Unravel today*s complex route to market

advertisement

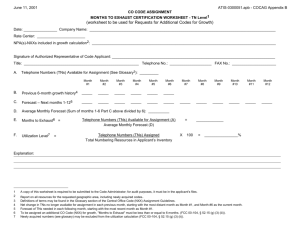

Unravel today’s complex route to market. TAPPS: Developments for 2013 Automotive Unravel today’s complex route to market © TNS Understanding the Chinese car buyer We talked to 1,000 people in China as they made a decision about which car to buy. We gathered the information in real-time to understand how people make decisions and what really is influential at each stage of the purchase journey. Automotive Unravel today’s complex route to market © TNS 2 Consumer buying behaviour has changed The traditional funnel fails to capture today’s complex world… Automotive Unravel today’s complex route to market © TNS 4 Today’s buying process takes place within a multi-faceted path to purchase Automotive Unravel today’s complex route to market © TNS 5 Consumers and brands now co-create the buying process Automotive Unravel today’s complex route to market © TNS 6 Traditional “look back” study designs are no longer adequate Tracking the same people through their buying process is optimum Automotive Unravel today’s complex route to market © TNS 7 A new approach TAPPS What is TAPPS? 4-month online continuous interaction measuring all touch points Provides a micro-level analysis of the path to purchase a Snakes and ladders Automotive Unravel today’s complex route to market © TNS 9 Valuable insights in real time with online data reporting TAPPS’ provides an in-depth understanding of: Actual buying process timeline Role and use of digital and social media Interactions between, and influence of, brand and consumer generated content Key touch points at different stages of the car-buying process Triggers of vehicle consideration, rejection and purchase The changing role(s) of dealers Automotive Unravel today’s complex route to market © TNS 10 TAPPS’ unique insights build into your marketing strategies… Positioning Communications TAPPS Media planning Pricing, promotions & incentives Targeting Automotive Unravel today’s complex route to market © TNS 11 2012 TAPPS A positive first step The operational framework consists of 4 components Months 0 1 2 3 4 1 2 3 4 Screening of the panelists & initial interview Online focus groups & click-stream data for a sub-sample Weekly online ‘touch point’ survey and photo journal Post-purchase interview (as soon as a consumer buys a vehicle) Automotive Unravel today’s complex route to market © TNS 13 Representative sample with wide geographic coverage Sampled from 184 cities in 27 provinces Automotive Unravel today’s complex route to market © TNS 14 Actionable TAPPS insights The benefits of a clear understanding of the buying process have multiple applications Media spend adjustments to reflect the importance of TV and social media CRM use adaptations to identify and activate committed brand owners to act as brand spokespersons in specific social media Brand website content adjustments to better reflect use throughout the buying cycle, not just at the end Communication styles adaptations in those media used extensively by ‘fast decision’ takers, to reflect their decision making style Dealer follow up behavior adaptations to enhance conversion of ‘confused’ shoppers Promotions and Incentives adaptation to reflect the parameters of what’s acceptable for specific brands. Automotive Unravel today’s complex route to market © TNS 15 TAPPS has been further optimized Changes for 2013 The 2013 operational framework again consist of 4 components Months 0 1 2 3 4 1 2 3 4 Screening of the panelists & initial interview Online focus groups & click-stream data for a sub-sample Weekly online ‘touch point’ survey and photo journal Post-purchase interview (as soon as a consumer buys a vehicle) Automotive Unravel today’s complex route to market © TNS 17 Study Background Consistent data collection method over time Year 1 Oct. 2011 – Feb. 2012 Year 2 Oct. 2012 – Feb. 2013 Online Panel Survey Sample from 214 cities in 32 provinces in China Initial n=1607, Diary n=864, Clickstream n=482 121 brands and 460 models available on the market • Aged 18 -50 yrs old; • Live in Tier 1, Tier 2 and Tier 3 cities • Did not participate in auto related survey in the past 3 months • Plan to purchase a vehicle in the next 6 months • Plan to purchase a new vehicle • Is the decision maker or one of the main decision makers for the purchase of the intended vehicle Automotive Unravel today’s complex route to market © TNS 18 Representative of the new car buying public 60% of respondents are first time car buyers Gender Age Family 60 Living in Personal monthly income Note: TAPPS focussed on intending buyers of sub-compact, compact and mid-size vehicles Unit: % N = 1,670 Automotive Unravel today’s complex route to market © TNS 19 Robust sample available for most brands Brands under consideration Sample size Audi 466 BMW 270 Buick 418 Cadillac 63 Chevrolet 351 Citroen 202 Ford 227 Honda 348 Hyundai 390 Mercedes 200 Nissan 212 Peugeot 207 Toyota 347 Volkswagen 745 Only selected brands shown of 78 under consideration by shoppers Automotive Unravel today’s complex route to market © TNS 20 Large sample (1399 of luxury and near luxury brand considerers) Brands under consideration Sample size Audi 466 BMW 270 Bentley 15 Ferrari 22 Infiniti 33 Jaguar 29 Land Rover 71 Lamborghini 14 Lexus 88 Lincoln 12 Lotus 18 Mercedes 200 Porsche 58 Volvo 79 Small samples also exist of Aston