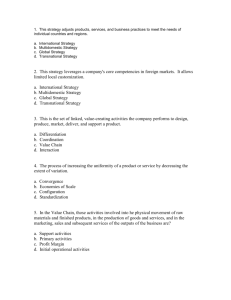

Country Managers

advertisement

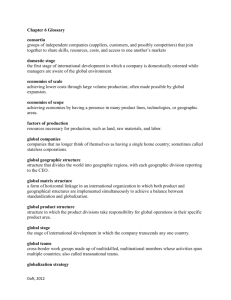

G L O B A L ORGANIZATION D E S I G N Enbe Chen, Luis Chan, Lee Min Quan, Cherylnn Tan (Group3) AGENDA Motivations for Global Expansion Stages of International Development International Strategic Alliance Global Organization Design Challenges Transnational Model Case Study: ABB World’s Largest Auto Market: CHINA Users united states china 0 200 400 600 800 Global Expansion United States Japan China France Germany Britain Switzerland South Korea Netherlands Canada Italy Spain India Taiwan Australia Brasil Russia Mexico Sweden Singapore Number of Companies on the Global 500 List 2006 2008 2011 170 153 133 70 64 68 20 29 61 38 39 35 35 37 34 38 34 30 12 14 15 12 15 14 14 13 12 14 14 11 10 10 10 9 11 9 6 7 8 3 6 8 8 8 8 4 5 7 5 5 7 5 5 3 6 6 3 1 1 2 Source: Based on data from "Global 500," Fortune magazine's annual ranking of the world's largest corporations for 2006, 2008, and 2011. Motivations Economies of Scale Economies of Scope Lost Cost Production Factors Economies of Scale Through large-volume production, companies are able to achieve the lowest possible cost per unit of production. Economies of Scope The number and variety of products and services a company offers as well as the number and variety of regions, countries, and markets it serves. Low Cost Production Factors The opportunity to get raw materials, labor, and other resources at the lowest possible cost. Low Cost Production Factors Lower cost of capital Sources of cheap energy Reduced Government Restrictions Stages of International Development I. Domestic III. Multinational IV. Global The company each Strategicdeals withDomestically Export-oriented, Multinational country individually. oriented Orientation multidomestic Global Stage of Development II. International Initial foreign involvement Competitive position Explosion Global Domestic structure plus Structure Specialist are hired to handle export sales, service, and department warehousing abroad Domestic structure plus international division Worldwide geographic product structure Matrix, transnational structure Very large, multinational Whole world Market Potential Moderate, Large, mostly domestic multidomestic International Strategic Alliance Joint Venture Consortia Joint Venture Separate entity created with two or more active firms sponsors. This is a popular approach to sharing development and production costs and penetrating new markets. Consortia Groups of independent companies that join together to share skills, resources, costs and access to one another’s market. Global Integration Globalization Strategy National Responsiveness Multidomestic Strategy International Division Weakness: Structure can be too complicated when broaden into more countries. Global Product Structure Weaknesses: Strengths: •Eliminates economies of scale •Decentralizes decision makinglines •Poor coordination across product •In-depth technical •Competitions betweenspecialization products Global Geographic Structure Weaknesses: Strengths: •Difficult •Leads totohigher plan on customer a global satisfaction scale •Poor •Decentralizes coordination decision across making different regions Global Matrix Structure Strengths: Weaknesses: •Meet dual demands •Dual authority •Time-consuming •Flexible sharing of resources •Needs more training for interpersonal skills •Power balance •Opportunities for talent development Global Organization Design Challenge Complexity and Differentiation Need for Coordination Transfer of Knowledge and Innovation Increased Complexity and Differentiation Companies have to create a structure to operate in numerous countries that differ in economic development, language, political systems and government regulations, cultural norms & values. And infrastructure such as transportation and communication facilities. Need for Coordination All organizations working globally face the challenge of getting all the pieces working together in the right way at the right time and in the right place. Transfer of Knowledge and Innovation Past From developed countries to less developed countries. Now Trickle-up Innovation or Reverse Innovation Challenges Faced Language Barriers Manager protect the interest of their own division Knowledge and innovation as power “Not-invented-here” syndrome