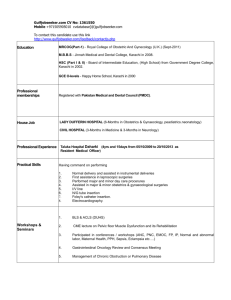

determination of tax liability & book keeping, records & returns

advertisement

Income Tax Bar Association Karachi WORKSHOP ON SALES TAX Pearl Continental Hotel, Karachi 21 – 22 July 2005 Income Tax Bar Association Karachi DETERMINATION OF TAX LIABILITY & BOOK KEEPING, RECORDS AND RETURNS Workshop on Sales Tax By MEHMOOD A. RAZZAK Partner Mehmood Idrees Masood & Co. Pearl Continental 21-22 July 2005 2 DETERMINATION OF TAX LIABILITY (SECTION-7) Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Basic Concept of VAT mode - deduction of tax paid (input tax) from the tax charged (output tax) and pay the difference to the ex-chequer. Claim the refund (newly inserted concept) in case the difference is negative. Only a registered person is entitled to such adjustment. A person who is liable to be registered but not registered shall not be so entitled. (section2(25)). Both input tax paid or payable (accrued) shall be admissible. Input tax should relate to goods used in supplies made or to be made. 3 DETERMINATION OF TAX LIABILITY (SECTION-7) Income Tax Bar Association Karachi (Contd…) Out of tax period input tax adjustment allowed for preceding twelve tax periods - the reasons for delayed adjustment required to be specified in the revised return. In order to claim adjustment, the registered person should hold. Workshop on Sales Tax Valid Tax Invoice - for locally purchased goods. Bill of entry or Goods Declaration - for imported goods. Treasury challan - for goods purchased in auction. Pearl Continental 21-22 July 2005 4 TAX CREDIT NOT ALLOWED – SECTION-8 Income Tax Bar Association Karachi Input tax paid on goods used or to be used for any purpose other than for the manufacture or production or supply of taxable goods shall not be allowed. Or any other goods which the Federal Government may so declare i.e., vehicles, food and beverages, garments, Workshop on Sales Tax fabrics, consumption on entertainment, gifts and give-away acquired otherwise as stock-in-trade. Certain prescribed items, if sold to un-registered persons, will not entitle the registered person to claim input tax e.g. polypropylene Pearl Continental 21-22 July 2005 granules, artificial filament, sugar, air conditioning plant. 5 TAX CREDIT NOT ALLOWED – SECTION-8 Income Tax Bar Association Karachi (Contd…) Extra tax charged under Section 3 (5) shall also not be allowed. Input tax paid on fake invoices shall be inadmissible. If the registered person fails to provide requisite information Workshop on Sales Tax as prescribed by the Board, he will be barred from adjusting input tax. Input tax relating to taxable supplies only shall be allowed (Apportionment of Input Tax). Pearl Continental 21-22 July 2005 6 DEBIT AND CREDIT NOTES ADJUSTMENTS – SECTION-9 Debit and credit note adjustments are allowed in cases of Income Tax Bar Association Karachi Workshop on Sales Tax Cancellation of supply Return of goods Change in the nature of supply Change in the value of supply Or in any event where the amount as per the tax invoice or the return needs to be modified The time limit allowed for such adjustment is 180 days from the date of supply, extendable for further 180 days by the collector on specific request. Goods unfit for consumption, returned by the buyer should be destroyed only after obtaining permission from the collector and yet under the supervision of sales tax officer. Pearl Continental 21-22 July 2005 The credit notes must be issued immediately upon receipt of the returned goods and the debit notes. 7 INADMISSIBLE TRANSACTIONS – SECTION-73 This section is directly related to section 7. Income Tax Bar Association Karachi Transaction value exceeding Rs. 50,000 should be made through Crossed banking instrument It should evidence the transfer of the amount in favour of supplier from the business account of the buyer. Online transfer of payment from the business account as well as payment through credit card will also be admissible. Workshop on Sales Tax Payments against utility bills are excluded. Any payment made otherwise shall not be admissible. Maximum period of settling the transaction is 180 days. The amount so received should be deposited in supplier’s business account in order to enable the supplier to claim input tax adjustment. Pearl Continental 21-22 July 2005 These business accounts should be declared by the registered persons to their relevant collectors. 