Homework Set 3

advertisement

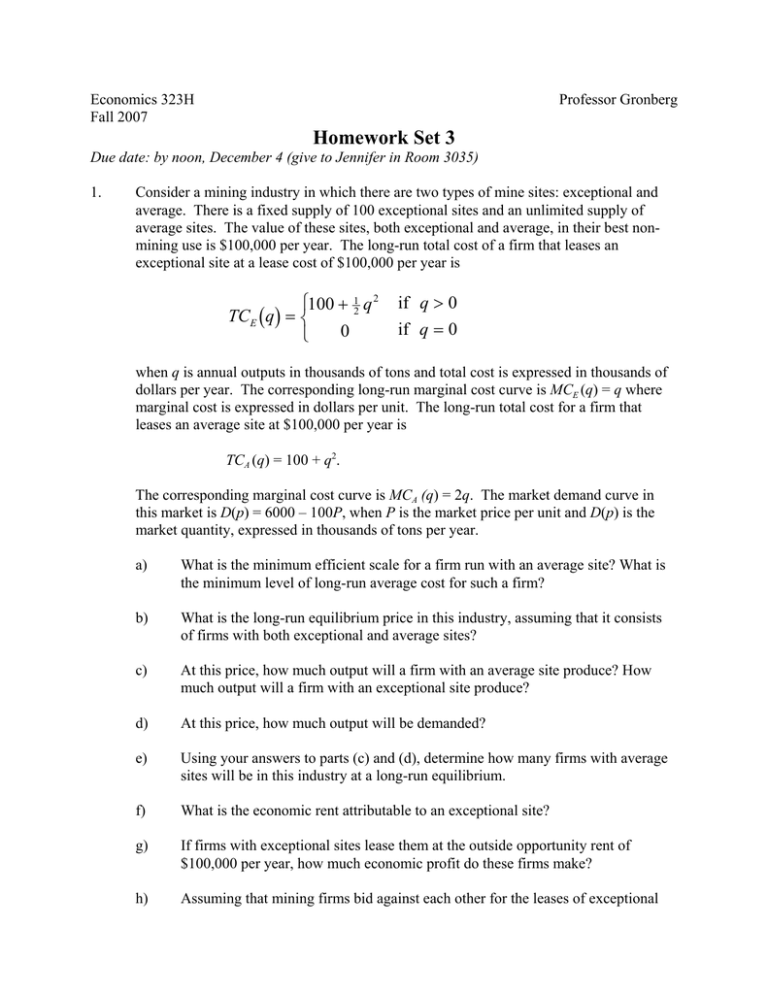

Economics 323H Fall 2007 Professor Gronberg Homework Set 3 Due date: by noon, December 4 (give to Jennifer in Room 3035) 1. Consider a mining industry in which there are two types of mine sites: exceptional and average. There is a fixed supply of 100 exceptional sites and an unlimited supply of average sites. The value of these sites, both exceptional and average, in their best nonmining use is $100,000 per year. The long-run total cost of a firm that leases an exceptional site at a lease cost of $100,000 per year is ⎧100 + 12 q 2 TCE (q) = ⎨ 0 ⎩ if q > 0 if q = 0 when q is annual outputs in thousands of tons and total cost is expressed in thousands of dollars per year. The corresponding long-run marginal cost curve is MCE (q) = q where marginal cost is expressed in dollars per unit. The long-run total cost for a firm that leases an average site at $100,000 per year is TCA (q) = 100 + q2. The corresponding marginal cost curve is MCA (q) = 2q. The market demand curve in this market is D(p) = 6000 – 100P, when P is the market price per unit and D(p) is the market quantity, expressed in thousands of tons per year. a) What is the minimum efficient scale for a firm run with an average site? What is the minimum level of long-run average cost for such a firm? b) What is the long-run equilibrium price in this industry, assuming that it consists of firms with both exceptional and average sites? c) At this price, how much output will a firm with an average site produce? How much output will a firm with an exceptional site produce? d) At this price, how much output will be demanded? e) Using your answers to parts (c) and (d), determine how many firms with average sites will be in this industry at a long-run equilibrium. f) What is the economic rent attributable to an exceptional site? g) If firms with exceptional sites lease them at the outside opportunity rent of $100,000 per year, how much economic profit do these firms make? h) Assuming that mining firms bid against each other for the leases of exceptional sites, what would you expect the lease rental values to be in a long-run competitive equilibrium? 2. a) Segway Corporation produces the Segway Human Transporter–which has five gyroscopes, two tilt sensors, dual redundant motors, 10 microprocessors, and can travel up to 12.5 mph. Suppose that Segway’s marginal cost is $2,000. Given that the Segway’s price is $5,000, calculate the firm’s Lerner Index and the elasticity of demand it believes it faces (assuming that it is trying to maximize its short-run profit). b) Suppose that the (inverse) market demand curve for a new drug, Adipose-Off, designed to painlessly reduce body fat, is represented by the equation P = 100 – 2Q, where P is the price in dollars per dose and Q is the annual output. (The marginal revenue curve is thus given by the equation MR = 100 – 4Q.) Suppose also that there is a single supplier of the drug who faces a marginal cost, as well as average cost, of producing the drug, equal to a constant $20 per dose. What are the monopolist’s profitmaximizing output and price? What is the resulting deadweight loss relative to the competitive outcome? 3. The domestic demand curve for portable radios is given by Qd = 5000 – 100P, where Qd is the number of radios that would be purchased when the price is P. The domestic supply curve for radios is given by Qs = 150P, where Qs is the quantity of radios that would be produced domestically if the price where P. Suppose radios can be obtained in the world market at a price of $10 per radio. Domestic radio producers have successfully lobbied Congress to impose a tariff of $5 per radio. a) Draw a graph illustrating the free trade equilibrium (with no tariff). Clearly illustrate the equilibrium price. b) By how much would the tariff increase producer surplus for domestic radio suppliers? c) How much would the government collect in tariff revenues? d) What is the deadweight loss from the tariff?