Knowledge is in the mind of employees Global Coordination Mechanisms Global Teams Headquarters Planning Expanded Coordination Roles Global Teams Intercultural Teams Members from different countries and meet face-toface. Virtual Global Teams Members reamin in separate locations and conduct their work electronically. Challenges of Global Team Cultural and language differences “Us-Against-Them” mentality Headquarters Planning Headquarters to take an active role in planning, scheduling. Delegating responsibility and decision making authority in some areas while maintaining strong control through centralised systems. Plans, schedules and formal rules & procedures to ensure greater commnication. Expanded Coordination Roles Functional Managers Responsibility includes coordinating across countries, identifying and linking organization’s expertise and resources worldwide Country Managers/ Business Integrators Coordinate across functions within a country. Coordination on a regional basis. Network Coordinators Coordinate information and activities related to key customer accounts. Benefits of Coordination Cost Savings Better Decision Making Greater Revenues Increased Innovation Cultural Differences Power Distance People’s acceptance of inequality in power among institutions, organizations and people Uncertainty Avoidance People’s tolerance with uncertainty and ambiguity. Centralized Approach USAJapan: : Coordination and Control through • Leverage on knowledge and resources at the corporate centre Formalization •Attain global efficiencies • Delegated responsibility to international •Coordinate across units (avoid turf divisions, battles) yet overall control of enterprise through sophiscated management control system and development of specialist headquarters staff. Europe: Decentralized Approach • High level of independence and decision making Traditional autonomy. China: Approach • each international unit focuses its business local • Traditional familyon like markets •Distinct hierarchy of authority •Strong centralization Transnational Model Global Efficiency Local Responsiveness Global Learning Transnational Model Assets and resources are dispersed worldwide into highly specialized operations that are linked together through interdependent relationships Structure are flexible, and ever changing Subsidiary mangers intiate strategy and innovations that become strategy for the corporation as a while Unification and coordination are achieved primarily through corportate culture, shared cision and values, and management style rather than through formal structures and systems. CASE STUDY: ASEA BROWN BOVERI AGENDA Background Information Company Structure – 4 Management Levels Implications Background Information ABB started with 2 separate companies – Allmanna Svenska Elektriska Aktiebolaget (ASEA) & Brown, Boveri and Cie (BBC) ASEA • US$6.8 billion revenue, employed 71,000 BBC • SEK58 billion revenue, employed 97,000 ASEA + BBC = ABB • • • • • Merged in 1988 Percy Barnevik HQ in Zurich US$17 billion revenue Employed 160,000 ABB in the Present Operations in about 100 countries 145,000 employees * $40 billion revenue for 2011 #186 in Forbes Glocal 2000 *as of June 2012 “ Global and local, big and small, radically decentralized but with central control…” Percy Barnevik, CEO (1988 – 1996) ABB’s Matrix Structure Top Management Group Executive Management • CEO • Deputy CEO • Executive Vice Presidents (EVPs) Scope • • Devise global strategies Review performance Middle Management Business Area Managers • Formulate strategy for allocated business area • Ensure quality and cost standards • Focus on R&D Country Managers • Implement ABB’s global strategy • Formulate HR policies Lower Management Front Line Operating Companies (FLOCs) • • • • Segregated according to business areas Distinct legal entities Minimal top management involvement Heads report to 2 managers Profit Center Level Operations of FLOCs split into profit centers • Achieve tasks allocated by FLOCs • Closest link to customers Implications Economies of Scope Selling ABB products from other regions Quick Response to Market Changes Due to decentralized structure *as of June 2012 Implications Too much to handle at the top Difficulty in monitoring all companies Conflicting interests of middle management Delayed decision making The End Questions?