8 OTHER FEATURES OF THE REGIME – SECTION-73 Income Tax Bar Association Karachi Supply to un-registered persons or that of exempt supply shall remain un-effected. Settlement of credit balance in kind shall remain unaffected provided the legal documentation of the property should be Workshop on Sales Tax transferred in the name of supplier, proper entry in books of accounts has been made and amount of sales tax is transferred as per the provision of this section. This condition of 180 days is not applicable in case of imports and goods exported out of Pakistan. Pearl Continental 21-22 July 2005 9 SALES TAX ON ADVANCES Income Tax Bar Association Karachi Time of supply is earlier of the delivery of goods or amount received. Serially numbered “Advance Payment Receipt” should be issued and tax shall be levied at the time of receiving advance payment. Workshop on Sales Tax Sale tax invoice may be issued at the time of delivery. No tax shall be payable at the time of issuance of sales tax invoice. Advance Payment Receipt shall be treated as a tax invoice. Pearl Continental 21-22 July 2005 Any subsequent adjustment can be incorporated through credit note and time limit of 180 days shall not apply. 10 RETURNS Income Tax Bar Association Karachi After having discussed the determination of tax liability, let us have a look at the prescribed format of monthly return. Workshop on Sales Tax Pearl Continental 21-22 July 2005 11 RETURNS (Contd…) GOVERNMENT OF PAKISTAN SALES TAX RETURN CUM PAYMENT CHALLAN Income Tax Bar Association Karachi (For registered persons other than those falling under Minimum Value Addition regime) Regular 5 Revised 5 [Pl. tick the relevant box] Tax Period (1) Sales Tax Registration No. (2) National Tax Number - (3) Name (4) Address (5) SUPPLIES - O UTPUT TAX Value Rate O utput Tax (Rs.) Value Rate Input Tax (Rs.) a) Taxable supplies b) Supplies to DTRE registered persons c) Zero rated supplies - Domestic d) Zero rated supplies - Exports e) Exempt supplies Total Sales f) Less Adjustment for Credit Notes (U/S. 9) Net Sales (6) PURCHASES - INPUT TAX a) Purchases - Domestic b) Purchases - Imported c) Utilities : Workshop on Sales Tax i) Electricity ii) Gas iii) Telephone d) Exempt purchases/Imports e) Local Zero rated purchases f) Purchases under DTRE scheme g) Input tax from previous tax period (if any) Total purchases h) Less Adjustment for Debit Notes (U/S. 9) Net purchases (7) Net Sales Tax Payable (5-6) (8) Sales Tax Refundable (6-5) (9) Sales Tax Arrears: i) Principal Amount ii) Default Surcharge iii) Penalty (10) TO TAL SALES TAX PAYABLE (Including Arrears) [7 + 9 (i to iii)] Rs. Rs. Rs. Rs. Rs. Rs. * * * Rs. Rs. Rs. 02200000 Sales Tax 02250000 Sales Tax on services collected on behalf of Provincial Government. 02260000 Central Excise Duty on services collected in the manner of Sales Tax DECLARATION :- I declare that the entries in this return are true and correct. Name : NIC : Pearl Continental 21-22 July 2005 Signature w ith Stamp Designition : Date Note: Amounts of Arrears (Col. 9) are not adjustable against refundable amount. NIL filers may file Return at any designated NBP Branch or respective Collectorate. For Bank Use Serial No. Amount Received Amount in Words Bank Officer's Signature Bank's Stamp 12 TYPE OF RETURNS Section Income Tax Bar Association Karachi Workshop on Sales Tax Types of Returns 26 Monthly Return To be filed by importer, manufacturers, wholesalers, distributors and importers 26AA Retail Tax Return To be filed by a Retailer 27 Special Return To be filed by such person containing such information as specified by the Board or the Counter 28 Final Return To be filed by the person who has applied for de-registration NIL RETURNS Is a return indicating no sales tax is payable NULL RETURN Is a nil return indicating zero transaction and ultimately zero amount of tax payable or refundable Nil returns may be filed in duplicate at Nil Return Receipt Counters in the collectorate, instead of designated banks. Summary of Sales & Purchases Pearl Continental 21-22 July 2005 Every registered engaged in import or supply of goods other than specified zero-rated goods (i.e. blended or man-made cotton yarn, textile fabrics and made-ups, garments, leather goods and footwear, carpets, surgical and sports goods) shall furnish statement of sales and