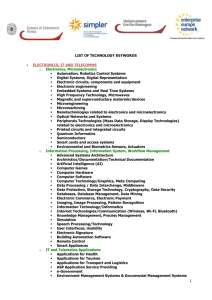

Introduction to equations used in skills forecasting

advertisement

Skills Planning for the FPM Sector Daryl McLean Pauline Matlhaela and Associates Outline of Presentation SSP requirements Relationship between SSP/ASP/APP Questions an SSP is trying to answer The structure of a sector skills plan “Performance-based” sector skills planning Methodology and Project Plan Analyses for Leather and footwear Clothing and textiles Forestry, wood, pulp and paper Furniture Publishing Printing and packaging Print media Priority Skills Interventions The Legal Mandate A SETA must, in accordance with any requirements that may be prescribed: a. develop a sector skills plan within the framework of the national skills development strategy; b. implement its sector skills plan byi. ii. iii. iv. v. establishing learnerships; approving workplace skills plans; allocating grants in the prescribed manner and in accordance with any prescribed standards and criteria to employers, education and training providers and workers; and monitoring education and training in the sector; promote learnerships by – 1. 2. 3. 4. identifying workplaces for practical work experience; supporting the development of learning materials; improving the facilitation of learning; and assisting in the conclusion of learnership agreements; “Performance” Requirements and Framework Treasury Regulations 5 and 30 require FPMSETA to: “Produce and table a Strategic Plan with a five-year planning horizon, outlining the planned sequencing of projects and programme implementation and associated resource implications and other prescribed information Produce and table an Annual Performance Plan including forward projections for a further two years, consistent with the medium-term expenditure framework (MTEF) period, with annual and quarterly performance targets, where appropriate, for the current financial year and the MTEF Identify a core set of indicators needed to monitor institutional performance Adopt a quarterly reporting system, including submission of agreed information to executive authorities, the Presidency or Premier’s Offices, the relevant treasury and Parliamentary portfolio committees. Public entities are encouraged to submit the reports to their executive authorities and responsible departments. Ensure that there is alignment of reporting between the Strategic Plans, Annual Performance Plans, budget documents and annual and quarterly reports”. Content and Structure of Strat Plans and Performance Plans Top-Down and Bottom-Up Planning Under NSDS1 and 2 The targets were set in NSDS These were cascaded to 22 SETAs The budgets were divided by the targets in developing the plans Under NSDS3: There are top-down AND bottom-up processes What is a “Sector Skills Plan”? What is Required in Each SSP Section SSP Section Purpose, Questions, Data and Analysis Required Profile of the Sector Purpose is to scope the sector – who is included/excluded in the analysis? What are the key features of the sector that are relevant to the analysis? The impact level of measurement must be defined here. Demand for skills Purpose is to identify how many (new and existing) employees must be trained over a 5 – 10 year timeframe; for which jobs; and why (the impacts intended). This includes growth demand and replacement demand. Data must include growth forecasts; employer/employee data; labour market trends; and key strategy drivers. Supply of skills Purpose is to analyze the supply-side capacity required to achieve the demandside targets. Data must include current providers; provider capacity; programs; enrolment, retention and achievement rates (all analyzed against demand side/regional distribution). Also budgets, EEEE analysis. Priority areas for skills interventions Purpose is to list the scarce/critical needs and to prioritize the most important. Then to identify the priority (systemic) interventions required to address the problems. Strategies for delivering priority interventions Purpose is to identify the key challenges in delivering the priority skills, and to propose strategic framework for SETA operations. These must relate back to the impact level of measurement and the RoI/EEEE baselines. Performance Information Categories of Performance Information Using SMART Performance Measures Managing Performance What are we trying to achieve? What evidence do we use? Where are we now? How do we add value? Performance Measures Performance Indicators Baselines and Targets Actions and Outputs Measuring “Effectiveness” Level Effectiveness Objective Level Sample Indicator 1 Are