Summer Budget – 8 July 2015_VA

advertisement

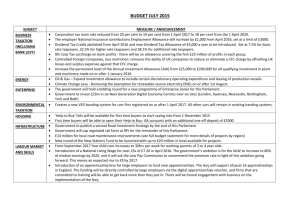

Summer Budget 8 July 2015: Presentation at the Verulam Golf Club on 10 July 2015 JAY DOSHI – VISIONARY ACCOUNTANTS – 01727 730 550 WWW.VISIONARYACCOUNTANTS.CO.UK Disclaimer These slides are for your general guidance only! Please take all appropriate professional advice as necessary. Neither the presenters/authors nor the organisers accept any liability for any loss suffered by anyone acting or refraining from acting as a result of anything mentioned during the presentations or as a result of anything expressed in these notes. e&oe. 2 From the Chancellor’s Speech … National Living Wage of over £9 an hour by 2020 ….. Government will run a surplus in 2019-20 ….. Reforming the welfare system ….. 3 million new apprenticeships by 2020 funded by a levy on large employers ….. From September 2017 30 hours of free childcare for 3 and 4 year olds ….. Student maintenance grants will be replaced with loans from 2016-17 academic year ….. Road tax to be reformed and monies raised to be spent on roads from 2020 ….. Extend the deadline for the first MOT of new cars and motorcycles from 3 to 4 years ….. etc. 3 Personal Tax etc. Personal allowances: Increase from £10,600 (2015-16) to £11,000 (2016-17) Higher rate threshold: Increase from £42,385 (2015-16) to £43,000 (2016-17) Dividend Taxation: From April 2016 the notional 10% tax credit to be abolished and a new “Dividend Tax Allowance” of £5,000/year to be introduced and the new rates of tax on dividend income above the allowance will be 7.5% for BR taxpayers, 32.5% for Higher Rate taxpayers and 38.1% for the additional rate taxpayers From April 2016 the “wear & tear” 10% allowance will be withdrawn and to be replaced by deduction of actual cost of replacing furnishings 4 Personal tax etc … cont. From April 2017: Tax relief on finance costs for buy-to-let properties to be restricted and the restriction will be phased in over a four year period starting from April 2017. Restriction will mean that tax relief will be at BR only (see a later slide) Rent-a-room relief to be increased from £4,250 to £7,500 from April 2016 Employer’s NI contributions ‘Employment Allowance’ to be increased from the current £2,000 to £3,000 with effect from April 2016 Non-dom: From April 2017 if anyone is resident in the UK for > 15 yrs of the past 20 yrs then he/she will be deemed domiciled for UK tax purposes 5 Personal tax etc … cont. From April 2017 individuals born in the UK to parents who are domiciled in the UK will no longer be able to claim non-dom status whilst being UK resident From April 2017 IHT will be payable on all UK residential properties owned by non-doms (regardless of their residence status or structure through which held – e.g., a offshore company or trust) Deemed domicile rule for IHT will also change, from April 2017, so that it is aligned with the above-mentioned 15 out of 20 years (currently 17 out of the past 20 years) Additional specialist personal tax resource for HMRC to tackle serious non-compliance by trusts, pension schemes and non-doms 6 Savings and pensions Lifetime Allowance for pension contributions to be reduced from £1.25m to £1m from April 2016. Transitional protection for pension rights already over £1m will be introduced The benefit of pensions tax relief for those with incomes (including pension contributions) above £150,000 will be restricted by tapering away the Annual Allowance (£40,000) with effect from April 2016 eventually to a minimum of £10,000 Lump sum death benefits where death occurs at age 75 or later will be taxed, with effect from April 2016, not at the current 45% rate but at the recipient’s marginal rate of tax 7 Inheritance tax Additional ‘nil rate band’ to be introduced when a residence is passed on death to direct descendants. This will be £100,000 (201718), £125,000 (2018-19), £150,000 (2019-20) and £175,000 from April 2020 Any unused nil-rate band will be transferred to a surviving spouse or civil partner It will also be available when a person downsizes (or ceases to own a home) on or after 8 July 2015 and assets of an equivalent value (up to the additional nil-rate band) are passed on death to direct descendants Tapered withdrawal of the additional nil-rate band for estates with a net value > £2m (withdrawal rate: £1 for every £2 over this threshold) 8 Business tax CT rate to be reduced from 20% to 19% from April 2017 and to 18% from April 2020 Capital allowances – Annual Investment Allowance (AIA) to be increased from £25,000 to £200,000 for all qualifying investments in plant and machinery made on or after 1 January 2016 Goodwill amortisation/write-off will be restricted for any new acquisitions/disposals made with effect from 8 July 2015 (see later slide) Loan relationships: Changes effective from accounting periods commencing on or after 1 Jan 2016 with some exceptions (e.g., provision relieving credit which arise when debts are released etc for companies in financial distress apply for releases/modifications on or after the date of the Royal Assent to the Summer Finance Bill). 