purchases in the prescribed format 13 alongwith the return. GENERAL REQUIREMENTS OF LAW Income Tax Bar Association Karachi Every registered person is required to maintain the following records at his business premises or registered office: Supplies, indicating particulars of good supplied and that of the buyer(s). Purchases with all the above particulars and details. Workshop on Sales Tax Zero - rated and exempt supplies. Imports Invoices, credit notes, debit notes, bank statement, banking instruments, inventory records, utility bills, payroll and wages records, rental agreements, sale-purchase agreements and lease agreements. Pearl Continental 21-22 July 2005 Any other records as specified by the Board. 14 TAX INVOICES – SECTION-23 Income Tax Bar Association Karachi Every tax invoice issued by the registered person at the time of supply should contain the following particulars: Name, address and registration number of the supplier Name, address and registration number of the recipient Workshop on Sales Tax Date of issue of invoice Description and quantity of goods Value exclusive of tax Amount of sales tax Pearl Continental 21-22 July 2005 Value inclusive of sales tax 15 SALES TAX ON RETAIL PRICE SECTION-3 (2) (a) THIRD SCHEDULE Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Following items as specified in the Third Schedule shall be subject to levy of 15% sales tax on ultimate retail price: Fruit and vegetable juices Ice cream Aerated waters on beverages Syrups and squashes Cigarettes Toilet and laundry soaps Detergents Shampoo Tooth paste and shaving creams Perfumes and cosmetics Biscuits and confectionary Tea Power drinks and milky drinks Footwears 16 SALES TAX ON RETAIL PRICE SECTION-3 (2) (a) THIRD SCHEDULE Income Tax Bar Association Karachi (Contd…) Only a manufacturer is required to charge sales tax on retail price. The amount of sales tax shall be prominently printed on each article package, container or label. Workshop on Sales Tax Manufacturers of biscuits shall levy 15% sales tax on exfactory price plus 15% sales tax on minimum value addition of 12% in lieu of sales tax payable on the basis of retail price. Pearl Continental 21-22 July 2005 17 RETENTION OF RECORDS – SECTION-24 Income Tax Bar Association Karachi The records should be retained for a period of three years after the end of tax period to which they relate. However, the sales tax officer is still empowered u/s 36 to serve show cause notice Workshop on Sales Tax within five years of the relevant date for the purpose of recovery of tax not levied, short levied or erroneously refunded. Pearl Continental 21-22 July 2005 18 MAINTENANCE OF E-RECORDS, FILLING OF E-RETURNS AND E-INVOICING Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Maintenance of records on computer is allowed subject to accessibility, availability of hard copies and having parallel back up of softcopy. Issuance of e-invoices is also allowed vide special procedure rule. E-invoicing basically means absolute elimination of paper work as far as invoicing is concerned. Prior approval from the relevant collector is mandatory. Authenticity of the origin and integrity of the data should be guaranteed e.g. through electronic signature or electronic data interchange (EDI). A copy of invoice should be simultaneously transmitted to the collector electronically. A disaster recovery plan should be in place. Both the buyer and seller should have infrastructure to cater with the e-invoicing. adequate 19 RETAILER – GENERAL – SECTION-3AA Income Tax Bar Association Karachi Workshop on Sales Tax A retailer having turnover of Rs. 5 million and above is required to be registered and charge sales tax @ 15%. Minimum value addition should be 10% other than on supply of motorcycle, rubber tyres, mild steel products, domestic electrical appliances, sanitary wares etc., where it range between 3% to 4%. Records to be maintained Cash memos (to be issued if specifically required by the buyer). Purchases Pearl Continental 21-22 July 2005 Audit once a year with exclusion of retailers declaring minimum 6% increase his total purchases. 