learners satisfied? • Course evaluation forms completed by learners 2 Are learners learning? • Assessor and moderator reports 3 Are learners transferring what they learn to the workplace? • Transfer of learning evaluation forms completed by learners, supervisors and managers 4 Is the transfer improving productivity or service delivery? • Multivariate analysis of performance data 5 Is the workplace performing better as a result? • Multivariate analysis of workplace/industry data 6 Is the country or sector doing better as a result? • Analysis and synthesis of data collated at previous levels Illustrative Framework of Indicators Education and training outcomes % correlation of enrolment figures against scarce and critical needs of sector % rise in achievement rates, measured by the number of learners passing divided by those who enrolled % rise in retention rates, measured by the number of learners completing divided by those who enrolled Stakeholder Satisfaction Outcomes Employment Outcomes Social Outcomes % learner satisfaction, measured against standardized course evaluation ratings % employer satisfaction, measured against standardized employer feedback ratings % of unemployed learners in jobs 6 months after training % transfer of learning to the workplace, measured against standardized transfer of learning ratings % contribution to sector employment equity objectives (applicable to all providers for reporting, but only to SETA-funded provision as measurement) Equity Baseline – Gender and Disability (ATR) Occupation Group Male Female Disabled Clerks 3824 6427 1686 Craft & Related Trades 3915 446 80 Elementary Occupations 7109 2506 73 Legislators, Senior Officials and Managers 3498 1872 40 Plant & Machine Operators & Assemblers 12562 2195 92 Professionals 1991 1987 22 Services & Sales Workers 5032 4960 102 10 5 0 Technicians & Associate Professionals 5333 5052 63 Baseline Expenditure 63% 37% 3% Skilled Argricultural & Fishery Workers Equity Baselines - Race Occupation Group Number African Coloured Indian White Clerks 2778 3181 3162 2816 Craft & Related Trades 1212 1177 775 1277 Elementary Occupations 6316 2492 619 261 Legislators, Senior Officials and Managers Plant & Machine Operators & Assemblers Professionals 660 668 613 3469 7043 4616 2104 1086 658 563 402 2377 Services & Sales Workers 2641 1706 1621 4126 2 7 0 6 1830 1743 2462 4413 32.6% 22.8% 16.6% 28% Skilled Argricultural & Fishery Workers Technicians & Associate Professionals Baseline Expenditure Baselines for Effectiveness/Efficiency Costs Divided by Pass Rates COOPERATIVE GOVERNANCE AND TRADITIONAL AFFAIRS 168 168 100% 7 72 10% DEPT OF SPORT,ARTS,CULTURE AND RECREATION 35 63 56% DEPT OF AGRICULTURE AND RURAL DEVELOPMENT 34 327 10% DEPT OF ECONOMIC DEVELOPMENT AND PLANNING 9 64 14% 304 227 134% 43 575 7% 9 639 1% 301 1% DEPT OF POLICE,ROADS AND TRANSPORT DEPT OF INFRASTRUCTURE DEVELOPMENT DEPT OF ECONOMIC DEVELOPMENT AND TOURISM DEPT OF PUBLIC WORKS DEPT OF LOCAL GOVERNMENT AND TRADISTIONAL AFFAIRS DEPT OF AGRICULTURE DEPT OF CO-OPERATIVE GOVERNANCE AND TRADITIONAL AFFAIRS . . 729 . 4 SETA Performance Value Chain Management Steers Organisation Toward Goals / Responds to Context Sector Skills Planning Identifies Strategic Issues, Needs, Causes, Policy Options Projects Grants Learning Programs Innovates Implements Implements Best Practice Best Practice Best Practice Solutions Solutions Solutions Increased Workplace Participation in Planning/Delivering Skills Development ETQA Steers Provision Toward Needs Improved Correlation Between Provider Capacity and Sector Skills Needs Measured Against Framework of Indicators Gov Serv Fin Ops METHODOLOGY AND PROJECT PLAN Past Approaches to SSPs in SA Current approach WSPs/ATRs analysis Employer surveys Consultations with stakeholders Reliance on WSP/ATR and employer information Coverage of employer through WSPS WSPs skewed to large employers WSPs not necessarily based on best practice WS planning Partial picture of scale and shortages Not differentiate between frictional as opposed to structural causes Limited predictive potential 19 Sector Skills Planning models internationally Skills forecasting Labour market signaling Qualitative models Cost – benefit models Each model has weaknesses – mixture of different models more effective to achieve purposes of sector skills planning Appropriate mix of models depends on availability of data; resources available for planning; timeframes 20 Qualitative Methods “…Qualitative methods involve attempting to reach an assessment of skill needs through in-depth interviews with key stakeholders such as policy makers, and