Profit Maximization in the Short Run

advertisement

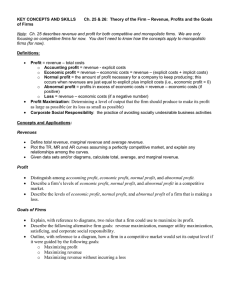

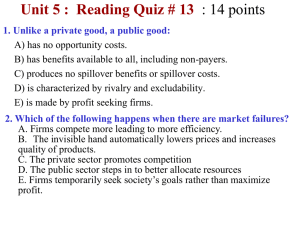

Profit Maximization in the Short Run Mr. Henry AP Economics AP Review Questions from Yesterday • A requirement of perfect competition is that i. Many firms sell an identical product to many buyers ii. There are no restrictions on entry into (or exit from) the market, and established firms have no advantage over new firms iii. Buyers are well informed about prices A. i only B. i and ii C. iii only D. i and iii E. i, ii, and iii E. i, ii, and iii • For a perfectly competitive corn grower in Nebraska, the marginal revenue curve is A. Downward sloping B. The same as the demand curve C. Upward sloping D. U-shaped E. Vertical at the profit maximizing quantity of production B. The same as the demand curve Three Questions for TR-TC Approach • Should we produce this product? • If so, in what amount? • What economic profit (or loss) will we realize? What is the Total-Revenue – Total-Cost Approach? • Perspective relies on the fact that profit equals revenue minus cost and focuses on maximizing this difference • Economic profit is an incentive for new firms to enter a market, but as they do so, the price falls and the economic profit of each existing firm decreases. Economic loss is an incentive for firms to exit a market, and as they do so the price rises and the economic loss of each remaining firm decreases. • Total revenue and total cost are equal where the two curves in 9.2a intersect. This is called the break-even point: an output at which a firm makes a normal profit but not an economic profit. Break-Even Point What is the Marginal-Revenue – Marginal-Cost Approach? • Perspective based on the fact that total profit reaches its maximum point where marginal revenue equals marginal cost. • This is known as the MR=MC rule. • A useful example for demonstrating that profit maximization occurs where MR = MC, not where MR is much greater than MC, is to ask a student if she would trade $50 for $100 (of course), then $60 for $100 (of course), then $70 for $100, and so on up to $99.99 for $100. The student should want to trade as long as her additional “revenue” exceeds her marginal cost. In other words, if someone can make as much as $.01 more profit, the rational person will trade. It is not the profit per unit but the total profit that the seller is maximizing! This simple notion bears repeating several times in different ways, because some students will continue to be puzzled by this despite its simplicity. Loss Minimizing Case Shut-down case • If price P falls below the minimum AVC (here $74 at Q=5), the competitive firm will minimize its losses in the short run by shutting down. There is no level of output at which the firm can produce and incur a loss smaller than its total fixed cost. Marginal Cost and Short-Run Supply