Billing_new - Directions Online Career Service

advertisement

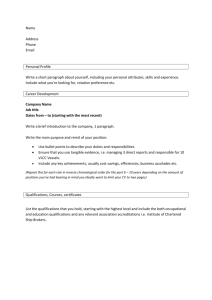

Job profile Billing Similar job titles Billing manager Billing administrator Accounts administrator What For a successful business to stay operational it needs a healthy cash flow, with money coming in when it’s due. People working in billing teams are tasked with making sure credit invoices are accurately prepared, sent out and paid on time. If supplying a product or service to another business, this could involve telephoning other finance departments to chase outstanding debts. On consumer finance, billing teams work in a variety of settings, including utility, loan and retail and credit card companies. They may often be dealing with high volumes of automated monthly invoices, processing cash payments, setting up monthly direct debits, reviewing payment terms and reissuing customer statements. Salary Entry level positions, such as a billings administrator, start at approximately £15,000 per annum. With the right experience, qualifications and skills you could progress to management roles and earn in excess of £50,000 per annum. This does not include potential bonuses or additional benefits. Salaries will vary considerably based on location and employer. Tasks Authorising and coding invoices and credit notes correctly, promptly sending them to customers Applying prices and other trading terms correctly, as previously agreed with customers Double checking to ensure that all calculations are arithmetically correct and comply with organisational requirements Processing payments promptly and accurately, reconciling them with bank records Authorising and documenting adjustments involving customers' accounts and transferring them correctly to the applicable ledger accounts Sending statements of account to customers promptly, according to company practice Preparing regular reports, including periodic comparisons of receipts against forecasts Filing all documentation in a logical and orderly manner Investigating significant discrepancies promptly as they arise, referring any outside your remit to the most appropriate person Delivering a reliable administrative support and customer service Skills Computer literate and good numerical skills Excellent telephone manner and communication skills Attention to detail Calm and assertive Confidence in handling potential conflict situations Methodical approach to record keeping and reporting A positive, ‘can do’ attitude to work Organised and good at planning Useful knowledge and experience A new entrant will not always be required to have this knowledge. Employers usually provide training to acquire skills for: Methods and procedures for collecting monies and for processing account documentation How to maintain your organisation’s sales ledger system Relevant aspects of your organisation’s credit terms Various payment methods used by trade, export and consumer credit customers and the documentation required by banks to process them Dealing with different reasons for non-payment Entry qualifications Working in billing requires an understanding of numbers and the ability to communicate with customers verbally and in a written format, so English and maths are important. General office administrative, retail banking, bookkeeping or accounting experience can be a good route in. In order to gain an entry level position, employers will look for people who have: GCSEs, Scottish Standard Grades or equivalent qualifications such as Business, Administration and Finance (BAF) Diploma, Welsh Baccalaureate (BAC) Foundation and Intermediate Diploma, and Scottish National Qualifications at Intermediate 2 (SCQF Level 5) Apprenticeships can be a useful way to gain entry and to progress on in the profession: Level 2 Apprenticeship in Accounting (England, Wales, Northern Ireland and Scotland) Level 3 Apprenticeship in Accounting (England, Wales, Northern Ireland and Scotland) Level 3 Apprenticeship in Accounting (England, Wales, Northern Ireland and Scotland) Level 4 Apprenticeship in Accounting (England, Wales and Scotland) Professional and higher qualifications Qualifications undertaken once in the job vary widely. For people wishing to progress into different credit control and credit management jobs qualifications are offered by The Institute of Credit Management (ICM). Billing staff can start with their Level 2 or Level 3 Diploma in Credit Management, which provides a general introduction to credit management functions, including developing knowledge in telephone collections, negotiation and influencing, cash collections and customer relations. It would be usual for credit professionals with more senior accountabilities to progress to: Level 5 Diploma in Credit Management, which aims to develop more advanced strategic and technical skills. The ICM Level 3 or 5 Diplomas offer an accelerated route to the: Level 5 Foundation Degree in Credit Management from the Thames Valley University, London Level 6 BA (Hons) in Business Studies with Credit Management. Some billing staff may decide to work towards an accounting technician qualification such as Association of Accounting Technicians (AAT), the Association of Chartered Certified Accountants (ACCA) Foundations in Accounting (FIA), or the ICAEW (Institute of Chartered Accountants in England and Wales) Certificate in Finance, Accounting and Business (CFAB). UK and global opportunities Billing jobs exist in consumer credit beyond financial and credit cards, including jobs in finance teams for high street and online retailers, utility (gas, electric, phone and water) companies and local authorities. Opportunities are nationwide. Most junior jobs are based in the UK. Some firms may outsource automated billing overseas. Credit controllers with one or more widely spoken European languages are often sought to work in credit contracts and billing functions, particularly in Eastern Europe. More senior positions in firms with international offices may present global promotional opportunities. Billing and accounts reconciliation remains a vital function within most finance teams and opens many career doorways in financial services and beyond. Once experienced, there are good opportunities to progress into managing or supervising people. With ICM qualifications moving into credit control and management jobs is entirely feasible. Find out more Association of Accounting Technicians (AAT) – www.aat.org.uk Association of Certified Chartered Accountants (ACCA) – www.accaglobal.com Credit Management Matters – www.creditmanagement.org.uk Credit Today – www.credittoday.co.uk Directions – www.directions.org.uk ICAEW (Institute of Chartered Accountants in England and Wales) – www.icaew.com/careers Institute of Credit Management (ICM) – www.icm.org.uk Scottish Qualifications Authority – www.sqa.org.uk Similar careers Accounts payable and receivable Bookkeeping Credit Management Payroll and Benefits Procurement