Test Review

advertisement

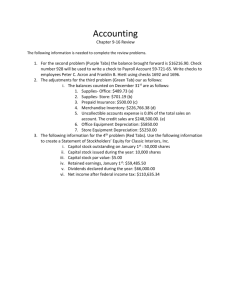

Test Review Bad Debt Expense 1. A company has credit sales of $120,000. They use the percent of sales method for estimating bad debt expense. At the beginning of the year the allowance for doubtful accounts was equal to $9,000. They estimate that 5% of the sales will be uncollectible. What is bad debt expense for the year? 2. A company uses the aging of receivables method for bad debt expense. The allowance for doubtful accounts at the beginning of the year is equal to $1,200. The bad debt expense was equal to $500. What were write offs for the year? Account under 30 Days 5% uncollectible $18,000 Account over 30 Days 10% uncollectible $6600 Depreciation 1. A piece of equipment was purchased for $48,000. The estimated salvage value is equal to $8,000. It has a useful life of 5 years. What is depreciation expense for each year using straight line depreciation? 2. A piece of equipment has an estimated useful life of 50,000 machine hours. It was purchased for $48,000 and has no salvage value. In 2014 15,000 machine hours were used. What was depreciation expense? 3. The acquisition cost of a machine is $33,000. The machine has an estimated useful life of 3 years and a residual value of $3,000. Prepare the depreciation schedule using double declining method. Bonds 1. A company issues $500,000 bonds with a life of 5 years. The stated rate is 8% and the market rate is 6%. The company received $542,123.64 for the bond. Prepare the amortization schedule. 2. A company issues $10,000 bonds with a life of 3 years. They were sold at 99 with the market rate equal to 5%. The stated rate on the bond is 3%. Prepare the amortization schedule. Stockholder’s Equity Preferred Stock: 10%, $20 par, 40,000 shares authorized Common Stock: $14 par, authorized 100,000 shares During the first year of operations, a company has the following transactions. Issue 80,000 shares of common stock for $22 a share Issue 10,000 shares of preferred stock at $36 a share Issue 6,000 shares of common stock at $28 per share and 2,000 shares of the preferred stock at $56 per share. Purchase 5,000 shares of common stock at $30 per share Net income of $96,000 and paid dividends of $10,000. What are the balances of the following accounts at the end of the year? Common Stock, Additional Paid in Capital-Common Stock, Preferred Stock, Additional Paid in Capital-Preferred Stock, Treasury Stock, and Retained Earnings