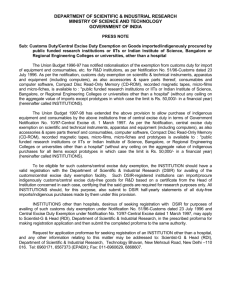

indirect taxes

advertisement

UNION BUDGET – 2014 AMENDMENT IN INDIRECT TAXES GAURAV ARYA CHARTERED ACCOUNTANT +91-9560607530 UNION BUDGET 2014 FOCUS Stability and Continuity Revenue Generation Simplicity OBJECTIVITY Widen the Tax Base Compliance Enhancement Facilitation Measures Highlights of Finance Bill, 2014 India has the second fastest growing service sector in the world with a compound annual growth rate at 9 percent. Contribution of Services in GDP composition over 60 percent. GDP growth in 2013-14 @ 4.7 percent; expected to be 5.4 percent in 2014-15. Tax- GDP ratio expected to be 10.5 percent in FY 2014-15. Hints at time line for GST and legislative changes in December 2014 and GST expected in 2015-16. Ambitious Revenue Collection Targets in Interim Budget. Proposed tax changes factored in the Budget Estimates 2014-15 Measures to revive the economy, promote investment in manufacturing, rationalize tax provisions to reduce litigation, address the problem of inverted duty structure in certain areas. Tax reliefs to individual tax payers 24X7 customs clearance facility extended to 13 more airports in respect of all export goods and to 14 more sea ports in respect of specified import and export goods to facilitate cargo clearance. ‘Indian Customs Single Window Project’ to facilitate trade, to be implemented. Customs and Central Excise Acts to be amended to expedite the process of disposal of appeals. The scheme of Advance Ruling in indirect taxes to be expanded to cover resident private limited companies. The scope of Settlement Commission to be enlarged to facilitate quick dispute resolution. Tax proposals on the indirect taxes side are estimated to yield additional 7,525 crore. WIDENING THE TAX BASE Service Old Provision New Provision Advertising Service Selling of space or time slots for Now Service Tax on all type of advertisements other than advertisements except service tax on advertisement on print media. advertisements broadcast by Coverage • Online and mobile advertising, radio or television. • Internet websites, • Out-of-home media, • On film screen in theatres, • Bill boards, • Conveyances, • Buildings, • Cell phones, • Automated Teller Machines, • Tickets, • Commercial publications, • Aerial advertising, etc. Print media is being defined in service tax law for the purpose. WIDENING THE TAX BASE Service Old Provision New Provision Radio Taxis Service of transportation of passengers, with or without accompanied belongings, by – (i) a stage carriage; (ii) railways in a class other than – (A) first class; or (B) an air conditioned coach; (iii) metro, monorail or tramway; (iv) inland waterways; (v) public transport, other than predominantly for tourism purpose, in a vessel between places located in India; and Service tax on services provided by radio taxis or radio cabs, whether or not airconditioned The abatement presently available to rent-a-cab service would also be made available to radio taxi service. Definition of radio taxi is being included in the exemption notification No.25/2012-ST. Radio Taxis – Which is in two-way radio communication with a central control office Enabled for tracking using Global Positioning system (GPRS) / General packet Radio service Metered cab definition u/s section 65 (32) of the Finance Act has also amended to excluded ‘ Radio Taxis’ (vi) metered cabs, Radio Taxis or auto rickshaws WIDENING THE TAX BASE Service Contract Carriage Old Provision Service of passenger transportation by a contract Entry No. 23b of carriage other than for the Mega Exemption purposes of tourism, Notification conducted tour, charter or 25/2012 - ST hire, is exempt from service tax. New Provision Exemption in respect of airconditioned contract carriages has been withdrawal. Service provided for transport of passenger by air-conditioned contract carriage including which are used for point to point travel, will attract Contract carriage means any service tax. motor vehicle contracted or adapted for use solely for the Abatement of 60% is available to carriage of Passengers, or that service. Service tax will be any motor vehicle not so charged at an abated value of 40% of constructed or adapted when the amount charged from service used for the carriage of receiver. Passengers. Services by non-air conditioned contract carriages for purposes other than tourism, conducted tour, charter or hire continue to be exempted. WIDENING THE TAX BASE – WITHDRAWAL OF EXEMPTIONS Service Old Provision Testing and Analysis of Drugs Services by way of Sl.No.7 of Mega Exemption Notification 25/2012 - ST New Provision Now it is being withdrawn. This would be taxable with Technical testing or analysis immediate effect. of newly developed drugs, including vaccines and herbal remedies on human participants by a clinical research organization approved to conduct clinical trials by the Drug Controller General of India. WIDENING THE TAX BASE – WITHDRAWAL OF