Draft Business Plan - Amazon Web Services

advertisement

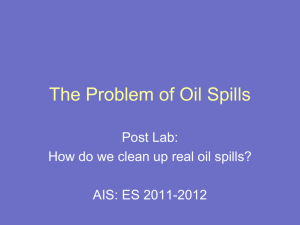

OPCSA presentation to Portfolio Committee on Minerals and Energy Background • • • • • • Minister of Minerals & Energy identified shortcomings in oil pollution control OPCSA was transformed into its present format during October 2002 OPCSA started to operate on 1 April 2003 as a subsidiary of CEF During 2004 the CEF Board expressed its concern regarding the loss that OPCSA was incurring A market survey was conducted to determine the need, if any, for oil pollution response services in SA A strategic planning session, attended by the Board, was held on 28&29 January 2005 to discuss the findings of the survey and determine the way forward Entities Surveyed during Market Survey • • • • • • • • • • • • • National Ports Authority Department of Environmental Affairs and Tourism South African Maritime Safety Authority BP Engen PetroSA Sapref Sasol Shell Smit Marine Total Various Independent Environmentalists Harbour Masters in Saldanha, Cape Town & Durban Key findings of Market Survey • • • • • Marine experts reported that South Africa has a very hazardous coastline The biggest risk for an oil spill appears to be bunker fuel South Africa has no real tier 3 response capability In most instances the tier 2 response capability is also suspect Overseas response is available, but only after more than 36 hours, which is too late Key findings of Market Survey • • • • • OPCSA’s capability is larger than all the other players in South Africa put together OPCSA is the only player that can clean up a spill on the open sea OPCSA is the only organisation that can easily develop a tier 3 capability All respondents lamented the fragmented nature of current oil spill legislation Most respondents were unaware of OPCSA’s capabilities Demand for OPCSA • • • • • Opportunities in other harbours to provide a response service Offshore oil rig protection Bunker fuel spills in most harbours Most of the respondents reported that OPCSA must develop a National response infrastructure Locations where OPCSA should establish response capabilities: • Cape Town • Mossel Bay • Port Elizabeth • Richards Bay • Durban SWOT Analysis - Strengths • • • • • • • • • Largest player in South Africa Existing well maintained equipment and facilities Highly skilled staff Only offshore capability in SA Responsiveness Proximity to market Continuous experience Proven track record Knowledge of coastal and local conditions SWOT Analysis - Weaknesses • • • • • Not sufficient funds No presence in other ports Lack of marketing Concentrated skills basis Transformation/employment equity at senior level SWOT Analysis - Opportunities • • • • • • • OPCSA is well placed to act with full Government authority Big market opportunity if we move fast Alliances with international Oil Pollution Response entities Getting buy-in and involvement of all role players Green donor funding and support Provide DEAT with certificate after event OPCSA sets standards with SABS SWOT Analysis - Threats • • • • Liability Industry apathy/complacency Low risk perceptions “Overseas will provide” myth Vision of OPCSA To be the cost effective State designated oil spill response organisation for large oil spills on land and sea in SA, and to be the service provider of choice for smaller spills and oil pollution measures in Sub Saharan Africa Mission of OPCSA The vision will be achieved through the provision of a cost effective rapid response service in cases of emergency on land and sea, supplemented by the delivery of continuous prevention, consulting and training services of the highest quality, in line with customer requirements. Goals of OPCSA • • • • • • To be the designated oil spill response entity in South Africa To build capacity to deliver on its mandate to re-act cost-effectively to all tier 2 & 3 spills in SA To be self funding in 5 years To become a recognised and esteemed brand in maritime oil spill response To have a 90% share of the oil spill control market in SA To operate on a supplier of choice basis in 2 Sub Saharan African countries in 4 years Where must OPCSA be housed? • • • • • • • DME already has a close relationship with the Oil Industry All the products handled by the Oil Industry will have a negative environmental impact when spilled Oil pollution control is important to the image of DME DME’s relationship can be expanded and strengthened if oil pollution control is included The above will ensure a single point of responsibility on all crude oil related activities OPCSA provide management services to SFF, another subsidiary of CEF Recommendation to remain a subsidiary of CEF Major Challenges • • • • Current legislation is confusing and does not provide enabling framework that is needed for rapid oil spill response There is no integrated oil spill contingency plan Apparent reluctance/complacency of certain role players in the oil industry Myth that South Africa do not have an oil pollution risk Main Features of Business Plan OPCSA must : • become the designated national oil spill response organisation • expand its tier 3 capabilities • expand to the ports identified • expand its commercial market • embark on a major employment equity plan CEF Board Approval The CEF Board : • Recognized the oil pollution risk in South Africa • Approved bridging finance for the next Financial year, in the interest of South Africa, to enable OPCSA to become self sustainable Deployment of boom around Tanker Oil vessel with Oilfence boom employed