of course, employers. Wilson, Woolard and Lee (2004) conclude that where the data permits, standard occupational forecasts should be produced regularly, complemented by the more qualitative approaches, to produce a more rounded and enriched view of changing skill needs”. An Assessment of International Trends in Occupational Forecasting and Skills Research: IRNI 2008 Project Plan Labour Market Forecasting Model 1 Macroeconomic model 2 Occupational employment model 3 Replacement demand model 4 Skills demand model Growth Demand Calculations FORMULA: GROWTH IN OUTPUT = GROWTH IN DEMAND FOR LABOUR (LESS PRODUCTIVITY IMPROVEMENTS, CAPACITY UNDER-UTILISATION, CAPITALISATION, LABOUR ELASTICITY) Separate growth scenarios were formulated based on conservative overand under-projections of the previous average growth in the sectors in the FP&M SETA (-1%, 2%, 5%). The total employment figures based on the Quarterly Labour Force Survey (QLFS) 2012 dataset from the first quarter The capacity under-utilisation percentage was found in the Statistics South Africa document entitled Manufacturing: Utilisation of production capacity by large enterprises, 2012. (Except for forestry) The productivity figures were calculated based on output data derived from the Quantec database Capital intensity data was collected from the Quantec database. (Except for Forestry) Labour elasticity was calculated based on sectoral output and wage data from the Quantec database. For the forestry sector, employment data was derived from Forestry South Africa’s Forestry and Forest Products and wage data was derived from the Quantec database. Occupational Modelling FORMULA: DIVIDE THE TOTAL NUMBER OF JOBS FORECAST ACROSS THE VARIOUS OCCUPATIONS ACCORDING TO PERCENTAGES The occupational employment figures and disaggregation were derived from the QLFS datasets from 2008 – 2012 Some of these look odd, so We are checking with Stats SA We may use the WSP categories/percentages instead Replacement Demand FACTORS: RETIREMENT, MORTALITY, MORBIDITY, MOBILITY The retirement forecast figure was calculated using the age profile from QLFS 2012. It was assumed that all of the workers aged between 60 and 65 years of age will retire in the next 5 years; and those aged between 55 and 60 years of age will retire in the next 10 years. The HIV/AIDS prevalence rate was modelled on various data sets (see following slides) but remains a very generic estimate compared to the modelling required For replacement demand based on deaths from causes other than HIV/Aids-related issues, a figure of 5% was picked. This was based on the ratio of the number of working people who died in 2009 (the latest available Cause of death data from Statistics South Africa) to total employed people which was 4.4%. This was rounded up to 5%. Mortality and Morbidity - HIV/AIDS Occupational Bands HIV/AIDS – Education Levels Impact of HIV/AIDS on Companies Epidemiology of HIV/AIDS SUMMARY OF FPM INDUSTRIES SKILLS PLAN FINDINGS Clothing, Footwear, Textiles, Leather and General Goods - Shrinking Output - Clothing, Footwear, Textiles, Leather and General Goods - Imports vs Exports- Growth Prospects The growth prospects for the sector remain by and large unchanged for the future unless the sector fundamentally restructures itself and improves product offering and pricing. Growth for the sector in the next 5 years is more a matter of retaining market share against cheap imports than about growth. If the DTI strategy works growth may be an option post 2015. Capacity Utilisation The overall sectoral utilisation of factors of production is down from 77.2% in 2009 and 74.1% in 2010. Stats SA conducted a sectoral survey on reasons for the under-utilisation of the factors of production…. The unused 22.6% was accounted for as follows: Lack of raw materials : 2% Lack of skilled labour : 0.9% Lack of unskilled labour : 0.4% Insufficient demand : 16.7% Other : 2.9% Productivity 2004 2005 2006 2007 2008 2009 14.8 7.3 7.2 7.2 20.4 -2.0 25.6 12.1 6.5 3.3 15.5 -6.0 Wearing apparel [313315] 0.7 1.6 7.1 7.8 22.3 4.6 Leather and products [316] 15.1 10.4 8.5 22.2 34.1 -23.2 17.6 8.2 2.8 5.0 4.2 -4.8 Textiles, clothing leather [311-317] and Textiles [311-312] Footwear [317] leather Growth and Replacement Scenarios: Leather Scenarios -1% 2% 5% Current total employment 12278 12278 12278 Job losses forecast -7743 -7504 -7265 New level of employment 4535 4774 5013 Total replacement demand* 3120 3120 3120 Final employment level 7655 7894 8133 Factor Totals Retirement Mortality (HIV/AIDS) Mortality (Other deaths) Migration Total 664 1228 614 614 3120 Growth and