Martin, Bugati, Maserati and Maybach considerers Automotive Unravel today’s complex route to market © TNS 21 Number of minutes on the site More detailed analysis on specific sites: eNissan.com.cn is attractive and sticky among shoppers Automotive Unravel today’s complex route to market © TNS 22 New Compare TAPPS results in China with US results How TAPPS helps our customers high Influence-Performance-Matrix of one specific or an overall purchase stage for any desired target group TP 1 Performance TP 2 TP 3 TP 1 TV TP 2 Billboard TP 3 Independent expert in newspaper/magazine TP 4 Friends/relatives TP 5 Visit Car Dealer TP 6 Ad in newspaper TP 7 Radio TP 8 Social Media TP 9 Manufacturer web sites TP 10 Blogs/Forums TP 11 Saw vehicle on the road TP 12 Visit price comparison web sites TP 13 Dealer web sites TP 14 Independent expert opinion online Importance to preference Derived by Hierarchical Bayes Regression SAMPLE ONLY low Performance: Stated performance for touchpoint Importance to brand preference low high Bubble size: Frequency of touchpoint usage Automotive Unravel today’s complex route to market © TNS 25 Allocating resource to the right channels at the right time In the early stage of shopping brand generated content is most influential and is widely used. TV Ads have the most impact. Performance of Touchpoint High Low 1=TV ad Importance of Touchpoint for Preference Score 2=Press as 6=Radio ad 3=Billboard ad 4=Discussed cars with family and friends 7=Discussed on social media 8=Online review 11=Car brand website 12=Car dealer website 5=Vehicle on the road 9=Car-related comments 13=Car dealer High 10=Saw vehicle in public space 14=Car promotional offer Automotive Unravel today’s complex route to market © TNS 26 Identifying the key hubs to influence Although they have limited impact in the final stage of decision making TV Ads and car dealers are crucial hubs. They drive the use of other touch-points that impact brand preference 5% 7% Car brand website 14% 4% Online review Car dealer website 8% Social media 4% Car dealer Promotional offer Brand preference 9% 3% TV ad 17% Billboard ad 4% Family and friends 5% Radio ad 6% Vehicle on the road 14% Press ad Other touchpoints Effects of Touchpoint (1 to 2 weeks ago)… % Significantly positive on usage of different touchpoints Significantly negative on usage of different touchpoints On brand preference (combined effect of contact yes/no and helpfulness) in terms of relative importance Automotive Unravel today’s complex route to market © TNS 27 Managing non-brand generated online content Ensuring good presence and content in multiple forums and blogs is important to impact consumers to buy Brand X Life service: ganji.com 0.2046 Life service: 58.com 0.4038 Mirco blog: t.qq.com 0.3596 Blog: Blog. hexun.com 0.5511 Auto: 51auto.com 0.1658 Auto:Auto .sina.com.cn 0.2786 Blog: Live.com 0.2052 Blog: blog.10 jqka.com.cmn 0.7374 SNS: yy365.com 0.4762 Blog: Blog. Sina.com.cn 0.3653 Auto: Auto home.com.cn 0.5767 Auto: Xcar.com.cn 0.4603 Blog: zhidao. baidu.com 0.6987 Auto: auto.163.com 0.1139 SNS: qzone.qq.com 0.6982 SNS: renren.com 0.6682 Micro blog: weibo.com 0.4552 Forum: tangdou.com 0.5153 Blog: Blog.163.com 0.4533 Auto: Bitauto.com 0.2101 SNS: pengyou.com 0.5946 Forum: taoguba.com.c n 0.1228 Life service: baixing.com 0.5256 Auto: 52che.com 0.1342 Buy Respondents who finally purchase Brand X N=51 Note: The websites marked in Pink are the websites that are only relevant to the PURCHASERS rather than those CONSIDERING the make Automotive Unravel today’s complex route to market © TNS 28 Getting personal Looking through the lens of individual consumers brings the data to life XXXX 40 years old Employed as Secondary level staff in hotel Personal salary: Around 17,000 RMB per month Lives together with his wife and children in Qingdao Education: University Time consumption on internet Morning v 1 Afternoon v Evening v Automotive Unravel today’s complex route to market © TNS 29 Getting personal Looking through the lens of individual consumers brings the data to life Auto Portal Forum of Auto Forum of Auto Forum of Auto Forum of Auto Forum of Auto Start Visit www.autohome.com.cn for first browsing Visit forum of www.autohome.com.cn to collect the information and read other people’s comments for first selection of model/brand Visit the specific channels of “Lavida” and “Excellent” to collect basic information for these two models Compare “Lavida” and “Excellent” in terms of the evaluation from forum of www.autohome.com.cn Browse and investigate the maintenance/repair/technics information for “Buick” on forum of www.autohome.com.cn Study the instruction for taking the delivery in 4S store via forum of auto Automotive Unravel today’s complex route to market © TNS 30 Valuable insights in real time To summarise, TAPPS’ provides an in-depth understanding of: Actual buying process timeline Role and use of digital and social media Interactions between, and influence of, brand and consumer generated content Key touch points at different stages of the car-buying process Triggers of vehicle consideration, rejection and purchase The changing role(s) of dealers Automotive Unravel today’s complex route to market © TNS 31 Andy Turton Andy.turton@tnsglobal.com + 44 (0)203 130 7350 Kelvin Koh Kelvin.koh@tnsglobal.com +86 21 2310 0995 ext. 156 Visit www.tnsglobal.com/automotive Automotive Unravel today’s complex route to market © TNS 32