The County General Fund and its Relatives

advertisement

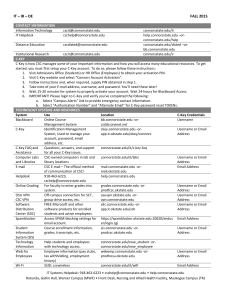

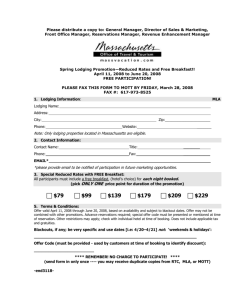

County Government Funding & Options Centra In-Service May 10, 2011 Notie Lansford, Extension Economist Program Leader, County Gov. Training Program, CTP Objectives Identify and Describe the “Funds” Discuss Ways to Acquire More Funds Discuss Some Ways to Use Funds More Effectively Know Enough “to be Dangerous” Identify Additional Resources Know Your Funds & Options Know enough to be dangerous! General Fund Highway Fund Cash Funds, e.g. ◦ ◦ ◦ ◦ ◦ Treasurer’s Resale Property, Clerk’s Lien Fee, Sheriff’s Service Fee, Sales Tax and Use Tax Lodging Tax Sinking Fund for Debt Others, like County Health Dept., EMS District, Solid Waste Mgmt, County Library County General Fund Revenue FY 2008-2010 CountyName FY 2008 FY 2010 Percent Change Alfalfa Haskell Latimer $2,238,427 $1,673,639 -25% $3,107,612 $2,558,551 -18% $2,561,690 $2,124,246 -17% Love Pushmataha Dewey $943,618 $1,300,498 38% $1,886,549 $2,721,889 44% $2,178,368 $3,489,741 60% Average $6,127,058 $6,355,397 5% County Highway Fund Revenue, FY 2008-2010 CountyName Blaine Beckham Latimer Tulsa Carter Cimarron Average Total Revenue Percent 2008 2010 Change $6,655,406.15 $2,872,556.88 -57% $6,823,918.48 $3,897,725.65 -43% $6,777,612.57 $3,944,353.95 -42% $10,588,279.67 $17,955,934.90 $6,287,172.99 $11,210,146.88 $3,480,008.91 $7,915,558.96 $4,664,410 $4,541,671 70% 78% 127% -1% County General Fund Historically, the fund paying for most courthouse functions Avg. FY ’04 Ad Valorem Levy Vo-Tech Sinking Fund 0.02% JC General Fund 0.54% Co. Sinking Fund 0.31% Vo-Tech Building Fund 2.82% Vo-Tech General Fund 9.94% Co. General Fund 12.17% JC Sinking Fund 0.07% 12.17% Cit y Sinking Fund 1.16% Co. Healt h Dept . 2.44% Emergency Med. Dist . 1.07% Emergency Med. Sinking 0.01% Count y Library 1.87% Sch. Sinking Fund 13.89% Co. Ind. Development 0.00% Sch. Building Fund 6.11% Sch. General Fund 47.62% Sources of Revenue General Fund 1. Ad Valorem Taxes A mill levy on tangible, taxable property. For example: Fair Cash Value of a Home $ 80,000 Assessment Ratio X .12 Assessed Value $ 9,600 less Homestead Exemption -1,000 Net Assessed Value $ 8,600 Tax Rate (80 mills) X 0.080 Tax Due $ 688 General Fund Sources 2. County Clerk Fees 28 O.S. § 32 ◦ For registration of deeds and various other instruments, such as leases, assignments, conveyances, plats, and mechanic’s liens. $ 8 for recording the first page $ 2 for recording each additional page $ 1 per page for furnishing hard copies 3. Interest on Investment; 68 § 348.1 General Fund Sources 4. County Sales, Use, & Lodging Taxes County Sales Tax ◦ A maximum of 2%. ◦ Must be approved majority of local voters. ◦ For specified purpose(s). ◦ Applies to the same items as the state sales tax. “Use Tax” may be added by resolution of county commissioners. County Sales, Use, & Lodging Taxes continued County Lodging Tax ◦ ◦ ◦ ◦ ◦ ◦ ◦ Counties of less than 200,000 Maximum of 5% on lodging rooms. Approved by majority of voters. For specified purpose. General Fund or a cash Revolving Fund Inapplicable within cities already levying a lodging tax. Adopted in : Blaine, Cimarron, Greer, Johnston, Love, Marshall, McCurtain, Osage, Pontotoc, Latimer 12 County Sales & Lodging Taxes BEAVER HARPER WOODS KAY GRANT OTTAWA CRAIG OSAGE ROGERS WOODWARD MAYES MAJOR PAWNEE ELLIS DEWEY BLAINE PAYNE CREEK LOGAN ROGER MILLS CUSTER LINCOLN CANADIAN