rules: treat all this gain as capital gain when the obligation matures and is then paid. 10/30/2012 (c) William P. Streng 35 Market Discount p.248 Borrower issues debt at a 5% market rate (e.g., receives 100x par value at time of issuance). Interest rate in the market then increases (e.g., to 8%) and 100x obligation declines to 70x fmv. Purchaser then acquires this discounted obligation for 70x and receives (1) the 5% interest (current income) and (2) 30x profit when the debt instrument matures. How treat the 30x? §§1276 and 1278 specify this gain is ordinary income – but not until the debt 10/30/2012 (c) William P. Streng proceeds are actually received. 36 Exceptions to the OID Rules P.248. Sale for deferred payment(s) of a principal residence or farm for less than $1 million (e.g., for a principal amount without any interest). See §483 – providing for the treatment of the discount portion (1) as interest income (and not as capital gain), but (2) only when the payment is received, i.e., a recharacterization rule, but not a timing acceleration rule for the cash basis seller. 10/30/2012 (c) William P. Streng 37 Open Transactions Burnet v. Logan p.249 Transfer of corporate shares in exchange for (1) cash and (2) a promise of future payments (iron ore royalties). Was the contract to be currently valued (discounted cash flow) and treated as received currently by the owner? IRS claims a “closed transaction,” with tax basis to be recovered in the future. Held: Open (not closed) transaction treatment; no current value for the promise of future payments. Entitled to return of all capital first. 10/30/2012 (c) William P. Streng 38 Open Transactions, cont. p.251 Possible approaches to the timing of gain recognition when a promise/contract (not a promissory note) is received: 1) Open transaction – all payments are tax basis components until full basis recovery. 2) Value the stream of expected payments as of date of sale. Compare this amount with basis. 3) Open transaction, but allocate basis to each expected payment (i.e., an installment method). 10/30/2012 (c) William P. Streng 39 Open Transaction Treatment p.252 Is available only in “rare and extraordinary circumstances.” Reg. §1.1001-1(a). See Warren Jones case, p. 252: Limited cash and a 133x contract received (fmv 77x). Fair market value is treated as GI when received. Why wanting “open transaction” treatment? 1) Postpone inclusion in gross income. 2) All proceeds treated as capital (gains) while the transaction is “open.” No receipts are considered as being interest income. 10/30/2012 (c) William P. Streng 40 Installment Method §§453, 453A, 453B p.254 Objective: coordinate income tax reporting with the taxpayer’s actual receipt of cash. Assuming no OID or unstated interest (§483): What is the ratio of (1) gain to (2) the total expected payments? Apply that ratio to each payment to determine the amount of gain embedded in each payment. §453(c). Alternative: Elect out of §453 treatment for closed transaction treatment, unless (unlikely) possible open transaction treatment is available. 10/30/2012 (c) William P. Streng 41 Second Disposition by Related Person p.255 §453(e) provides if (1) 1st disposition of property is to a “related person,” and (2) 2nd disposition is by the related person to another before all installments are paid on disposition One, then the 1st disposition is treated as closed when the related person sells. E.g., 1st sale on installment basis to related person and 2nd sale for cash, related person can not hold cash pending installment payments with deferral to 1st seller. 10/30/2012 (c) William P. Streng 42 Planning Around §453(e) p.255 How avoid this “second disposition by related person” rule of §453(e)? Transfer to a person other than a “related person”? Who is a related person? See §453(f) re crossreference to §318(a) or §267(b) related party definitions. Does not include (1) a nephew or niece, or (2) same-sex relationship person (whether marriage or otherwise). See DOMA which precludes latter as a defined relationship. Then, a form over substance argument by IRS? 10/30/2012 (c) William P. Streng 43 Limitations on Installment Sales Eligibility See §§453(b)(2) and (k). Installment sales provision is not available for (1) inventory sales or (2) sales of publicly traded securities. See §453A – interest charge is applicable if aggregate obligations from $150,000 plus sales exceed $5 million. §453A(d) – a loan is treated as payment if the obligation is pledged for a bank loan. §453(i) – no deferral for installment obligation when “recapture of depreciation” income arises. 