Personal Finance Semester Review

advertisement

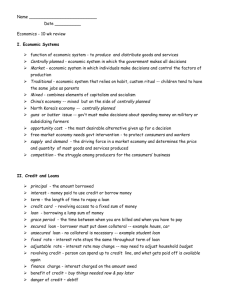

PERSONAL FINANCE SEMESTER REVIEW RESUME • What is a resume? • A resume is a collection and summary of your previous experiences and skillsets that you submit to a potential employer for review. VALUES • Values are the beliefs and principles you consider important, correct and desirable. • Religious beliefs • Right vs. Wrong • Political views WANTS VS. NEEDS • Wants are things that aren’t necessary for your survival but can make your life more enjoyable. • Ex. John wants a new phone but needs food and water. NETWORKING • The people around you can often serve a unique purpose in your pursuit for a job. • Finding out about a job opportunity through contact with friends and family and having them connect you with a potential employer is called Networking. HUMAN CAPITAL • Human Capital Consists SOLELY of two things: • Knowledge • Skills • Determines your value in the job market. INTERNAL REVENUE SERVICE • The Internal Revenue Service (IRS) is a government agency responsible for collecting federal taxes. EMPLOYEE BENEFITS • Many different workplaces offer benefits such as: • • • • • Gym Memberships Flexible hours Repayment of education loans Merchandise discounts Child care • These benefits are called Employee Benefits PAY PERIOD • The length of time an employee’s wages are calculated. • Ex. Charlie’s pay period at Hy-vee is two weeks. Every two Saturdays, he gets a paycheck that consists of the money earned from those two weeks. GROSS PAY VS. NET PAY • Gross pay is the amount of money you earn before any payroll deductions such as federal tax, social security, and any retirement savings. • Net pay is the money you get after those deductions, “money in your pocket”. FEDERAL INSURANCE CONTRIBUTION ACT (FICA) • FICA is a tax that includes two separate taxes: • Medicare • Social Security • These can often be considered Payroll Deductions. BOUNCING A CHECK • Bouncing a check is when you write a check without the sufficient funds to support it. (NSF another name) • Ex. Kelly only has 200 dollars in her bank account but due to her forgetfulness she writes a check for 300 dollars at the grocery store. • Consequences: • Grocery store fee • Bank fee • Credit score drops CREDIT LIMIT • The maximum amount you can charge on a credit card is called your credit limit. PAY YOURSELF FIRST • “Pay yourself First” means that money is set aside for savings before spending. • This strategy is commonly used to give you “cushion” when you run into an emergency and provide security for your future. BUDGET DEFICIT • If your expenses are higher than your income you have a Budget Deficit. • Ex. Josh spends 954 dollars each month on clothes, food, gas, and entertainment but he only earns 300 dollars a month from his part-time job. Josh has a Budget Deficit ASSETS • Assets are things that you own that are worth money. • TV's are assets, Cars are assets, and houses are assets. LIABILITIES • Liabilities are things that you owe money on. ANNUAL PERCENTAGE RATE • The annual percentage rate (APR) is the interest rate charged on an unpaid balance expressed as a percent per year. SECURE WEBSITES • When you are surfing the web and purchasing an item or anything requiring your personal information, make sure there’s an “S” (which stands for secure) after the HTTP. TYPES OF LOANS (MORTGAGES AND REPAYMENT) • The interest paid depends on the length of time you choose to repay it back. • The longer your home loan is, (typical 30 years) the higher the total amount you back • Rule of thumb – 30 year home loan have lot more interest being paid then 15 year home loan (15 year (interest is typical lower in • 15 year loan) Higher payment in 15 year • Loan, but low total interest being paid CREDIT REPORT • A credit report is: • A written record collected by a credit agency that tracks a borrower’s bill-paying habits. Assess how credible you are in paying back your loans REVOLVING CREDIT • A credit card is a form of revolving credit. • This means that it does not have a fixed number of payments. The payments depend on how much you spend. FINANCE CHARGE • The amount of interest paid on unpaid credit balances is called the: • Finance Charge PAYDAY LOANS • These institutions claim to give you immediate cash loans without checking your credit report. • Payday loan companies typical charge the highest interest rate out all financial institutions. MINIMUM MONTHLY PAYMENTS • The worst thing to do with a revolving balance amount is only paying the minimum every month. • This allows interest to build up and you will have to pay more and more at an exponential rate. HIGH RISK LOANS • The relationship between the interest rate charged to an individual and the person’s risk of nonpayment of a loan is… • The higher the risk of nonpayment, the higher the interest rate. CO-SIGNING • The danger of co-signing a loan is: • If the person doesn’t pay, you become responsible for the debt. CREDIT REPORT • The following are able to and most likely to review your credit report: • Landlords Insurance providers • Potential Employers COLLATERAL • Collateral describes items of value that an individual can use to help back their loans, which can be sold if the loan is not paid back. PRIME RATE • People that have great credit