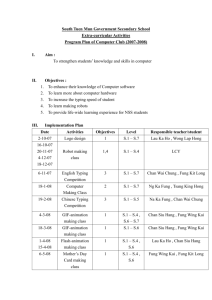

PowerPoint 簡報

advertisement

SCM and Network Orchestration The Li & Fung Experience Chang Ka Mun Managing Director Li & Fung Development (China) Limited Li & Fung Research Centre 9 November 2010 APEC e-Trade and Supply Chain Management Training Course Li & Fung Group • Founded in Canton (now Guangzhou) in 1906 • Global multinational headquartered in Hong Kong • World’s leading supply chain manager in the consumer goods market • 2009 Total Revenue: US$16 billion • Staff Population: 35,000 • Geographic Spread: Across 40 economies worldwide Li & Fung Group • Ranked number 888 in Forbes’ “The World’s 2,000 Largest Public Companies” in April 2009 • One of Hong Kong’s top 10 companies in the Wall Street Journal Asia’s “Asia’s 200 Most-Admired companies” in September 2009 and one of the top 40 companies in BusinessWeek’s “The World’s Best Companies” in October 2009 • Financial Times’ “FT Global 500” in September 2009 and Forbes Asia’s “Fabulous 50” from 2007 to 2009 • Dr. Victor Fung & Dr. William Fung have been inaugurated to the World Retail Hall of Fame by World Retail Congress in 2009 Our Chairman & Group Managing Director Victor K. Fung William K. Fung Group Chairman Group Managing Director Group Structure Li & Fung (1937) Ltd. A privately held entity and controlling shareholder of the Li & Fung Group EXPORT SOURCING DISTRIBUTION RETAILING The Group’s export trading arm is The Group’s distribution Li & Fung Limited – one of the businesses are housed under the largest global supply chain integrated Distribution Services The Group’s retailing businesses include the publicly listed Convenience Retail Asia Ltd, the Trinity Group and privately held Toys “R” Us, with store networks extending from the China markets to Singapore, Malaysia, Thailand, Indonesia, south Korea and the Philippines management companies that manages the supply chain of highvolume, time-sensitive consumer goods through its office network in more than 40 economics Listed on HKSE Group which provides its customers with a menu of integrated Distribution Services in three core businesses across Asia: Manufacturing, Logistics and Distribution Listed on HKSE Listed on HKSE Privately Held entity Li & Fung Trading Li & Fung Trading • 100 years of trading history since 1906 • Export trading arm handles the supply chain of high volume, timesensitive consumer goods through its worldwide office network • Around 14,000 staff • Orchestrates nearly 15,000 international suppliers in over 40 economies to service approximately 2,000 customers • Member of Hang Seng Index, MSCI Index and FTSE4Good Index • 2009 Revenue: US$13.4 billion Li & Fung Trading • Li & Fung specializes in orchestrating a highly-customized path through the supply chain in order to deliver high-quality, low-cost products to its customers reliably and quickly. Suppliers Manufacturers Distribution Global Network East Asia : 24 Beihai Beijing Chengdu Dalian Guangzhou Hangzhou Liuyang Longhua Nanjing Ningbo Qingdao Seoul Shantou Shenzhen Xiamen Zhanjiang Europe & The Mediterranean : 29 Bucharest Cairo Casablanca Denizli Istanbul Izmir Kahramanmaras Keighley Lucca Milan Moscow Oporto Sofia St.Albans Trowbridge Vilnius The Americas : 8 Guatemala City Managua Santo Domingo Marketing Offices Amersfoort Amsterdam Bremerhaven Druillat Hamburg Huddersfield Paris St.Gallen Warsaw Marketing Offices Gaffney Mexico City New York City San Francisco San Pedro Sula South Africa : 3 Antananarivo Durban Moka Barcelona Dusseldorf London Vienna Changsha Dongguan Hong Kong Macau Panyu Shanghai Taipei Marketing Offices Tokyo South Asia Amman Chennai Delhi Faisalabad Lahore Sharjah : 12 Bangalore Colombo Dhaka Karachi Mumbai Tirupur Over 80 offices in over 40 economies with about 14,000 employees and a sourcing network of nearly 15,000 international suppliers Southeast Asia : 9 Bangkok Hanoi Ho Chi Minh City Jakarta Johor Makati Phnom Penh Saipan Singapore Global and Diversified Customer Base North America Customers European Customers Others Approximately 2,000 customers in major developed markets Li & Fung Retailing Li & Fung Retailing • Focused on convenience retailing, toy