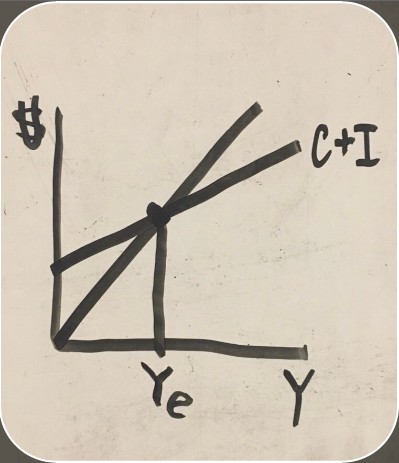

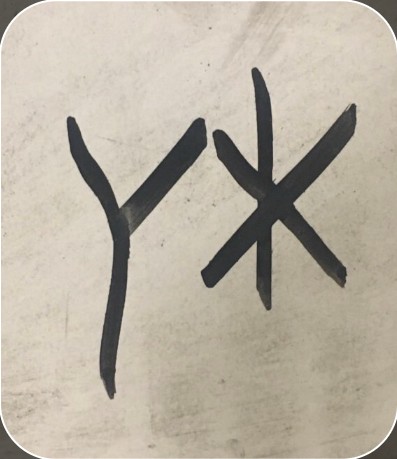

non-descriptive aggregate spending graph

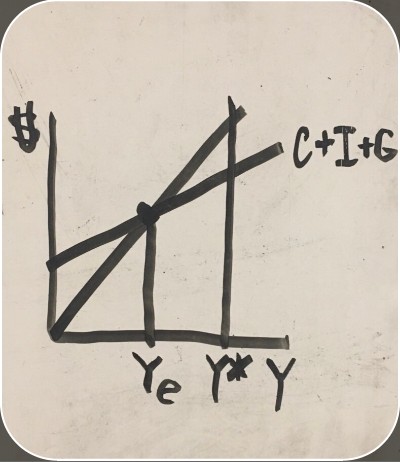

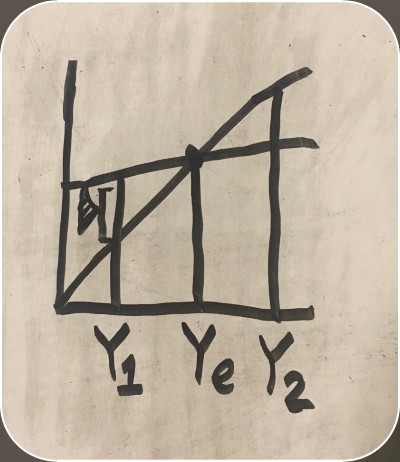

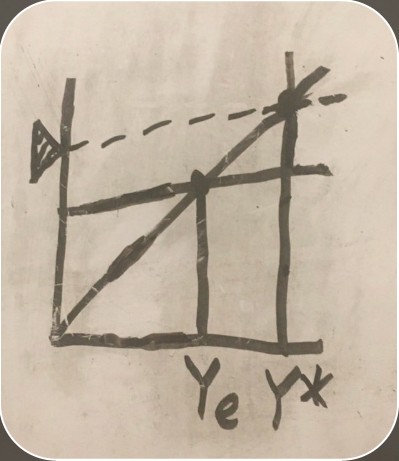

recession on an aggregate spending graph

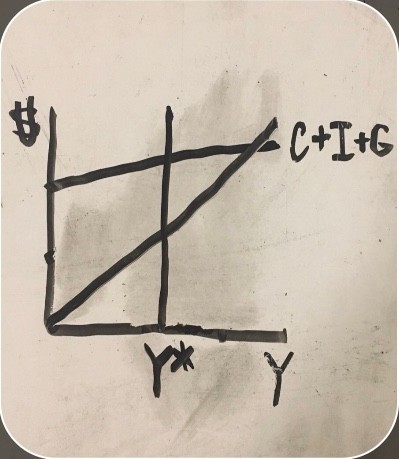

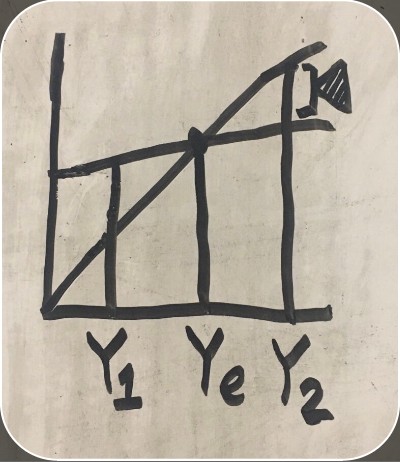

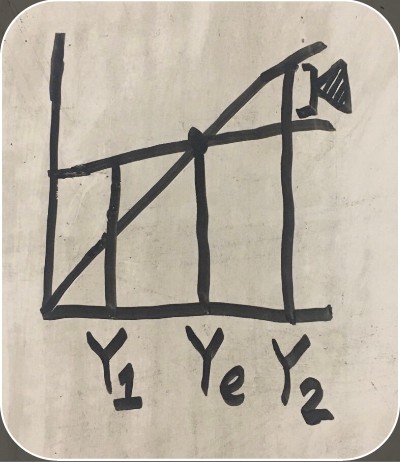

inflation on an aggregate spending graph

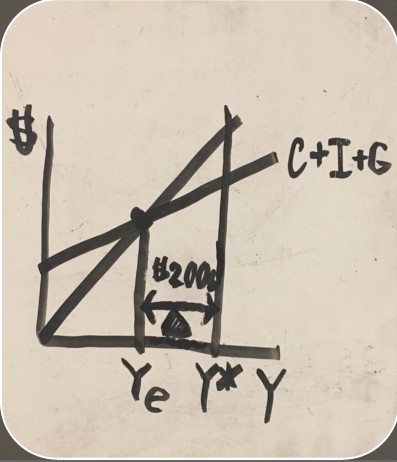

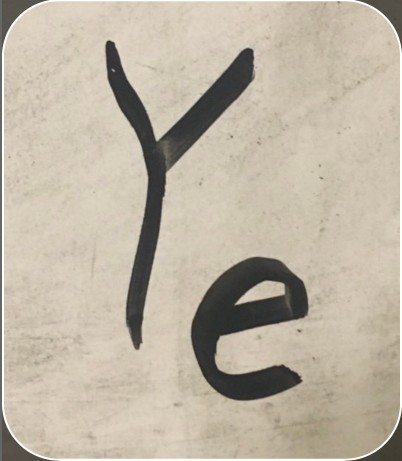

size of a recession on an aggregate spending graph

potential GDP (aggregate spending graph)

equilibrium (aggregate spending graph)

amount of goods being produced

amount of goods being consumed

decreasing inventory

increasing inventory

fiscal policy

when the government changes spending, taxes, and/or transfer payments

G (fiscal policy)

government spending

T (fiscal policy)

taxes

TR (fiscal policy)

transfer payments

fiscal policy actions that can end a recession

increasing government spending, decreasing taxes, and increasing transfer payments

