IB Economics

advertisement

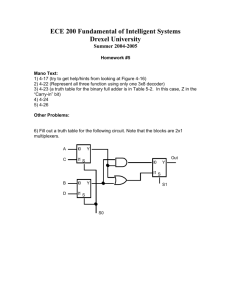

IB Economics Unit 2: Microeconomics IB Chapter 13: Market Failure Measuring Economic Welfare Price (BHD) • Consumer surplus • Producer surplus • Total surplus (or welfare) = CS+PS • Why does market failure lead to a reduction in TS? Quantity (000’s) What is Market Failure? Definition: • Where the market mechanism fails to allocate resources efficiently, when left to the market we get an inefficient allocation of resources • TS is not maximised • Types of efficiency – – – – Social efficiency Allocative Efficiency Productive Efficiency (Dynamically efficient) Market Failure: Types of Efficiency • Social Efficiency: where external costs and benefits are accounted for when decisions are made in both consumption and production. • Allocative Efficiency: A market will be allocatively efficient if it is producing the right goods for the right people at the right price (where MC = AR known as marginal cost pricing). – Also referred to as; Pareto Efficient Allocation where resources cannot be readjusted to make one consumer better off without making another worse off – zero opportunity cost! Vilfredo Pareto (1848 – 1923) • Productive Efficiency: production of goods and services at lowest factor cost (lowest point of AC curve). • Static Efficiency: efficiency at a point of time (e.g. using current technology) • Dynamic Efficiency: an economy that appropriately balances short run concerns (static efficiency) with concerns in the long run (focusing on encouraging research and development) Market Failure: When? • Market Failure occurs where: – – – – – Knowledge is not perfect – ignorance or deception Goods are differentiated Resource immobility e.g. Labour or Capital Market power e.g. Monopolies Services/goods would or could not be provided in sufficient quantity by the market e.g. street lighting – Existence of external costs and benefits – Inequality exists e.g. wealth, income Market Failure: Imperfect Competition • Market Power: – – – – – – Existence of monopolies and oligopolies Collusion Price fixing Abnormal profits Rigging of markets Barriers to entry Welfare loss under IMPERFECT COMPETITION Why? Costs, Benefits & Price Quantity How do CARTELS operate? Why? Costs, Benefits & Price Quantity What can be done to limit the failures caused by imperfect competition? • Legal measures to increase competition – 25% – Concentration ratio • Regulatory bodies – Monitor behaviour of firms e.g. OFWAT – Monopoly regulators e.g. UK Competition Commission We must ensure that all intervention results in an improvement in economic welfare and does not make the situation worse (Government Failure) The Existence of Public Goods • Public Goods: Markets would not provide such goods and services at all! – Non-excludability: Person paying for the benefit cannot prevent anyone else from also benefiting - the ‘free rider’ problem – Non-rivalry: Large external benefits relative to cost – socially desirable but not profitable to supply! • Possible Solutions: – The government collects tax (in most countries) and supplies public goods themselves, but how does it know how much to supply? – Subsidisation of private firms to produce A non- excludable good? Would you pay for this? Under provision of a Public Good: MSB Vs MSC Why? Merit Goods • Merit Goods: goods and services which are better for us that we realise: • Under provision • Under consumption • • • • • Education Healthcare Organic food Seat belts Sports facilities • Possible Solutions • Government provision • Subsidised production • Positive advertising to encourage consumption and/or production Would we all pay if the state did not provide it? Under provision of a Merit Good: MSB Vs MSC Why? Under consumption of a Merit Good: MSB Vs MSC Why? Demerit goods and services De-Merit Goods • Over Production: • Over Consumption: • Examples: – Tobacco – Alcohol – Drugs – Gambling – Sheesha • Possible Solutions – Regulation of use – Negative advertising to discourage production and/or consumption – Taxation to reduce QD via increased P A Russian drug addict injects heroin Over Consumption of a De-Merit Good: MSB Vs MSC Why? Over Supply of a De-Merit Good: MSB Vs MSC Why? Market Failure: Knowledge • Imperfect Knowledge: – – – – – Consumers do not have adequate technical knowledge Advertising can mislead or mis-inform Producers unaware of all opportunities Producers cannot accurately measure productivity Decisions often based on past experience rather than future knowledge How does imperfect knowledge affect the market? Why? Market Failure • Goods/Services are differentiated – Branding – Designer labels - they cost three times as much but are they three times the quality? – Technology – lack of understanding of the impact – Labelling and product information