10/30/2012 (c) William P. Streng 44 Additional Limitations on §453 Eligibility p.256 No §453 eligibility where payment in the sale is made by buyer with (1) demand notes or (2) publicly traded debt obligations. But, no limitation applies where (1) the debt is guaranteed, §453(f)(3), or (2) a bank guarantee with a “standby letter of credit” is provided by the buyer to seller. Reg. §15a.453-1(b)(3)(iii) 10/30/2012 (c) William P. Streng 45 Sales with Contingent Payments p.256 What if the amount of the payments is actually contingent? Note Burnet v. Logan. Apply §453 in this order: 1) Allocate basis over the maximum to be paid. 2) Allocate tax basis over the maximum payment period. 3) Allocate tax basis in equal annual amounts over a 15 year period. 10/30/2012 (c) William P. Streng 46 Constructive Receipt Doctrine p.256 Cash taxpayers include an item in income when actually or constructively received. See Reg. §1.451-2(a) re constructive receipt, i.e., when set aside or otherwise made available. See Amend case, p. 257. Cash basis taxpayer. Deal to deliver grain under an agreement to get payment in the subsequent year. No constructive receipt. A bona fide deal. No right to currently demand the funds & no GI inclusion currently.(c) William P. Streng 10/30/2012 47 Pulsifer v. Commr. P.262 Minors win Irish Sweepstakes but not entitled to current funds until (1) becoming of majority or (3) court approval for funds release. Held: Winnings are to be included in GI for the year of the award, and not for the subsequent year when actually retrieved. The funds were irrevocably assigned for benefit of minors and only need apply for the funds. “Economic benefit” occurred in the earlier year. 10/30/2012 (c) William P. Streng 48 Non-Qualified Deferred Compensation p.263 See Rev. Rul. 60-31 identifying “non-qualified” compensation whose income is deferred for tax recognition in a future year. Cf., a “qualified” deferred compensation plan. No monetary limit on the deferrable amount. Must have a “cash method” taxpayer who receives a mere “promise to pay.” Immediate income recognition if the funds are paid into an escrow account for the employee (i.e., funds are not controlled by the employer). 10/30/2012 (c) William P. Streng 49 Minor v. U.S. p.264 Contributions made to a deferred compensation plan held not currently includible in GI. Supplemental agreement with employer that compensation for future services paid to a trust & retirement annuity policies to be purchased. Does “economic benefit” rule require inclusion? - “Constructive receipt” doctrine not applicable. - Economic benefit? Not here; assets remain subject to the employer’s creditors; & risk of forfeiture arises with non-compete requirement. 10/30/2012 (c) William P. Streng 50 Deferred Compensation Tax Issues p.268 - When can an employer deduct future payment to be made? Only in the future when paid, even though an accrual basis taxpayer. §404(a)(5). - §457 – dollar limitations on plans of state agencies; payor is not subject to tax. - §403(b) – Tax-exempt charities and public educational agencies have limitations. - §409A – taxpayer employer; no employee deferral if election exists to accelerate benefitseven though based on an external condition. 10/30/2012 (c) William P. Streng 51 Qualified Pension/Profit Sharing Plans p.270 Personnel objectives: Enable employee loyalty and employee incentives (including investing in the employer’s stock; cf., Enron Corp.). Defined benefit (DB) plan: employer agrees to pay fixed retirement benefits based, e.g., on (1) years of service and (2) final pay amount. Defined contribution (DC) plan: amount contributed based on formula (e.g., 5% of current compensation) and the amount paid on retirement is based on investment returns. 10/30/2012 (c) William P. Streng continued 52 Qualified Pension/Profit Sharing Plans p.270 Qualified plan income tax results: 1) Employer deduction for plan contributions. 2) No current GI to the employee-participant; GI inclusion upon later distribution to retiree. 3) No GI for investment returns received by the intermediary holding entity (e.g., trust). 4) Non-tax benefit – funds are protected from employer’s financial risks (although possible actuarial underfunding for DB plans). Cont. 10/30/2012 (c) William P. Streng 53 Qualified Pension/Profit Sharing Plans p.273 Limitations on qualified plan structuring: 1) Non-discrimination rules – can not favor highly-paid employees (but social security integration). 2) Vesting – benefit becomes nonforfeitable; cf., effect of termination before retirement. 