The Second National Uninsured Congress How Tax

advertisement

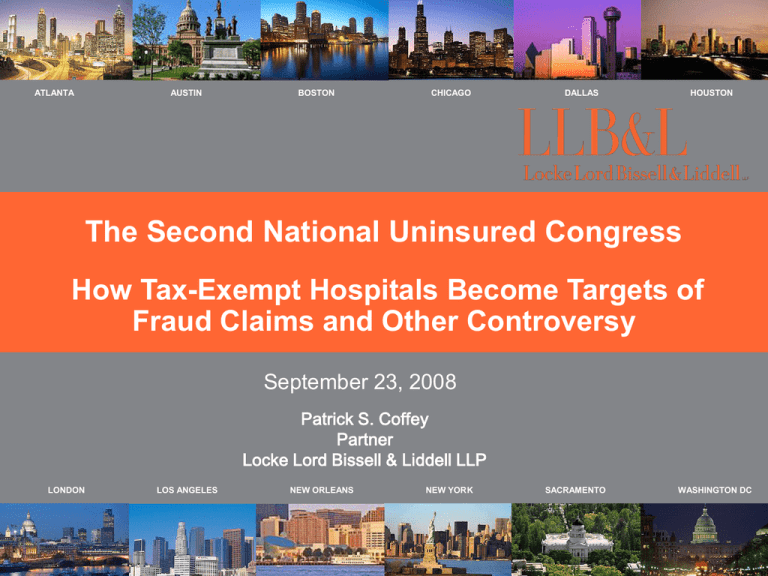

ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON The Second National Uninsured Congress How Tax-Exempt Hospitals Become Targets of Fraud Claims and Other Controversy September 23, 2008 Patrick S. Coffey Partner Locke Lord Bissell & Liddell LLP LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Outline of Presentation 1. The Exemption Controversy and Relationship to the Un and Under Insured 2. Survey of Exemption Challenges 3. The Illinois Experience 4. Managing Challenges to Exempt Status -National -State -Attorney General -NFP Litigation -Community Benefits 1 5. Questions ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC 1. The Controversy Over Tax Exemptions ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Media Scrutiny of Hospital Tax Exemptions THE WALL STREET JOURNAL FRIDAY, APRIL 4, 2008 - VOL. CCLI NO. 79 ############## ########### ####### ###### # ## ######## ########### ############ ################## ## What’s News #### ######### ####### ### ############ #### ### #### ### ### ## # ## ### # ###### #### ######### ####### ### ############ #### ### #### ### ### ## # ## ### # ###### #### ######### ####### ### ############ #### ### #### ### ### ## # ## ### # ###### #### ######### ####### ### ############ #### ### #### ### ### ## # ## ### # ###### ######### ############### ############ #### ######## ############ #### ### #### ### ### ## # ## ### # ###### #### ######### ####### ### ############ #### ### #### ### ### ## # ## ### # ###### #### ######### ####### ### Nonprofit Hospitals, Once For the Poor, Strike It Rich With Tax Breaks, They Outperform For-Profit Rivals BY JOHN CARREYROU AND BARBARA MARTINEZ Nonprofit hospitals, originallyset up to serve the poor, have transformed themselves into profit machines. And as the money rolls in, the large tax breaks they receive are drawing fire. Riding gains from investme -nt portfolios and enjoying the pricing power that came from a decade of mergers, many nonprofit hospitals have seen earnings soar in recent years. the combined net income of the 50 largest nonprofit hospitals jumped nearly eight-fold to $4.27 billion between 2001 and 2006, according to a Wall Street Journal analysis of data from the American Hospital Directory. AHD, an informationservice company, com- piles data that hospitals report to the federal government. The cleveland Clinic swung from a loss to net income of $229 million during that period. No fewer than 25 nonprofit hospitals or hospital systems now earn more than $250 million a year. Once nonprofit hospital system, Ascension Health, has a treasure chest of $7.4 billion - more than many large, publicly Officials Say They #### ######## ######### ### ####### ##### ############ #### ### #### ### ### ## ### ## ########## ### # ###### #### #### ### ######### ## ####### ### ##### #### ## ####### ##### ### #### #### ### ### ## ### ## ### # ##### ############ ##### #### ## ##### ##### # ### #### #### ##### ##### # #### ######## 3 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Ranging Views on Tax-Exempt Hospitals and Obligations to Serve the Uninsured • “We are not obligated by law to give anything.” Reported statement by health system counsel to city council. • “Some tax-exempt healthcare providers may not differ markedly from for-profit providers in their operations, their attention to the benefit of the community or their levels of charity care.” Letter to Senate Finance Committee by Mark Everson, Commissioner of the IRS. • “[C]urrent tax policy lacks specific criteria with respect to tax exemptions for charitable entities and…standards could be established that would allow nonprofit hospitals to be held accountable for providing services and benefits to the public commensurate with their favored tax status.” Testimony before Committee on Ways and Means by David W. Walker, Comptroller General of the United States. 4 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Ranging Views on Tax-Exempt Hospitals (cont’d) • “For many non-profit hospitals, we found the link between tax-exempt status and the provision of charitable activities for the poor or underserved is weak. Currently, the Internal Revenue Service (IRS) has no requirements relating hospitals’ charitable activities for the poor to their tax exempt status. If the Congress wishes to encourage nonprofit hospitals to provide charity care and other community services that benefit the poor, it should consider revising the criteria for tax exemption.” Mark Nadel, Associate Director of the GAO (in July, 1991). • “I don’t know when these charity people are going to get it, but we need to build more accountability into the nonprofit world if people are going to get these big tax breaks.” Dean Zerbe, former investigator to Senate Finance Committee. • “When nonprofit hospitals sit on big cash reserves, I wonder how much public service they’re offering.” Senator Chuck Grassley. 5 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Key Features of Exemption Controversy • Estimated 46 million uninsured at issue in still evolving crisis. • Focus on whether hospitals are providing sufficient charity with increasing efforts to mandate minimum obligations. • Rising healthcare costs amidst national recession and huge state revenue shortfalls. • Chargemaster pricing and collections continue to spawn challenges. • IRS compliance initiatives and new Form 990 require hospitals to justify “privileges and benefits” of exempt status. • Class action rulings equate hospital conduct with “unfair” and deceptive business practices. • Media focus on lack of charity, aggressive collections, executive compensation and other “for-profit” conduct. 