Replacement Scenarios: Footwear Scenarios -1% 2% 5% Current total employment 13922 13922 13922 Job losses forecast -5812 -5529 -5246 New level of employment 8110 8393 8676 Total replacement demand* 3192 3192 3192 Factor Retirement Mortality (HIV/AIDS) Mortality (Other deaths) Migration Total Totals 408 1392 696 696 3192 Footwear Occupational Modelling (Major Occupational Groups) Legislators, senior officials and managers 839 Technical and associate professionals 1073 Clerks 2032 Craft and related trades workers 4733 Plant and machine operators 4326 Elementary Occupation 919 Total 13922 Footwear Occupational Modelling (Minor Occupational Groups) Supply and distribution managers 839 Technical and commercial sales representatives 814 Decorators and commercial designers 259 Stock clerks 677 Receptionist and information clerk 894 Other office clerks 461 Millers, bakers, pastry chefs 2947 Shoemakers and related workers 1786 Sewing-machine operators 902 Fur and leather-preparing machine operators 982 Shoemaking and related machine operator 2442 Hand-packers and other manufacturing labourers 919 Supply and distribution managers 839 Technical and commercial sales representatives 814 DTI Industry Strategy Leather is divided into cattle hides, ostrich, crocodile, etc 2.5m cattle slaughtered in SA annually 60% of the hides used in auto industry 251m pairs of shoes consumed domestically, only 50m made here Thus beneficiating the hides in footwear potentially brings these jobs back to SA Footwear design, quality of workmanship, branding and international retail linkages are key constraints Limited supply-side training to address these concerns Leather and Footwear Strategy: Projections Strategy Driver 2008 Strategic Framework for Leather and Footwear Industries Growth demand 30 000 new jobs Supply-side capacity/ interventions General: •Build local design training capacity •Strengthen quality of workmanship/career pathing •Ethical branding/quality management implications •Small business competitiveness improvement •Strengthen international networks/linkages •Collaborative clustering” strategy behind training Specific: •Leather technologists •Ethical branding – quality management Specific Skills Priorities Leather and Footwear Skills Strategy Leather Leather technologists NB Quality control (ethical branding) focus Career pathing from NQF2 upwards Electrical and engineering NB Footwear “Collaborative Bursaries Design clustering” to inform skills interventions for international design studies (short-term) Institute Growth and Replacement Scenarios: Textiles Scenarios -1% 2% 5% Current total employment 253742 253742 253742 Job losses forecast -10432 -9876 -9320 New level of employment 243310 243866 244422 Total replacement demand* 60962 60962 60962 Factor Totals Retirement Mortality (HIV/AIDS) Mortality (Other deaths) Migration Total 10214 25374 12687 12687 60962 Textiles Retirement Demand 15-19 20-24 25-29 30-34 35-39 40-44 45-49 50-54 55-59 60+ Total Male 1498 2784 5,513 2,584 9,254 1,923 3,433 1,919 3,267 2,289 34,464 Female 785 1172 2076 3,152 6,943 5,578 5214 4,092 4,817 2518 36347 Total 2283 3956 7,589 5,736 16,197 7,501 8,647 6,011 8,084 4,807 70,811 Growth and Replacement Scenarios: Clothing Scenarios -1% 2% 5% Current total employment 121324 121324 121324 Job losses forecast - 35370 - 31466 - 27563 New level of employment 156694 152790 148887 Total replacement demand* 30979 30979 30979 Factor Totals Retirement Mortality (HIV/AIDS) Mortality (Other deaths) Migration Total 6715 12132 6066 6066 30979 Retirement Demand (Clothing) Male Female Total 15-19 0 1,800 1,800 20-24 0 7,790 7,790 25-29 2,828 11,621 14,449 30-34 2,243 15,575 17,818 35-39 4,817 13,982 18,799 40-44 2,200 12,037 14,237 45-49 3,374 17,065 20,439 50-54 705 13,195 13,900 55-59 1,466 9,288 10,754 60+ 0 1,338 1,338 Total 17,633 103,691 121,324 Clothing and Textiles CSP Strategy Driver DTI Customised Sector Program Growth demand 50 – 60 000 new jobs Clothing and Textiles CSP/Charter CSP focus areas Domestic market development (local sourcing, trade measures, combat illegal imports, promote local) Exports (promote trade, market access) Competitiveness (capitalisation, supply chain) Sustainable HR (training of managers, avoid sweatshops…) Empowerment Empowerment (charter commits to 30% BEE in textiles, 50% in clothing) Clothing and Textiles Technical textiles Replacement demand – aging workforce New equipment coming in Critical skills: new equipment; technical artisan skills especially; mechanical engineers; technicians; mechanics; quality contollers Challenges with existing provision: no external