CONTRACT AND COMMERCIAL LAW (U09062)

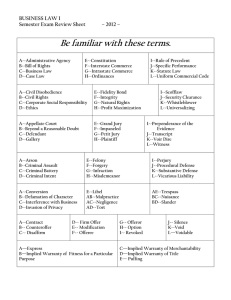

advertisement

STEPH SHAW February 2010 10 credits Unit co-ordinator: Steph Shaw Lecturer: Steph Shaw Aims: develop an understanding of the legal liabilities of business organisations towards consumers and other businesses 100% Coursework Problem question - 3000 words Distributed w/c 09 March This unit aims to build upon the knowledge of contract law developed in Level 1 Sale of Goods Exclusion Clauses Consumer Credit The law relating to commercial activity, especially transactions concerned with the sale and supply of goods and services and the financing thereof. Most of the legal principles applicable to contracts of sale were developed at common law, particularly during the eighteenth and nineteenth centuries. By the late nineteenth century an extensive body of rules concerned with the rights and duties of buyers and sellers had developed and the law of sale was therefore included in the partial codification of commercial law. Sale of Goods Act 1893 Industrial revolution – between 1860 and 1900 estimated that the real wages of urban workers increased by 60% Mass production of consumer durables led to a massive increase in commercial activity Growth in provision of credit Existing contractual basis for analysis of commercial activity with its assumption of equality of bargaining power was inadequate to deal with the problems created by the increase in consumption and the increasing complexity of goods and sales techniques Courts developed principles of negligence law to deal with problems caused by defective goods Parliament legislated to regulate the supply of credit – Moneylenders Act 1927 and Hire Purchase Act 1938 Licensing Criminal law self regulation introduced Consumer protection Issued directives on: consumer credit, unfair contract terms, distance sale, unfair commercial practices contracts Introduced new concepts into UK law: ‘good faith’ ‘average consumer’ New Directive on Consumer Rights proposed in 2008 A contract is a legally binding agreement which is essentially commercial in its nature and involves the sale or hire of commodities such as goods, services or land. Only a minority of contracts must be written in order to be valid. These include contracts to sell land and contracts to obtain credit. Terms define the obligations which the parties to the contract have undertaken Different types of terms, can be express or implied If any terms are breached the injured party will have a remedy for breach of contract. The nature of the remedy will depend upon what type of term as breached Express terms are agreed by the parties Implied terms are implied by the court or by a statute Importance of statement-Bannerman v White Special skill and knowledge-Dick Bentley Productions Ltd v Harold Smith (Motors) Ltdif statement made by someone with special skill/knowledge more likely to be a term Timing-Routledge v McKay-the more time that elapses between the statement being made and the contract being concluded, the less likely it will be a term A misrepresentation is an untrue statement of fact by one party which has induced the other to enter into the contract There must be: An untrue statement It must be a statement of fact and It must have induced the innocent party to enter the contract Conditions-important terms of the contract, breach of which allows the innocent party to terminate the contract and sue for damages. Warranties-less important terms, breach of which allows the innocent party to claim damages but does not allow them to treat the contract as terminated Terms are implied into contracts by 3 statutes: Sale of Goods Act 1979 Supply of Goods (Implied Terms) Act 1973 (contracts of hire-purchase) Supply of Goods and Services Act 1982. The terms which these statutes imply are inserted into certain types of contracts without the parties needing to agree to them. Sale of Goods Act 1893 was the first statute to imply terms into contracts. 1893 Act replaced by the Sale of Goods Act 1979 Contain 5 major implied terms, all of which are conditions s12(1) implies a condition that the seller has the right to sell the goods s13(1) implies a condition that the goods will correspond with any description by which they were sold s14(2) implies a condition that the goods are of satisfactory quality s14(3) implies a condition that the goods are fit for the buyer’s purpose s15(2) implies a condition that where goods are sold by sample that the bulk will correspond with the sample The terms implied by ss. 14(2) and 14(3) are implied only into contracts for the sale of goods which are made in the ‘course of a business’. The other terms are implied into all contracts for the sale of goods The swing of the pendulum from: Caveat emptor – ‘buyer beware’ to Caveat venditor – ‘seller beware’ A necessary change rendered necessary by the conditions of modern commerce and trade Only applies to contracts for the sale of goods s2(1) ‘a contract by which the seller transfers or agrees to transfer the property in goods to the buyer for a money consideration called the price’ Property in goods means ownership or title, therefore contracts of hire are not covered by the SGA as ownership is not transferred. s8 clarifies the term ‘price’. Consideration must be money, therefore a free gift cannot be a sale s 61 SGA-defines goods as ‘all personal chattels other than things in action’ A personal chattel is a physical thing which can be touched or moved (land and houses cannot be moved) A thing in action is a right which can be enforced only by suing (guarantees, debts, intellectual rights like a trademark or copyright) ss 12 and 13 Sale of Goods Act