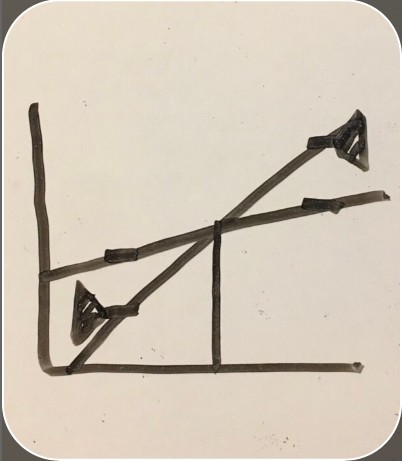

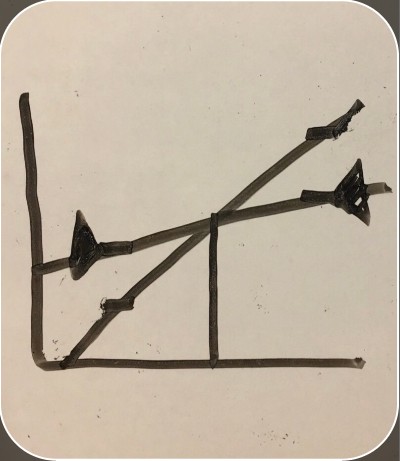

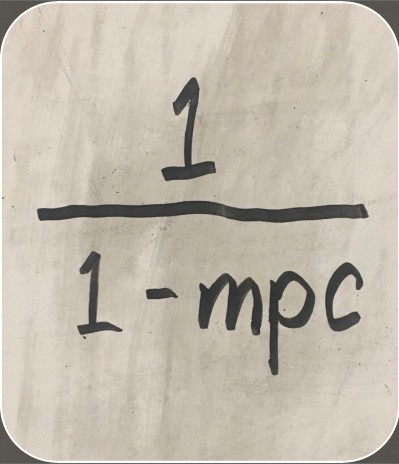

government spending multiplier formula

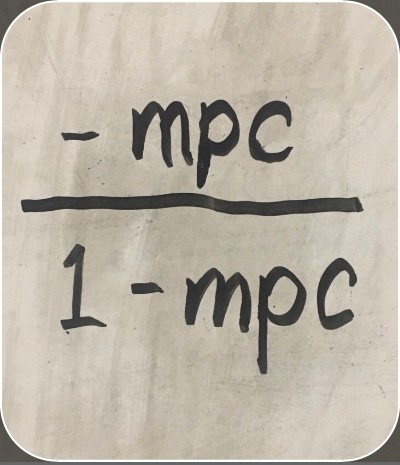

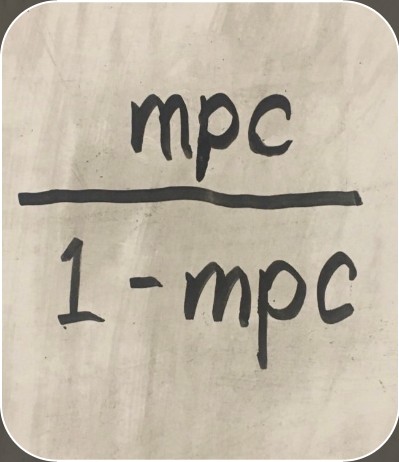

tax multiplier formula

transfer payments multiplier formula

how to calculate the fix for a recession

Use one of the formulas to calculate the multiplier, then divide the monetary amount of the recession by the multiplier.

how to use two policies to fix a recession

split the GDP distance so that half can be fixed with one policy and half can be fixed with the other, then proceed as normal

economic growth from fiscal policy

new equilibrium created by fiscal policy

example of a regressive tax

sales tax

example of a progressive tax

income tax

main issue of a recession

unemployment

unemployment rate definition

percentage of labor force (aged 16 or older) who want to work, but are without jobs

full employment rate of employment

4%-5%, not 0%

situation if unemployment is equal to job vacancies

the unemployment rate is still the amount of the labor force aged 16 and older who want to work but do not have jobs

effect on model if unemployment is equal to job vacancies

the model is at full employment, so nothing needs to be done to stimulate the economy

frictional unemployment

percentage of people in-between jobs

structural unemployment

longer-term frictional unemployment due to having to move or train for the new job

problems with unemployment

financial hurt of the unemployed, social ills with unemployment, in a recession, everyone’s income grows more slowly and lost production is permanent

inflation

a general increase in prices

price index

index used to measure inflation

C.P.I.—Consumer Price Index

price index that measures the change in prices in goods and services that consumers consume

P.P.I.—Producer Price Index

price index that measures the change in prices in goods and services that producers consume; also influences C.P.I.

GDP deflator

used to calculate real GDP

problems with inflation

fixed incomes’ purchasing power decreases, it destroys price information, and it affects lending and borrowing (making lending riskier)

ideal inflation rate

1.5%-2%

one thing that resists price reductions

wages

effect of wage raises not being given during inflation

real wages decrease

automatic stabilizers

unemployment compensation, graduated income tax, and spending rigidities

fiscal drag

stabilizers when preventing the eradication of inflation or a recession by reducing the size of the multiplier

deficit

this year’s debt or surplus number

debt

total debt

surplus

a negative deficit that makes debt decrease

surplus equation

T>G+TR

deficit equation

T<G+TR

balanced budget equation

T=G+TR

budget philosophies

annually balanced budget, full employment balanced budget, and discretionary fiscal policy

annually balanced budget effect

causes destabilization by stimulating inflated economies and increases deficit

full employment balanced budget effect

balances the economy only if it is at full employment and has a neutral impact on the economy

discretionary fiscal policy effect

stabilizes the economy while making surpluses and deficits worse

investment multiplier formula

same as the government spending multiplier

how to calculate an equilibrium output increase

Use the investment multiplier formula to calculate the multiplier, then multiply the amount of the investment by the multiplier."