Insurance Explaned - by Jenny Foster CIC

advertisement

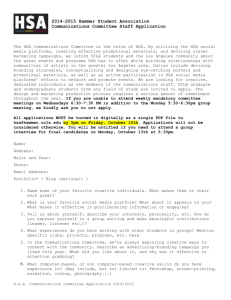

"Insurance Explained” Jenny Foster, CIC www.ehlinsurance.com Speaker Bio Jenny is the Senior Employee Benefits Advisor and Human Resources Manager for EHL Insurance, headquartered in Poulsbo, Washington. She joined the agency in 2002 and holds her Certified Insurance Counselor (CIC) designation and is a licensed agent and broker in Property and Casualty and Life and Disability. Jenny has a Bachelor of Science in Physiological Psychology from the University of California, Davis. Her focus is helping clients obtain and retain the very best employees and ultimately improving her client company’s profits. She is most passionate about employee education. “If employees do not understand their benefits, how can they value them?” An active member of our community, Jenny has served on the board of her local SHRM chapter. She enjoys creative writing, traveling, walking, shopping, and serving in her local church. Jenny lives with her husband, two girls, and eccentric Japanese Shiba Inu, Charlotte. Jenny can be reached at (800) 929-1669 ext. 8170 or jenny@ehlinsurance.com. www.ehlinsurance.com House Keeping Musical stretch breaks every 20-30 minutes Candy throwing (hold harmless agreement) Late return policy following breaks Participation increases everyone’s fun and ability to learn and retain information Interruptions are encouraged www.ehlinsurance.com Let’s Get It Started…! Post it note participation exercise Introductions (time permitting) Health plan quiz (prizes) www.ehlinsurance.com Tough Statistics 23.6 million children and adults in the United States (7.8% of the population) have diabetes. Total costs of “diagnosed” diabetes in the United States in 2007: 174 billion. Nearly 7 out of 10 office visits in the U.S. result in a prescription being written. www.ehlinsurance.com It’s A Jungle Out There! High toll of cancer on our nation Death rates for cancer of the pancreas, esophagus, thyroid and liver are increasing. An estimated 14% of cancer deaths in older men and 20% in older women can be attributed to excess body fat. www.ehlinsurance.com It’s A Jungle Out There! Currently more than 64% of U.S. adults are either overweight or obese, according to NHANES. Fruit and vegetable intake is not increasing. Red meat and fat consumption are not decreasing. Average 20% increase in employer’s portion of group health plan premiums since 2005. www.ehlinsurance.com Average Health Insurance 2005-2010 $10,880 $2,713 $1,284 Worker Contribution Increase $13,770 $3,997 27% 47% $8,167 $9,773 20% 2005 Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2005-2010. 2010 Worker Contribution Employer Contribution www.ehlinsurance.com It’s A Jungle Out There! Confusing health care reform legislation Increase in stress-related diseases National unemployment rate still 9.6% Average litigation verdict for Chelan County, Washington in 2009 was $350,000. www.ehlinsurance.com The Cost Of Hiring The “Wrong” Employee What is the true “cost” to your company? The lazy employee The dressed up resume The Waffle Mr. Do Nothing The Folder Mr. Conspiracy Theory Best way to avoid hiring the “wrong” employee? Have a clear, consistent, written hiring process! www.ehlinsurance.com The Cost Of Hiring The “Wrong” Employee The WRONG employee will: Create a negative work environment Sue your company Harass/discriminate against other employees Quit at the drop of the hat Inappropriately file for unemployment or workers compensation www.ehlinsurance.com The Cost Of Hiring The “Wrong” Employee The RIGHT employee will: Create a positive work environment Improve profitability Empower coworkers Build customer loyalty Work in a safe manner, lowering insurance costs www.ehlinsurance.com The “Right” Employee High cost of retaining the “wrong” employee. High cost of losing the “right” employee! What if they are a key employee? What if they take other key employees with them? What if they go to a competitor? How do we KEEP the right employee? www.ehlinsurance.com How To KEEP The “Right” Employee Maintain some type of employee benefits program that is well understood and valued by employees. 74% of covered employees regard health benefits as an important factor in their loyalty. Even in these economic times engineers at Google are still allowed to allocate 20% of their time to projects of their own choosing. www.ehlinsurance.com The Importance of Employees “Good business leaders create a vision, articulate the vision, passionately own the vision, and relentlessly drive it to completion.” - Jack Welch (former CEO, General Electric) “We want passion for our business... workers who can interpret and execute our mission, who want to build a career, not just take a temporary job.” - Howard Schultz (CEO, Starbucks and Seattle SuperSonics) www.ehlinsurance.com Break Time! When we return… Employer Trends www.ehlinsurance.com General Employer Trends According to this year’s Kaiser Family Foundation study, 69% of companies reported offering health benefits (up from 60% in 2009). 