6 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC 2. Survey of Exemption Challenges ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Minnesota Applies “Purely Public Charity” Standard for Exemption • Property tax exemption for hospitals, churches and schools judged by “purely public charity” standard. • In December 2007, Minnesota Supreme Court ruled that Under the Rainbow Child Care Center provided only “incidental” charity which did not qualify for exemption. • Moratorium sought to protect existing nonprofit property tax exemptions in Minnesota. 8 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Union Challenges to Exempt Hospital Practices • In 2007, United Nurses Association of California filed action alleging Sharp hospitals provide charity at less than one percent of operating expenses. • In March 2008, California Nurses Association declared a third strike against Sutter Medical Foundation hospitals alleging overcharging of uninsured, reduced charity to indigent patients, excessive executive compensation and abusive collection practices. • SEIU challenges Beth Israel Deaconess Medical Center “commingling of charity care and bad debt” in financial reporting. 9 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Indiana Grants Exemption to Physician Offices and Chaplain Residence • July 8, 2008 ruling reversed decision imposing property taxes on physician offices and hospital chaplain residence owned by Saint Margaret Mercy hospital. • Ruling affirmed chaplain residence and employed physician offices were used in service of hospital’s charitable mission. • Tax refund of $400,000 decried by authorities given budget shortfalls and opening of “floodgate” for similar requests. 10 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Indiana Denial of Tax- Exemption on Predominant Charitable Use Basis • Methodist Medical Plaza of Carmel leased land to Clarian Health Partners, a nonprofit provider with charity and medical education program. • Charitable, educational and hospital purposes exemption denied and appealed. • Tax court upheld denial based on lack of “any evidence showing [property] used more than 50% of the time to educate medical students or to provide charitable health care.” 11 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Continuing Challenges to Ohio Hospitals and Facilities Exemptions • Ohio tax authorities continue challenges taxexempt status of nonprofit healthcare providers. • Charitable tax exemption denied to Cleveland Clinic outpatient clinic and surgery center in test case where less than 2% “charitable care provided to indigent persons or those who cannot afford full cost of care.” • Challenges serving to define tax-exempt status by the ratio of charity care to all hospital services. • Trend is for exemption to be allowed when charity care exceeds 5% but denied when below 2%. 12 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Michigan Rejects Quantum of Charity Test for Exemption • Wexford Medical Group denied tax exemption based solely on the amount of free care given in the tax year at issue. • Michigan Supreme Court reversed holding that charitable exempt status is determined by analysis of charitable purpose - not some threshold level of charity care. • Appellate court overturns similar denial of exemption to McLaren Regional Medical Center and affiliated practice group based on Wexford. 13 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Washington Court Restores TaxExemption for Hospital Imaging Center • Legacy Salmon Creek Hospital was denied exemption for imaging center adjacent to hospital. • Imaging facility deemed insufficiently integrated to be part of the “hospital unit.” • In August 2007, court restored exemption finding facility was sufficiently integrated to meet exemption requirements. • Ruling appealed by Washington Department of Revenue. 14 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC New Jersey Denies Exemption to Satellite Hospital Facilities • In 2007, Hunterdon Medical Center’s physical therapy, pediatric and wellness center ruled ineligible for property tax exemption. • New Jersey appeals court affirmed based on lack of integration between hospital and satellite facilities. • New Jersey law requires “hospital purposes” use and function to extend tax exemption coverage. 15 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Louisiana Court Extends TaxExemption to Medical Office Building • Willis Knighton Medical Center challenged finding that leases to physicians constituted a commercial and non-exempt use of office property. • Trial court ruled medical office leases did not “cross over the line” and constitute non-exempt commercial use. • In March 2008, appellate court affirmed exemption finding leases related to the hospital’s tax-exempt purpose of providing medical care. 16 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Carlton Cove and Related Challenges to Exemptions for Retirement Facilities • In 2007, Alabama appellate court held that Carlton Cove retirement facilities were not exempt from property tax solely because of 501(c)(3) status. • Carlton Cove failed to meet state standard of “use[] exclusively ….for purposes purely charitable” given small amount of charity. • Growing trend of challenges involving senior living facilities serving the “financially well-off” prompting use of PILOTs and other measures. 