Which one is the ‘quality’ item and why? How does product differentiation affect the market? Why? Market Failure: Immobility • Resource Immobility – Factors are not fully mobile – Labour immobility – geographical and occupational – Capital immobility – what else can we use the Channel Tunnel for? – Land – cannot be moved to where it might be needed – e.g. London and South East! World Income Distribution Market Failure: Externalities External Costs and Benefits • External or social costs – The cost of an economic decision to a third party • External benefits – The benefits to a third party as a result of a decision by another party Market Failure External Costs • Decision makers do not take into account the cost imposed on society and others as a result of their decision – e.g. Pollution, traffic congestion, environmental degradation, depletion of the ozone layer, misuse of alcohol, tobacco, anti-social behaviour, drug abuse, poor housing External Costs: MSB Vs MSC Why? Market Failure: Benefits External benefits – – by products of production and decision making that raise the welfare of a third party – e.g. Education and training, public transport, health education and preventative medicine, refuse collection, investment in housing maintenance, law and order. External Benefits: MSB Vs MSC Why? Market Failure • Inequality: – – – – – – Poverty – Absolute and Relative Distribution of factor ownership Distribution of Income Wealth Distribution Discrimination Housing Inequality FIG: 1.1 Diagram Title: The LORENZ curve %age of Income (Y) RECORD NOTES HERE %age of Population GINI Co-Efficient Source: ECONandBIZ.com Gini co-efficient formula A A+B A B Market Failure Measures to Correct Market Failure – – – – – – – – – – State Provision Extension of property rights Taxation Subsidies Regulation Prohibition Positive Discrimination Redistribution of Income Price Controls Buffer Stocks Correcting Market Failure: Taxes e.g. de-merit Why? Correcting Market Failure: Education e.g. de-merit Why? Correcting Market Failure: Subsidy e.g. Merit Why? Correcting Market Failure: Regulation e.g. Merit Why? Correcting Market Failure: Inequality e.g. Min wage Why? Correcting Market Failure: Redistribution of Income Why? Correcting Market Failure: Max/Min Prices Why? Correcting Market Failure: Buffer Stocks Why? Government Failure Government failure is when intervention by the government in a market results in a worsening of welfare for society. P1 Take this example of a tax aimed at reducing consumption. While the policy has been successful in reducing quantity demanded from Q1 to Q2 what about the price increase and how will this affect people on poor incomes? Price in $US What we are saying here is that the GOVERNMENT SOMETIMES MAKES IT WORSE THAN IT WAS ALREADY. Q: How effective will this policy become as PED falls? S2 (S1+Tax) S1 Tax P2 D Q2 Q1 QD & QS per yr How does PED affect our analysis? S2 (S1+Tax) S1 Tax A P2 B P1 Price in $US A + B Tax burden that falls on the consumer Tax burden that falls on the producer Total Tax Revenue D Q2 Q1 QD & QS per yr Has this tax been successful? Record Student views here YES: it has raised revenue for the government NO: the low level of PED means that there has been limited results YES: it has discouraged some people from consuming the good or service NO: what about the poor people or those who cannot change their consumption patterns? Sources of Government Failure Political self-interest Policy myopia Regulatory capture Government intervention and disincentive effects Government intervention and evasion Policy decisions based on imperfect information The Law of Unintended Consequences! Costs of administration and enforcement TASK: Take 5-10 minutes to read the handout ‘Does the government always get it right?’ and then right a paragraph to explain what you understand by the term GOVERNMENT FAILURE Examples of Government Failure Government intervention to reduce the power of monopolies which hinders international competitiveness and/or is against the public interest The Government uses increases in minimum wages to win votes during the election campaign Incorrect or inefficient tax/benefit systems to correct for the existence of externalities Regulations which result in harmful unregulated black markets The existence of unintended consequences as a result of government action Task: Take each of the scenarios and write a brief example to illustrate the issues raised. Make sure that you explain a likely instance of government failure. Case Study: Smoking Bans A UK businessman has begun marketing an 'electronic cigarette' which he says allows smokers to get around the smoking ban. http://news.bbc.co.uk/2/hi/uk_news/england/7660141.stm Case Study: Tax on cigarettes http://news.bbc.co.uk/2/hi/uk_news/4096911.stm Ideas Board