Procedural aspects of central excise law and its applicability

advertisement

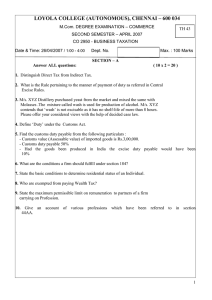

D e e C e e A s s o c i a t e s Budget 2014 – 15 Central Excise & Service Tax Highlights 1 D e e C e e A s s o c i a t e s Rate of duty of Central Excise & Service Tax No change in rate of Central Excise duty, except for Cigarettes, Aerated drinks etc. The same rate of 12.36% continues. ♦ NO change in rate of Service Tax. The same rate of 12.36% continues. ♦ 2 D e e C e e A s s o c i a t e s Proposed Service Tax on Services ♦ Sale of space for advertisements is proposed to be extended in segments like online and mobile advertising, internet websites, out-of-home media, on film screen in theatres, bill boards, conveyances, buildings, cell phones, Automated Teller Machines, tickets, commercial publications, aerial advertising, etc ♦ Service tax is proposed to be levied on services provided by radio taxis or radio cabs, whether or not air-conditioned 3 D e e C e e A s s o c i a t e s Service Tax on Services with immediate effect ♦ ♦ ♦ Service provided for transport of passenger by air-conditioned contract carriage including which are used for point to point travel, will attract service tax, with immediate effect. Services by non-air conditioned contract carriages for purposes other than tourism, conducted tour, charter or hire continue to be exempted. Services by way of technical testing or analysis of newly developed drugs, including vaccines and herbal remedies on human participants by a clinical research organization approved to conduct clinical trials by the Drug Controller General of India will attract service tax Service provided by dharmashalas, ashram or any such entity which offer accommodation by way of place meant for residential or lodging purposes, having a declared tariff of a unit of accommodation above rupees one thousand per day or equivalent” shall be liable to service tax. 4 D e e C e e A s s o c i a t e s Works Contract Service/ Services by / to Educational Institution Works contract entered into for,(i) maintenance or repair or reconditioning or restoration or servicing of any goods; or (ii) maintenance or repair or completion and finishing services such as glazing or plastering or floor and wall tiling or installation of electrical fittings of immovable property, service tax shall be payable on seventy per cent. of the total amount charged for the works contract” Services by / to Educational Institution Services provided,(a) by an educational institution to its students, faculty and staff; (b) to an educational institution, by way of,(i) transportation of students, faculty and staff; (ii) catering, including any mid-day meals scheme sponsored by the Government; (iii) security or cleaning or house-keeping services performed in such educational institution; (iv) services relating to admission to, or conduct of examination by, such institution;” 5 D e e C e e A s s o c i a t e s Rate of Interest & E - payment Extent of delay Simple interest rate per annum Up to six months 18% More than six months & upto one year More than one year 18% for first six months, and 24% for the period of delay beyond six months 18% for first six months, 24% for second six months, and 30% for the period of delay beyond one year This new interest rate regime will become operational only on 1st October 2014. In other words, upto 1st October, 2014, the rate of interest of 18%, presently applicable, will continue to apply. The variable interest rates will apply only on or after 1st October, 2014 E-payment E-payment of service tax is being made mandatory with effect from the 1st Oct 2014. Relaxation from e-payment may be allowed by the Deputy Commissioner/Asst. Commissioner on case to case basis. 6 D e e C e e A s s o c i a t e s Time limit for taking Cenvat Credit on Inputs / Input Services A manufacturer or a service provider shall take credit on inputs and input services within a period of six months from the date of issue of invoice, bill or challan w.e.f. 1st September,2014 7 D e e C e e A s s o c i a t e s Relief from Fiat Judgement The Central Excise Valuation (Determination of Price of Excisable Goods) Rules, 2000 is being amended so as to provide that in cases where excisable goods are sold at a price below the manufacturing cost and profit and there is no additional consideration flowing from the buyer to the assessee directly or from a third person on behalf of the buyer, value for the assessment of duty shall be deemed to be the transaction value. 8 D e e C e e A s s o c i a t e s Address: Dee Cee Associates 328 Nirmal Galaxy (Avior) Opp Johnson & Johnson, LBS Marg, Mulund West, Mumbai –400 080 India.