California Kitchen Case Study

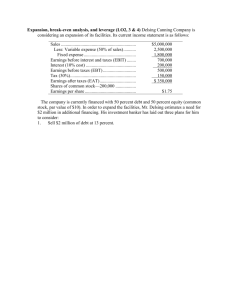

advertisement

California Pizza Kitchen Case California Pizza Kitchen has been operating since 1985 predominantly in California. As of June 2007, they had 213 retail locations in the US and abroad. Analysts have put estimates on the potential of 500 full service locations. CPK's strategy includes the opening of 16 to 18 new locations this year including the closing of one location. In the second quarter of 2007, revenue increased 16% while comparable restaurant sales grew by 5%. Performing comparatively well against its competitors, CPK's stock has been depressed recently falling to $22.10 in June making their P/E equal to 31.9 time current earnings. In comparison with BJ's Restaurants with a P/E of 48.9, CPK appears undervalued. CPK's direct competitor, BJ's pays no dividend and has a similar beta and therefore it makes for a good comparative company. Despite uncertainty in the industry and general poor performance among competitors, CPK is performing marginally better than the overall industry. Susan Collyns has several decisions that need to be made. Her two primary issues are how to finance expansion and the firm’s most appropriate capital structure. The focus of this analysis will be on the change in capital structure through the repurchase of shares at today’s market price of $22.10. The effect of the repurchase will be analyzed from an EBIT breakeven, ROE, EPS, Cost of Capital, and stock price perspective. It should be noted that there is an $85 million cost to fund further expansion of their full service restaurants. This is a known expense that will have to be financed by issuing equity or leveraging the company by taking on debt. How does debt add value to CPK? By moderately levering up and repurchasing shares, companies can normally increase their EPS because of the interest tax shield. This typically makes the cost of issuing debt cheaper, than that of issuing equity. The interest tax shield will reduce taxable income so that when debt is used to repurchase shares outstanding, there will be a subsequent increase in EPS. A similar effect happens with ROE. Because less of the company is being financed with equity, earnings are spread out over less equity and therefore increase ROE. Cost of Capital CPK has an equity cost of capital of 5.03% and a debt financing rate of 6.16%. 𝑅𝑒 = 𝑅𝑓 + 𝛽(𝑅𝑚 − 𝑅𝑓) 𝑅𝑓 = 5.2% (30 𝑦𝑒𝑎𝑟 𝑟𝑎𝑡𝑒) 𝑅𝑚 = 5% (𝑆&𝑃 𝑆𝑚𝑎𝑙𝑙𝐶𝑎𝑝 600 𝑅𝑒𝑠𝑡𝑎𝑢𝑟𝑎𝑛𝑡𝑠) 𝑅𝑒 = 5.03% 5.03% = 0.052 + 0.85(0.05-0.052) WACC 𝑊𝐴𝐶𝐶 = 𝑊𝑒𝑅𝑒 + 𝑊𝑑𝑟𝑑 10% Debt scenario 5.14% = .9(0.0503) + .1(0.0616) 30% Debt scenario 5.37% = .7(0.0503) + .3(0.0616) Based on our WACC calculations neglecting tax, we found that as CPK acquires debt, their cost of capital increases. Based on this finding, it is not sensible for CPK to take on debt. If their cost of capital increases, it will affect every project they take on by lowering their returns on every capital project. This can be seen in the graph below. CPK's WACC 5.55 5.5 5.45 5.4 5.35 5.3 WACC % 5.25 5.2 5.15 5.1 5.05 A 10% 30% Because the cost of debt is higher than the firm’s unlevered cost of capital and their cost of equity, adding debt to the business does not add value to California Pizza from a cost of capital perspective. Return on Equity The Return on Equity is rising as the firm takes on more debt, becoming more leveraged. This is true as interest payments to creditors are tax deductible and therefore the company is able to generate a higher return on fewer shares outstanding because of the repurchase. The result is that a higher proportion of debt in the firm's capital structure leads to higher ROE as earnings are spread over a reduced amount of equity. Share Price 𝑆ℎ𝑎𝑟𝑒 𝑃𝑟𝑖𝑐𝑒 = 𝐸𝑞𝑢𝑖𝑡𝑦 𝑆ℎ𝑎𝑟𝑒𝑠 𝑂𝑢𝑡𝑠𝑎𝑛𝑑𝑖𝑛𝑔 𝑃𝑉 = 𝑃𝑀𝑇 𝑁𝑃𝑉 = 𝐷 + 𝑃𝑉 𝑉𝐿 = 𝑉𝑈 + 𝑇 ∗ 𝐷 𝑟 0% Debt Share Price = E/CSO Share Price = 643 773 000/29 130 000 Share Price = 22.10$ 10% Debt Share Price = E/CSO Share Price = 628 516 000/28 108 000 Share Price = 22.36$ 20% Debt Share Price = E/CSO Share Price = 613 259 000/27 086 000 Share Price = 22.64$ 30% Debt Share Price = E/CSO Share Price = 598 002 000/26 064 000 Share Price = 22.94$ The share price of the firm’s stock rises as it increases its debt. Share price being determined by the Total Market Value of Equity divided by the current number of shares outstanding. As the firm increases its leverage, it buys back shares, as well as reduces its equity. The rate that equity decreases is smaller than that