Discount Window Discounted?

advertisement

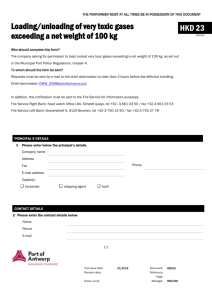

Discount Window Discounted? Steve Xu Treasury Economist Standard Chartered Bank Oct. 9, 1999 Agenda Contagion effects insignificant. A permanent reduction in the risk premium. The objectives of the Discount Window. Suggested changes to the Base Rate. Ultimate objectives of “7 wonders”. The Base Rate: An overly binding constraint 8.00 7.50 7.00 6.50 6.00 5.50 5.00 4.50 4.00 1-Sep-98 31-Oct-98 30-Dec-98 28-Feb-99 29-Apr-99 28-Jun-99 27-Aug-99 Banks have little incentive to use the Discount Window Borrowings at the Discount Window 4.50 4.00 3.50 3.00 2.50 2.00 1.50 1.00 0.50 0.00 7-Sep-98 6-Nov-98 5-Jan-99 5-Mar-99 6-May-99 5-Jul-99 30-Aug-99 Licensed banks’ ability to pledge 102.00 84.00 82.00 101.00 80.00 100.00 78.00 99.00 76.00 98.00 74.00 72.00 97.00 96.00 95.00 5-Oct-98 Exchange Fund paper held by licensed banks(HKDbn) Exchange Fund paper(HKDbn) 70.00 68.00 66.00 31-Dec-98 31-Mar-99 29-Jun-99 23-Sep-99 The Discount Window eliminates wild swings in short-term rates The Base Rate dampens rate volatility. The Base Rate acts as a ceiling for licensed banks to obtain liquidity. Expanded base money and repeated borrowing at the Window avoids sharp rise in local interest rates. Waning contagion effects from the region 18.00 16000 16.00 14000 14.00 12000 12.00 10000 10.00 8000 8.00 6000 6.00 4000 4.00 HKD overnight rate 2.00 2000 USD/IDR 0.00 0 Jun-97 Oct-97 Feb-98 Jun-98 Oct-98 Feb-99 Jun-99 Waning contagion effects (continued) 18.00 60.00 16.00 50.00 14.00 12.00 40.00 10.00 30.00 8.00 6.00 4.00 2.00 0.00 Jun-97 20.00 HKD overnight rate 10.00 USD/THB 0.00 Oct-97 Feb-98 Jun-98 Oct-98 Feb-99 Jun-99 Yen shock taken in stride 18.00 160.00 16.00 140.00 14.00 120.00 12.00 100.00 10.00 80.00 8.00 60.00 6.00 40.00 4.00 2.00 20.00 0.00 0.00 Oct-97 Jan-98 Apr-98 Jul-98 Oct-98 Jan-99 Apr-99 Jul-99 The HKD de-coupled from the CNY CNY 6mth implied yield 18.00 16.00 14.00 12.00 10.00 8.00 6.00 Jan-99 Feb-99 Mar-99 Mar-99 Apr-99 May-99 Jun-99 De-coupling effect continues CNY 12mth implied yield 20.00 18.00 16.00 14.00 12.00 10.00 8.00 Jan-99 Feb-99 Mar-99 Apr-99 May-99 Jun-99 The HIBOR/LIBOR convergence 25.00 6.00 5.50 20.00 5.00 4.50 15.00 4.00 10.00 3.50 3.00 5.00 1-mth LIBOR(RHS) 1-mth HIBOR(LHS) 0.00 31-Oct-97 2.50 2.00 23-Jan-98 17-Apr-98 10-Jul-98 2-Oct-98 25-Dec-98 19-Mar-99 11-Jun-99 3-Sep-99 Review the Base Rate The HIBOR/LIBOR convergence is driven by market forces. The perceived HK premium: 100bps over the Fed Fund Rates, or 50bps over? The key issue is to avoid having an overlybinding constraint. The ultimate objectives of the “7 wonders” Technical measures: rapid convergence between the HIBOR and the LIBOR a pleasant surprise. The HKD is almost a perfect substitute for the USD in the inter-bank market. Is the HKD a perfect substitute for the USD in the inter-bank market only?