17 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC 3. The Illinois Experience ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Community Health Care Denied, Then Restored to Exempt Status • In 2007, Illinois appellate court ruled Community Health Care, a federally qualified heath center, was not sufficiently charitable to warrant exemption. • Provision of free or discounted care to 27% of patients deemed inadequate under “exclusively” charitable exemption requirement. • State authorities subsequently rely on case to argue exempt hospitals must provide more than 27% of net revenue in free care. • In July 2008, Illinois Department of Revenue reverses course and approves charitable exemption to FQHC on new application. 19 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Carle Foundation Hospital Denied Tax-Exemption • • • • • Tax board sought revocation because hospital property not “actually and exclusively used for charitable…purposes.” Recommendation found less than one half of one percent of hospital revenue devoted to charity care and use of property for private gain. Tax board further alleged hospital had “unfair policy of overpricing services” and bringing collection actions against uninsured patients. Carle returned to the tax rolls and headed to administrative hearing on charitable exempt status. Related litigation challenging basis for IDOR denial remains pending. 20 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Richland Memorial Denied, Then Restored to Tax-Exempt Status • Hospital ownership converted in 2005 and spurred reapplication for property tax exemption. • Tax board recommended that hospital be allowed charitable exemption. • In 2007, Illinois Department of Revenue director denied exemption finding that hospital “operates primarily as a business.” • In 2005, 75% of hospital patients were Medicaid, Medicare or charity recipients and 14% of budget went to uncompensated care. • Tax authority later reversed revocation decision without public explanation. 21 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC IDOR Grants Exemption to Armenian Church of Lake Bluff • In June 2008, amidst controversial challenges to exempt status of community hospitals, IDOR grants exemption to mansion converted to church. • Exemption ruling grants $80,000 annual tax break over objection of local tax authorities. • Residential mansion deemed exempt by IDOR on basis of sworn affidavit and other submissions. • Case raises serious questions about fairness, consistency in operation of property tax system. 22 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC IAG Initiatives on Charity Care and Tax Exemption • “Tax-Exempt Hospital Responsibility Act” introduced in 2006 proposing 8% of hospital operating costs be devoted to charity care. • Attorney General seeks discounting scheme for uninsured and reporting requirements, warning hospitals to “lack confidence” over tax-exempt status given Provena Covenant controversy. • Investigations of nonprofit hospital business activities and other ongoing efforts intended to generate support for new law in Illinois. 23 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Assessor Report on Exempt Hospitals • In November 2007, Cook County Assessor issued report estimating that property tax on Chicago area hospitals would generate $240 million per year. • Report not intended to “answer the question of whether these hospitals should be taxable or not, but instead provides an estimate of what their value would be were they deemed to be taxable.” • Report noted “current litigation” over hospital exemptions and “uncertain” outcome of that litigation. • County budget deficit was then estimated at approximately $240 million. 24 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Proposed Resolution on Exempt Hospitals • In September 2007, two Cook County commissioners proposed removal of tax exemptions from hospitals failing to provide adequate charity. • Resolution sought investigation of the charity care provided by 50 hospitals within Cook County. • Commissioners asserted citizens “have been repeatedly defrauded by these hospitals that are not providing sufficient levels of charity care…” 25 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Denial of Property Tax-Exemption to Provena Covenant • In 2006, IDOR Director denied charitable property exemption to Provena Covenant based on the following findings: – Level of charity care failed to “prove that its primary purpose was charitable care.” – Provena provided “seriously deficient” charity measured by “total revenues” in given tax year. – Charity policy use federal poverty guidelines was inconsistent with charitable purpose and exempt status. – Later revisions to hospital assistance policy demonstrate the failure to provide adequate charity. – ED and other contracts with for-profit providers are inconsistent with charitable exemption. – Medicare, Medicaid and other uncompensated costs deemed irrelevant to tax-exemption. – Charitable contributions other than free care not relevant to exempt status. – Any collections action against patients is incompatible with charitable exemption. 