20 RETAILER – GENERAL – SECTION-3AA (Contd…) Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 21 RETAILER OF SPECIFIED GOODS – SECTION-3AA Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Specified goods means textile fabrics, textile made-ups, garments and articles of textile including house textile, articles of leather, carpets and surgical goods. Threshold of Rs. 5 million turnover is applicable in this case also. (Turnover of specified goods). The applicable rate under this scheme is 3% ad valorem (2% sales tax and 1% income tax) a final discharge of tax liability. In case of corporate retailers 1/3 shall be treated as advance tax adjustable against final tax liability. No adjustment of input tax is allowed. Similarly tax charged by a retailer under this scheme shall also be disallowed as input adjustment in the hand of the buyer. The question of a retailer falling under this scheme shall be decided by the collector or Board, as the case may be. The rule is silent on the issue of audit. 22 RETAILER OF SPECIFIED GOODS - SECTION-3AA (Contd…) Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 23 COMMERCIAL IMPORTERS Income Tax Bar Association Karachi Input tax is payable on assessed value @ 15% Sales Tax @ 15% is payable on minimum value addition at the time of making payment of Custom Duty and Sales Tax as above. Minimum value addition shall be taken as higher of 10% or that of preceding year. Workshop on Sales Tax Payment of Sales Tax on minimum value addition shall entitle exemption from audit. The format of return for a commercial importer is prescribed which differs slightly from the normal return In addition, he has to file a statement of value addition for imported and domestic purchases of at the end of the Financial Year Pearl Continental 21-22 July 2005 A separate challan is prescribed for a commercial importer for payment of sales tax on value addition. 24 COMMERCIAL IMPORTERS (Contd…) GOVERNMENT OF PAKISTAN Annex-B [See rule 12] Regular Revised Sales Tax Return - cum - Payment Challan for COMMERCIAL IMPORTERS Note: In case of revised return,insert date of initial return. -- Pl. tick the relevant box -- Please see the instructions on the reverse before you fill this return Income Tax Bar Association Karachi (01) Sales Tax Registration No. (03) Name (05) Sales (a) Taxable Supplies Exports/ Zero-rated Supplies Supplies to DTRE Registered Persons (b) (c) (d) (06) Taxable Purchases (Domestic) Exempt Purchases/ Imports (d) Rs. Rate 15% Rs. Rs. 15% Rs. Rs. 15% Rs. TOTAL Rs. Arrears / recoveries. Rs. 15% (08) Penalty Rs. (09) Default Surcharge (10) Net amount payable (including, arrears, default surcharge and penalties) Declaration SALES TAX PAID (Input Tax) Rs. (6A) Sales tax on value addition already paid Rs. on Treasury Challans (07) SALES TAX DUE (Output Tax) Rs. 0% VALUE (Excluding Sales Tax) All other Purchases Year 0% Rs. Rs. (b) 15% Rs. TOTAL Taxable Imports Rate VALUE (Excluding Sales Tax) Rs. Rs. Purchases -Month (04) Tax period Exempt Supplies (a) (c) Workshop on Sales Tax (02) N.T.N # Rs. Rs. Rs. TOTAL SALES TAX PAYABLE [5- (6+ 6A) +(7+8+9)] Rs. Head of Account 0220000 Sales Tax I declare that the entries in this return are true and correct. Signature Name Stamp N.I.C # -- -Date Designation Pearl Continental 21-22 July 2005 For Bank use Serial No.......................................... Amount in words.................................................................. ............................................................................................. Bank Officer’s signature ............................................................................. Amount Received Day Month Year Rs. Bank’s Stamp 25 JEWELLERS Minimum threshold of Rs. 5 million is applicable. Income Tax Bar Association Karachi Jewelers, other than zarqar, are required to pay sales tax on services only i.e. Sale Price minus cost of gold or silver. Value addition on account of services should not be less than 10%. Zarqar is a person who is engaged in the making process only and not in the sale of jewelry. No adjustment of input tax is allowed. Workshop on Sales Tax Sales tax invoice, in case of jewelers, has also been prescribed. The following records are prescribed to be maintained by a jeweler. Register of goods dispatched / sold Sales tax invoices Pearl Continental 21-22 July 2005 Utility bills, rent receipts, wage payment records and proof of all other business expenditures Monthly returns Purchase invoices / memos etc. 26 JEWELLERS (Contd…) GOVERNMENT OF PAKISTAN Annex-B [See rule- 27(2)] Sales Tax Return - cum - Payment Challan FOR JEWELLERS Note: In case of revised return,insert