Running Header: EL PASO NATURAL GAS EL PASO NATURAL

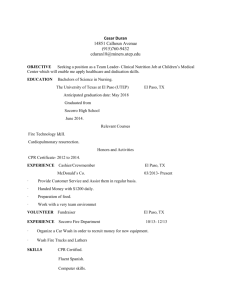

advertisement

Running Header: EL PASO NATURAL GAS El Paso Natural Gas Pipelines Thomas Chapley Moore Chancellor University 1 EL PASO NATURAL GAS 2 Abstract El Paso Corporation operates 42,000 miles of interstate natural gas pipelines in the United States. They operate about 25% of the entire interstate pipelines and operate in an oligopoly in which they are the dominant pipeline supplier. They face demand from consumers, energy companies, industry, and transportation sector. Supply is driven by exploration and production activities and weather. They face several key risks such as inflation, credit, environmental, and governmental. All of these risks can be hedged with additional costs and additional key personnel. The key is for El Paso Corporation is to focus on core business operations and build pipelines and manage the risks to create additional profits. EL PASO NATURAL GAS 3 El Paso Corporation (EP) is a New York Stock Exchange listed corporation that owns and operates natural gas pipelines and produces natural gas (El Paso Corporation, n.d.). This paper will focus exclusively on the natural gas pipeline side of the business. El Paso owns and operates 42,000 miles of interstate pipelines through 10 separate pipeline companies (El Paso Corporation, n.d.). Pipeline capacity is 26 billion cubic feet per day (BCF/d) per day or 15% of US capacity and they deliver 19 BCF/day or 30% of US demand. They have excess capacity in the pipeline of 7 BCF/d. Pipelines: There are about 160 pipeline companies that control 170,000 miles of interstate pipelines that can move gas across state lines to areas in need of NG (Natural Gas Industry, n.d.). The pipeline companies business is to transport natural gas across state lines from areas of excess supply to areas of excess demand. Pipeline companies make less money as demand slows and supply increases since natural gas is stored instead of consumed. Federal Energy Regulatory Commission (FERC): The FERC is the primary regulator of the NGI. The FERC regulates the transporters of natural gas across state lines. They regulate the 160,000 miles of pipeline for the protection of the end user (FERC, n.d). FERC has determined that the interstate pipeline can only be used for the transport and not the sale of natural gas (FERC, n.d.). Supply of natural gas is driven by exploration and production (E&P) activities. E&P activity creates more natural gas that either needs to be transported to storage or to an end user. Weather is a weak supply force in natural gas. Hurricanes enter the Gulf of Mexico, NG E&P ceases as the rigs must be abandoned and tornadoes may interrupt equipment in the Midwest and Texas. Supply is driven by the miles of pipeline operated. The more miles of pipeline that are EL PASO NATURAL GAS 4 operated the greater the supply to any given area and the more that can be supplied. El Paso operates the most pipelines and has the most excess capacity so they are often the choice to deliver NG to areas so they can handle excess demand. Citibank’s Oil and Gas analysts expect onshore natural gas production to end at 57 BCF/d and that is 1 BCF/d more than 2009 (Khan, 2010, p.7). Natural gas has four groups that demand gas. The groups are consumers, industrial, electric generation, and to a small extent the transportation sector (Natural Gas Industry, n.d.). Consumer demand is driven mainly by weather patterns and geographic density. The colder the weather the more gas consumers use to heat both homes and commercial buildings. Population density is a driver the demand for natural gas, as the population density increases the total demand increases but per capita demand is relatively flat. Residential demand accounts for 22% of natural gas consumption (Natural Gas Industry, n.d.). Industries use NG for energy intensive manufacturing such as steel smelting and non energy intensive manufacturing. The energy intensive manufacturing is expected to shrink demand while non energy intensive manufacturing demand is expected to grow. Demand from the industrial sector accounts for 37.6% of all NG demand (Natural Gas Industry, n.d.). Natural gas powered electricity plants are a growing portion of the demand for NG. NG powered plants produced 16% in 2002 it is forecasted that by 2025 21% of all electricity will be generated by NG powered plants (Natural Gas Industry, n.d.). The demand drivers for NG are the retirement of old no NG powered plants and the increased demand for electricity by a growing population. EL PASO NATURAL GAS 5 Transportation accounts for about 3% of NG demand (Natural Gas Industry, n.d.). The ever increasing demand for cleaner and environmentally friendly transportation is a demand driver for the future. Market Structure El Paso Pipelines operates in an oligopoly structure. There are few operators of the 170,000 miles of interstate pipelines in the U.S., El