retailing, international designer brands and lifestyle brands • Around 13,000 staff • 2009 Revenue: US$0.8 billion • Over 1,000 retailing outlets in Greater China, SE Asia and South Korea Li & Fung Retailing Li & Fung Retailing 114 Stores Li & Fung Retailing Outlets (as of 31 Dec 2009) Total : Over 493 Stores 398 Stores 1,000 outlets Li & Fung Retailing South Korea 28 Stores Mainland China 379 Stores Taiwan 60 Stores Hong Kong and Macau 457 Stores (as of 31 Dec 2009) The Philippines Thailand 36 Stores 14 Stores Malaysia 21 Stores Li & Fung Retailing Outlets Singapore 10 Stores Total : Over 1,000 outlets • Established in 1986 as a joint-venture with Toys “R” Us, USA • In May 2002, Li & Fung Retailing acquired 100% ownership as a licensee of Toys “R” Us International • Operates over 114 outlets across the region in Mainland China, in Hong Kong, Macau, Taiwan, Singapore, Malaysia, Thailand and the Philippines • Established the Circle K Convenience Store chain in Hong Kong in 1985 • Listed on the Hong Kong Stock Exchange in January 2001 • Over 392 company owned and managed stores in Hong Kong, Macau, Guangzhou, Zhuhai and Shenzhen • The Saint Honore Cake shop in Hong Kong was established in 1973 • Acquired by Convenience Retail Asia, the holding company of Circle K in February 2007 • 101 company owned and managed stores Trinity Group • Established in Hong Kong in 1971 as an apparel export manufacturer • On 29 April 2006, Li & Fung (1937) Limited, with funds managed by LF Asia Investments Limited, acquired 100% of the Trinity Group of companies from the owner operators • Currently one of the largest high-end menswear retailers in the Greater China region • A fully integrated business model with in-house capabilities for product design, buying, sourcing, assembly and finishing plus a wholly controlled retail network • Operates a portfolio of 7 menswear brands through over 390 monobrand outlets in major high-end malls and department stores • Successfully listed on the main board of the Hong Kong Stock Exchange in November 2009 Trinity Group Trinity has full control over the value chain, from design and sourcing, to sales and marketing allowing it to swiftly respond to changes in customer needs whilst maintaining the highest standards of quality Strong Customer Service Self-Managed Retail network 7 1 In-House Design 6 2 Fabric Sourcing 3 5 4 Marketing and Pricing Critical Assembly / Finishing Outsourced Manufacturing Trinity Portfolio Trinity Group Trinity Group Li & Fung Retailing Chinese Mainland 278 Cerruti 1881/ Blue 69 South Korea Kent & Curwen 78 Ferragamo Durban 47 Gieves & Hawkes 64 Taiwan 44 Intermezzo 15Hong Kong and Macau 38 5 Kent & Curwen 13 Durban 12 Cerruti 1881 12 10 10 Altea 28 28 Intermezzo 2 Gieves & Hawkes Durban 7 Kent & Curwen Cerruti 1881 8 Gieves & Hawkes 6 3 Altea 2 Ferragamo 3 Thailand Malaysia 3 Ferragamo 3 Singapore 4 Ferragamo 4 398 Stores IDS IDS stands for .... Integrated Distribution Services • Provides a menu of Integrated-Distribution Services in three core businesses across Asia: Marketing, Logistics and Manufacturing • 2009 Revenue: US$1.8 billion • Around 8,000 staff Marketing • • • • Provide comprehensive distribution services specializing in Consumer and Healthcare products National coverage of over 150 cities Distribution coverage reached 15,000 retail points (Abbott’s distribution is over 11,000) Operating in 6 regions supported by 18 branch offices and over 500 staff across China Logistics • Logistics services managed by IDS Logistics (23 facilities, 1100 staff, 1.6M ft² of warehouse space in China) • Investment on technology to support operation & provide information visibility Our Business Network Distribution Manufacturing 2,500 staff Asian-wide distribution network for FMCG and Healthcare products covering modern trade and traditional trade, hospitals & clinics Asian wholesaling of apparel & accessories UK 1,200 staff, 4 centers of excellence Home & personal care, health & beauty, food & beverage, and pharmaceuticals with growing export volume Diverse production lines with full GMP & ISO compliance – TetraPak, Hot PET, aerosol, jars, tubes, sachets etc Logistics International 4,000 staff 