Provisions, Contingent liabilities & Contingent assets

advertisement

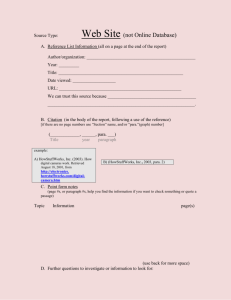

Introduction NZ IAS 37 addresses the recognition, measurement and presentation of: Provisions (excluding those covered by another Standard, e.g. income taxes, leases, employee benefits) Contingent assets and liabilities Restructuring provisions Onerous contracts 2 Provision A provision is a subset of liabilities, defined as a liability of uncertain timing or amount (para 10) A liability is a present obligation arising from a past event that is expected to result in an outflow of economic resources (para 10 & NZ Framework) A present obligation exists only where the entity has no reasonable alternative but to settle the obligation The obligation may be the result of law (e.g. legal contract) or constructive, where there is valid expectation of discharge of responsibilities based on an established pattern of past practice. 3 Distinguishing provisions from other liabilities Typical provisions are for warranties, restoration, restructuring or onerous contracts. Accrued liabilities are not provisions. (para 11) Provisions are disclosed in the financial statements 4 Contingent liabilities Contingent liabilities are either a: a) Possible obligation (confirmed by the occurrence, or non-occurrence, of one or more uncertain future events not wholly within the control of the entity) – e.g. a guarantee on a loan for another entity; or b) Present obligation (where it is not probable that an outflow of economic resources will be required to settle the obligation; or the amount cannot be measured reliably) - e.g. a law suit where the amount of damages is uncertain Contingent liabilities are not recognised in the financial statements (para 27) but must be disclosed in the Notes to the financial statements (para 86) 5 Contingent assets This is a possible asset arising from past events whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the entity (para 10) e.g. a legal claim where the outcome is uncertain Contingent assets are not recognised in the financial statements (para 31) but are disclosed in a Note if an inflow of economic benefits is probable (para 89) 6 Recognition criteria - Provisions All three following criteria must be met for a provision to be recognised: An entity has a present obligation (legal or constructive) as a result of a past event; and It is probable (i.e. more likely than not) that an outflow of resources will be required to settle that obligation; and A reliable estimate can be made of the amount of the obligation (para 14) If all these criteria are not met the provision cannot be recognised (para 14) See the decision tree – Figure 5.2 p. 144 7 Measurement of provisions “Best estimate” of provision amount recognised. This requires professional judgements and is calculated using ‘expected value’ estimation and measured before tax Estimates should be discounted to present value where material Due to the uncertainty involved, caution is required to avoid overstatement 8 Measurement cont’d Should account for expected cash outflows only, disregarding any expected cash inflows Reimbursements must be virtually certain (not just probable) to be recognised (para 53) Must review provisions at each balance sheet date (para 59) 9 Example ABC sells goods with a 3 year warranty. Warranty provisions are calculated as a percentage of annual sales based on historical data and are discounted to present value using the government bond rate Relevant data is as follows: End of year 1 % of sales to be incurred as warranty expenses Discount rate 2% 6.0% 2 3% 6.5% 3 5% 6.9% 10 If total sales for the year ended 31 March 2013 were $2 million, calculate the total provisions for warranties that should be set aside in relation to 31 March 2013 financial year sales. End of year 1 Expected cash outflow Discount PV of cash factor outflow 1.06-1 37,736 2% x $2 mill = $40,000 2 3% x $2 mill = $60,000 1.065-2 52,900 3 5% x $2 mill = $100,000 1.069-3 81,859 Total PV of Future Cash Outflows 172,495 11 Recognition & Measurement Rules Potential future operating losses must not be recognised as provisions (para 63) If an entity has a contract that is onerous the present obligation under the contract is recognised as a provision (para 66) An onerous contract implies that the unavoidable cost of meeting contract is more than anticipated benefits e.g. a manufacturer has entered into a contract for the supply of goods at a price lower than the cost of production 12 Restructuring provisions These can be part of an acquisition of another business, in which case NZ IFRS 3 covers this All other restructurings are covered in NZ IAS 37 and are the most controversial aspect of the Standard Necessary conditions: Have a present obligation to restructure Costs must be directly and necessarily caused by the restructuring A binding sale agreement is needed for the sale to be deemed an obligation. 13 Examples Restructuring provisions: Sale or termination of a line of business Closure of business locations in a country/region or relocation of business activities from one region to another Changes in management structure Reorganisations that have a material effect on the nature and focus of the entity’s operations (para 70) 14 Present obligation Present obligation is considered to arise when the entity has a detailed plan identifying at least: The business (or part thereof) concerned The locations affected The employees affected The expenditures that will be undertaken The timing of implementation 15 Restructuring - qualifying costs Only direct expenditure arising from the restructuring can be included (para 80) Costs must be a necessary part of the restructure and not associated with the ongoing activities of the entity (para 80) Examples – costs of terminating leases and other contracts; costs associated with employees dismantling plant etc.; employee redundancy costs Costs excluded are retraining or relocating continuing staff; marketing or investment in new systems and distribution networks (para 81) 16 Disclosure for provisions Involves estimation and judgement Disclosure required of: Carrying amount at beginning and end of period Any additional provisions made in period Amounts used (incurred and charged) Unused amounts reversed in period Increase during period in discounted amount arising from passage of time and the effect of any change in the discount rate (para 84) 17 Disclosure cont’d… Additionally a description of the nature of the obligation, timing, uncertainties and any expected reimbursement must be disclosed (para 85) Contingent Liabilities Contingent liabilities note is considered one of the most important provided by a company 18