date of initial return. Regular Revised -- Pl. tick the relevant box -- Please see the instructions on the reverse before you fill this return Income Tax Bar Association Karachi (01) Sales Tax Registration No. (02) N.T.N # (03) Name of Jeweller (05) (04) Tax period Sales VALUE (Excluding Sales Tax) (a) Total value of Supplies Rs. (b) Total value of exempt Gold / Silver Total taxable value ( 5a - 5b ) and tax Rs. (c) (06) Purchases (b) Taxable Purchases Workshop on Sales Tax Purchases Rate Rs. 15% Rate VALUE (Excluding Sales Tax) (a) Taxable Imports Exempt (c) imports / Total Rs. 15% Rs. 15% Rs. 0% Rs. (10) Net amount payable (including, arrears, default surcharge and penalties) (08) Penalty for late filing TOTAL SALES TAX PAYABLE [ 5c+7+8 ] SALES TAX DUE (Output Tax) Rs. SALES TAX PAID (Input Tax) Rs. Rs. Head of Account 0220000 Sales Tax Rs. Refund claimed Declaration Year Rs. (07) Arrears/default surcharge / recoveries Rs. pointed out by audit (09) -Month I declare that the entries in this return are true and correct. Signature Name Stamp N.I.C # -- -Date Designation Pearl Continental 21-22 July 2005 For Bank use Serial No.......................................... Amount in words.................................................................. ............................................................................................. Bank Officer’s signature ............................................................................. Amount Received Day Month Year Rs. Bank’s Stamp 27 ELECTRIC POWER COMPANIES Income Tax Bar Association Karachi Value of supply shall be the amount received by the company (IPP, HUBCO, KAPCO) on account of Energy Purchase Price only. Value of supply for KESC, WAPDA etc., shall be price of electric power including charges, surcharges, late payment Workshop on Sales Tax surcharges, rents, commissions, duties taxes etc.. WAPDA and KESC shall deposit tax on collection basis. WAPDA and KESC shall adjust input tax paid relating to purchases of previous tax period. Pearl Continental 21-22 July 2005 Others will follow the normal course. 28 ELECTRIC POWER COMPANIES Income Tax Bar Association Karachi (Contd…) The registered consumer shall be entitled to claim input tax paid on electricity, evidenced by the electricity bill, which should contain registration number and business address of the consumer. WAPDA and KESC are required to submit returns by 21st of Workshop on Sales Tax the following month. IPPs shall file returns by 25th of the following month Other persons engaged in supply of electric power shall file returns by 15th of the following month Pearl Continental 21-22 July 2005 There are no specific requirements with respect to book keeping. 29 NATURAL GAS COMPANIES The rule also applies to persons involved in the supply of CNG and LPG. Income Tax Bar Association Karachi The return shall be filed by 15th of the following month except in case of companies supplying directly to consumers charging bill on monthly basis, the return shall be filed by 15th of the second following month. The sales tax is chargeable at open market price even if supplied free of charge. Workshop on Sales Tax No specific conditions with respect to input tax adjustments in the hand of Gas Companies. The consumer can adjust input tax on payment basis, irrespective of the tax period. The bill should contain registration number and business address of the consumer in order to constitute a valid invoice. No specific conditions with respect to record keeping. Pearl Continental 21-22 July 2005 Gas transmission and distribution companies are not required to maintain records of daily stocks and sales. 30 SUPPLY OF SUGAR TO TRADING CORPORATION OF PAKISTAN (TCP) Income Tax Bar Association Karachi TCP will pay only value of sugar to the mills at the time of successful grant of tender. The mill will issue a sales tax invoice at the time of actual delivery. At this time, TCP will pay the amount of Sales Tax to the mill. Workshop on Sales Tax In case of delivery for export, mill will issue zero-rated tax invoices. The mill will disclose its activities in the month of issuing invoices. Pearl Continental 21-22 July 2005 This rule deviates from basic principles of charging sales tax, tax period and filing of return. 