100 DCs & depots covering over 10m sq ft with deep & extensive logistics network in ASEAN, Greater China, USA & UK Transportation Management Services Regional and global SCM services with hubbing and end-toend logistics capabilities Freight Forwarding services to facilitate International Trade Offices in HK, SG, US & UK China Pakistan Bangladesh Thailand Malaysia US Taiwan Hong Kong Cambodia Philippines Brunei Singapore Indonesia Our Business Partners 400 local, regional and global brands partner with IDS, throughout Asia and across our core businesses I. Basic concepts 1. Supply Chain Management Supply Chain A supply chain encompasses all activities from obtaining the raw materials, through production, wholesale, retail, warehousing and transportation, to the delivery of the final goods or services to the end-customers. “Four Flows” (1) Work flow (2) Physical flow (3) Information flow (4) Funds flow Supply Chain Management (SCM) Supply chain optimization Deliver the right product at the lowest price, in the shortest time, and in the right place to the end user Advantage:Overall cost reduction with maximum efficiency Orchestrator of the Supply Chain Li & Fung (Trading) Supply Chain Management Supply Chain Financing Supply Chain Consumer Needs Financing Raw Material Mills Financing Factories Financing Shipping / Airlines Product Design Product Development Optimize the Supply Chain Factory & Raw Material Sourcing Manufacturing Control Importers, Wholesalers Forwarder Consolidation Retailers Customs Clearance Consumers Local Forwarding Consolidation Distribution Services Inventory Management Principles of SCM Globalization effect: Competition is no longer between companies but between companies’ supply chains Definition of SCM is yet being compromised 5 fundamental principles are identified 5 Principles of SCM (1) Be customer-centric and respond accordingly to the market demand Distribution/ retail Manufacturers Sell Sell Inventory Consumers Inventory Supplier-centric/ the “Push” model Demand Manufacturers Distribution/ retail Demand Quick response, zero-inventory Customer-centric/ the “Pull” model Consumers 5 Principles of SCM (2) Focus on one’s core competency and outsource non-core activities, and develop a positioning in the supply chain High M&A Outsourcing Selfestablished Can consider outsourcing Low The uniqueness of the capability Develop with outside consultant Low High The enterprise’s capability 5 Principles of SCM (3) In contrast to the traditional adversial relationship, modern SCM emphases a close, risk- and profit-sharing relationship with business partners A collaborative environment that is flexible and adaptable to the changing customer needs Working with critical entities along the supply chain as a team to eliminate non value-added processes, and leveraging the capabilities of each team member to maximize value. Avoid wasting time in matching the right partners, improve product quality, shorten production lead-time and lower costs. 5 Principles of SCM (4) Adopt IT to optimize the operation of the supply chain Facilitating information sharing, reducing lead times, increasing accuracy in planning and enabling business partners to engage in instantaneous worldwide communication, analysis of complex decision rules, and real-time visibility in most business processes. “Business drives IT” not “IT drives business” 5 Principles of SCM (5) Design, implement, evaluate and adjust the work flow, physical flow, information flow and fund flow in the supply chain Shorten product lead time and delivery cycles Lower costs in sourcing, warehousing and transportation 2. Network orchestration and supply chains Networks and supply chains Three roles of Network Orchestration (1) Design and manage networks The best supply chain is drawn from a robust universe of suppliers The orchestrator creates, develops, and expands the network, and then draw supply chain from it Three roles of Network Orchestration (2) Control through empowerment In contrast to rigid control system, a combination of empowerment, training and certification is adopted to manage a network Actors along the supply chains can act entrepreneurially Three roles