26 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Provena Covenant Restored to TaxExempt Status • In August 2007, IDOR decision denying exemption was deemed “in error and reversed.” • Court found that exempt status was demonstrated by “uncontested and unrebutted evidence”. • “[A]pplicable law and precedent as set forth in the Plaintiff’s briefs, and as found by the [ALJ], establishes by clear and convincing proof” that Provena Covenant met qualifications for charitable and religious use exemption. • Court decision immediately attacked as product of inattentive court that failed to seriously consider 27 the issues. ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Illinois Appeals Court Reverses Ruling on Provena Covenant Exemption • On August 26, 2008, Court of appeals reversed Circuit Court judgment and upheld IDOR Director’s decision denying exemption from property taxes. • Court of appeals determined that IDOR position denying exemption was required to be upheld absent clear error. • Provena Covenant as until later in September 2008 to seek rehearing or petition for appeal to the Illinois Supreme Court. • Despite tax-exempt status pending final appeal, local authorities reported to be demanding hospital to immediately pay and return property taxes. 28 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Court’s Ruling Upholding IDOR Decision Denying Tax Exemption • • • • • Court held it was not clear error for IDOR to conclude that Provena Covenant was not a “charitable institution.” Provision of medical care is not, in and of itself, charity. The number of patients treated for free or at a reduced rate matters in determining whether a hospital is “charitable.” By spending only 0.7% of revenues on charity care, Provena could not have dispensed charity care to all in need. Existing charity policy failed to consider the financial condition of individual applicants and record failed to reflect operation of charity program. 29 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC 4. Managing the Risk of Challenges to Tax-Exempt Status ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC States Will Continue to Lead Challenges to Tax-Exempt Status • • • • • • State authorities will press new requirements on “modern hospitals” and seek to revisit tax-exempt status without regard to federal action. Demands for justification of state tax-exempt status will accelerate as uninsured and healthcare costs increase and budget deficits mount. Billing, pricing and collection practices will drive criticism and challenges. Community benefit reporting will fan controversy and confusion with state exemption standards. State challenges will include unprincipled demands with resulting erosion of charitable exemptions. The Illinois experience will spread past the Midwest. 31 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Managing State Challenges • • • • • • • Know what AGs are demanding from tax-exempt hospitals. Consider the use of valuation data. Understand what drives controversy and implement necessary measures to protect status. Use Board approved community benefit plans and enhanced reporting to make the case for exemption. Educate local tax authorities, patient advocates and editorial boards on the hospital value and contributions. Ensure pricing to uninsured is sensitive to deceptive and “unfair” practice claims. Use safeguards to reduce collections controversy. 32 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC AGs Continue Investigations Challenging Exempt Hospitals • In 2005, Illinois AG commenced investigation of “charity delivery services” by over 100 hospitals based on the alleged lack of sufficient charity and abusive practices. • In 2007, Minnesota AG threatened enforcement and achieved industry settlements proscribing discounting and charity practices. • Wisconsin brought enforcement in 2007 for unfair pricing and negotiated deals to end “overcharging” and billing and collections guidelines. • In early 2008, Ohio AG reinstituted initiative to define charity care and other tax-exemption standards, emphasizing concern over charges to uninsured and indigent patients. AG requiring submission of charity care information. • Kansas, Montana and other states have investigated hospital billing and collection practices deemed inconsistent with tax-exempt status. 33 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Managing AG Challenges • • • • • • Use outreach, advertising and other initiatives to prevent complaints that attract Attorney General attention. Revise charge and collection practices to avoid legitimate complaints. Improve charity care process and document the operating program. Enhance governance and reporting efforts to present the charitable mission and case for exempt status. Prepare to defend joint ventures, for-profit subsidiaries, potential conflicts of interest, executive compensation and other purported “for profit” business conduct. Consider exemption applications as opportunities for authorities to revisit qualifications for exemption. 