Paso operates 42,000 miles or 25% of mileage. El Paso also has the capability to deliver 26 BCF/d of the 57 BCF/d output or 46% of daily production. Natural gas is a homogenous product. Barriers to entry are high as pipelines are capital intensive as they may cost in excess of $1 million to carry 1 million cubic feet of capacity. FERC has control of the permitting process of all intrastate pipelines and projects from start to finish can run in excess of five years (El Paso Corporation, 2009, p. 49). Pricing is very competitive and the price charged to carry gas is fixed in the run as pipeline companies often enter into long term contracts. Non price competition is in the form of volume which is the key to driving revenue and the key to volume is the miles of pipeline available to move gas from excess supply to excess demand. El Paso has the dominant position in the pipeline business as they possess the most miles and the outlets to metropolitan areas with high population density. Risks Risk is part of the pipeline industry. There are several key risks El Paso must learn to navigate and mitigate. Risks are inflation/interest rate, credit, environmental, and environmental. There are many other risks to be faced. Each section will discuss the risk, potential cures, potential economic risk, and potential profit from the risk. EL PASO NATURAL GAS 6 Inflation risk is the risk that prices and interest rates will fall or rise (Hirschey,2009, p.632). The risk that interest rates could rise are a concern to El Paso as they have to raise capital from the bond market and as rates rise the cost of debt rises as well. El Paso issues non callable fixed rate debt so if rates fall then they have locked interest costs and cannot take advantage of lower rates. Hedging inflation/interest rate risk can be accomplished by two main methods. The first are interest rate swaps that a company can purchase to offset rising or falling rates. The other method is to manage your debt issuance by balancing the amount of fixed and floating rate debt. Commodity inflation is a concern for El Paso as they have to buy pipe and other commodities to build pipelines this will squeeze economic profits. Commodity price fluctuations can be hedge by forecasting demand of any given commodity and entering into hedges, futures or forward contracts to minimize price increases. Profits can be had on these risks as well. If a hedge is not implemented and interest rates fall then interest costs can be saved as well as the economic cost of the hedge. If the commodities such as steel and concrete fall and there are no hedges in place or long term contracts then the costs decrease and profits increase. Credit risk is the chance that another party will fail to meet its contractual obligations in a timely manner (Hirschey, 2009, p. 633). El Paso signs long term contracts for the use of its pipelines, as long as 25 years so the likelihood exists that the lease may not exist in 20 years. Credit risk can be mitigated by first during financial/credit analysis on your counterparty and determining their creditworthiness. Credit default swaps may be available for you to hedge your counterparty risk. Hedging can be expensive and carries two risks. The first risk is noncorrelation, non-correlation is the fact that a hedge may not be effective and as a company may not meet its demands the hedge does not mirror the company’s demise. Hedging in and of itself carries counterparty risk. Lehman Brothers was counterparty to many credit default swaps and EL PASO NATURAL GAS 7 when it failed so did the credit default swaps. Credit hedges can be expensive especially if they are entered into when the viability of a company is in question. So not hedging is an option if the due diligence is done ahead of time and on an ongoing basis the costs should be less than the credit insurance increasing profits in the short run. The long run profits will be less impacted as some companies will default and costs therefore rise. Environmental risk is a major concern of El Paso. They have 40,000 miles of pipeline risk and they run through many environmentally sensitive areas. Pipelines require maintenance and that means heavy machinery that can damage the environment or private property. El Paso has FERC approval but they do run afoul of environmentalist’s that oppose their construction. The risk is more in headline or perception. The most effective way to mitigate this risk is to create a social license (Fromartz, 2009, p.4). The social license reduces the risk from environmental damage and private property owners and decrease the cost to operate. El Paso could create policies to protect the land, animals and property rights on which it operates. Environmentalists are less likely to bring negative headlines if they know a company is protecting land and animals. Property owners will respect corporations that respect their land and their privacy rights (El Paso, 2009, p.53). Environmental