Flexible Benefits Plans

advertisement

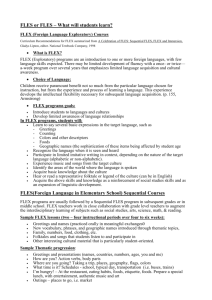

Flexible Benefits Plans • Group #10 Cecilia Martinez Melissa Martin Ravi Arman Jas Sangha Why offer Benefits plans? • Many employers have implemented flexible benefit plans to respond to their workers’ deferring needs • Competitive advantage • Retain existing staff Flexible Benefits • Central idea is to let employees choose among cash or nontaxable benefits provided by their employers • To maximize the cost-effectiveness of the plan sponsor’s expenditures for all employee benefits it is important to incorporate work and family issues. The Process of Developing a Flexible Benefits Program • Examination of all benefits and compensation issues. • Maximizing savings. • Communicating the program. • Compliance with regulatory issues. • Plan implementation must be accompanied by administrative system. Developments In The Flex Program • Flex programs will involve employees in benefit costs. • Optional benefits can create costly adverse selection. • Flexible spending accounts if not designed properly can increase costs. • Redesigning certain programs can create significant administrative savings. Overall Purpose of Flex Benefit Programs • Improve compensation effectiveness. • Increase perceived value. • Contain costs. • Manage compensation more effectively. Flexible Benefits Effects on Employees • Participation • Employee Ownership • Employee Appreciation • Budgets Participation • All participants must be employees. • Spouses and beneficiaries may receive benefits due to employees’ participation. Employee Ownership • Basic prerequisite for success. • Important for employees to feel sense of ownership. • Acceptance, understanding, and usage will be enhanced. Employee Appreciation • Plan sponsors feel employees will be more appreciative if given a choice. • Employees’ reactions are favorable to flex benefits programs. Budgets • Flex benefits help solve budget problems. • The plan sponsor can set specific dollar amounts as the plan credits for a given year. Reasons for Popularity • Historically, plans have been more uniform, and had few choices. • Radical changes in the work environment have led to: – More individualized plans. – Greater degree of choices. The Changing Workforce • The major reason plan sponsors implement flex • • • • programs is to meet the need of the changing workforce. The need to address the diversity in the workforce. Family compensation has also dramatically changed. Rising levels of education also affect the motivation for flex programs. Plan sponsors face competition for their customers and their staff. Present Demographic of Family Composition in the U.S. Is • Married-both US Age Composition of Adult Population 30 Percent of Adult Population spouses work, 45%. • Single-head of household-no dependent, 25%. • Marriedhusband works, wife does not, 20%. • Single-head of household-with dependents, 10%. 25 16-24 25-34 35-44 45-54 55-64 65 & Over 20 15 10 5 0 1950 1970 1990 2000 Year Issues Addressed For Effective Flex Programs • Issues for both activities and retirees • Eligibility • Communication/Education • Paid time off ( Sick Leave, Holidays, Vacation) • Define benefits • Define contribution • Salary compensation Types of Flexible Benefit Plans Include: • Flexible Spending Accounts • Job Sharing • Section 125 • Cafeteria Accounts Flexible Spending Accounts (FSA) • Generic term for reimbursement accounts. • Allows employees to be reimbursed on a pretax basis for out-of-pocket health care and dependant care expenditures. • Two types of spending accounts: – Health care spending account; for your family health care costs which are not covered by insurance. – Dependant day care spending account; for eligible expenses incurred for dependant daycare while you are at work. Health FSA • Allows employees to be reimbursed for eligible health care expenses. – Ex: insurance deductibles, co-payments, dental work, eye glasses etc. • Employees elect at the beginning of the plan year how much they wish to have withheld on a pre-tax basis each pay period. Health FSA Continued • Amounts set aside which are not used can NOT be rolled over. • City may establish a maximum contribution amount to limit risk, since IRS does not provide it. • Health FSA’s may be subject to federal requirements such as COBRA. Dependant Care Assistance Plan (DCAP) • EE reimbursed up to max of $5000 per year. • EE cannot be reimbursed through a flex plan and then claim child-care credit on their tax return. • Health FSA’s and DCAP’s fall under different section of the IRS tax code. How FSA’s Work • Deduction from paycheck set aside • When expense incurred file claim for reimbursement (tax free) • Help reduce participants taxes • Risk incurred if funds not used • Funds don’t rollover to next year • Account can ONLY be made within 31 days of divorce, or the birth of the child Which Expenses Are Reimbursed Under FSA? • Fee’s paid to doctors, dentists, surgeons, chiropractors, • • • • • • • • etc… Fee’s for hospital services Acupuncture treatments Inpatient treatment Dentures, hearing aids, crutches, wheelchairs Deductibles Braces Prescription drugs NON-elective cosmetic surgery What is the Advantage of Before-Tax Dollars? • Let’s assume you are the sole wage earner in your family and will earn $25,000 next year. You expect to spend $2000 for your child’s orthodontic work. The following illustrates how a health FSA actually increases your spendable income. The table assumes a married filer with 3 dependants. With a Health Care Account Without a Health Care Account Base Salary $25,000 $25,000 Health Care Account $2,000 $0 Gross Income $23,000 $25,000 Less Federal Income Tax $755 $955 Less Social Security Tax $1,760 $1,913 Less State Income Tax $510 $570 After Tax Income $19,975 $21,562 Less Heath Care Expenses Yet to be Paid $0 $2,000 Spendable Income $19,975 $19,562 Flex Pricing • Now let’s