EXEMPTIONS Service Old Provision Sl.No.9 of Mega Services provided to an educational Exemption Notification institution in respect of education 25/2012 – ST exempted from service tax, by way of,Auxiliary educational services Renting of immovable property Auxiliary educational services” means any services relating to imparting any skill, knowledge, education or development of course content or any other knowledge – enhancement activity Any services which educational institutions ordinarily carry out themselves but may obtain as outsourced services from any other person, including services relating to admission to such institution, conduct of examination, catering for the students under any mid-day meals scheme sponsored by Government, or transportation of students, faculty or staff of such institution; New Provision Auxiliary educational services” is deleted and the following services received by eligible educational institutions are exempted from service tax: I. Transportation of students, faculty and staff II. Catering service , government sponsored mid-day meals scheme III. Security or cleaning or house-keeping services IV. Admission related services V. Exam Related Services Exemption hitherto available to services provided by way of renting of immovable property to educational institutions stands withdrawn, with immediate effect WIDENING THE TAX BASE – WITHDRAWAL OF EXEMPTIONS Service Old Provision New Provision Municipality Service Exemption to Services by way of water supply, public Sl.No.25 of Mega health, sanitation Exemption Notification conservancy, solid waste management or slum improvement and upgradation Earlier exemption will continue but it will not extendable to other services such as consultancy, designing, etc., not directly connected with these specified services. Services by a Hotel, Service by way of renting Inn or Guest House of a hotel, inn, guest house, club or campsite or Sl. No. 18 of Mega other commercial places Exemption Notification meant for residential lodging purposes, having a declared tariff of a unit of accommodation below rupees one thousand per day or equivalent. Service by way of renting of a hotel, inn, guest house, club or campsite or other C o m m e r c i a l places meant for residential lodging purposes, having a declared tariff of a unit of accommodation below rupees one thousand per day or equivalent. Widening The Tax Base Service Service tax on service portion in Works Contracts Old Provision New Provision Rule 2A of the Service Tax (Determination of Value) Rules, 2006, Rule 2A of the Service Tax (Determination of Value) Rules, 2006, Taxability Table A. Original Work – 40% B. Repair & Maintenance Movable Property – 70% C. Repair & Maintenance Immovable property, Finishing work, Glazing Work etc. – 60% Taxability Table A. Original Work – 40% B. Repair & Maintenance Movable Property, Immovable property, Finishing work, Glazing Work etc. – 70% C. Repair & Maintenance Immovable property, Finishing work, Glazing Work etc. – 60% Compliance Enhancement Increase in Interest Rates Notification No. 12/2014 – ST Simple interest rates per annum payable on delayed payments under section 75, are prescribed as follows Extent of delay (In Months) Simple interest rate per annum Effective Date Example 0 to 6 18% 6 -12 0-6 – 18% 6-12 -24% Effective Date - 1st October 2014. Upto 1st October, 2014, present rate of 18% remain in effect. New rates will apply from 1st October, 2014. > 12 0-6 – 18% 6-12 -24% > 12 months – 30% For eg. service tax became due, say, on the 6th of July, 2012 and the assessee pays the dues on 6th of December, 2014. Interest to be charged would be as below: (i) Upto September, 30th, 2014 - 18% simple interest (ii) From 1st October, 2014 to 6th December, 2014, the rate of interest will be 30% since the period of delay is beyond one year. As specified in the proviso to section 75, three per cent concession on the applicable rate of interest will continue to be available to the small service providers. E - Payment Mandatory E- Payment for everyone E-payment of service tax is being made mandatory with effect from the 1st Oct 2014 Relaxation from e-payment may be allowed by the Deputy Commissioner/Asst. Commissioner on case to case basis [Notification 09/2014-ST]. Facilitation Measures Exchange Rates Provision / Rules/ Section Amendment Section 67A in the Finance Earlier the government Act, 1994 (Exchange Rates) used to issue weekly notification for exchange rates for import and export of services. Now new set of rules are prescribed for determination of rate of exchange for calculation of taxable value in respect of certain services. This amendment has been proposed in view of requests from the trade and industry to delink the conversion from the notified Customs rates of exchange as at present. Remarks ICAI suggested the government to prescribe the exchange rates in accordance with the Accounting Standard -11 to for ease the industry and trade. Provision