43% to 60% of organizations are already using an HDHP (to include focus on HSA bank account). Ten million Americans are now covered by HDHP/HSA plans, an increase of 25% since 2009. www.ehlinsurance.com General Employer Trends 25% of covered employees have a deductible of at least $1,000. The average annual premium for family coverage is running at $13,770 (a 114% increase since 2000). 51% of workers with family coverage pay more than 25% of the cost of premium. www.ehlinsurance.com General Employer Trends 78% of covered employees have plans with 3 or more tiers of pharmacy cost sharing. 74% of employers offering health benefits offer at least one of the following wellness components: Weight loss program Gym membership Smoking cessation Personal health coaching Healthy living classes Web-based resources Wellness newsletter Health Risk Assessment www.ehlinsurance.com Employee Benefits Relevant To Retention? Workplace benefits have remained resilient despite the recession. 53% of employers report controlling benefits costs as their top objective. Employee retention (formerly first concern) is still second most important employer objective. www.ehlinsurance.com Employee Benefits Relevant To Retention? Employees are more satisfied with their benefits than at any time since 2007. More than 35% of employees are prepared to shoulder more benefits costs to keep benefits they value. Of employees satisfied with their benefits, 81% say they are very satisfied with their jobs. www.ehlinsurance.com Employee Benefits Relevant To Retention? 69% cite high benefits satisfaction as a key reason to stay with their employer. The average worker loses 115 productive hours a year due to poor health (cost: $250 billion/year). 59% of employees who participated in company wellness programs said the programs were effective at improving productivity. www.ehlinsurance.com Stretch Break Time! When we return… Retention Strategies www.ehlinsurance.com Retention Strategies Retention begins with an exceptional hiring process. What culture do you want to have that keeps people from leaving? Employee Benefits are only as limited as your imagination! Happy Hour is 9 to 5 book www.ehlinsurance.com Retention Strategies Flexible work schedules Worksite fitness or wellness programs Employee Benefit Statements (Total Comp) Employee Assistance Programs (Chevron Corporation saves $7 for every $1 spent on its EAP) Health Advocacy www.ehlinsurance.com Retention Strategies Education and training Clear communication Approachable supervisors/managers Involvement in decision-making process www.ehlinsurance.com Retention Strategies Work-Life Programs can boost both loyalty and productivity. Employees and employers report similar conclusions. “Many companies have long contended that stress in the home causes productivity loss in the market place...and it does. But research now reveals that stress on the job causes stress at home. In other words, they feed off each other.” Zig Ziglar www.ehlinsurance.com Retention Strategies Gift cards & incentives (know your employees; $10 to $200) Free parking and other perks Company discounts Cisco is one of the nation’s largest providers of onsite child care with over 800 children enrolled, and parents can track their kids via computer. www.ehlinsurance.com Retention Strategies Employees want help with their retirement “Life is full of uncertainties. Future investment earnings and interest and inflation rates are not known to anybody. However, I can guarantee you one thing.. those who put an investment program in place will have a lot more money when they come to retire than those who never get around to it.” Noel Whittaker Maximize employee education! www.ehlinsurance.com Retention strategy group activity Please form groups and take 2-3 minutes to discuss: 1)What/if any of the retention strategies we discussed are you using at your company? Are they working? Why or why not? 2)What is one retention strategy we discussed today that you might consider implementing? Why? 3)As a group write down one retention strategy you came up with as a group not presented today (be ready to share it with the group). www.ehlinsurance.com Break Time! When we return… Leveraging Employee Education “Always treat your employees exactly as you want them to treat your best customers.” - Stephen R. Covey www.ehlinsurance.com Leveraging Employee Education Think about how you scored on our health plan quiz. What do your employee benefits meetings look like? How often do you have them? What is employee feedback? What do you think your employees would score on a health plan quiz? How many questions do you answer each day/week/month related to your employee benefits? How much time does this take from revenue focused work? How much do you think this costs your firm annually? What if there was a low cost/no cost solution? www.ehlinsurance.com Leveraging Employee Education Low cost or no cost! If employees understand their benefits; they value them! Harris study: only 29% of employees reported their benefits education was excellent or very good in 2009. www.ehlinsurance.com Leveraging Employee Education Highly engaged employees are 26% more productive. How you communicate your benefits are as important as what they are. Employees who believe their benefits were clearly communicated are more likely to feel their employer values their work and well-being. www.ehlinsurance.com Leveraging Employee Education Employ a 3+3 strategy to benefits education. 