of Network Orchestration (3) Create value through integration Identify new opportunities by leveraging the competence of actors across the network 3. Process orchestration — Dispersed and virtual manufacturing Process orchestration It is more than sourcing products or components It involves: (1) Breaking up the processes/ stages of the supply chain (2) Farming them out to different companies in different locations (3) Managing these dispersed processes It requires designing the entire supply chain, drawing players from the networks, optimizing and managing the whole process Dispersed Manufacturing / Borderless Manufacturing Lining Taiwan Assembly Chinese Mainland Made BY Hong Kong Label, elastic, studs, toggle and string Hong Kong Design USA Shell Korea Filler Chinese Mainland Zipper Japan Performing ‘production slicing’ to identify the best location/ country to undertake each stage of process, adding value along the way & integrating the entire supply chain Virtual Manufacturing Benefits from owning 12,000+ “smokeless factories” without investing huge sums of money to acquire the production and associated logistics facilities Leverages the assets of our partners and mobilizes them to reach our growth initiatives, instead of owning them Reduces the risks associated with the burden of asset ownership Enjoys high degree of flexibility More responsive to potential market shifts and technological changes 4. The 10 flatteners – Competing in a flat world The 10 flatteners End of the Cold War Computer technology development – personal computer and internet Available resources on the Net – Free tools and workflow software – Search for free information Changing ways of production – Offshoring – Outsourcing – Insourcing – Supply Chain II. Competing in a flat world— The Li & Fung Story 1. Take a holistic view of the supply chain Compete network against network Don’t optimize just one section of the supply chain Cases: – Overtime payment and airfreight are expensive, but they can boost efficiency and thus avoid a huge markdown cost – Improve forecasts by delaying ordering and sourcing decision to avoid markdown – Baby Talk Doll– accessing best in class capabilities – 9/11 and SARS– building resilience – 2 million Christmas trees– boosting speed 2. Orchestrate & discover value along the supply chain Product Sourcing Logistics Wholesale Information Management Design Retail $1 $4 The cost that is spread throughout the distribution channels – the “Soft $3” 2. Orchestrate & discover value along the supply chain The Evolution of SCM Consumer Needs Product Design Product Development Raw Material Sourcing Consumer Li & Fung’s Supply Chain Wholesaler Factory Sourcing Local Forwarding Consolidation Customs Clearance Forwarder Consolidation Shipping Consolidation Manufacturing Control 2. Orchestrate & discover value along the supply chain Capture the “Soft $3” by looking beyond the factory For example: – – – – Boosting efficiency: containers and flawless execution Improving coordination: minimizing markdowns Onshore business of the Trading Group Selling to the source: synergy of companies within the Li & Fung Group 3. Redesigning the whole chain for optimization Process mapping to enhance efficiency Formation of middle office Cases: IDS Postponement Strategy For Diageo Improve Diageo’s Asia-Pacific supply chain through a “Postponement” strategy at IDS bonded ASRS facility • Final market specific labeling & packaging on bespoke, high-speed, semi-automated production lines • Throughput of 3.5 million cases in Year 1 increasing to 6 million in Year 2 initially servicing 11 countries in Asia • Lead time to market cut from 10 weeks to 2 weeks • Regional markets can now also arrange for special promotions/packing for other than main line brands • Increase market sales with reduction in overall stock position Regional Hubbing & SCM For Timberland Europe / USA Korea Japan China Asia Pacific Hub - HK Taiwan Hong Kong India Thailand MalaysiaOrders Singapore Indonesia Australia / NZ Reduced Inventory by over 30% and warehousing costs by over 20% Shortened order leadtime and improved responsiveness & fulfillment More efficient supply chain, leading