File

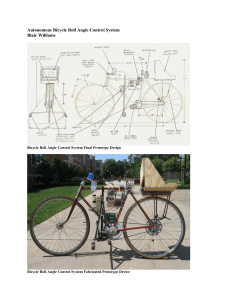

advertisement

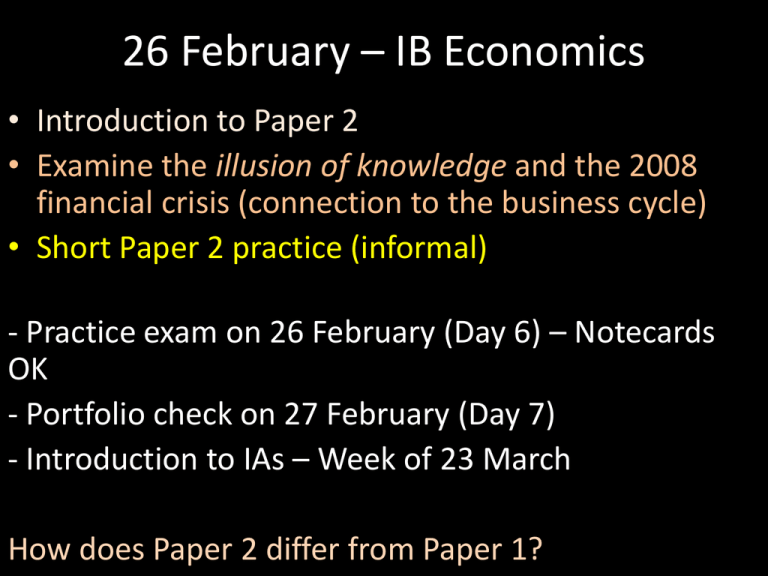

26 February – IB Economics • Introduction to Paper 2 • Examine the illusion of knowledge and the 2008 financial crisis (connection to the business cycle) • Short Paper 2 practice (informal) - Practice exam on 26 February (Day 6) – Notecards OK - Portfolio check on 27 February (Day 7) - Introduction to IAs – Week of 23 March How does Paper 2 differ from Paper 1? Syllabus Item 81 • Explain, using a business cycle diagram, that economies typically tend to go through a cyclical pattern characterized by the phases of the business cycle. • Explain the long-term growth trend in the business cycle diagram as the potential output of the economy. • Distinguish between a decrease in GDP and a decrease in GDP growth. How does a bicycle work? • On a scale of 1-7, rate your understanding of how a bicycle works. • Sketch a working model of a bicycle. Your model can be simple, but it should include all required parts. How accurate is your model? • Does your bicycle have a chain? If so, it is connected to the right parts? • Does the frame connect the front and back wheels? • Are the pedals connected to the inside of the chain? • Can your bicycle turn? • How does it brake? * On average, subjects rated their understanding at 4.5/7. However, major errors were common. On a 1-7 scale, rate your knowledge/understanding of the following: • • • • • Zipper Toilet Helicopter Cylinder locker How the economy works Illusion of knowledge • People tend to think they know/understand more than they actually do. • Psychologists call this bias the illusion of knowledge. Implications for learning • By re-reading the textbook or making mind maps can fool ourselves into thinking we know/understand more than we do. • We benefit from testing ourselves. Do we really know/understand X, Y, and Z? • How did the financial crisis happen? • How does the illusion of knowledge relate to it? The Causes and Effects of the 2008 Financial Crisis http://www.youtube.com/watch?v=N9YLta5Tr2 A http://upload.wikimedia.org/wikipedia/commons/thumb/6/66/Mortgage_backed_security.j pg/350px-Mortgage_backed_security.jpg One of the new homeowners… • Alberto Ramirez of Watsonville, California bought a house for $720,000 (€520,000) with no money down. • He was a strawberry picker who earned about $15,000 (€10,800) a year. HCL Finance’s “Ninja” Loan • No income • No job • No assets Do you know what mortgage-backed securities are? • If not, don’t feel bad… Most bankers and traders didn’t either. • They deceived themselves into thinking they understood their value and risk. Is the financial sector more stable today? Connection to the business cycle Only a few people predicted that the housing bubble would burst and a serious recession would result. We know there will be booms and busts but can we ever predict what will happen next? For more info about the crisis This American Life http://www.thisamericanlife.org/radioarchives/episode/355/the-giant-pool-of-money References Charbris, Christopher, and Daniel Simons. The Invisible Gorilla and Other Ways Our Intuitions Deceive Us. London: Harper, 2011. Print. Taleb, Nicolas Nassim. Antifragile: Things That Gain from Disorder. New York: Random House, 2011. Print. Syllabus http://ibeconomics-isd.weebly.com/