Making America Work - The University of Oklahoma

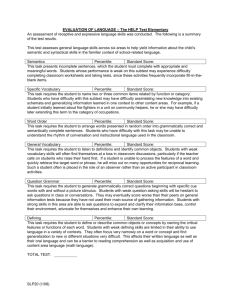

advertisement

Making America Work* Jon Forman Alfred P. Murrah Professor of Law University of Oklahoma www.law.ou.edu/faculty/forman.shtml Law and Society Association Law, Society, and Taxation Panel 07 Montreal, Canada May 30, 2008 *A presentation based on Jonathan Barry Forman, Making America Work (Washington, DC: Urban Institute Press, 2006). 1 Figure 1. Share of Household Income 60 50 Percent 40 30 20 10 0 Poorest 20% Free market Middle 20% Richest 20% After taxes & transfers 2 Percent of household income 100% Figure 2. How Taxes and Transfers Improved Equity, 2004 80% 60% Line of perfect equality Lorenz curve (income before taxes and transfers) Lorenz curve (income after taxes and transfers) 40% 20% 0% 0% 20% 40% 60% 80% Percent of households 100% 3 Figure 3. Family Income by Percentile, 1950-2003 (2003 dollars) $180,000 $160,000 $140,000 20th percentile 40th percentile $120,000 60th percentile 80th percentile $100,000 95th percentile $80,000 $60,000 $40,000 $20,000 $0 1950 1960 1970 1980 1990 Source: U.S. Census Bureau (2005b), table F-1. 2000 4 Figure 4. Ratio of Average Household Income of the Top 5 and 20 Percent of Households to the Average Household Income of the Bottom 20 Percent of Households, 1970-2000 30 T op 20%/bottom 20% T op 5%/bottom 20% 24.6 25 22.7 19.1 20 17.0 Ratio 16.2 14.5 15 14.7 13.2 10.6 11.3 9.8 13.8 11.9 10.2 10 5 0 1970 1975 1980 1985 Year S o urc e : U.S . C e ns us B ure a u (2004b), ta ble IE-3. 1990 1995 2000 5 Table 1. Average Annual Earnings of Full-time Workers, 2004 Doctors Lawyers Economists Nurses Police Auto mechanics Secretaries Garbage collectors Orderlies Waiters and waitresses $128,689 105,716 71,672 53,289 50,063 38,967 32,349 31,284 20,959 8,789 6 Figure 5. Distribution of Earnings, 2004 $400,000 Earnings $300,000 $200,000 $84,000 $100,000 $36,000 $15,600 $26,000 $50,000 $0 0 10 20 30 40 50 60 70 80 90 100 Percentile 7 Figure 6. Distribution of Workers by Earnings Category, 2004 Percent of workers 12 11 10 9 8 7 6 5 4 3 2 1 0 <0 15 30 45 60 75 90 105 120 135 150 165 180 195 210 225 240 >250 Earnings (thousands of dollars) 8 Figure 7. Wages by Percentile, 1979-2003 $40 Dollars per hour 2003$) $35 $30 95th percentile $25 90th percentile $20 80th percentile $15 50th percentile $10 20th percentile $5 10th percentile $0 1979 1985 1991 1997 2003 Year 9 Figure 8. The Size Distribution of Wealth, 2004: Percentage Share of Wealth Held by... 100 84.7 90 80 Percent 70 60 50 40 30 20 34.3 24.6 12.3 13.4 11.3 3.8 10 0.2 0 Top 1% Next 4% Next 5% Next 10% Top 20% 2nd 20% 3rd 20% Bottom 40% 10 Figure 9. The Distribution of Various Resources, by Quintiles 100% 80% Consumer unit consumption, 1999 60% Household earnings, 1998 40% Household income, 1998 Household wealth, 1998 20% 0% Lowest Second Middle Fourth Highest 11 Figure 10. Share of Household Income 60 50 Percent 40 30 20 10 0 Poorest 20% Egalitarian Middle 20% Free market Richest 20% After taxes & transfers Just? 12 Recent Policy Trends Encouraging Work • • • • Welfare reform Cutting tax rates on earned income Outlawed employment discrimination Social Security, pension, labor markets 13 Figure 11. Persons in Jail and Prison 1980-2005 2,500,000 Number 2,000,000 1,500,000 1,000,000 500,000 0 1980 1985 1990 1995 2000 2005 Year 14 Figure 12. How a 30 Percent Payroll