risks can be ignore or put aside in search of short term cost reductions therefore increasing short run profits. Long run costs will increase as the shortfalls are discovered and remediation is required. Government policy risk is the risk that governments control permitting process for El Paso. FERC has to approve all the pipeline projects for El Paso. The Bureau of Land Management reviews and approves all the projects that are near or on federal land. El Paso must maintain good relationships with these federal agencies. El Paso must make sure that their employees that interact with government officials comply with all rules regarding government EL PASO NATURAL GAS 8 interactions especially removing any conflicts of interest that could be negative. El Paso must have a compliance department that regularly inspects and monitors government relations to maintain its credibility. The risk of having the government encumber your project and slow it down can be costly and having the government on the company’s side can be profitable. The quicker an approval is made the better. The long term profits of having a quick and seamless approval can lead to long term profit however the risk of losing all future business is risky. El Paso faces many risks in operating and building pipelines. Most of these risks can be mitigated with hedging, proper financial management and creating a social license. Hedging poses risks within themselves and those risks need to be identified with systems and cross checks in place as not to amplify risk but minimize. Business Cycle Natural gas has several cycles that it operates in. Seasonal cycles are demand cycles. Winter increases demand from consumers to warm the buildings they live and work in. Strong winter storms in the Northeast cause spikes in demand while milder winters allow more normal seasonal demand. Demand curves shift to the right and prices rise supply curves shift to the left and prices rise quickly in the commodity market. El Paso makes money as it transports more gas to the end consumer. As summer approaches and demand for electricity increases so the power generating facilities demand more natural gas and prices increase. The summer is the peak hurricane season so as storms enter the Gulf of Mexico supply can be constricted and shifting supply curves. El Paso needs to use both macro and microeconomic forecasting. El Paso operates in many states that the overall economy will have an impact on its operating business units. US EL PASO NATURAL GAS 9 GDP has fallen over the last two years and so has the demand for natural gas so inventories have risen. Natural gas prices have fallen from $8.44 March 2008 to $4.36 in March 2010 a decrease of 48% (EIA,n.d.) as GDP has fallen from 2.6% in 2008 to -1.3% in 2009) (BEA,2010) while this correlation is not proven it seems to be correlated. Microeconomic forecasting is needed to forecast what El Paso will do in building pipelines and how the industry will either oversupply the market with pipelines or undersupply the market. If your competitors are building too much supply then it El Paso has to forecast its potential demand for the areas served. Conclusion El Paso Corporation faces both supply and demand uncertainty in the future as it is reliant on several drivers of volume including weather and consumers. A backdrop of uncertainty can create opportunity for this largest pipeline company in an oligopoly. Access to cheap funds and a social license will allow them to build more pipelines and have more access to more users of natural gas. The economies of scale work in their favor going forward. El Paso Corporation can capitalize on the economies of scale and minimize risks in inflation, credit, counterparties and focus on core business they can create excess profits going forward. Government relations and ethical behavior will also yield excellent returns for El Paso Corporation. EL PASO NATURAL GAS 10 References Bureau of Economic Analysis (BEA). (n.d.). National Economic Accounts. Retrieved from http://www.bea.gov/national/index.htm#gdp El Paso Corporation.(n.d.).El Paso Pipelines. Retrieved from http://www.elpaso.com/pipelines/ El Paso Corporation.(2009). El Paso Pipeline Group: 2009 Analyst Presentation. Retrieved from http://phx.corporateir.net/External.File?item=UGFyZW50SUQ9MzYyMTExfENoaWxkSUQ9MzU1NzIxfF R5cGU9MQ==&t=1 Energy Information Agency (EIA). (n.d.). Natural Gas Navigator. Retrieved from http://www.eia.doe.gov/dnav/ng/hist/n9190us3m.htm Federal Energy Regulatory Commission. (2009). What the FERC Does. Retrieved from http://www.ferc.gov/about/ferc-does.asp Fromartz, Samuel. (2009). The Mini-Cases: 5 Companies, 5 Strategies, 5 Transformations. Boston, MA. MIT Sloan Management Review Hirschey, Mark. (2009). Managerial Economics, 12th Edition. Mason, OH. South-Western Cenage Learning Natural Gas Supply Association. (N.D.). Industry and Market Structure. Retrieved from http://www.naturalgas.org/index.asp