9 Tax avoidance Common Reporting Standard (i.e. a type of disclosure channel) – Tax advisers and financial intermediaries will be notified by HMRC to write to their clients about: the CRS, the penalties for evasion and the opportunity to make a disclosure Direct recovery of debts – tax and tax credit debts direct from taxpayers bank account (including funds held in ISAs). There will be a county court appeal process and a face-to-face meeting before the taxpayer will be subject to the direct recovery method Criminal investigations to increase HMRC to obtain data from online intermediaries and electronic payment providers from April 2016 Digital disclosure channel to make it easier to make a disclosure 10 Tax avoidance … cont. The ability for companies to use UK losses and reliefs against a controlled foreign company (CFC) charge will be removed from 8 July 2015 Sums which arise to investment fund managers by way of carried interest will be charged to the full rate of CGT with only limited deductions being permitted Inheritance tax – Counteraction measure to stop the use of pilot trusts (typically used to gain advantage of multiple IHT nil rate bands on ten year anniversary calculations for each trust).Generally applying to new trusts created (or to old trusts where capital additions are made) on or after 10 December 2014 11 Restricting finance cost relief for individual landlords Finance costs include mortgage interest, interest on loans to buy furnishings and fees incurred in relation to borrowing/repayment 2017-18: 25% of the finance costs will be relieved at BR and the rest (75%) allowed fully 2018-19: 50% of the finance costs will be relieved at BR and the rest (50%) allowed fully 2019-20: 75% of the finance costs will be relieved at BR and the rest (25%) allowed fully 2020-21: 100% of the finance costs will be relieved at BR only 12 EIS / SEIS New investments will not qualify EIS unless the original investment was already made under EIS/SEIS or Social Investment Tax Relief (SITR) New rule to prevent companies from using EIS/VCT funds to acquire a business Companies must first raise the monies under EIS/SEIS/SITR within 7 years of making the first commercial sale or 10 years if the company is a ‘knowledge intensive company’ (i.e. basically research based but there is a strict definition), unless the amount of the investment is at least 50% of the company’s annual turnover averaged over the previous 5 years. The age limit will also apply to any business that has been owned previously by another company. 13 Restriction of CT relief for business goodwill amortisation Applies to accounting periods beginning on or after 8 July 2015 but not in respect of acquisitions made before 8 July 2015 Withdrawal of relief for goodwill and customer related intangible asset acquisitions If there is a disposal of goodwill (which falls under the new rules) on or after 8 July 2015 then any additional relief (typically this would arise if there is a loss on disposal) will be allowed as a ‘non-trading’ debit. This measure will apply to all acquisitions made on or after 8 July 2015 unless made pursuant to an unconditional obligation entered into before that date. It also applies to all goodwill created on or after that date. 14 Entrepreneurs’ relief – some recent changes announced previously Associated disposals – Assets used in the business but owned personally – as long as the disposal is associated with the qualifying disposal of the business / share in a partnership / qualifying shareholding. The amount of the gain eligible for relief may be restricted (so that only part of the gain then qualifies for relief). From 18 March 2015 the associated disposal must be associated with disposal of at least a 5% shareholding in the company or of at least a 5% share in the assets of partnership carrying on business If disposal is on or after 3 December 2014 to a close company and you are a related party then gain on goodwill will not be eligible for entrepreneurs’ relief. You are related to a close company if you or a near family member are a participator in the close company 15 Entrepreneurs’ Relief – trading investment via another entity With effect from 18 March 2015 claims to entrepreneurs’ relief in respect of shares in certain companies which invest in joint venture companies, or which are members of a partnership (LLP etc), are denied where the investing company has no trade (or no relevant trade) of its own! 16