Section / Rules/ Amendment Service Tax Rules Rule 2(1)(d) – Reverse Charge Remarks Service provided by a Director to a Coverage – IIT, IIM, RBI etc. body corporate is being brought under the reverse charge mechanism; service receiver, who is a body corporate will be the person liable to pay service tax. [Notification 9/2014 –ST] Services provided by Recovery Agents to Banks, Financial Institutions and NBFC is being brought under the reverse charge mechanism; service receiver will be the person liable to pay service tax. [Notification 10/2014-ST] Change take place from immediate effect Place of Provision Rules, 2012 Rule Amendment Remarks Rule 4(a) Rule 4 will not apply – Rule 3 will apply Scope Restricted Goods Exported – Than Imported – Reexported Number of Activities Additional Condition Additional Condition – Goods must not be put to use in taxable territory except for such use as may be required for carrying out such repair Exclusion does not apply to goods that arrive in the taxable territory in the Earlier Present Repair Repair Reengineering Reengineering Reconditioning Reconditioning usual course of business and are subject to repair while such goods remain in the taxable territory, e.g., any repair provided in the taxable territory to containers arriving in India in the course of international trade in goods will be governed by rule 4. Place of Provision Rules, 2012 Rule Amendment Remarks Rule 9 (c ) Now Intermediary of Goods Effective Date – 01.01.2014 falls under definition of intermediary. Now the commission agent or consignment agent shall be covered under rule 9(c) of the Place of Supply of Services Rules. Rule 9(d) Service consisting of hiring Hiring of yatchs would however continue to be of Vessels, Yatchs and covered by rule 9 (d) Aircraft . Now hiring of vessels, or Effective Date – 01.10.2014 aircraft, irrespective of Mode 0 to 1 month > 1 month whether short term or long Vessel (Other Rule 3 Rule 3 term, will be covered by than Yatch) the general rule (Rule 3) i.e. Yatchs Rule 9 Rule 3 the location of the service receiver. [Notification Aircraft Rule 3 Rule 3 14/2014-ST] All other means Rule 9 Rule 3 of Transport Point of Taxation Rules, Cenvat Credit Rules Rules Amendment Remarks Point of Notification No.13/2014-ST Applicability Date - 1st October, 2014. Taxation Amendment to first Proviso to Rule 7 of Rules the Point of Taxation Rules (POTR) New transition rule is being prescribed – (POTR) Rule 10 of POTR POT in respect of reverse charge will be earlier of following Payment date The first day that occurs immediately after a period of three months from the date of invoice CENVAT Credit Rules Notification No.21/2014-CE (N.T.) Credit Taken Availment Limit –six months Cenvat credit on Full Reverse Charge Payment of Service Tax Payment to Vendor Cenvat Credit on Export Proceeds delay received. Allowed if remittance received within one year from the period so specified or extended period. This can be done on the basis of documents evidencing receipt of export proceeds Amendments in Abatement Notification Entry No. Amendment Remarks 7 (GTA For availing abatement the Good Move. Illogical condition has been Service) condition for non- availment of taken away. Service Recipient feel relieved . credit is required to be satisfied by the service providers only. Service recipient will not be required to establish satisfaction of this condition by the service provider 9A (AC New entry to line the AC contract Contract carriage services with rent – a-cab Carriage) or radio taxis. Taxable portion of AC Contract carriage service is 40%. Cenvat Credit on Inputs, Input Services, Capital Goods are not allowed. 9 (Rent-a- Benefit of Cenvat Credit is allowed Big Relief to the industry. cab) to the person in the same line of business. Amendments in Abatement Notification Entry No. Amendment Remarks 11 (Tour Operator Services) Cenvat Credit on input services is allowed for Service recipient in the same line of business Effective Date – 1st October, 2014 Transport of goods by vessel Effective Date – 1st October, 2014 Taxable portion reduced from 50% to 40%. Effective service tax will decrease from the present 6.18% to 4.944%. Other Provisions Particulars Amendment Remarks Partial Reverse Charge mechanism Notification No.10/2014-ST Effective Date - 1st of October 2014 Renting of motor vehicle. Value SP SR Abated - Non 60% Abated 50% Advance Ruling 40% 40% 50% Notification No.15/2014-ST This change will come into effect in class of persons eligible to immediately. make an application for Advance Ruling in service tax Resident Private Limited Company is the new entry Special Economic Zone SIMPLIFICATION OF PROCEDURES Notification No. 07/2014 amending the Notification 12/2013 –ST dated 1st July, 2013 Form A-2 -Time Limit defined – 15 Days CEO would issue authorization in Form A-2 within 15 working days from the date of receipt of Form A-1 Form A-1- Authorization by SEZ Officer Authorization