31 SUPPLY OF FOOD This rule applies to: Income Tax Bar Association Karachi Workshop on Sales Tax Every person or establishment supplying food, drinks and other eatables to canteens, messes or to any organization, institution or person. Clubs, caterer, hotel or restaurants (other than those located in hotels), etc.. The rate of tax is 15% (tax fraction). Minimum threshold of Rs. 5 million is applicable. Due date for filing return is 15th of the next month. Pearl Continental 21-22 July 2005 In case of clubs charging bill on monthly basis, due date of filing returns is 15th of the second following month. 32 SUPPLY OF FOOD Income Tax Bar Association Karachi (Contd…) No specific conditions with respect to input tax adjustment. All prescribed records shall be maintained with addition of menu card showing prices of cash item or combination of food. Workshop on Sales Tax The price as per menu card shall be inclusive of sales tax. Use of Fiscal Electronic Cash Register or issuance of computerized invoices also allowed. Pearl Continental 21-22 July 2005 Daily gross take should be recorded and maintained. 33 SUPPLY OF FOOD (Contd…) ANNEX-A [See rule 53(3)] Income Tax Bar Association Karachi SALES TAX INVOICE (BILL) Sales Tax Registration No._______________ M/s. ————————————————————————————————— (NAME & ADDRESS OF SUPPLIER OF FOOD) Workshop on Sales Tax Book No.________________ Invoice No. ______________________ Table/Room No.__________ Date__________ Time _________ PARTICULARS OF FOOD SUPPLIED/SOLD S. No. Item Quantity Rate (Rs.) Amount charged (Rs.) TOTAL : Pearl Continental 21-22 July 2005 (NB: This invoice / bill includes amount of sales tax). Signature of Authorised Person 34 TAXABLE SERVICES Income Tax Bar Association Karachi This rule applies to advertisers, courier companies, custom house agents, hotels, ship-chandlers and stevedores. No minimum threshold with respect to turnover is available. Sales tax @ 15% is leviable. Workshop on Sales Tax Due date of filing return is 15th of the following month. No specific conditions with respect to input tax adjustment. No specific requirement with respect to maintenance of records. Pearl Continental 21-22 July 2005 Records are record should be retained for a period of 5 years. 35 SPECIFIC PROVISION Income Tax Bar Association Karachi Workshop on Sales Tax Value of supply for custom-house agent shall be the amount received for providing services only. It shall be exclusive of any amount received on account of transportation, demurrage, wharfage, duties, excise, etc., which the agent pays on behalf of his clients. Minimum values of various services offered by custom house agents are prescribed ranging from Rs. 500 to Rs. 2000. Sales tax numbers and licenses number should be quoted on Goods Declaration. Photocopy of last month’s return should also be appended with Goods Declaration. Pearl Continental 21-22 July 2005 Sales tax charged by the agent is adjustable as input tax in the hand of the client. 36 SHIP-CHANDLERS Income Tax Bar Association Karachi Value of supply shall be the amount received on account of services provided only. It shall be exclusive of any amount received as reimbursement of payments made on behalf of the client. Workshop on Sales Tax Pearl Continental 21-22 July 2005 37 STEEL MELTERS AND RE-ROLLERS Income Tax Bar Association Karachi Sales Tax @ 15% is leviable. Production of steel melter shall be calculated at the rate of one metric ton ignotes or billets per 800 units of electricity consumed. Workshop on Sales Tax Minimum value addition shall be Rs. 3200 per metric ton where the sales tax invoice of local scrap is not available. Minimum value addition shall be Rs. 2200 per metric ton where the sales tax invoices or GD (for imported) scrap is available. Adjustment of input tax u/s 7 is allowed. Pearl Continental 21-22 July 2005 38 STEEL MELTERS AND RE-ROLLERS (Contd…) In case of combination of scrap (i.e. imported, with invoice Income Tax Bar Association Karachi and without invoice) the liability shall be determined proportionately. Production of steel re-roller shall be calculated at the rate of one metric ton MS product per 130 units of electricity consumed. Workshop on Sales Tax Minimum value addition in case of re-rollers shall be Rs. 535 per metric ton. No specific requirements with respect to maintenance of records or filing of return. Pearl Continental 21-22 July 2005 Detail of production in prescribed format is required to be submitted alongwith the return. 39