Exhibit II-6A Building Photograph

advertisement

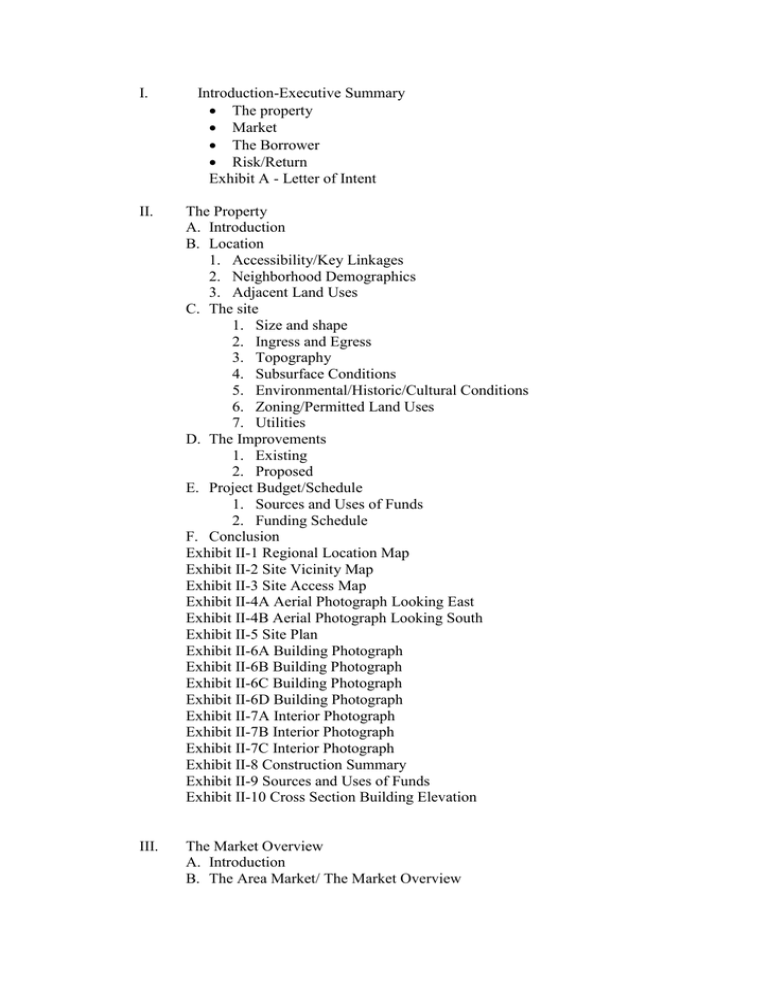

I. Introduction-Executive Summary The property Market The Borrower Risk/Return Exhibit A - Letter of Intent II. The Property A. Introduction B. Location 1. Accessibility/Key Linkages 2. Neighborhood Demographics 3. Adjacent Land Uses C. The site 1. Size and shape 2. Ingress and Egress 3. Topography 4. Subsurface Conditions 5. Environmental/Historic/Cultural Conditions 6. Zoning/Permitted Land Uses 7. Utilities D. The Improvements 1. Existing 2. Proposed E. Project Budget/Schedule 1. Sources and Uses of Funds 2. Funding Schedule F. Conclusion Exhibit II-1 Regional Location Map Exhibit II-2 Site Vicinity Map Exhibit II-3 Site Access Map Exhibit II-4A Aerial Photograph Looking East Exhibit II-4B Aerial Photograph Looking South Exhibit II-5 Site Plan Exhibit II-6A Building Photograph Exhibit II-6B Building Photograph Exhibit II-6C Building Photograph Exhibit II-6D Building Photograph Exhibit II-7A Interior Photograph Exhibit II-7B Interior Photograph Exhibit II-7C Interior Photograph Exhibit II-8 Construction Summary Exhibit II-9 Sources and Uses of Funds Exhibit II-10 Cross Section Building Elevation III. The Market Overview A. Introduction B. The Area Market/ The Market Overview 1. Regional Market 2. Relevant Submarket for Subject C. Competitive Market Survey (Comparables) 3. Rental Rates 4. Occupancies 5. Sales Prices D. Conclusion Exhibit III-1A Summary of Population Growth Exhibit III-1B Average Household Income Exhibit III-1C County Employment Forecast Exhibit III-2A County Apartment Market Exhibit III-2B Average Monthly Rent for Rental Housing Exhibit III-3 Competitive property Survey Exhibit III-4 Competitive property Amenity Matrix Exhibit III-5 Competitive Property Survey Map IV. The Borrower/Developer/The Joint Venture Partner A. Introduction B. The Organization C. Rouse & Associate 1. Company Overview 2. Rouse& Associates- Delaware D. Development Team 1. Developer/Seller 2. Leasing/marketing/Sales team 3. General Contractor 4. Major Subcontractors 5. Golf Course Management E. Conclusion Exhibit IV-1 Balance Sheet Exhibit IV-2 Consolidated Balance Sheet Exhibit IV-3 NHP Properties in the Metropolitan Washington, D.C. Area Exhibit IV-4 Parkford Companies Track Record V. The Risks and Returns A. Introduction B. Valuation 1. Pro Forma Income and Expenses 2. Valuation Methodology C. Returns 1. Projected NOI and Cash Flows From Operations 2. Projected property Reversions 3. Base Debt Service 4. Annual Returns to Equity 5. Cash Proceeds at Sale to Equity 6. Additional Interest from Operations 7. Additional Interest from Sale or Refinancing 8. Rates of Returns a. Annual Returns b. Time-Weighted Returns 9. Yield Analysis D. Risk 1. Market Risk 2. Operation Risk 3. Financial Risk 4. Partnership Risk 5. Sensitivity Analysis Exhibit V-1 Pro Forma Income and Expenses Exhibit V-2A Valuation Summary Exhibit V-2B Cost of Improvement Exhibit V-2C Land Valuation Exhibit V-2D Direct Sales Comparison Approach Exhibit-V-3 Assumptions Table Exhibit-V-4 Projected property Cash Flow Exhibit V-5 investors Yield Summary Exhibit V-6 Total USF&G Cash Flow ExhibitV-7A Composition of USF&G’s Proceeds at Sale ExhibitV-7B Composition of USF&G’s Proceeds at Sale Exhibit V-8A Sensitivity Analysis CAP Rates and Inflation Exhibit V-8B Sensitivity Analysis Yield VS Holding Period Yield VS Holding Period E. Conclusions and Recommendations VI. Appendix A-1A Floor Plans Appendix A-1B Appendix A-2 Appendix A-3 Appendix B Piedmont Realty Advisors