validity - Date on which Form A-1 is verified by the Specified Officer of SEZ. Delay beyond 15 days - Form A-1 is furnished after a period of 15 days from the date of its verification by the Specified Officer, the authorization shall have validity from the date of furnishing of Form A-1 to the Central Excise Officer. Upfront exemption without authorisation but subject to time limit to furnish authorisation SEZ Units or the Developer will, pending issuance of Form A-2, be entitled to avail upfront exemption on the basis of Form A-1. However, in such a case, the SEZ Unit/Developer would be required to furnish a copy of authorization issued by the Central Excise Officer within 3 months from the date of receipt of specified services. If a copy of authorization is not provided within the said period of three months, the service provider shall pay service tax on the service so provided availing the exemption. Resolve the conflict of jurisdiction Jurisdictional DC/ AC of Central Excise for all purposes under the said notification would be the authority with whom SEZ Units or the Developers are registered for taking upfront exemption or for the purposes of Chapter V of the Finance Act, 1994. In case of centralized registration under the Service Tax Rules, the authority having jurisdiction over centralized registration is the jurisdictional authority. Reverse Charge Mechanism As regards services covered under full reverse charge, it is being mentioned specifically in Form that there would be no requirement of furnishing service tax registration number of service provider. Exclusivey Used Services It is being provided that a service shall be treated as exclusively used for SEZ operations if the recipient of service is SEZ unit or developer, Invoice is in the name of such unit/developer Service is used exclusively for furtherance of authorized operations in SEZ INPUT SERVICE DISTRIBUTOR Notification No. 05/2014-CE (N.T.) Rule 7 of the CENVAT Credit Rules, 2004, provides for the manner of distribution of common input service credit by the Input Service Distributor Notification clarifies that the amended rule 7 allows distribution of input service credit to all units (which are operational in the current year) in the ratio of their turnover of the previous year/previous quarter as the case may be. Remarks – Now non operational units are not considered while distributing credit. Exemptions to Social Sectors Mega Exemption Notification Particulars Sl. No.26A of All life micro-insurance schemes approved by the Insurance Regulatory Notification Development Authority (IRDA), where sum assured does not exceed 25/2012 50,000 are being exempted from service tax -ST amended by [Notification No.06/2014-ST]. Sl.No. 20 and Transport of organic manure by vessel, rail or road (by GTA) is being 21. exempted Sl. No. 20 & 21 Services by way of loading, unloading, packing, storage or warehousing, and 40 transport by vessel, rail or road (GTA), of Cotton, Ginned or Baled, is being exempted Sl. No.2B New Entry Sl. No. 36 – Services provided by Common Bio-medical Waste Treatment Facility operators by way of treatment, disposal of bio medical waste or processes incidental to such treatment or disposal are being exempted Service provided by Employees State Insurance Corporation (ESIC) during the period prior to 1.7.2012 is proposed to be exempted from service tax. Presently any service provided by ESIC to persons governed under the Employees State Insurance Act, 1948 is already exempt from 1.7.2012 Mega Exemption Particulars Notification New entry at Sl. No. Specialized financial services received by RBI from outside India, in the 41 of 25/2012-ST course of management of foreign exchange reserves, e.g. external asset management, custodial services, securities lending services, are being exempted New entry at Sl. Services provided by the Indian tour operators to foreign tourists in No.42 relation to tours wholly conducted outside India are being exempted. This exemption is available to Indian tour operators in cases where they organize tours for a foreign tourist wholly outside India Central Excise provisions made applicable to Service Tax: Section 83 is being amended to prescribe that the provisions of following sections of the Central Excise Act shall apply, mutatis mutandis, to service tax. Section 5A(2) Any explanation inserted in a notification or special order at any time within One Year of issue of notification or order, for clarifying the scope or applicability thereof, shall have effect from the date of issue of such notification or order. Section 15 A This new section is being inserted in the Central Excise Act to stipulate that Third Party Sources shall furnish periodic information, as specified, in the manner as may be prescribed. Section 15B This new section is being inserted in the Central Excise Act to prescribe that failure to provide information under section 15A of the Act would attract penalty as specified. Central Excise provisions made applicable to Service Tax: Section 35F Mandatory Fixed Pre-Deposit 1st Stage Appeal - 7.5% of the duty demanded or penalty imposed or both for filing of appeal before the Commissioner(Appeal) or the Tribunal. 