training capacity due to specialisation Have to send people oversees, or bring people in from outside country – could look at partnerships with industry (esp india) or at increasing stipend since learning is international Clothing Replacement demand: aging workforce; provident fund debacle Need for versatile/multi-skilled machinists Three most important things: supporting more learnerships in companies and trying to see how we can multi-skill Bridging courses from ABET to higher levels, to enable progress toward supervisor Growth and Replacement Scenarios: Forestry Scenarios -1% 2% 5% Current total employment 36174 36174 36174 Job losses forecast - 15884 - 14974 - 13704 New level of employment 52058 50968 49878 Total replacement demand* 8844 8844 8844 Factor Totals Retirement Mortality (HIV/AIDS) Mortality (Other deaths) Migration Total 1609 3617 1809 1809 8844 Retirement Demand (Forestry) Age group Male Female Total 20-24 1146 874 2020 25-29 1939 3452 5391 30-34 2569 1916 4485 35-39 4434 867 5301 40-44 3750 348 4098 45-49 583 780 1363 50-54 312 1013 1325 55-59 1333 0 1333 60-64 0 784 784 Total 16066 10034 26100 Growth and Replacement Scenarios: Wood Scenarios -1% 2% 5% Current total employment 53364 53364 53364 Job losses forecast -10233 -9782 -9330 New level of employment 43131 43582 44034 Total replacement demand* 13178 13178 13178 Factor Totals Retirement Mortality (HIV/AIDS) Mortality (Other deaths) Migration Total 2506 5336 2668 2668 13178 Retirement Demand (Wood) Male Female Total 15-19 1,229 0 1,229 20-24 3,578 619 4,197 25-29 3,903 4,025 7,928 30-34 13,112 3,487 16,599 35-39 5,218 1,493 6,711 40-44 3,001 1,436 4,437 45-49 7,278 4,441 11,719 50-54 4,852 1,181 6,033 55-59 3,278 565 3,843 60-64 742 0 742 Total 46,191 17,247 63,438 Pulp and Paper This sector has had the highest output in the past 10 years but around the 3rd lowest employment figures. Consequently, the labour productivity in this sector is particularly high. Therefore, the growth projection scenarios used in this example are so low that they would result in negative employment growth and negative employment in this sector. Because the labour productivity is so high, this sector is not likely to require new labour at such low growth situations. Only at very high growth levels would positive employment be maintained. Forestry, Timber, Pulp, Paper Strategy Driver 2007 Forestry Strategy/Charter Growth demand 26 000 new jobs in Forestry (EC) and 300 downstream 15 000 new jobs KZN, with 500 downstream 3% of payroll on learning programmes for black employees, over and above the 1% spent on the skills levy Scarce Skills in Forestry Forestry, Wood, Pulp and Paper Relevant growth demand: targets are almost certainly wrong, need to be reviewed – closer to 6000,. Problems include land reclamation debates; number of hectares constrained; some shrinkage taking place in land use; Main drivers: aging workforce. Main factors in terms of critical skills. We are driving more timber from less land through critical skills development, therefore this should be an important focus. Challenges with existing provision: not a lot of basic training (sawmilling etc). For pulp and paper we need a lot of higher levels (scientists, engineers) Areas for intervention: Improve skills of existing employees; dedicated training centres for these skills; problems for reinvestmnt of timber; private companies don’t have cashflow to invest in new areas (costs more to clear land etc). Forums for large roleplayers to talk about the needs of their employees for training. Furniture Strategy Driver Furniture Industry Strategy Growth demand 9 932 new jobs Furniture Growth demand drivers: domestic market development, empowerment, technology Replacement demand: aging, remuneration (other sectors poaching our technical skills) Main factors driving critical skills: technology, design, aging. Challenges with training: appropriate accreditation, qualifications, staff, technology Someone decided not to offer technical subjects in school, a big problem in industry Partnerships with industry and training providers – the providers (esp FET colleges) approach only for placement – partnership ratther than a dumping ground Important things the SETA can do: engage majority of employers not only Gauteng; engage more with SMMEs; turnaround times with grants and programs Growth and Replacement Scenarios: Printing Scenarios -1% 2% 5% Current total employment 75156 75156 75156 Job losses forecast -7791 -7604 -7510 New level of employment 67365 67552 67646 Total replacement demand* 19364 19364 19364 Factor Totals Retirement Mortality (HIV/AIDS) Mortality (Other deaths) Migration Total 4332 7516 3758 3758 19364 Retirement Demand (Printing) Male Female Total 15-19 1,450 0 1,450 20-24 2,556 3,478 6,034 25-29 6,359 7,082 13,441 30-34 6,407 4,521 10,928 35-39 8,596 5,711 14,307 40-44 8,417 3,503 11,920 45-49 2,742 2,354 5,096 50-54 2,140 1126 3266 55-59 5011 2569 7580 Publishing and Print Media Strategy Driver Publishing Industry Strategy Growth demand 0 new jobs forecast Publishing and Print Media Move to digital driving industry, therefore not employment growth Understanding how to use digital in business terms Small niche market, individuals are not leaving industry thus no replacement demand Critical skills: sustainability of business/market needs Gap between younger and older employees – we have an aging workforce, training focused on bridging this gap Institutions do provide training, but learners graduating are not fully competent when they enter the workforce Engagement at all levels, pointing industry in right direction, assisting in meeting with stakeholders (eg universities) Understanding the collaborative clustering, bringing it together in the industry Funding for discretionary grant: training is in-house, often can’t be funded from DG – how do we do this? List of experts in our industry, SETA to make use of this for eg. program design Language in training is a concern Straddling FPMSETA and MICSETA – SIC CODE SPLIT; INDUSTRY COMPETITION; MDDA, ENTRY HEQ BUT PORTFOLIO; PROFILE NB; AIP STRAT; Is it possible to bring Printing and Packaging Strategy Driver No Industrial Strategy As Yet Growth demand ? new jobs Printing and Packaging Strategy Critical skills drivers Technology changes Multiskilling Strengthening the Skills Pipeline Grow skills pipeline into the industry – attracting new/right talent Improve base level of learning within the sector Generation Y factors Succession planning/knowledge management to address aging workforce Industrial strategy Lack of industrial strategy in SA – upstream/downstream linkages Building supply-side platform, capacity, throughput – incl HEI Industrial cooperation Printing No industrial strategy. Growth demand issues: technology; poor levels of general education; upskilling of currently qualified staff to improve skills levels; aging workforce; shift from low skill to high skills base; Are not training enough people overall; are promoting unqualified people to senior positions, need to qualify these people properly. Critical skills drivers: science and technology; life skills at more basic levels; business skills for the succession planning strategy; Challenges in terms of training provision: more than enough providers of artisan development; but at higher levels there are gaps, need to create programs and build HET capacity to do this; Realistic funding model needs to be developed (especially to sustain the private training provider capacity) Three most important things: develop an industry strategy; develop the higher level intellectual leadership; speed up development of new curriculum that’s been in process for the past three years Obstacles to the industrial strategy: we need to understand why there isnt, deal with the challenges behind this. Industry currently fragmented, silo mentality that is inhibiting this. Also have seen steady decline in training of apprentices. We need representation and inclusivity. RoI Planning More than 150 000 new jobs Guesstimate of 10% replacement demand pa (on 209323 employees) = 100 000 existing employees will need to be replaced Thus total of 250 000 people to be trained excluding critical skills development Total skills budget of R200m pa? Learnership = R25k Apprenticeships = R35k Skills program = R120 per credit, 60 credits? ABET = R3500 Interns = R25k for 6 months Therefore need to Improve economy and efficiency of skills efforts Improve completion and pass rates Explore more cost-effective training SUMMARY OF FPM INDUSTRIES SKILLS PLAN FINDINGS Generic Patterns in Analysis Literature survey Industrial strategies aim to achieve growth in employment, through various strategies Labour market analysis LMA shows high replacement demand (due to retirement/HIV) Yet despite replacement demand, LMA shows overall negative employment growth in every single industry, because employers are buying machines and improving productivity Stakeholder interviews and engagements Almost unanimous that industry strategies are ambitious Positive sentiment toward industrial strategies, constraints in industrial cooperation to achieve these WSP/ATR/ETQA findings and project allocations?? Return on investment analysis