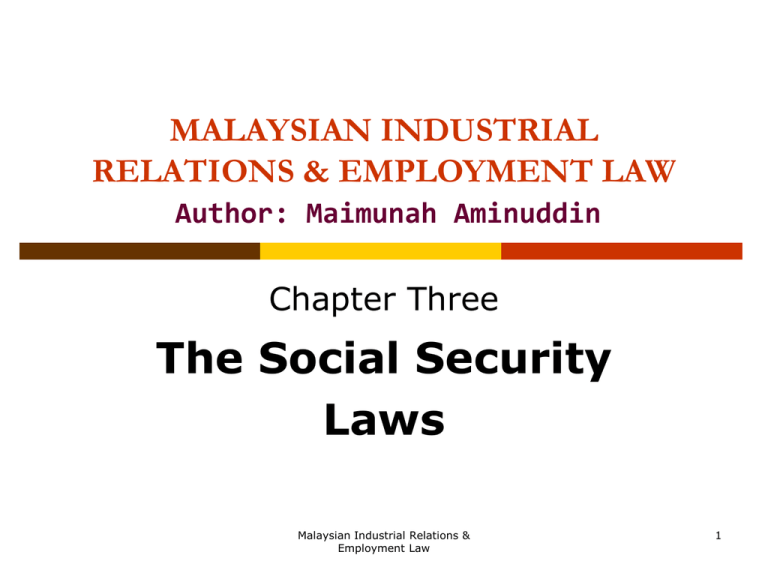

malaysian industrial relations and employment law

advertisement

MALAYSIAN INDUSTRIAL RELATIONS & EMPLOYMENT LAW Author: Maimunah Aminuddin Chapter Three The Social Security Laws Malaysian Industrial Relations & Employment Law 1 Preview Purpose of social security systems The Employees Provident Fund – social security for old age Contributions required by both employer and employee The Employees Social Security Act – compensation in event of occupational accident or disease Contributions required by both employer and employee Workmens Compensation Act Malaysian Industrial Relations & Employment Law 2 Social security systems Social security systems are designed to reduce financial stress in the event of loss or reduction of income. Social security may protect income when people are faced with: Unemployment Post-retirement Accident or serious illness Child birth Death of income earner Malaysian Industrial Relations & Employment Law 3 Social security for post-retirement Options to ensure elderly have sufficient income after retirement: Voluntary savings & investment State provided pensions Employer provided pensions Joint employer-employee contribution saving schemes Malaysian Industrial Relations & Employment Law 4 The Employees Provident Fund The EPF is a compulsory savings scheme for employees so that they will have sufficient funds in their post-retirement years. Simpanan Hari Tua Anda Malaysian Industrial Relations & Employment Law 5 The Employees Provident Fund, cont. Membership Compulsory for: All Malaysian employees working in private sector Voluntary for: Public sector employees on pension scheme Foreign employees Domestic servants Self-employed persons Malaysian Industrial Relations & Employment Law 6 The Employees Provident Fund, cont. Contributions Employer responsible to contribute 12% of employee’s wages and deduct 11% from employee’s wages and send both contributions to the EPF every month. Malaysian Industrial Relations & Employment Law 7 The Employees Provident Fund, cont. Definition of wages under EPF Act: “All remuneration in money, due to an employee under his contract of service or apprenticeship … and includes any bonus or allowance payable by the employer to the employee … but does not include: Service charge Overtime payment Gratuity or retirement benefit Retrenchment or termination benefit Travelling allowance Malaysian Industrial Relations & Employment Law 8 The Employees Provident Fund, cont. Failure by an employer to remit EPF contributions as required by the law is a serious offence. Offenders are prosecuted and may be punished as follows: The money owing must be paid; The employer may be fined or jailed (RM10,000 and/or 6 months); Assets of employer may be seized; and Directors of company may be prevented from leaving the country until payment made. Malaysian Industrial Relations & Employment Law 9 Employees Social Security Act (SOCSO) Purpose of the Act is to establish an insurance scheme which ensures employees involved in a work-related accident, or who contract a work-related disease receive compensation. Malaysian Industrial Relations & Employment Law 10 Employees Social Security Act (SOCSO), cont. Monthly contributions are made to SOCSO by employers and employees. Scheme is compulsory for Malaysian employees in the private sector, earning up to RM3,000 per month. Once-in, always in! Malaysian Industrial Relations & Employment Law 11 Employees Social Security Act (SOCSO), cont. Definition of wages: “All remuneration payable in money by the employer to the employee, including any payment in respect of leave, holidays, overtime and extra work on holidays but does not include: a) Travelling allowance Malaysian Industrial Relations & Employment Law 12 Employees Social Security Act (SOCSO), cont. b) Annual bonus c) Reimbursement for employment related expenses d) Gratuity paid on retirement or end of contract Malaysian Industrial Relations & Employment Law 13 Workmen’s Compensation Act Employers who employ foreign workers must purchase an insurance policy to provide compensation in case of work-related accident or work-related disease. The insurance policy must be paid for by the employer. Malaysian Industrial Relations & Employment Law 14 Review Purpose of social security systems The Employees Provident Fund – social security for old age Contributions required by both employer and employee The Employees Social Security Act – compensation in event of occupational accident or disease Contributions required by both employer and employee Workmens Compensation Act Malaysian Industrial Relations & Employment Law 15