section - SchoolRack

advertisement

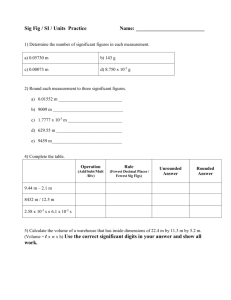

SECTION 10-3 Closing Cost pp. 349-350 SECTION 10-3 • • • • • Click to edit Master text styles Section Objective Second level Figure out: Third level • total closing costs Fourth level Fifth level 2 Copyright © Glencoe/McGraw-Hill MBA, Section 10-3, Slide 2 of 13 SECTION 10-3 • • • • • Click edit Master text styles KeytoWords to Know Second level closing costs (p. 349) Third level The costs of transferring ownership of property, Fourth level such as credit checks and title searches, to the Fifth buyerlevel by the seller. 3 Copyright © Glencoe/McGraw-Hill MBA, Section 10-3, Slide 3 of 13 SECTION 10-3 • • • • • Click to edit Master text styles Formula Second level Closing Costs = Sum of Bank Fees Third level Fourth level Fifth level 4 Copyright © Glencoe/McGraw-Hill MBA, Section 10-3, Slide 4 of 13 SECTION 10-3 • Click to edit Master text styles • Second level • Third level The Hunt to Find a Home p. 349 • Fourth level Why might the lender charge • Fifth level additional costs (over and above the loan documents)? 5 Copyright © Glencoe/McGraw-Hill MBA, Section 10-3, Slide 5 of 13 SECTION 10-3 • • • • • Click to edit 1Master text styles Example Second level Trudy and Germane Hallett have been granted a Third level mortgage loan at an annual interest rate of 8 percent for 25 years by State Bank. The home has a Fourth level selling price of $95,500. They need a 15 percent Fifth down level payment. State Bank will allow them to finance the closing costs as part of the mortgage. What are the total closing costs? What is actual amount financed with the mortgage? 6 Copyright © Glencoe/McGraw-Hill MBA, Section 10-3, Slide 6 of 13 SECTION 10-3 • • • • • Click to edit 1 Master text styles Example Answer: Step 1 Second level Find the down payment. Third level $95,500 × 15% = $14,325 Fourth level Fifth level 7 Copyright © Glencoe/McGraw-Hill MBA, Section 10-3, Slide 7 of 13 SECTION 10-3 • • • • • Click to edit 1 Master text styles Example Answer: Step 2 Second level Find the amount of the mortgage. Third level $95,500 – $14,325 = $81,175 Fourth level Fifth level 8 Copyright © Glencoe/McGraw-Hill MBA, Section 10-3, Slide 8 of 13 SECTION 10-3 • • • • • Click to edit 1 Master text styles Example Answer: Step 3 Second Find the level closing costs. Third level Fourth level Fifth level 9 Copyright © Glencoe/McGraw-Hill MBA, Section 10-3, Slide 9 of 13 SECTION 10-3 • • • • • Click to edit 1 Master text styles Example Answer: Step 4 Second level Find the actual amount financed. Third level Amount of Mortgage + Closing Costs Fourth level $81,175 + $3,194.96 = $84,369.96 Fifth level 10 Copyright © Glencoe/McGraw-Hill MBA, Section 10-3, Slide 10 of 13 SECTION 10-3 • • • • • Click to edit1Master text styles Practice Second level Joseph and Marla Liebowitz have agreed to Third level purchase a house for $362,000. They made a down paymentlevel of 30 percent and are financing the Fourth remaining amount. The total closing costs are 3.25 Fifth level percent of the mortgage loan. What are the closing costs? What is the total mortgage loan? 11 Copyright © Glencoe/McGraw-Hill MBA, Section 10-3, Slide 11 of 13 SECTION 10-3 • • • • • Click to edit1Master text styles Practice Answer Second level Closing costs: $8,235.50 Third level Total mortgage loan: $261,635.50 Fourth level Fifth level 12 Copyright © Glencoe/McGraw-Hill MBA, Section 10-3, Slide 12 of 13 END OF SECTION 10-3 Closing Costs