3+ weeks and 3 ways to learn (visual, auditory, tactile) Effective benefits communication contributes to a sense of financial security for employees. www.ehlinsurance.com Employee Benefit Surveys What employee benefits are most important to you? Medical Dental Vision Life Disability EAP FSA HSA www.ehlinsurance.com Employee Benefit Surveys Wellness What other benefits would you be most interested in? www.ehlinsurance.com Signing Of The PPACA “How we might help the American people deal with costs, coverage, insurance, these other issues. And we might surprise ourselves and find out that we agree more than disagree. And that would then help to dictate how we move forward. It may turn out on the other hand there’s just too big of a gulf.” — President Obama www.ehlinsurance.com The Chips Are Still Falling We basically know what the problems are, all of us. We basically know that the current system is unsustainable.“ – Senator Max Baucus, D-Montana “People are angry. We promised them change in Washington,” - Senator John McCain, R-Arizona "If you think they want a government takeover of health care, I would simply submit you’re not listening to them.” - Representative Paul Ryan, R-Wisconsin www.ehlinsurance.com Health Care Reform Effective Immediately: adult children covered to age 26 January 1, 2011 January 1, 2014 No reimbursement for OTC drugs unless prescribed (HSA/FSA) No pre-existing condition exclusions Non-qualified HSA distributions subject to 20% tax penalty (previously 10%) No annual limits September 1, 2011 No lifetime limits on essential benefits No pre-existing condition exclusions for those under age 19 First dollar coverage for preventive care www.ehlinsurance.com Health Care Reform 2018 Cadillac Tax – 40% excise tax on employer sponsored health plans exceeding $10,200 for individual coverage (dental, vision, accident, disability, long term care, specified disease insurance excluded) Other Highlights Small business tax credits available 2010-2013 10 or fewer FTEs & average annual wage of $25,000 or less (up to 35% credit) 10-25 FTEs & average annual wages of $50,000 or less (up to 25% credit) Non-grandfathered fully insured plans must satisfy IRS Section 105 nondiscrimination rules. www.ehlinsurance.com What Is An HSA? INSURANCE A High-Deductible Health Plan (HDHP) BANK ACCOUNT Tax-Free IRS Qualified Checking Account (HSA) www.ehlinsurance.com Typical HSA Plan Deductible waived for preventive care No copay. Office visits (“talking”) subject to deductible. Procedures subject to deductible (“doing”) Key preventive benefits (deductible waived): Routine care Pap smears Childhood immunizations Prenatal care Mammograms Cancer screenings www.ehlinsurance.com Typical HSA plan $2,500 deductible for an individual ($5,000 deductible if enrolled with dependents). $2,500 out-of-pocket maximum (capped at $5,000 for a family) 80% (in-network); 50% (out-of-network) plan Worst case scenario: $2,500 deductible + $2,500 out of pocket = $5,000 $5,000 deductible + $5,000 out of pocket = $10,000 www.ehlinsurance.com Prescriptions & HSAs Prescription drugs are subject to the deductible. Once deductible is met prescriptions are covered at 80%. Once coinsurance (out of pocket maximum) is met: 100% Rx coverage! www.ehlinsurance.com Truly A Legal Tax Shelter? You can contribute to your HSA bank account via pretax payroll deduction. The IRS allows you to tax shelter up to $3,050 per individual per calendar year and up to $6,150 if enrolled as a family (combination of company and employee contributions). Employees need to keep all receipts, as this is an IRS regulated benefit. www.ehlinsurance.com HSA Tax Implications Tax Savings Example: HSA Contribution Federal (25%) Social Sec (6.2%) Medicare (1.45%) Estimated employee tax savings: $1,000.00 $250.00 $62.00 $14.50 $326.50 www.ehlinsurance.com Traditional vs. HSA plans HDHP/HSA Plan: Traditional Plan: Family deductible Individual deductible Deductible waived for preventive care Deductible waived for preventive care Rx subject to deductible Rx copays Rx reimbursable through HSA Predictable Rx co-pays Tax sheltered account No employee tax advantage HSA funds grow and roll over tax free; portable (“owning”) No equity (“renting”) Pre-tax premium & HSA contributions Pre-tax premium payroll deductions www.ehlinsurance.com Words Of Wisdom “In the end, all business operations can be reduced to three words: people, product and profits. Unless you've got a good team, you can't do much with the other two.” -Lee Iacocca www.ehlinsurance.com What about dental? Unless perceived as a benefit by employees, dental ROI may not always pencil out. 83% of employees reporting excellent dental health visit a dentist every six months or more. 64% of employees who say they have good dental health also report better overall health. www.ehlinsurance.com What about dental? Regular dental care is critical in early detection: Mouth/throat cancers Diabetes Colon cancer Heart disease Gingivitis Heart burn Lymphoma 20+ conditions Dental health is also correlated to