to improved profitability Visibility of inventory and orders tracking leading to better control and decision making China Offshore DC For Pacific Brands Offshore DC Domestic cross-dock depot Moving distribution centre operations to China reduce inventory holding, and warehousing & transportation costs Pick and pack operations in China, cross-dock in Australia for direct delivery to retailers Estimated pilot program cost savings from warehousing, transportation and inventory reduction estimated US$1.5M p.a. Increased sales due to more efficient and responsive supply chain 4. Organization & management – control & empowerment (1) Take responsibility for the whole chain (whether you own it or not) Addressing the root cause: control without ownership Creating a code of conduct Monitoring rigorously Anticipating Ensuring accountability Creating the context 4. Organization & management – control & empowerment (2) Building the company around the customer Customers evoking supply chains – Build network around the potential needs of future customers – Evoke a specific supply chain from this network based on the needs of specific customers Cosourcing with customers Understanding and anticipating customers – Increasing customization – Engaging in Co-Development The need for thick connections – a combination of human relationships, business processes, and technology 4. Organization & management – control & empowerment (3) Think like a big company, act like a small one Nimble Organization Design a. Customer-Centric Divisions Designed around customers Creates a customized value chain for each of the customer’s orders Encourages Entrepreneurship – Little John Wayne Optimizes the supply chain by better fulfilling customers’ needs, maximizing performance & maintaining high quality level 4. Organization & management – control & empowerment b. Operation Support Group (OSG) Centralizes and maintains tight control over the financial control & operating procedures Set up an OSG to serve as the back-office hub administering 3 functions: IT, finance & human resources Marries the strengths of being both small and big at the same time: being flexible and responsive, and having rich & powerful resources 4. Organization & management – control & empowerment (4) Manage a loosely coupled network A network of 12,000+ active suppliers 80 offices in 40 countries Europe/Mediterranean (12 Locations) East Asia (24 Locations) South Asia (10 Locations) Americas (5 Locations) Southeast Asia (9 Locations) Africa (3 Locations) 4. Organization & management – control & empowerment (4) Manage a loosely coupled network Follow the 30/70 rule to create loose-tight organizations Becomes the orchestrator of the entire production process Share responsibilities with suppliers 5. Asset light model One of the best embodiments: – Virtual Manufacturing Maintains minimal financial leverage. Almost no debt on the balance sheet Minimum fixed assets: Sales and lease back office buildings and warehouses Li & Fung continues to deliver a return on equity of more than 20% Employee productivity: close to US$1 million in sales per employee 6. Business drives IT 1995 – Intranet 1997 – Extranet Li & Fung has established sophisticated & Internet-based systems to link up all its business partners, including customers, producers, distributors, logistics service providers, etc. Lead time is reduced from 3 months to 5 weeks 7. Three-year plan Trade off between “salability” and “responsiveness” 3 years – stable and can be measured After 3 years – zero-based The power of stretch A new organization every three years 8. Use of acquisitions Creating a plug-and-play enterprise This requires the appropriate technology and the modular structure This approach has led to a very high retention rates of managers after acquisition and best practices of acquisitions are absorbed to improve the overall business Acquire new talents and new capabilities – product range, technology, customers “100-Days Acquisition” 50+ acquisitions since 1992 with 100% successful rate of integration 9. Corporate Social Responsibility Interest of the stakeholders Vendor compliance Corporate governance Sustainability Thank you!