scores and are considered reliable and stable customers sometimes get a PRIME RATE for their continued loyalty. RISK AND RETURN • Pertaining to stocks: • The general relationship between risk and return is, the higher the risk, the higher the potential return. STOCK • Stock is defined as shares of ownership in a corporation. BEAR MARKET • Bear market refers to an economy that is doing poorly and does not have investor confidence. LIQUIDITY • Liquidity is the ease with which an asset, something you own of value, can be turned into cash. INVESTING • When investing, you should consider three important factors. • Risk • Rate of return • Liquidity THE FEDERAL RESERVE • The Federal Reserve: • Acts as a depository service for the United States Government • Influences Interest rates • Supervises and regulates commercial banks BLUE CHIP STOCKS • Blue Chip Stocks are stocks from nationally recognized companies that have been profitable for a very long time. • Reliable and Profitable PRINCIPAL • What is principal? • Principal is defined as the original, initial amount of money invested or lent. BALANCING A CHECKBOOK • If Jack has a balance in his checking account of $790 and he withdraws, 110 dollars, deposits 90 dollars and writes a check at MCSports for 70 dollars, what is his new balance? • • • • $200 $600 $700 $850 DEDUCTIBLE • Insurance policies often have a deductible. • You have to pay the deductible yearly and then the insurance will cover any expenses beyond that. • Example: • You hit a light pole and it caused $1000 worth of damage. You have an auto insurance policy with a $300 deductible. The insurance company will cover: • $700 COMPREHENSIVE COVERAGE • This is a type of Auto-Insurance policy. • It covers: • • • • Damage to your car if it is stolen Flood damage Fire damage Animal damage DEBIT CARD • Using a debit card to buy something is most similar to using a check. COMPOUND INTEREST • Compound interest is the interest earned on both principle and interest. PHISHING • Phishing is the use of Pop-up ads, messages, or emails to lure consumers into giving their private information. CHECK 21 • The goal of Check 21 is to decrease the amount of float. (The amount of time between when the check is presented and when it actually reaches the bank) W-2 • The purpose of the W-2 form: • To report wages paid to employees and the taxes withheld from them. W-4 • The purpose of W-4 is: • To allow the employer to withhold Federal Income taxes from an employee’s wages. SAVING TACTICS • Financial experts recommend that people begin to save while they are young because it allows you to benefit from compound interest. CAPITAL GAINS • Marie owns a house that is worth $200,000 after 5 years she wants to move out and get a bigger house. She sells her house for $350,000. Her capital gains would be $150,000. • Capital gains is the difference of the price you bought the house and the amount you sell it for. MUTUAL FUNDS • Mutual Funds: Diversifies risks in the stock market by investing in multiple companies. • Note: a mutual fund is more stable than buying a bunch of one stock. DIVERSIFICATION • Financial planners recommend that investors invest in a variety of financial assets, such as stocks, bonds, savings accounts, and money market funds. • This diversifies their portfolio, therefore, reducing the overall risk of losing money. BODY-INJURY LIABILITY • This type of car insurance is required for a driver to license a car. • Also known as just “liability insurance”. DEPRECIATING ASSETS • The following are examples: • Gaming systems • Standard new car • These things lose value very quickly over the years. ROTH IRA • The main purpose of either a traditional or Roth IRA is it: • Reduces tax liability for retirement accounts. Money put in these accounts are generally either not taxed at all or have a very low tax. COLLATERAL LOANS • Banks and financial institutions are more likely to give you a loan if they know you will pay it back. • Example: • If two people have equal credit scores, a bank is more like to loan out $5,400 to a person that wants to use it for a car rather than a person wanting to go on vacation. • The person going on vacation has a high risk of leaving and not coming back, whereas for a car, the bank can just take the car as collateral if you don’t pay. FDIC AND NCUA • These government agencies insure that consumer deposits are protected from loss. • FDIC – Insures government chartered commercial banks’ deposits against loss. • NCUA – provide insurance for credit union deposits. LIFE INSURANCE • If these three scenarios had the same take-home pay, who would need the greatest life insurance? • A young single woman with two young children • A young single woman without children • A young married man without children MISSOURI AUTOMATIC DEDUCTIONS • State and Federal taxes are automatically deducted in the state of Missouri from your paycheck. CERTIFICATE OF DEPOSIT • A certificate of deposit is an insured interest earning saving instrument with restricted access to the funds. CANCELED CHECK • A canceled check is a check that has been cleared through the bank. CREDIT SCORES • These factors determine your credit score: • • • • Whether your bills are paid on time The amount owed on all accounts Number of credit cards Number of years a person has had credit