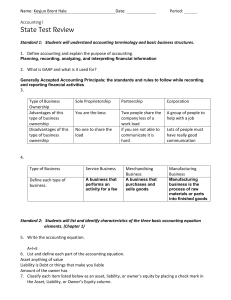

The Six-Column Work Sheet

advertisement

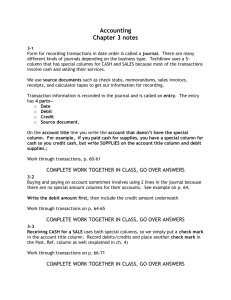

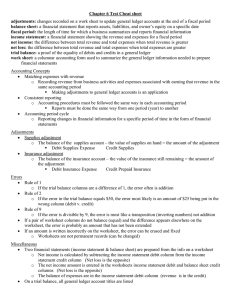

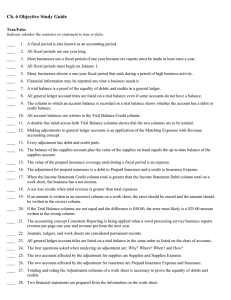

The Six-Column Work Sheet Chapter 8 The Accounting Cycle These steps are performed frequently during a cycle 1. Collect and verify source documents 2. Analyze each transaction 3. Journalize each transaction 4. Post to the ledger 5. Trial balance These steps are only performed at the end of an Accounting Cycle 6. Work Sheet 7. Prepare financial statements 8. Journalize and post closing entries 9. Prepare a post-closing trial balance Pg 196 What is the purpose of a Work Sheet? • A Work Sheet is a working paper used to collect information from the ledger accounts in one place • Sections of a work sheet – The heading – The Account Name section – The Trial Balance section – The Income Statement section – The Balance Sheet section Pg 197 Report Headings • Headings answer the questions: Who, What and When Ex: Roadrunner Delivery Service ---Who Work Sheet ---What For the Month Ended October 31, 2013 ---When Pg 197 The Account Name Section and Trial Balance Section Pg 198 This information comes from the ledger and is filled out much like a trial balance report is filled out. Ruling and Totaling a Work Sheet • Ruling means to draw a line. In accounting a single rule means that the entries above the rule are ready to be totaled. After the totals have been proven to equal, a double rule is drawn under them. Pg 199 The Balance Sheet and Income Statement Sections • These are both financial statements prepared at the end of the accounting period. The work sheet organizes the information for these reports • The Balance Sheet Section – contains Assets, Liabilities, and Owner’s Equity accounts • The Income Statement Section – contains the Revenue and Expense accounts • Single rule and then total all columns. Pg 201 Balance Sheet and Income Statement Accounts Pg 202 Balance Sheet and Income Statement Totals Showing Net Income or Net Loss • Matching Principal – according to GAAP expenses incurred in an accounting period must match with the revenue earned in the same period • Net Income – the amount of revenue that remains after expenses for the period have been subtracted • Net Loss – happens when total expenses exceed total revenue To Record Net Income or Loss Pg 204 • Determine if Revenue or Expenses is the larger number, then subtract the two numbers. • Skip a line under the account names and write Net Income if the Revenue column is higher or Net Loss if the Expense column is higher. • Write the difference between the two columns on the same row as the words New Income or Net Loss under the smaller of the two totals • On the same line, write that same number under the total in the Balance Sheet section that is opposite of the Income Statement column. – Ex If you wrote it in the Debit column on the Income Statement section then write it in the Credit column on the Balance Sheet section Worksheet with Net Income Pg 204 It Stands to Reason • If Revenue (a credit) is larger than expense the business made a profit, that amount is then recorded under the debit column to bring expenses equal to revenue. • If the business made a profit, that amount would be added to the Capital account (a credit) which is the offset of the amount added to the expense account as a debit. Completing the Work Sheet • Draw a single rule under the entire Net Income or Net Loss area. • Add all columns down • Check that the debit and credit columns of the Income Statement balance and that the debit and credit columns of the Balance Sheet columns balance • Once everything is in balance, double rule the entire totals line. Complete Work Sheet A Net Loss