a healthy heart! www.ehlinsurance.com Vision Insurance Relatively low cost but high perceived value Vision providers may be able to diagnose retinal disorders, arteriosclerosis, or diabetes. Approximately half of employers offer a formal vision plan. Employers stand to gain as much as $7 for each dollar spent on vision coverage. www.ehlinsurance.com Life & Disability 3 in 10 workers entering the workforce today will become disabled before retiring! Life and disability insurance pack a powerful punch for a small premium. Increasing group enrollment in these benefits Determine your company’s goals before selecting a product (short vs. long term disability). www.ehlinsurance.com Voluntary Benefits Dental, accident, specified disease, some STD and LTD programs, supplemental or dependent life and AD&D Employees offered voluntary benefits are 17% more satisfied with their benefits than those not offered voluntary products. 40% of employees are interested in a wider range of voluntary benefits. Smaller companies less likely to offer. www.ehlinsurance.com Unknown Benefits Left On The Table Your health plan typically offers discounts on: Health Risk Assessments Wellness coaches Weight management Vision discounts Alternative care Hearing devices Hearing screenings Fitness clubs Family safety products Senior discounts Red Cross CPR courses Your payroll vendor www.ehlinsurance.com Your Health Plan Website Find a preferred doctor Access documents & forms Review benefits & claims Mail order pharmacy Compare hospitals Use wellness tools Learn about prescriptions Look up symptoms Access discounts www.ehlinsurance.com Celebrate Your Benefits Portfolio! Dual choice health plans Wellness tools Paid time off Flexible Spending Account (FSA) 401(k) Life/AD&D coverage Tax advantaged HSA account Excellent dental benefits Vision program Short & Long Term Disability www.ehlinsurance.com Closing Remarks Be wary of hiring the wrong employee! Leverage Employee Benefits to retain the best. Get creative with retention strategies. Harness the power of employee education! www.ehlinsurance.com Closing Remarks Consider your HSA strategy Evaluate voluntary benefits Celebrate your Employee Benefits Portfolio! www.ehlinsurance.com Contact Information Jenny Foster, CIC (800) 929-1669 ext. 8170 jenny@ehlinsurance.com www.ehlinsurance.com Questions & Answers Enjoy your time in Seattle! www.ehlinsurance.com Definitions Deductible – the amount an insured person is responsible for before insurance kicks in (i.e. $500 or $1,000) Copay – a small, fixed amount required by the insurance company that a subscriber must pay typically for office visits or prescriptions. Coinsurance – you and your insurance company share expenses (i.e. insurance company pays 80%; you pay 20%) Out of pocket maximum – the financial worst case scenario that an insured must pay in a calendar year before the insurance company pays 100%. The most you would have to pay in a single year out of your own pocket. Maximum benefit – the maximum an insurance company will pay per calendar year or over a specified period of time (i.e. $2 million lifetime maximum, $1,500 rehabilitation maximum per calendar year) “Solutions you can understand” Definitions Emergency Room copay – a small, set amount that must be paid to visit the ER in addition to a deductible when the visit it not serious enough to cause inpatient admission. Typically this copay is waived if admitted. Generic – Drugs that have typically been on the market long enough to have lost their patent and can be duplicated by other companies, typically lowering their market value and price. Chemically equivalent to the drugs they copy cat. Preferred Brand name drug – A brand name drug that is still under patent protection but preferred by insurance companies based on efficacy and cost. Non-preferred brand name drug – A brand name drug that is still under patent protection but not preferred by insurance companies due to safety and or cost concerns. Typically another drug can be substituted. Pre-Certification – when an insurance company requires that a member call to gain written approval before a complex or costly procedure. Failure to pre-certify can result in no coverage or reduced coverage. www.ehlinsurance.com References The Henry J. Kaiser Family Foundation & Health Research & Educational Trust; www.kff.org 8th Annual Study of Employee Benefit Trends; www.metlife.com/business National Underwriter, Allison Bell 5/17/2010; www.lifeandhealthinsurancenews.com “Employee Education and Enrollment Education Survey,” January 2010. American Diabetes Association; www.diabetes.org Mayo Clinic; www.mayoclinic.com American Cancer Society; www.cancer.org National Cancer Institute; www.cancer.gov www.ehlinsurance.com References National Health and Nutrition Examination Survey; www.nhanes.org Magellan Behavioral Health; www.magellanhealth.com Americas Health Insurance Plans; www.ahip.org www.benefitsellingmag.com http://apps.nccd.cdc.gov “What Employers are Considering,” International Foundation of Employee Benefit Plans “Behind the Numbers: medical Cost Trends for 2011,” Pricewaterhouse Coopers WRG. 2006. S. Aldana, PhD Bringham Young University www.ehlinsurance.com