of shares being bought back, thus causing an increase in share price. Shares Outstanding Shares outstanding decrease as the firm takes on more debt. The reason being is that the firm buys back shares with the newly acquired cash from issuing debt. By leveraging their company, California Pizza Kitchen adds value to their Total Market Value of Capital. They also increase their share price. It should be considered that as they increase their debt to equity ratio, they also increase their risk of default. Breakeven levels of EBIT for each scenario No Leverage Debt Equity Total Capital Interest on Debt 0 225888 225888 0 CSO CSOU/CSOL Breakeven EBIT 29130 n/a n/a 10% EBIT/CSOU=(EBIT-i)/CSOL EBIT=(CSOU/CSOL)(EBIT-i) EBIT=1.036(EBIT-i) EBIT=1.036(EBIT-1391) -.036EBIT= -1446 $40,166.67 30% EBIT/CSOU=(EBIT-i)/CSOL EBIT=(CSOU/CSOL)(EBIT-i) EBIT=(1.118)(EBIT-i) EBIT=1.118(EBIT-4174) -.118=-4174 $35,373.00 10% 22589 203299 225888 1391 20% 45178 180710 225888 2783 30% 67766 158122 225888 4174 28108 1.036 $40,166.67 27086 1.075 $37,106.67 26064 1.118 $35,373.00 20% EBIT/CSOU=(EBIT-i)/CSOL EBIT=(CSOU/CSOL)(EBITi) EBIT=(1.075)(EBIT-i) EBIT=1.075(EBIT-2783) -.075EBIT=-2783 $37,106.67 The results from the breakeven EBIT analysis are calculated to current market conditions. The market has equities; in particular, California Pizza priced its prices at very high valuations. This is exhibited by California Pizza’s price/earnings ratio of 31.9. Because of this lofty valuation, if California Pizza is going to repurchase shares at the current market price of $22.10, it will be costly to investors. It will be especially expensive to investors to buy back shares if California Pizza using debt because their cost of debt is higher than their cost of equity. California Pizza has decreasing break even EBITs because the numerator (interest expense) is expanding with each scenario of debt financed stock repurchases. Because the cost of debt is higher than the cost of equity, the breakeven EBIT is decreasing with each increased debt scenario. What happens to ROE and EPS if…? As the company changes their capital structure to incorporate varying levels of debt, they are reducing their common shares outstanding and equity within the company. In all three cases, ROE continues to rise as more debt is added in. When EBIT is at a point that is above the Break-even point, ROE increases at a much larger rate, compared to if EBIT is below the Break-even point. As seen under the 100% EBIT chart, ROE increases at a much higher rate than compared to the 50% reduced EBIT tables, which is below the break-even EBIT. Current EBIT EBIT Interest Actual 30,054 0 10% 30,054 1,391 20% 30,054 2,783 30% 30,054 4,174 Taxes 9,755 9,303 8,852 8,400 NI 20,229 19,360 18,419 17,480 ROE EPS Because the repurchase cost of shares is so high, the number 8.99% $0.69 9.52% $0.69 10.19% 11.05% $0.68 $0.67 Actual 10% 20% 30% 15,027 15,027 15,027 15,027 0 1,391 2,783 4,174 Taxes 4,877 4,426 3,974 3,523 NI 10,150 9,210 8,270 7,330 ROE EPS 4.49% $0.35 4.53% $0.33 4.58% $0.31 4.64% $0.28 of shares outstanding after the repurchase is not enough to offset the additional interest costs making for a reduction in EPS. EBIT Reduced 50% EBIT Interest When EBIT is reduced by 50%, EPS shows a declining trend from 0.35$-0.28$. In this case, EPS declines because the interest from the added debt is decreasing your EPS. When EBIT is reduced by 50% the EPS lies below the break-even point, any additional debt at this point is a disadvantage. 100% EBIT Actual 10% 20% 30% 60,108 60,108 60,108 60,108 0 1,391 2,783 4,174 Taxes 19,510 19,058 18,607 18,155 NI 40,598 39,658 38,718 37,779 ROE 17.97% 19.51% 21.43% 23.89% EBIT Interest $1.39 EPS $1.41 $1.43 When EBIT is increased by 100%, EPS shows an increasing trend from $1.39 $1.45. EPS increases as more debt is added because it is above the break-even EBIT point. Because we are above the EBIT breakeven point, the firm benefits from the increased leverage which raises the EPS as more debt is added. Conclusion & Recommendations In conclusion, it is the analysts’ recommendation that California Pizza Kitchen change its capital structure by issuing debt and repurchasing shares. This instates a tax shield, which reduces taxable income, increases the value of the company, and in turn increases the return to shareholders. Subsequently allowing earnings to be spread out over fewer shares and as the market increases, shareholders will have greater ROE and EPS. $1.45