ACC202_Chapter_9_notes

advertisement

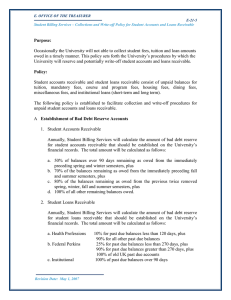

Chapter 9 notes Recognizing A/R When merchants recognize A/R in a sale on merchant account, on the credit side, they are recognizing revenue (sale). Any sales discount or return will affect A/R if the balance has not been paid off yet. Valuing A/R Because not all customers will honor their outstanding A/R balance, the merchants will have to write off some of the A/R balances. Basically, there are three methods in writing off A/R: 1. Direct write-off (page 388) 2. Allowance method (percentage of sales approach) ---- page 392 3. Allowance method (percentage of receivables) ----- page 393 Basically, under direct write-off method, we write off A/R when we determine an account will not be paid. Sometimes matching principle will be violated because the sales recognized might not fall within the same period as A/R written-off. Under allowance method (sales approach), we estimate the total write-off for the past year at year-end. We multiply net credit sales with an estimated write-off percentage (based on prior years experience). Then we will debit the write-off number to bad debt expense and credit to the allowance account. On the balance sheet, the A/R balance will be reduced by the allowance account balance to come up with the net-realizable A/R value. In a later date, when we actually determine to write off a customer account, we will debit the allowance account and credit the A/R account. Be aware that when we write off a customer account, the net realizable value for A/R remains unchanged. Under allowance method (percentage of receivable approach), the procedures are very similar to the sales approach except instead of using net credit sales, we will use the aging A/R balances (page 393). We assign a write-off percentage (based on prior years experience) to each aging column. At the end, we will add up all the estimated write-off amounts for all columns. One thing to be aware of is we do not simply credit the total estimated write-off amount to the allowance account. Instead we need to adjust the allowance account balance to have a final credit balance exactly the same as our estimated write-off amount. Disposing of A/R Some companies do not want to maintain customers’ A/R balances and they sell their A/R to a bank or a factor company who will buy up a portion or entire A/R portfolio for a service fee. (page 395) Notes receivable Notes receivable is basically an A/R receivable with a promissory note(with interest charged) attached to it. The rules for recognizing, valuing (only for short-term), and disposing N/R are very similar to A/R. On page 401, when a N/A is dishonored, it will become A/R and all the interest accrued will also be debited to A/R.