Chapter 3 Part I What are costs?

advertisement

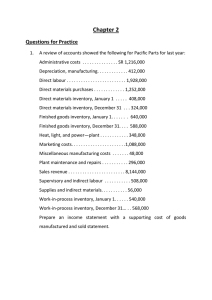

Chapter 3 Basic Cost Concepts Part I What are costs? Direct and Indirect Costs Examples and types of Indirect costs 1 Overhead and Allocation base Example 1 Prime Cost and Conversion Cost 2 Part II Relevant Range Cost Behaviors: Variable and Fixed Costs Mixed Costs Step-Cost Unit Cost and Marginal Cost Product Costs and Period Costs Cost of Goods Sold 3 Cost Flows for a manufacturing firm, the Inventory Formula, and T-Accounts Example 2 Income Statement for a Manufacturing Firm Example 3 Income Statement for a Service Firm Problems 3-50 and 3-53 4 Part III Cost Concepts for Planning and Decision Making Relevant and Differential Costs Opportunity Cost Sunk Costs Controllable costs 5 Example 1 Estimated overhead costs Indirect materials Indirect labor Rent Depreciation Taxes Insurance total Estimated Activity Activity, June 2004 $20,000 14,000 120,000 45,000 4,000 3,000 $206,000 4,000 Machine hours 510 Machine hours Example 2 Work-in-process 1/1/04 Work-in-process 12/31/04 Finished Goods 1/1/04 Finished Goods 12/31/04 Raw materials 1/1/04 Raw materials 12/31/04 Direct materials purchased Direct labor incurred Actual activity (see example 1) Example 3 $24,000 18,900 54,000 55,000 18,000 19,200 110,000 $220,000 3,800 MH (see examples 1 and 2) Sales Operating expenses: Salaries Marketing costs Fixed administrative expenses $1,154,000 $90,000 $124,000 $212,000 6 Problem 3 – 50 The following data pertain to Duvernoy Company for the year ended December 31, 2012: January 1, 2012 January 1, 2013 Purchases of direct materials $60,000 Direct labor $45,000 Indirect labor $25,000 Factory insurance $12,000 Depreciation-Factory $80,000 Repairs and maintenance-Factory $15,000 Marketing expenses $66,000 General and administrative expenses $55,000 Direct materials inventory $20,000 $35,000 Work-in-process inventory $33,000 $35,000 Finished goods inventory $23,000 $20,000 Prepare a schedule of cost of goods manufactured and an income statement for Duvernoy Company. Problem 3 – 53 The following information was taken from the accounting records of Blazek Manufacturing Company. Unfortunately, some of the data were destroyed by a computer malfunction. Case A $100,000 $15,000 $16,000 ? $25,000 ? $10,000 ? $18,000 $15,000 $20,000 ? $7,000 ? Sales Finished goods inventory, Jan. 1, 2004 Finished goods inventory, Dec. 31, 2004 Cost of goods sold Gross margin Selling and administrative expenses Operating Income Work-in-Process inventory, Jan. 1, 2004 Direct material used Direct labor Factory overhead Total manufacturing costs Work-in-Process inventory, Dec. 31, 2004 Cost of goods manufactured 7 Case B ? $8,000 ? $43,000 $3,000 $1,000 $2,000 $14,000 $8,000 $9,000 ? $35,000 ? $45,000