2nd Stage Appeal - 10% of the duty demanded or penalty imposed or both for filing appeal before the Tribunal. Amount of pre-deposit payable would be subject to a ceiling of Rs 10 Crore. All pending appeals/stay application would be governed by the statutory provisions prevailing at the time of filing such stay applications/appeals. This new provisions would, mutatis mutandis, apply to Service Tax. Central Excise provisions made applicable to Service Tax: Section Amendment Section 73 Sub-Section 4B to Section 73 has been inserted (a) within six months from the date of notice where it is possible to do so, in respect of cases whose limitation is specified as 18 months in sub-Section (1); (b) within one year from the date of notice, where it is possible to do so, in respect of cases falling under the proviso to sub-Section (1) or the proviso to sub-Section (4A).; Section 80 Exclude the reference of the first proviso to Section 78. This amendment removes the power to waive the 50% penalty imposable in cases where service tax has not been levied, not paid or short levied or short paid on account of suppression of facts or willful misstatement but details of transactions are available in the specified record . It curtails the wings of CEO. Section 82(1) Powers to Joint Commissioner or Additional Commissioner or any other officer notified by the Board can authorize any Central Excise Officer to search and seize Central Excise provisions made applicable to Service Tax: Section Amendment Section 87 Power to recover dues of a predecessor from the assets of a successor purchased from the predecessor as it is presently provided for in section 11 of the Central Excise Act, 1944 Section 94 Rule making powers (a) to impose upon assessees, inter alia, the duty of furnishing information, keeping records and making returns and specify the manner in which they shall be verified; (b) for withdrawal of facilities or imposition of restrictions (including restrictions on utilization of CENVAT credit) on service provider or exporter, to check evasion of duty or misuse of CENVAT credit; and (c) to issue instructions in supplemental or incidental matters. SERVICE TAX NOTIFICATIONS NOTIFICATION NO. PARTICULARS 6/2014-ST dated Seeks to amend notification No. 25/2012- Service Tax, dated the 20th June, 11th July, 2014 2012, so as to amend certain existing entries granting exemption on specified services and inserting new entries for granting exemption from service tax on specified services 7/2014-ST dated Seeks to amend notification No.12/2013-ST dated 1st July, 2013, relating to 11th July, 2014 exemption from service tax to SEZ Units or the Developer. 8/2014-ST dated Seeks to amend notification No. 26/2012- Service Tax, dated 20th June, 11th July, 2014 2012, so as to make necessary amendments in the specified entries prescribing taxable portion and the conditions for availing the exemption therein 9/2014-ST dated 11th July, 2014 Seeks to amend the Service Tax Rules,1994 so as to prescribe,(i) the person liable to pay service tax for certain specified services and (ii) mandatory e-payment of service tax for all the assessees, with effect from 1st October,2014. NOTIFICATION NO. PARTICULARS Service Tax Notifications 10/2014-ST Seeks to amend the notification No.30/2012-ST dated 20th June,2012, so as to dated 11th July, prescribe, the extent of service tax payable by the service provider and the recipient 2014 of service, for certain specified services. 11/2014-ST Seeks to amend the Service Tax (Determination of Value) Rules, 2006 so as to dated 11th July, prescribe the percentage of service portion in respect of works contracts, other than 2014 original works contract. 12/2014-ST Seeks to notify the interest rate applicable in cases of delayed payment of service tax dated 11th July, for the purposes of section 75 of the Finance Act, 1994. 2014 13/2014-ST Seeks to amend the Point of Taxation Rules, 2011, to prescribe the point of taxation dated 11th July, for the services on which person liable to pay service tax is the recipient. 