3) Funding – infusion of contributions into a separate trust enables security of funds. 4) Limits on contributions made by employer. 10/30/2012 (c) William P. Streng 54 Special Retirement Plan Structures p.273-4 - Self-employed persons – use a Keogh plan when only one (or several) employees. - But, other mechanisms for corporate plans? - IRAs – individual retirement accounts – e.g., when employer not providing benefits. §408. - Roth IRA –nondeductible contributions, but non-inclusion for accruals and distributions. Note: (1) Penalties for early withdrawals, & (2) Required minimum distributions (70 ½). 10/30/2012 (c) William P. Streng - 55 Stock Options & Restricted Property P.275 What is a stock option? Right to buy stock (employer’s common stock?) at a specified price during a defined period of time. Compensation –as additional work inducement. Should the issuance of an option to purchase employer’s stock (or other property) constitute employment income when issued to an employee? Yes, benefit derived for rendered services. See LoBue, p. 276. 10/30/2012 (c) William P. Streng 56 Options – Timing & Characterization Issues Option One: 1) Employee includes value of option in GI in the year of grant of the option. 2) Employer deducts that amount as compensation in year of grant. 3) Later, employee increases tax basis for shares when exercising option at option price. 4) Employee has capital gain when subsequently selling shares at price above tax basis. 10/30/2012 (c) William P. Streng 57 Options – Timing & Characterization Issues Option Two: 1) Employee includes nothing in GI in the year of grant of the option. Possible forfeiture? 2) Employer deducts nothing as compensation in year of grant but later when exercise. 3) Later employee exercises & compensation income for FMV of stock less option price. 4) Employee has capital gain when subsequently selling shares at price above tax basis. 10/30/2012 (c) William P. Streng 58 Options – Timing & Characterization Issues Option Three: 1) Employee includes nothing in GI in the year of grant of the option. Possible forfeiture? 2) Employer deducts nothing as compensation in year of grant but later when exercise. 3) Employee exercises but no compensation income (for FMV of stock less option price). 4) Employee has capital gain when subsequently selling shares at price above tax basis (and no compensation income). 10/30/2012 (c) William P. Streng 59 Incentive Stock Option (ISO) Rules §422 P.278 Statutory structure permitting GI inclusion limited to capital gain upon sale of stock. What is ISO stock? See §422 rules: 1) Stock retention requirements. 2) Option price at FMV when granted. 3) Granted under an option plan. 4) $100,000 limit on option stock amount. 5) No employer deduction for compensation. Net benefit if employer loses immediate deduction but deferral ofP. Cap. 10/30/2012 (c) William Streng Gain for EE? 60 Nonstatutory Stock Options p.280 Stock is available to employee but is subject to restrictions on transferability and a risk of forfeiture. No inclusion since a valuation issue? Note §83(a) – inclusion in GI when stock option is issued if a “readily ascertainable” FMV. No current inclusion when option is “nontransferable” and a “substantial risk of forfeiture” – inclusion when conditions lapse. GI inclusion when exercise for the difference between exercise price and stock value. 10/30/2012 (c) William P. Streng 61 Election to Accelerate Inclusion re NSO p.281 §83(b) – employee can elect current inclusion (even if forfeiture risk) to extent of FMV. GI inclusion based on value of stock without restrictions. No tax deduction by employee who made a §83(b) election if forfeiture of the option subsequently occurs. 10/30/2012 (c) William P. Streng 62 Cramer p.283 Options provided to acquire non-publicly traded stock. Vesting and transfer restrictions applied to induce continued employment. §83(b) elections filed to include value at grant as ordinary income & to enable future capital gains. Elections reported fmv at grant as zero. Reported option gain as LTCG & high basis. But, upholding Reg. §1.83-7(b)(2) (& no ascertainable FMV & therefore ordinary income). Plus, serious penalties are applicable. 10/30/2012 (c) William P. Streng 63 Transfers Incident to Marriage & Divorce p.290 1) Should transfers of property (including cash) from one divorced spouse to another cause realized ordinary income to the transferee? 2) Should such a transfer enable a tax deduction to the transferor (particularly if sourced from transferor’s current income stream)? 