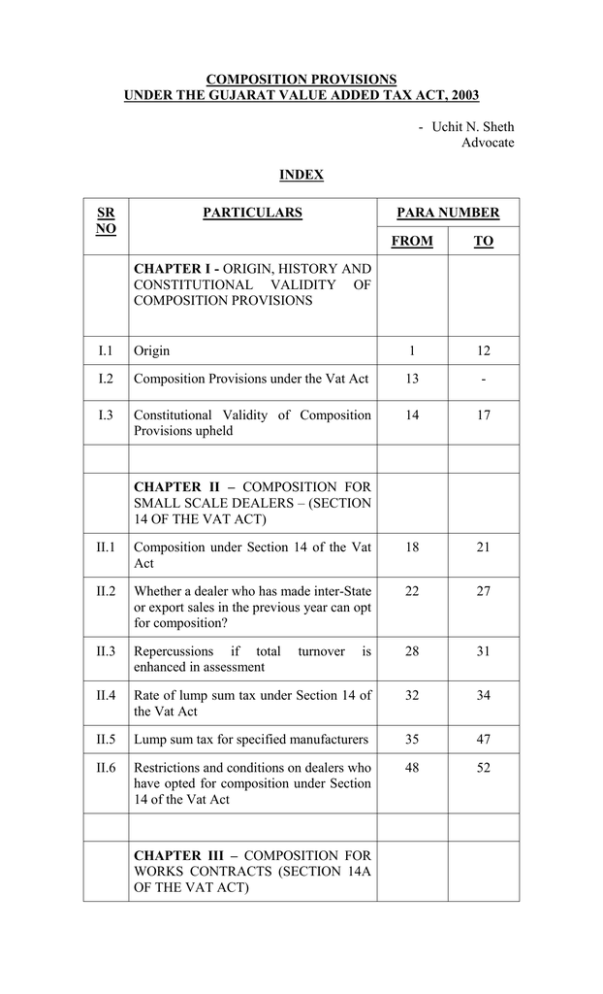

Composition provision under Section 14B of the Vat Act

advertisement