34 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC IRS Enhances Oversight of Exempt Organizations • IRS requires more disclosure through new Form 990 and other reporting on how “nonprofit hospitals serve the public consistent with the privileges and benefits of tax exemption.” • In 2007, IRS issued long-awaited report on executive compensation and benefits, confirming “significant reporting problems” and $21 million in proposed excise tax assessments. • IRS reviews continue on compensation practices and community benefits in 2008. • In February 2008, IRS issued updated guidance on governance practices, signaling commitment to pursuing improved corporate governance as element of EO oversight function. • IRS memorandum cross-references Form 990 and telegraphs concerns over conflicts, document retention, whistleblower policies, and the importance of board oversight and management policies. • IRS final excess benefit rules issued in March 2008 emphasizing the importance of avoiding transactions which risk the loss of exemption. 35 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Managing Increased IRS Oversight • Understand IRS governance guidelines and conduct reviews to ensure board oversight and management practices are appropriate to the mission and current legal requirements. • IRS focus requires close scrutiny of compensation, process loans to insiders, major transactions, billing, collections, management agreements, joint ventures, and for-profit subsidiaries. • IRS measure drive reporting of expanding information with greater disclosure and focus on case for tax subsidy. • Use new Form 990 to improve overall reporting and as a checklist for the compliance health of the exempt organization. • Understand IRS final regulations on excess benefit transactions and implement any needed governance or compliance safeguards to protect status. 36 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Continuing NFP Hospital Litigation • Every federal lawsuit filed by Scruggs and related counsel beginning in 2004 concluded but state cases continue. • In March 2008, certified class action involving uninsured patients in Missouri (Quinn et al. v. BJC Healthcare) resulted in class settlement. • In January 2008, Scripps Health announced a settlement involving a class of uninsured patients. Case arose from counterclaim that alleged uninsured patients overcharged for emergency services (R.M. Galicia Inc. v. Franklin). • Similar class settlements in other California cases alleging overcharging of uninsured and unfair collection practices (Sutter Health Uninsured Pricing Cases and Dancer v. Catholic Healthcare West). • Earlier class settlements in Oregon included Legacy Health System and Providence Health System. 37 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Managing NFP Litigation Risk • • • • • • Understand the evolving class action settlement terms. Compare existing charity, pricing and collection policies to those prompting class action claims and settlements. Know that collections actions trigger counterclaims. Understand how plaintiffs firms view hospitals and mine for class consumer fraud cases and class representatives. Know how tax-exempt status is used in “unfair” and deceptive practice claims. Consider cases where hospitals were not required to extend discounts to uninsured (Banner Health v. Medical Savings Ins. Co. (AZ), Urquhart v. Manatee Memorial Hospital (FL), and King v. AnMed Health (SC)). 38 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Accountability Demands Continue to Impact Community Benefit Reporting • Local, state and federal demands for accountability, justification of exempt status will continue. • Reporting must effectively address the range of financial benefits provided to the community. • Quantifying economic and financial benefits can help present the hospital mission and case for exemption. • Departures from consistent reporting or accepted guidelines will continue to spawn controversy. • New Form 990 substantially impacts reporting. 39 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Managing Demands for Improved Reporting • Avoid inconsistent reporting in state, federal filings. • Conform accounting to accepted practices and know what critics will use to create trouble. • Evaluate the benefits associated with knowing the value of tax-exempt status. • Know the benefits and risks of making the “quid pro quo” case for tax-exempt status. • Be prepared to respond to union, media and tax authorities’ skewed exemption valuations. 40 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC 5. Questions ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC Locke Lord Business Litigation, Health Law, and Compliance Practices • The development of effective corporate compliance and financial assistance programs are critical to a strategic plans to reduce challenges to tax-exempt status. The attorneys at LLB&L are qualified to offer insights to the tax and other regulatory enforcement authorities’ views on exemption standards and assist organizations in structuring charity care and related operational activities to meet evolving legal and compliance standards. • The firm also aggressively defends tax-exempt organizations in response to governmental enforcement challenges and related private actions around the country. • Please contact the Locke Lord Bissell & Liddell attorney with whom you work, or call Patrick S. Coffey at 312.443.1802 (pcoffey@lockelord.com). 42 ATLANTA AUSTIN BOSTON CHICAGO DALLAS HOUSTON LONDON LOS ANGELES NEW ORLEANS NEW YORK SACRAMENTO WASHINGTON DC