3) Should a transfer of appreciated property from one spouse to another be treated as (a) a sale of property and (b) the transfer of proceeds to the other spouse (with a §1012 tax basis)? 10/30/2012 (c) William P. Streng 64 Davis p.291 Transfers in Divorce The property transfer to an ex-spouse of appreciated property in the divorce context (in exchange for a release) is a gain recognition event to the property transferor – since a “sale or exchange.” How value the transaction? Are rights given up equal to property transferred? What is the income tax treatment to the other party who is acquiring the property? What tax basis for that property to transferee? What did that person transfer in the exchange? 10/30/2012 (c) William P. Streng 65 Code §1041 p.295 §1041 provides for (1) no recognition to the transferor on a property transfer in divorce; and (2) a transferred tax basis for the property when held by the recipient. Further, no deduction is available for the property transfer to the other (ex)spouse. Limits on §1041 – see Rev. Rul. 87-112 re no tax-free transfer of accrued interest income. Does the Davis case survive the enactment of §1041? 10/30/2012 (c) William P. Streng 66 Property Transfers – Example H and W together own investment property: 1) W receives Property One – 90x tax basis and 100x fair market value. 2) H receives Property Two – 110x tax basis and 100x fair market value (depreciated). Equal property division on a pre-tax basis (but not on an after-tax basis). What happens when they sell these properties? Consider the impact of §1041. 10/30/2012 (c) William P. Streng 67 Farid es Sultaneh p.296 He transferred appreciated shares to her in contemplation of marriage. An antenuptial agreement concluded for gift (after the stock transfer) where she released (any) dower rights. What tax basis when she sells (for $19) shares transferred to her? 15 cents or $10 per share? Held: She took the shares as a purchaser. What did she sell? Gain to her? What did he sell? Gain to him? Dissent: He was married to another when gift. 10/30/2012 (c) William P. Streng 68 Alimony & Child Support p.300 Certain payments (alimony) after divorce: - Income to recipient (§71(a)), and, -Deduction to payor spouse (§215), “above the line” (§62(a)(10)). A federal definition of alimony applies to determine whether the payment constitutes gross income. No deduction to payor parent for child support payments made to the other ex-spouse. 10/30/2012 (c) William P. Streng 69 Alimony Requirements §71(b) p.300 1) Cash payments (not property transfers). 2) Termination of this obligation occurs at the death of the payee spouse. §71(b)(1)(D). 3) No excessive front-loading. §71(f). P.301. 4) No disguised child support. §71(c). Note “deadbeat dad” treatment. §71(c)(3). 5) Parties are not living in the same household. §71(b)(1)(c). Under §71(b)(1)(B) parties can opt out of alimony tax status (c) (and 10/30/2012 Williamagree P. Streng on no deduction). 70 Indirect Alimony Payments H pays (in cash): (1) her mortgage payments on her residence (paid directly to the lender bank); and (2) Premiums on a life insurance policy on his life (paid to the insurer) & she owns the policy. Result: Taxable alimony to her if she owns (1) the house and/or (2) the life insurance policy, even though she does not receive the funds. Remember the Old Colony Trust Co. case. 10/30/2012 (c) William P. Streng 71 Child Support Obligations P.304 Child support is (1) not deductible by the payor and (2) not gross income to payee (custodian?). Diez-Arguelles v. Commr., p.304. Failure to pay child support and here custodial parent deducts amount as nonbusiness bad debt Held: No tax basis for the bad debt (§166(b)) and no tax deduction to the payor. But, was an indirect loan made to the obligor parent when the custodian pays child expenses and a bad debt occurs when no reimbursement? 10/30/2012 (c) William P. Streng 72 Consumption Tax p.308 Should a “consumption tax” be implemented as an alternative to the current income tax? What is a consumption tax? I.e., taxation only on consumption but a deduction is permitted for income from savings. The income tax is between a wealth tax and a consumption tax. How determine the consumption tax base? Income plus borrowings less savings (zero basis) equals the consumed amount tax base times the applicable tax rate. 10/30/2012 (c) William P. Streng 73 Value Added Tax p.310 A transactions tax similar to a retail sales tax, but imposed on the national level (in all OECD countries except U.S.). Cf., wealth tax VAT applies at each stage of production, with an immediate credit for the VAT taxes previously paid in the chain of supply as attributable to the manufacturing of that specific item. 10/30/2012 (c) William P. Streng 74 Accrual Method Taxpayers p.312 Fundamentals of the accrual method of accounting: 1) Income inclusion for amounts earned (even though not received); and, 2) Deduction for obligations incurred, even though not paid. However, federal income tax exceptions: (1) not permitting deferral of prepaid income or (2) no accrual of estimated future expenses. 