Tax Can Reduce Work Effort $25,000 Before: 2,000 hours, $20,000/year $20,000 Income after tax After: 1,750 hours, $12,500/year $15,000 Income $10/hour $10,000 Income after tax Utility curve 1 Utility curve 2 $5,000 $0 2,500 2,000 1,500 1,000 500 0 Hours of work 15 Top 10 Income Tax Expenditures, 2009 (Billions of Dollars) Health insurance exclusion Mortgage interest deduction $168 101 401(k) plans Charitable contrib. (other than health & education) Accelerated depreciation Capital gains (except timber, iron ore, coal) 51 47 44 55 Deductible nonbusiness state and local taxes other than on houses Employer plans 33 Step-up of basis at death Capital gains exclusion on homes 37 34 2009 Federal Budget, Analytical Perspectives, Chapter 19, Tax Expenditures, Table 19-3 46 16 Some Specific Recommendations • Making Taxes Work • Making Welfare Work • Modestly Raising the Minimum Wage and indexing It for Inflation • A Two-Tiered Social Security System • A Restructured Pension System • Universal Health Care • Move Toward Full Employment 17 Fig. 13. 2005 Percentage Composition of Federal Receipts by Source: 1940- 60 50 Individual Income Tax 40 Percent Corporation Tax Social Insurance 30 Excise Taxes 20 Other 10 0 1940 1950 1960 1970 Year 1980 1990 2000 18 Figure 14. Income Tax Rates, Single Parent with Two Children and Earned Income Only, 2006 60% 50% Tax rate 40% 30% 20% 10% 0% $0 $50,000 $100,000 Earned income $150,000 $200,000 19 Figure 15. Social Security Tax Rates on Earned Income, 2006 60% 50% Tax rate 40% 30% 20% 10% 0% $0 $50,000 $100,000 Earned income $150,000 $200,000 20 Figure 16. U.S. Payroll Tax Rates: Selected Years Percent paid jointly by employee and employer 20 18 16 14 12 Medicare Social Security 10 8 6 4 2 0 1940 1960 1980 2006 Year 21 Figure 17. Actual Tax Rate on Single Parents with Earned Income Only, 2006 60% Effective tax rate 40% 20% 0% $0 -20% $50,000 $100,000 $150,000 $200,000 Earned income -40% Effective tax rate Linear trend line 22 Figure 18. Average Cumulative Tax Rates Confronting Low-to-Moderate-Income Families ($10k - $40k) 100% 88.6% 80% 58.8% 60% 40% 35.9% 20% 0% Tax Plus Food Stamps & Health Plus TANF, Housing, Child Care 23 Figure 19. Rates in a Comprehensive Tax and Transfer System 60% 50% Tax rate 40% 30% 20% 10% 0% $0 $50,000 $100,000 Earned income $150,000 $200,000 24 Figure 20. $2,000 per Worker Earned Income Credit, with or without a Phase-out Credit Amount t $5,000 $4,000 $3,000 $2,000 $1,000 $0 $0 $20,000 $40,000 $60,000 $80,000 Earned income $2,000 per worker credit $2,000 per worker credit with phase-out 25 Figure 21. How a Simple 50 Percent Earnings Subsidy Can Increase Work Effort $20,000 $17,500 After: 1,750 hours, $13,125/year Post-transfer Income $15,000 $12,500 Income $5/hour Income after transfer $10,000 $7,500 $5,000 Utility curve 1 Utility curve 2 Before: 1,500 hours, $7,500/year $2,500 $0 2,500 2,000 1,500 1,000 500 0 Hours of work 26 Table 3. How a Comprehensive Tax and Transfer System Would Affect a Single Parent with Two Children Pre-transfer Earnings plus plus Worker Universal Credit Grants less Tax Imposed Equals Aftertax Income 0 $6,000 0 0 $6,000 $5,000 $6,000 $1,000 $1,000 $11,000 $10,000 $6,000 $2,000 $2,000 $16,000 $20,000 $6,000 $2,000 $4,000 $24,000 $30,000 $6,000 $2,000 $6,000 $32,000 $40,000 $6,000 $2,000 $8,000 $40,000 $50,000 $6,000 $2,000 $10,000 $48,000 $100,000 $6,000 $2,000 $27,500 $80,500 $150,000 $6,000 $2,000 $45,000 $113,000 $200,000 $6,000 $2,000 $62,500 27 $145,500 Post-tax, post-transfer income Figure 22. How a Comprehensive Tax and Transfer System Would Affect Single Parents $200,000 $150,000 $100,000 Pre-transfer earnings $50,000 Post-tax, post transfer income $0 $0 $50,000 $100,000 $150,000 $200,000 Earnings 28 Figure 23. Minimum-Wage Earnings versus Poverty Levels, 1960-2007 $25,000 Poverty level, family of three Earnings $20,000 $15,000 Poverty level, family of four $10,000 Annual minimum wage earnings $5,000 $0 1960 1970 1980 1990 Year 2000 29 Age Figure 24. Life Expectancies at Birth versus Social Security Retirement Age 90 85 80 75 70 65 60 55 50 45 40 1900 Life expectancy at birth, males Life expectancy at birth, females Full retirement age for people born that year 1940 1980 Year of birth 2020 2060 30 Figure 25. Labor Force Participation of Men Age 55 and Older, 1950-2004 80% Participation rate Men age 55 and over Men age 65 and over 60% 40% 20% 0% 1950 1960 1970 1980 Year 1990 2000 31 Fig. 26. Individual Account Benefit in the First Year of Retirement (3%-of-earnings IA, 2007 Dollars) Year Cohort Turns 65 Single Male Low Average High Tax Max 2005 - - - - 2025 $1,137 $2,527 $4,043 $6,166 2045 $3,488 $7,752 $12,403 $18,936 2065 $4,965 $11,033 $17,652 $26,998 32 Fig. 27. Individual Account Replacement Rates (3%-of-earnings IA as a Percent of Final Wage) Year Cohort Turns 65 Single Male Low Average High Tax Max 2005 0.0 0.0 0.0 0.0 2025 5.1 5.1 5.1 5.0 2045 12.5 12.5 12.5 12.5 2065 14.4 14.4 14.4 14.4 33 Table 4. Health Coverage 2006 Source of Coverage millions percentage Total population 296.8 100.0 Employment-based coverage 177.2 59.7 Individually Purchased 27.1 9.1 Public 80.3 27.1 Medicare 40.3 13.6 Medicaid 38.3 12.9 Military health care 10.5 3.5 47.0 15.8 No health insurance 34 Clusters without Coverage • • • • • • • • • Employees of small businesses Workers who lose their jobs Workers who decline employer coverage Low-income parents Low-income childless adults The near elderly Young adults Children Immigrants 35 Transition to Expanded Coverage • Tax Changes: cap the exclusion for employerprovided insurance at a fixed dollar amount and gradually replace it with a tax credit • Employer Mandate: require employers to offer a plan, and automatically enroll workers • Individual Mandate: require workers to get coverage 36 Summary—Making America Work • Government should intervene – To encourage work – Promote economic justice • Tax, spending, and regulatory proposals – Increase the size of the economic pie – Allow us to divide it more equally 37 About the Author • Jonathan Barry Forman (“Jon”) is the Alfred P. Murrah Professor of Law at the University of Oklahoma, where he teaches courses on tax and pension law. • Professor Forman is also Vice Chair of the Board of Trustees of the Oklahoma Public Employees Retirement System (OPERS) and the author of Making America Work (Washington, DC: Urban Institute Press, 2006), http://www.urban.org/books/makingamericawork/index.cfm. • Prior to entering academia, Professor Forman served in all three branches of the federal government. He has a law degree from the University of Michigan, and he also has master’s degrees in economics and psychology. • Jon can be reached at jforman@ou.edu or (405) 325-4779. His web page is www.law.ou.edu/faculty/forman.shtml. 38