ACCOUNTING

PRINCIPLES

Third Canadian Edition

Prepared by:

Keri Norrie, Camosun College

CHAPTER 19

MANAGERIAL

ACCOUNTING

MANAGERIAL ACCOUNTING

BASICS

Managerial accounting is a field of accounting

that provides economic and financial

information to managers and other internal

users to assist them in making decisions and

evaluating the effectiveness of those decisions.

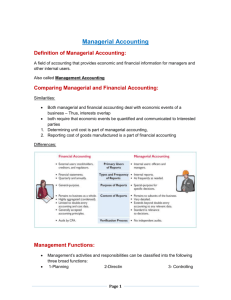

ILLUSTRATION 19-1

DIFFERENCES BETWEEN FINANCIAL AND

MANAGERIAL ACCOUNTING

Financial Accounting

Managerial Accounting

External users such as

shareholders, creditors, and

regulatory agencies.

Internal users such as managers

and officers.

Financial statements, issued at

least annually.

Internal reports, issued as

frequently as needed.

General-purpose information for all

users.

Special purpose for specific

decisions.

Reports pertain to company as a

whole; are highly aggregated; are

limited to double-entry accounting

and cost data; use standard of

GAAP.

Reports pertain to subunits of the

company; are very detailed; can

include any relevant data; use

standard of relevance to decisions.

Annual independent audit.

No independent audit.

MANAGERIAL ACCOUNTING BASICS

Management Functions

1. Planning

•

•

Management looks ahead and establishes

objectives

A key objective is to add value to the business

2. Organizing and Directing

•

•

Management coordinates the company’s

diverse activities and human resources to

produce an operation that runs smoothly

This function relates to the implementation

of planned objectives

MANAGERIAL ACCOUNTING BASICS

Management Functions

3. Controlling

•

•

The process of keeping the firm’s activities

on track

Management determines whether planned

objectives are being met and whether changes

are necessary

Managerial accounting assists in all three

management functions by providing the

necessary information to management.

MANAGERIAL ACCOUNTING BASICS

Contemporary Developments

• The role of managerial accounting has

expanded to meet the information needs of

businesses

• The following trends have contributed to this

expanded role:

•

•

•

•

•

•

Value Chain Management

Technological Change

Just-In-Time Inventory Methods

Product Quality Management Systems

Activity-Based Costing (ABC)

Cost Management

MANAGERIAL COST CONCEPTS

To perform the three managerial functions effective and

reliable information is needed. Cost information is when

answering questions such as the following:

What costs are

involved in making a

product?

What impact will

automation have

on total costs?

If production is

decreased, will

costs decrease?

How can costs best

be controlled in the

organization?

MANAGERIAL COST CONCEPTS

Manufacturing Costs

• Manufacturing consists of activities and

processes that convert raw materials into

finished goods

• Manufacturing costs are typically classified as

follows:

• Direct materials

• Direct labour

• Manufacturing overhead

MANAGERIAL COST CONCEPTS

Manufacturing Costs

Raw materials represent the basic materials and

parts that are to be used in the manufacturing

process. They can be classified as either:

Direct Materials

Raw materials that can be

physically and conveniently

associated with the finished

product during the

manufacturing process.

Or

Indirect Materials

Raw materials that cannot be easily

associated with the finished

product. Indirect materials are

accounted for as part of

manufacturing overhead.

MANAGERIAL COST CONCEPTS

Manufacturing Costs

• Direct labour

• The work of factory employees that can be

physically and conveniently associated with

converting raw materials into finished goods.

• Indirect labour

• The labour costs that have no physical

association with the finished product or it is

impractical to trace the costs to the goods

produced

• Like indirect materials, indirect labour is

classified as manufacturing overhead

MANAGERIAL COST CONCEPTS

Manufacturing Costs

Manufacturing overhead costs are indirectly

associated with the manufacture of the finished

product such as:

• Indirect materials and labour

• Amortization on factory buildings and

equipment

• Insurance, taxes, and maintenance on

factory facilities

Allocating manufacturing overhead to specific

products is challenge faced in managerial

accounting .

MANAGERIAL COST CONCEPTS

Product versus Period Costs

The three manufacturing costs are also known as

product costs since they become the cost of the

finished product.

