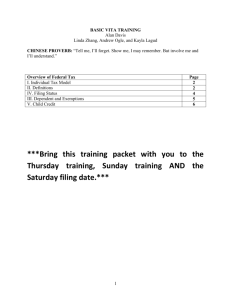

Chapter 3 Lecture Outline

advertisement

Chapter 3 • • • • • Calculate Taxable Income Personal and Dependency Exemptions Standard Deduction Filing Status Calculating Tax for Children Overview -- Taxable Income Formula • Gross Income Separate taxable income from nontaxable items • less: Deductions FOR AGI • Adjusted Gross Income • less: Itemized Deductions (or Std. Deduction) • less: Exemptions • Taxable Income Personal Exemption Personal Exemptions - exemption for taxpayer and spouse …………. Each exemption worth $3,300 in 2006. Dependency Exemptions A. Qualifying Child 1. Relationship Test – must be related 2. Abode – must live with the taxpayer > ½ year 3. Age – child must be <19 (< 24 if full time student) 4. Support – must provide > ½ support Dependency Exemptions B. Qualifying Relative 1. Relationship Test – expanded to include individuals that live with the taxpayer (i.e you don’t have to be related) 2. Gross Income Test – gross income must be less that the exemption amount ($3,300) 3. Support – must provide > ½ support Dependency Exemptions (two last test that apply to both Dependent Child and Dependent Relative) • • Joint Return Test - If dependent is married, dependent cannot file a joint return. See exception where there is no tax liability. Citizenship or residency - must be a US citizen or US resident or resident of Canada or Mexico. Relationship Test • The child must be the taxpayer’s: – – – – – – Son or daughter Stepson or stepdaughter Brother or sister Stepbrother or stepsister Half brother or half sister, or A descendant of such individual (e.g., grandchildren, nephews, nieces) • A child who has been adopted, or whose adoption is pending, qualifies • A foster child may also qualify Domicile Test (also referred to as “Abode”) • The child must have the same principal place of abode as the taxpayer for more than half of the taxable year – Temporary absences from the household due to special circumstances (e.g., illness, education) are not considered Age Test • The child must be under age 19 (or under age 24 in the case of a full-time student) – Exception - individuals who are disabled are not subject to any limitations as to age Support • Except in one situation, the definition of qualifying child makes the support of an individual irrelevant – The one case where support becomes relevant involves self-support • A child who provides more than one-half of his or her own support cannot be claimed as a dependent Questions - Exemptions • Can a parent be considered a “Qualifying Child”?? • Can a parent be considered a “Qualifying Relative”?? • At what age does a child stop becoming a “Qualifying Child” for purposes of the exemption? Filing Status Single - unmarried or separated by a decree of divorce or separate maintenance. Status determined at year end. Abandoned Spouse Rules allow a married taxpayer to file as single. Married - Not always advantageous when compared to single rates. Marriage penalty relief phased in between 2005 and 2009. Joint rates apply for two years to a surviving spouse who maintains a household for a dependent child. Married Filing Separate - large medical expenses sometimes make this advantageous. Also, innocent spouse considerations. Head of Household - unmarried maintaining a household for a dependent child or dependent relative. Dependent must be “related” ….. cannot qualify as a member of the household. Exception - Maintaining a separate home for a parent (one must be a dependent). Filing Status Clarification Head of Household Surviving Spouse Unmarried taxpayer who maintains a household for a dependent. The surviving spouse must maintain a household for a dependent child. The child must be a son / daughter, or stepchild. To qualify, a taxpayer must pay more than half the cost of maintaining a household. The household must be the principal place of abode for the dependent. (Exception for parents.) See example 40 & 41, p. 3-30 See example 38, p. 3-30 Standard Deduction Single $5,150 Head of Household $7,550 Married -- Joint $10,300 Married -- Separate $5,150 Additional Standard Deduction • $1,000 or $1,250 dollars each, depending on filing status (single or married). • Taken in addition to the: • $5,150 (single) • $10,300 (married) • $7,550 (head of household) • Available for taxpayers: • Over age 65 • Legally blind Standard Deduction and Exemption for Individuals who can be claimed as a Dependent Standard Deduction is $850 or Earned Income plus $300 (up to the $5,150 standard deduction) Personal Exemption - there is no personal exemption since it is claimed by another taxpayer Capital Gains and Losses First, net all short term gains/losses and net all long term gains and losses. Short Term Long Term Second, then net the gains and losses together. If both are gains or both are losses, they keep their character. Capital losses are limited to $3,000 per year. Unused losses are carried forward. Kiddie Tax • Investment income in excess of $1,700 for children under age 14 would be taxed at the parents rate. • The Technical Rule: Unearned income less $850 less the std deduction (greater of $850 or investment expenses) = Income Taxed at Parent’s Rate Child Tax Credit • $1,000 Credit per Child • Child must be: • under age 17 • claimed as a dependent on the tax return • Credit is reduced when Modified AGI exceeds: • $110,000 for Married Taxpayers • $75,000 for Single Taxpayers Capital Gains (Investment Property) Support Capital Losses (Investment Property) Relationship Alimony Paid Gross Income Child Support Paid Married Alimony Received Citizenship Child Support Received Inheritance from a Grandparent Head of Household Interest Earned Mortgage Interest Paid Property Taxes Paid Dividends Earned Life Insurance Proceeds Received Loss on Sale of Motorboat Gain on Sale of Motorboat Charitable Contributions Wages Earned Loan Proceeds Received from Bank Scholarship Lottery Jackpot Court Award for Personal Injury Interest Earned on State of Nebraska bonds Contribution to IRA