WAGONER OKMUL GEE OKLAHOMA MUSKOGEE OKFUSKEE BECKHAM McINTOSH WASHITA HASKELL GRADY GREER KIOWA LATIMER MCCLAIN COMANCHE GARVIN JACKSON COAL TILLMAN Sales & Use Tax, 67 STEPHENS COTTON MURRAY CARTER Lodging Tax Counties, 9 ATOKA PUSHMATAHA JEFFERSON LOVE Sales Tax only, 8 JOHNSTON BRYAN CHOCTAW General Fund Sources 5. Transfer Payments From State,To Counties Motor Vehicle License & Registration Fees ◦ Excise Tax 68 O.S. 2000 § 2103 - … ◦ Annual Registration 47 O.S. 2000 § 1132 - … ◦ 0.83% - County General Fund General Fund Sources 6. Reimbursements – “pass through” Visual Inspection (Revaluation) The cost of the “program of visual inspection” is shared by all local jurisdictions collecting an ad valorem levy. Each jurisdiction’s share is proportional to its total levy the prior year. 68 O.S. §§ 2820, 2822-2823 General Fund Sources 6. Reimbursements District Attorney = County + State Portion The county must provide the D.A. with office space; law library and legal subscriptions; funds for investigation, prosecution or defense of any action wherein the county is a party. 19 O.S. §§ 215.36 215.38 The state shall provide for all other expenses through the District Attorneys Council. However, the county pays these expenses and is reimbursed monthly. General Fund Sources 6. Reimbursements Election Board “The salary and fringe benefits paid to each secretary shall be paid from county funds on a monthly basis and shall be reimbursed from funds appropriated by the Legislature …” 26 O.S. §§ 2-118 - 2-121 Variation Across the State Heavy Dependence on Property Tax Heavy Dependence on Sales Tax Sales Tax Placement ◦ General Fund and/or Cash Fund Diverse Use of Sales Tax ◦ 100% Hospital or Jail ◦ Split 17 Different Ways Roads, Rural Fire, Solid Waste, Fair, General, … S. T. Cash Balance Carried Over County Highway (Road) Fund Average County Highway Fund Revenue Sources, FY 2007 All Other 17.9% Gasoline Tax 29.0% Gross Production Tax 18.1% Special Fuels 0.002% Diesel Tax 8.2% Motor Vehicle Taxes 26.7% Highway Fund, FY 2004 Hughes Gross Production Tax Diesel Tax Gasoline Tax Motor Vehicle Fees Federal Total Beginning Cash Population Miles of County Roads Grant Lincoln Wagoner 205,029 232,121 853,186 787,776 728,624 3,015,919 170,651 287,324 1,183,133 1,135,400 2,941,485 691,692 345,578 1,307,966 1,125,915 4,616,451 6,814 306,008 1,075,458 954,095 32,813 3,227,479 891,594 410,499 408,636 1,283,412 5,025 1,779.16 32,240 1,547.02 13,992 912.23 60,497 959.61 Highway Fund, FY 2004 per capita & per mile Hughes Gross Production Tax Diesel Tax Gasoline Tax Motor Vehicle Fees Federal Total Beginning Cash Total per Mile of Road Grant Lincoln Wagoner $15 $17 $61 $56 $52 $216 $34 $57 $235 $226 $0 $585 $21 $11 $41 $35 $0 $143 $0 $5 $18 $16 $1 $53 $64 $82 $13 $21 $3,306 $1,653 $2,984 $3,363 Cash Funds (Special Revenue Funds) Generally, funded from a fee or limited number of fees Generally, highly restricted as to use. e.g. Resale Property Fund – Funded from interest charged for late payment of taxes. Treasurer is to use it for collection of delinquent taxes. Cash Funds, FY 2004 Hughes Sheriff Service Fee Resale Property Co. Clerk Lien Assessor Revolving Sales Tax Sales Tax Notes: 41,642 34,379 23,583 2,734 None Grant 65,708 19,459 2,724 13,431 240,888 1.0 cent Rural Fire EMS Sheriff Lincoln Wagoner 132,028 115,832 11,414 6,304 1,462,691 167,384 180,753 107,191 14,562 - 1.0 cent Roads & bridges Jail, Fire, Fair Senior Citizen Econ. Dev. Em. Mgmt. Courthouse