Managerial Accounting: An Introduction To Concepts, Methods, And

advertisement

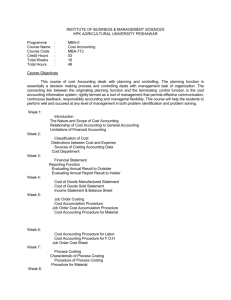

Managerial Accounting: An Introduction To Concepts, Methods, And Uses Chapter 2 Measuring Product Costs Maher, Stickney and Weil Learning Objectives (Slide 1 of 3) Understand the nature of manufacturing costs. Explain the need for recording costs by department and assigning costs to products. Understand how the Work-in-Process account both describes the transformation of inputs into outputs in a company and accounts for the costs incurred in the process. C2 - 2 Learning Objectives (Slide 2 of 3) Compare and contrast normal costing and actual costing. Know various production methods and the different accounting systems each requires. Compare and contrast job costing and process costing systems. Compare and contrast product costing in service organizations to that in manufacturing companies. C2 - 3 Learning Objectives (Slide 3 of 3) Understand the concepts of customer costing and profitability analysis. Identify ethical issues in job costing. Recognize components of just-in-time (JIT) production methods and understand how accountants adapt costing systems to them. Know how to compute end-of-period inventory book value using equivalent units of production. C2 - 4 Manufacturing Costs Include three major categories: Direct materials Direct labor Easily traced to a product Labor of workers who transform materials into a finished product Manufacturing Overhead All other costs of transforming materials into a finished product C2 - 5 Relation Between Departmental Costing and Product Costing(Slide 1 of 3) Manufacturing costs are first assigned to departments or responsibility centers A responsibility center is any organizational unit with its own manager e.g., divisions, territories, plants Aids in planning and performance evaluation C2 - 6 Relation Between Departmental Costing and Product Costing(Slide 2 of 3) Direct Materials Direct Labor Manufacturing Overhead Record Costs for Performance Evaluation Assign Costs To Products Assembly Dept. Product A Finishing Dept. Product B C2 - 7 Relation Between Departmental Costing and Product Costing(Slide 3 of 3) Actual manufacturing costs recorded in departments can be compared to standard or budgeted amounts Differences, called variances, can be investigated further Costs are then assigned to products Useful in managerial decision making such as evaluating product profitability C2 - 8 Model of Cost Flows WIP-Dept.1 Beg.Inv. Direct Mat. Direct Labor Overhead End.Inv. Finished Goods Inventory WIP-Dept.2 Transfer to Dept.2 Added MLO in Dept. 2 Cost of Goods Sold Beg. Inv. Costs Allocated to Units Finished This Period Costs of Units Sold This Period End. Inv. Balance Sheet Accounts Income Statement Accounts Mktg. & Admin. C2 - 9 Basis Cost Flow Equation Beginning Balance + Transfers In= Transfers Out + Ending Balance Transfer In to Work-In-Process include: Materials Labor Overhead Equation is useful in determining reasonableness of inventories C2 - 10 Cost Measures (Slide 1 of 2) Normal Costing--commonly used to assign costs to products Assigns actual direct materials and direct labor plus “normal” manufacturing overhead Overhead is applied to units produced using an application rate estimated before the accounting period begins C2 - 11 Cost Measures (Slide 2 of 2) Actual Costing--assigns actual overhead to products Actual overhead may vary for reasons unrelated to production activity resulting in product cost fluctuations unrelated to production activity Normal costing tends to smooth out these fluctuations C2 - 12 Applying Overhead Costs Normal costing works as follows: 1. Select a cost driver 2. Estimate overhead and the level of activity for the accounting period 3. Compute the predetermined manufacturing overhead rate 4. Apply overhead to production by multiplying the predetermined overhead rate times the actual activity C2 - 13 Overhead Rate Computation Predetermined manufacturing overhead rate is calculated as follows: Estimated Manufacturing Overhead Normal (or Estimated) Activity Level = Predetermined Overhead Rate C2 - 14 Example-Overhead Rate Computation Plantimum Builders estimates that next year variable overhead will be $100,000 and direct labor will be 50,000 hours The predetermined overhead rate for next year will be: $100,000 50,000 DLHs = $2.00 Per Direct Labor Hour C2 - 15 Cost Systems Effective cost systems must have the following characteristics: Decision focus Provide different cost information for different purposes Pass the cost-benefit test C2 - 16 Production Methods and Accounting Systems Type Production Accounting System Job Job Costing (e.g., Custom Homes) Type Product Customized Operations (e.g., Cars) Mostly Standardized Operation Costing Continuous Flow Process Costing Processing (e.g., Oil Refinery) Standardized C2 - 17 Job Costing Collect costs for each “unit” produced Typically used by companies producing customized products or “jobs” Examples: print shops, customized construction companies, defense contractors C2 - 18 Process Costing Company accumulates costs in a department or production process Those costs are spread evenly over units produced Essentially, computes an average cost per unit Examples: manufacture of soft drinks, paint, chemicals C2 - 19 Operation Costing A hybrid of job and process costing Typically used when production involves a standardized method of making a product that is performed repeatedly Products may share common production methods but differ in details Examples: Clothing, computers, furniture C2 - 20 Service Organizations Flow of costs is similar to that of a manufacturing company Providing a service requires labor, overhead, and sometimes materials (called supplies) Costs are collected by the job or client Provides info for cost control, performance evaluation, and future pricing decisions C2 - 21 Ethical Issues in Job Costing Improprieties in job costing generally arise from: Misstating stage of completion Charging costs to the wrong job May be an attempt to avoid the appearance of cost overruns Misrepresenting the costs of jobs Causes problems when job is billed on a costplus-fee basis C2 - 22 Just-In-Time (JIT) Methods Attempt to obtain materials or provide finished goods just in time Reduces or eliminates inventories and related carrying costs May allow production costs to be recorded directly to Cost of Goods Sold (COGS) May involve use of “Backflush Costing” Used to transfer costs back to inventories when production costs are initially recorded as COGS C2 - 23 Spoilage and Quality of Production Normal waste is typically included in the cost of work performed If waste is not “normal” it may be included in an expense account called “Abnormal Spoilage” Companies concerned about quality production may not treat any waste or spoilage as normal Prevents these costs from being buried in production costs C2 - 24 Computing Costs of Equivalent Production Five steps required to compute costs of products, ending inventory, and finished goods 1. 2. 3. 4. 5. Summarize flow of physical units Compute equivalent units Summarize costs to be accounted for Compute unit costs Compute cost of goods completed and transferred out and cost of ending inventory of WIP C2 - 25 If you have any comments or suggestions concerning this PowerPoint Presentation for Managerial Accounting, An Introduction To Concepts, Methods, And Uses, please contact: Dr. Donald R. Trippeer, CPA donald.trippeer@colostate-pueblo.edu Colorado State University-Pueblo C2 - 26