2014 14/2014-ST dated 11th July, 2014 Seeks to amend the Place of Provision of Services Rule, 2012, to prescribe or modify the place of provision of services for certain specified services 15/2014-ST dated 11th July, 2014 Seeks to specify the class of persons for the purposes of section 96A of the Finance Act,1994 ?????GOODS AND SERVICE TAX????? Extract of Budget Speech of Finance Minister The debate whether to introduce a Goods and Services Tax (GST) must now come to an end. We have discussed the issue for the past many years. Some States have been apprehensive about surrendering their taxation jurisdiction; others want to be adequately compensated. I have discussed the matter with the States both individually and collectively. I do hope we are able to find a solution in the course of this year and approve the legislative scheme which enables the introduction of GST. This will streamline the tax administration, avoid harassment of the business and result in higher revenue collection both for the Centre and the States. I assure all States that government will be more than fair in dealing with them. CUSTOMS AND CENTRAL EXCISE Customs Act, 1962 Legislative Changes Section 3 Class of officers of Customs Principal Chief Commissioner of Customs and Principal Commissioner of Customs. Reference in that Act Reference in the Act to a Chief Commissioner of Customs or a Commissioner of Customs may also include a reference to the Principal Chief Commissioner of Customs or the Principal Commissioner of Customs Section 15(1) Determination of rate of duty and tariff valuation for imports through a vehicle in cases where the Bill of Entry is filed prior to the filing of Import Report (as the Manifest is called in case of imports by land). Section 46(3) Allow the filing of a Bill of Entry prior to the filing of Import Report (as the Manifest is called in case of imports by land) for imports through land route. Section 25 No Customs duties on mineral oils including petroleum & natural gas extracted or produced in the continental shelf of India or the exclusive economic zone of India shall not be recovered for the period prior to 7th February, 2002. Section 127A “Customs and Central Excise Settlement Commission” is now known as “Customs, Central Excise and Service Tax Settlement Commission”. Section 127L An Explanation has been inserted that the concealment of particulars of duty liability relates to any such concealment made from the officer of customs and not from the Settlement Commission. Section 129A(1) Increase the discretionary powers of the Tribunal to refuse admission of appeal from the existing Rs.50,000 to Rs.2 lakh. Section 129A(1B) Power to the Board to constitute a Review Committee by way of an order instead of by way of a notification. Section 129D New proviso in sub-section (3) - Powers to board to condone delay for a period of upto 30 days, for review by the Committee of Chief Commissioners of the orders in original passed by the Commissioner of Customs. Section 129E Mandatory fixed pre-deposit 7.5% of the duty demanded or penalty imposed or both for filing appeal with the Commissioner (Appeals) or the Tribunal at the first stage 10% of the duty demanded or penalty imposed or both for filing second stage appeal before the Tribunal. The amount of pre-deposit payable would be subject to a ceiling of Rs. 10 crore. Section 131BA Commissioner (Appeal) to take into consideration the fact that a particular order being cited as a precedent decision on the issue has not been appealed against for reasons of low amount. CUSTOMS TARIFF ACT, 1975 Section 8B Levy of safeguard duty on inputs/raw materials imported by an EOU and cleared into DTA as such or are used in the manufacture of final products & cleared into DTA. AMENDMENT IN THE FIRST SCHEDULE TO THE CUSTOMS TARIFF ACT, 1975 Tariff item 2402 20 60 is being omitted as a consequential change to amendment in the First Schedule to the Central Excise Tariff Act. The tariff rate of basic customs duty on goods falling under tariff items 8517 62 90 and 8517 69 90 is being increased from Nil to 10%. The unit quantity code against certain entries is being changed. CENTRAL EXCISE • CENTRAL EXCISE ACT, 1944 Reference in that Act Reference in the Act to a Chief Commissioner of Customs or a Commissioner of Customs may also include a reference to the Principal Chief Commissioner of Customs or the Principal Commissioner of Customs Central Excise Officer Principal Chief Commissioner of Central Excise Principal Commissioner of Central Excise Section 32E(1) In cases where the applicant has not filed the returns after recording reasons for the same, application can be filed before the settlement commission. Section 35L Determination of disputes relating to taxability or excisability of goods is covered under the term “determination of any question having a relation to rate of duty” and hence, appeal against Tribunal orders in such matters would lie before the Supreme Court. Amendments in the Central Excise Valuation Rules, 2004: The Central Excise Valuation (Determination of Price of Excisable Goods) Rules, 2000 is being amended so as to provide that in cases Price -Excisable goods are sold at a price below the manufacturing cost and profit. Consideration - There is no additional consideration flowing from the buyer to the assessee directly or from a third person on behalf of the buyer, Valuation -Value for the assessment of duty shall be deemed to be the transaction value. Notification No.45/2000-Central Excise (NT) dated 30th June, 2000 as amended vide notification No.20/2014-Central Excise dated 11th July, 2014 refers.