Imp. Sales tax goes into the General Fund 1.85 cents for courthouse improvemen ts, roads, sheriff, and general How to Get More Funding Treasurer & Sheriff actively involved in collecting delinquent taxes; “Personal Property Tax Sale Warrants” EMS/Fire/Ambulance mill levy for countywide ambulance service Lodging, Use, and Sales Tax Increase the Assessment Percentage on Taxable Property Investment policy How to get more funding Transfer of Funds if needed to avoid paying interest on non-payable warrants Tribal Joint Ventures ◦ Road and Bridge Projects ◦ Tribal Government Institute REAP – Rural Economic Action Plan grants – e.g. OK Water Resources Bd. CDBG – Community Development Block Grants – OK Dept of Commerce Circuit Engineering Districts funding page Ways to Save Money Sharing Resources ◦ Equipment ◦ Employees Co-op Purchasing among ◦ Departments Paper; internet service; office supplies Purchasing in quantity – keep good consumable inventories Blister (individuals wrapped) packs for medications ◦ Counties Pharmacy for Prisoners Medical supplies Joint road projects Ways to Save Money Education for Employees ◦ Safety programs offered by ACCO ◦ Wellness programs offered by insurance company ◦ Employment/Management Programs with OSU Insurance Deductibles Conserve Energy Turn off computers/lights Energy efficient light bulbs Labor Force Management ◦ Full Time vs. Part Time ◦ Contract for services Ways to Save Money: Be informed Local ◦ Communicate with each other Budgets are part of your everyday life Meet to discuss budgets throughout the year Understand goals for officer; keep the dialog open Don’t assume the largest budget can take the largest cut ◦ Be involved with local economic development ◦ Seek input of constituents Legislative ◦ Keep in touch with local legislators ◦ Study the impact of pending legislation State Associations/Government ◦ Attend meeting ◦ Learn from your counter parts in other counties ◦ Utilize technical assistance with SA&I, OTC, OCES’s County Training Program Resources Publications: http://agecon.okstate.edu/faculty/publications_results.asp?page=1 Fact Sheets: 1. Ad Valorem Taxes 2. Duties & Responsibilities of Elected County Officials 3. Duties & Responsibilities of Non-Elected County Officials 4. … http://www.rd.okstate.edu/RDPublications.htm#D 1. Abstract of County Government General, Highway, and Special Revenue Funds in OK (Fiscal Year 2008-2009) 2. Summary - County Sales, Use, & Lodging Taxes, FY 09 3. "Oklahoma Ad Valorem Mill Levies, Fiscal Year 2009“ OCES CTP Training – http://agecon.okstate.edu/ctp/ Courses, Handbooks, Technical Assistance Other Sources of Information Oklahoma Tax Commission ◦ http://www.oktax.state.ok.us/oktax/ Publications State Auditor and Inspector ◦ http://www.sai.state.ok.us/ Audit Reports County Training Program (CTP) ◦ http://www.agecon.okstate.edu/ctp/ Budget Process, 2 day class Building Your Budget, 1 day class CTP, OSU Contacts Notie Lansford, Extension Economist ◦ (405) 744-6555 or notie.lansford@okstate.edu Ann Embree, Local Government Specialist ◦ (405) 744-9838 or ann.embree@okstate.edu Judy Rudin, Communications Specialist ◦ (405) 744-9812 or judy.rudin@okstate.edu Sherri Schieffer, Local Government Specialist ◦ (405) 744-9828 or sherri.schieffer@okstate.edu Suzanne Spears, Local Government Specialist ◦ (918) 762-3253 or sspears@hrblock.com Glenda Emerson, Local Government Specialist, glenda.emerson@okstate.edu Gloria Cook (405) 744-6160, ctp@okstate.edu