10/30/2012 (c) William P. Streng 75 Delay in the Receipt of Cash p.313 Georgia School Book Depository case – p. 313. Accrual basis taxpayer: Should school book royalties be accrued when books are sold? Is expectation reasonable that claims would be paid? Here, current fund insufficient to pay bill. But, all duties were performed for the accrual of income. And, payment would eventually occur from the collection of the beer excise tax. No serious doubt as to ultimate collection and the sales commission should have been accrued. 10/30/2012 (c) William P. Streng 76 Hallmark Cards case p. 316 (note) Hallmark cards – shipped Valentine cards to retailers in December, but retailers did not want ownership on 12-31 for personal property tax purposes. Then, Hallmark retained title until January 1. Hallmark’s income was permitted to be accrued in the subsequent year when tile passed to the retailer and all events occurred when title passed. 10/30/2012 (c) William P. Streng 77 Prepaid Income p.316 American Automobile Association – p. 317 One year membership fee paid in advance. When earned by AAA? Ratable allocation to each month (& partial deferral to next year). IRS says immediate accrual to gross income. Ratable reporting was not permitted. What if proof of delivery of services is provided? What if the method is consistent with GAAP? What effect of repeal of §452 and §462? & §455? 10/30/2012 William P. expenses? Streng Cf., dissent: What(c)about 78 Subsequent Prepaid Income Cases p.321 Schlude (Sup. Ct., p.321): prepaid dance lessons; inclusion at time of receipt of payment. Artnell (7th Cir.) – deferral until games played. Boise Cascade (Ct. Cl.) – consistently reporting income when services rendered (not requiring any earlier reporting if advance receipt). Rev. Proc. 2004-34 (services) – reporting in the current or subsequent year, if consistent with financial accounting; Regs. §1.451-5 (sales of goods) & similar treatment as services. 10/30/2012 (c) William P. Streng 79 Deposits v. Advance Payments p.323 Indianapolis Power & Light, p. 323 Advance deposits to enable establishing electric service received. Interest paid on the deposit amount. Eventually credited against customer’s account. No separate escrow or segregation of funds. Held: Equivalent to loans by customers, rather than advance payments. Loan repayment was possible and not a prepaid amount received. Same treatment for lease deposit amounts? 10/30/2012 (c) William P. Streng 80 Westpac Pacific Food p.324 Is an “advance trade discount” paid (for volume purchase commitment) to retailer gross income? Taxpayer treated up-front cash as a liability. Then applied the discount pro-rata to full purchase price as paid. This method was consistent with GAAP. Tax Court says advance payment was income. Reversed, as advance trade discounts not constituting GI. Not an “accession to wealth.” 10/30/2012 (c) William P. Streng 81 Current Deduction of Future Expenses P.329 Can an income tax deduction be available before the liability is actually paid? Deductions are subject to the “all events” test for accrual basis taxpayer. Question: Is the fact of liability firmly established and the amount determined with reasonable accuracy. 10/30/2012 (c) William P. Streng 82 General Dynamics Corp. Sup.Ct. P.329 Deduction was claimed for medical expenses reimbursable to employees 1) when the expense was incurred, but 2) no current claim to the employer had been made as of the end of the tax year. Amount claimed based on estimates of past experience. Sup. Ct.: “All events” test was not satisfied; some employees might not file a claim for reimbursement. 10/30/2012 (c) William P. Streng 83 The “Economic Performance” Test P.330 §461(h)(1) enacts the “all events” test. This provision also specifies that the “all events” test is not treated as met any earlier than when economic performance for that item occurs. A fixed obligation to pay an amount next year can not be deducted currently. 10/30/2012 (c) William P. Streng 84 10/30/2012 (c) William P. Streng 85