will point to equity/effficiency baselines. Generic Skills Priorities “Salvage” strategies? Training layoff scheme? State procurement Turnaround/growth strategies Collaborative clustering to inform when, how and what interventions take place Organising some parts of sector HET role in sector leadership development/think-tanks? Branding, international networks, retail linkages and SMME FET role in SMME/coop development? Supply-side strategies Feeder systems into schools/FETs? Specialist capacity/international linkages Mainstreaming into FETs Research partnerships with HETs? Non-formal/”whole organisation” interventions Succession planning linked to coaching and mentoring HIV/AIDS strategy Efficiency strategies Effectiveness strategies Non-Formal Interventions A “More Developmental” SETA? Non-formal interventions can be conducted through Recruit/select sample of participant companies/practitioners Agree and develop package of tools (policies, procedures, ME criteria, codes of practice, etc) Pilot, revise and link to grant windows Non-Formal Interventions Non-formal interventions can be conducted through Recruit/select sample of participant companies/practitioners Agree and develop package of tools (policies, procedures, ME criteria, codes of practice, etc) Pilot, revise and link to grant windows Clothing, Textiles, Footwear and Leather Work closely with DTI, sector designations are an important growth driver (means preferential procurement will include local manufacturing) – our industry isn’t adequately prepared for this (barganing council, OSH, business plans, etc are weaknesses). But this is a major potential lifeline to the current industry, which is struggling to survive New skins and hides policy will also ensure local beneficiation, need to gear for this in finishing plans, die houses within southern africa Informal sector needs not being adequatley addressed, is a major growth point – not high capitalisation required. Also not a lot of training, but there are career paths, business development skills required, quality assurance Leather technologistss Industry on verge of collapse, we need to link skills strategy to the survival strategies under discussion with DTI and the industry Printing/Packaging Growth demand drivers: needs to be a national industrial strategy. Will help to give direction to the industry. Another driver is government itself – expressed demands for printed material, scale challenges (eg. textbooks = 30m books a year – how this is managed impacts on industry. Also example of etolling tender – thus state procurement is a demand driver that should be managed carefully. Replacement demand: aging workforce, technological changes in industry Skilled professionalism is needed Poaching of staff is a problem General skills shortage because industry is highly technical, unless training infrastructure exists to supply these skills we will always have a problem Critical skills drivers: technology; supply of training; Closure of centralised capacity resulted in proliferation of private training providers; FET capacity not yet build to address the gap Print training is highly capital intensive, need FPMSETA to explore support in this. Eg, training facility for electronic origination. Updating qualifications/standards or development of new ones – these will enable RPL and skills training to be properly focused SETA support priorities: work closely with industry to build supply side capacity for FETS, including equipment. An industrial strategy would help. Also standardise learning material. Also SETA red tape is frustrating, SETA staff need to be better equipped within the industry to be able to lead the industry adequaely. Leather and Footwear Beneficiation of ostrich and crocodile focus No design institute No specialist training for designers in terms of specific materials Partnerships between industries and providers - links between theory and practice/provider and workplace Capacity-building to increase output International training to benchmark internationally Productivity focus Niche market focus to competitiveness strategies Profiling what we can do, where we can compete Links between manufacturing and brand strategies – affiliations and international networking Quality control issues and systems – ethical production focus to quality Supply chain program to improve competitiveness Training of people on learnrships – NQF 2 upwards career pathing Growth demand optimistic Policy levers and systems – eg. tracking systems for each hide in each ractory Electrical and engineering side – provifer capacity in the more rural areas NB