Direct materials

Direct labour

Manufacturing overhead

Under the matching

principle, the product costs

are expensed when the

finished goods are sold.

Finished Goods Inventory

Cost of Goods

Sold Expense

MANAGERIAL COST CONCEPTS

Product versus Period Costs

• Non-manufacturing costs are known as period

costs as they are related to a specific time

period rather than to a saleable product

• Period costs include operating costs that are

deducted from revenues in the period incurred

• Operating costs are often subdivided into:

selling expenses (e.g. delivery and promotion)

administrative expenses (e.g. accounting and

personnel management)

ILLUSTRATION 19-2

Product versus Period Costs

All costs

Product costs

Manufacturing Costs

Period costs

Non-manufacturing Costs

Direct Materials

Selling Expense

Direct Labour

Administrative

Expenses

Manufacturing

Overhead

MANUFACTURING COSTS IN FINANCIAL

STATEMENTS: Balance Sheet

Manufacturing Company

Balance Sheet

December 31, 2005

Current assets

Cash

Receivables (net)

Inventory:

Raw materials

Work in process

Finished goods

Total current

assets

$

16,700

18,400

24,600

42,500

71,900

59,700

$235,000

A manufacturing company’s balance sheet will

have three inventory accounts based on the stage

of production.

MANUFACTURING COSTS IN FINANCIAL

STATEMENTS: Income Statement

Merchandising Company

Beginning

Merchandise

Inventory

+

Cost of Goods

Purchased

-

Ending

Merchandise

Inventory

Manufacturing Company

Beginning

Finished Goods

Inventory

+

Cost of Goods

Manufactured

-

Ending

Finished Goods

Inventory

Unlike a merchandise company which

purchases its products, a manufacturer

has cost of goods manufactured

=

Cost of Goods

Sold

=

ILLUSTRATION 19-6

MANUFACTURING COSTS IN FINANCIAL

STATEMENTS: Income Statement

MANUFACTURING COMPANY

Partial Income Statement

For the Year Ended December 31, 2005

Cost of goods sold

Finished goods inventory, January 1

Cost of goods manufactured

Cost of goods available for sale

Finished goods inventory, December 31

Cost of goods sold

$ 24,600

370,000

394,600

19,500

$ 375,100

ILLUSTRATION 19-7 MANUFACTURING COSTS IN

FINANCIAL STATEMENTS

Income Statement Cost of Goods Manufactured

Beginning

Work In Process

Inventory

Total Cost of

Work In Process

+

-

Total Current

Manufacturing

Costs

Ending

Work In Process

Inventory

Total Cost of

= Work In Process

=

Cost of Goods

Manufactured

ILLUSTRATION 19-8

MANUFACTURING COSTS IN FINANCIAL

STATEMENTS

The Cost of

Goods

Manufactured

Schedule – as

shown on the

right is an

internal financial

schedule that

shows each of

the cost

elements

explained in

Illustration 19-7.

OLSEN MANUFACTURING CORPORATION

Cost of Goods Manufactured Schedule

Year Ended December 31, 2005

Work in process, January 1

Direct materials

Raw materials inventory, January 1

Raw materials purchases

Total raw materials available for use

Less: Raw materials inventory, December

31

Direct materials used

Direct labor

Manufacturing overhead

Indirect labor

Factory repairs

Factory utilities

Factory amortization

Factory insurance

Total manufacturing overhead

Total manufacturing costs

Total cost of work in process

Less: Work in process, December 31

Cost of goods manufactured

$ 18,400

$ 16,700

152,500

169,200

22,800

$ 146,400

175,600

14,300

12,600

10,100

9,440

8,360

54,800

376,800

395,200

25,200

$ 370,000

COPYRIGHT

Copyright © 2004 John Wiley & Sons Canada, Ltd. All rights reserved.

Reproduction or translation of this work beyond that permitted by

Access Copyright (The Canadian Copyright Licensing Agency) is

unlawful. Requests for further information should be addressed to the

Permissions Department, John Wiley & Sons Canada, Ltd. The

purchaser may make back-up copies for his or her own use only and

not for distribution or resale. The author and the publisher assume no

responsibility for errors, omissions, or damages caused by the use of

these programs or from the use of the information contained herein.