look at an actual example of pricing multiple health plans. We will start by using three distinct integrated steps in pricing flexible benefit programs. • Step 1. Project the costs of the current benefit programs to the first flex pricing year. • Step 2. Conduct an analysis of the relative actuarial values of the options to be offered in the flex program. • Step 3. Calculate the impact selection will have on overall costs, the construction of the plan costs, and prices that reflect selection costs. Step 1. Projection of Current Costs. • The first step is the analysis of costs to the flex pricing year. • By looking at the number of claims submitted per employee per month, an analysis can be made. Step 1. Continued • Graph 4 shows the • change in utilization over time. The graph shows the number of claims per employee over the last 30 months. Time series analysis is applied to the 12 month rolling average to produce a projection of expected future use of the medical program. Step 1. Continued • Graph 5 shows the • impact on price inflation on the medical program over time. It represents the average size claim pad in a month. Graph 6 shows a synthesis of these two projections and the overall future costs. Step 2. Relative Values • The first step is • developing a model of employee distribution of claims by size. Graph 7 shows the distribution of percentage of employees with various sizes of claims. Step 2. Continued • Graph 8 shows the calculation of relative or actuarial values. The area under the curve represents the plans cost commitment. Until the deductible has been satisfied all medical cost are the responsibility of the employee. Step 3. Cost Selection • The final step in the flex pricing process is determining the impact of selection of the program. The original distribution of claims model is used again rebuilding the distribution for various segments of the employee population. Step 3. Continued • Figure 10 represents the distribution of claims for an overall population. Rebuilding this graph for 10% of the population will cause a shift to the left, since this segment of the typical employee population has fewer and less severe claims then the overall population. Step 3. Continued • Figure 10 shows the claims for 10% of the employee population. Compared to figure 11 which has shifted to the right because the least healthy 10% tends to have both more claims and more severe claims than the overall population. Step 3. Continued • To analyze the impact of selection on plan costs, build a distribution of claims model for the healthiest to leas healthy of the employee population. • Then with initial enrollment assumptions you can make the determination of over plan costs, including the impact f a flexible benefits program. Step 3. Continued • Cost projections and price tags can be finalized based on enrollment results or feed back from focus groups and survey’s show in figure 12. Job Sharing • Two people share the same position in a company, each working part of the week. • They split the hours, pay, holidays and benefits between them according to hours they each work. Three Main Types of Job Share: • Shared Responsibility • Divided Responsibility • Unrelated Responsibility Cafeteria Plans • Is an employee benefit plan that offers employees certain choices among IRC Section 125. • Offers combination of qualify nontaxable benefits that include: – Health Insurance, Sickness, Accident Insurance, and Long Term Disability Other Types of Flexible Plans • Medical Savings Account (MSA)= is a Tax-exempt trusts or accounts allowing individuals to pay certain medical expenses that are not reimbursed under a health plan with pr-tax contributions • Health Reimbursement Arrangements (HRAs)= is a strictly employer funded plan that reimburses employees for certain medical expenses incurred by the employee and the employees spouse or dependent Funding • Flexible benefit plans can be funded by employer & employee contributions or both • The salary reduction that employees agreed to pay before taxes is frequently used to fund health care and dependent care spending accounts. Impact on Cost • Flexible benefit plans help reduce their benefit costs and their overall expenditures for health coverage and other benefit programs • Under flex plans employees have more control over employer contributions Advantages to Flexible Benefit: • Employees can always change their benefits as life fluctuates. • Employees can start to appreciate more their benefits and therefore increases or improves their morale and productivity. • Employees can be more involved in controlling or balancing their benefit costs • Flexible compensation plans can be used to convert workers income into Tax-Free Employee Benefits. Disadvantages to of Flexible Benefit Plans • Employees might not understand or have a difficulty in choosing their needed benefits • Flexible plans might result in increased utilization and Adverse Selection • Health care spending accounts that provide uniform coverage throughout the plan year could expose an employer to additional liability • Greater benefit flexibility can result in a greater administrative complexity and costs to the company or firm Solutions to Disadvantages: • Careful Planning • Incorporate a program that will assure basic protection and also an effective communication program • Plan features can be added to minimize adverse selection • Define lower annual maximums or limiting midyear changes can minimize the exposure of the employer liability • Restriction limit to the amount of flexibility benefits can be controlled Problems Facing the Health Care System • Few employees understand the cost their companies spend for health care services • Plan sponsors and providers have not done a good job of educating employees about various health care options • Doctors and hospitals are geared to respond to crises with all available resources. Any Questions?