Exam Review Guide with Answers

advertisement

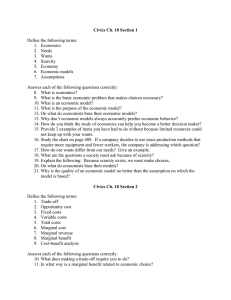

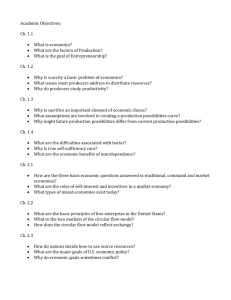

Mr. Mullins Economics Semester Exam Review Guide Unit 1 1. Define Economics: Economics is the study of the use of SCARCE resources to satisfy unlimited human wants. 2. List the Seven Economic Goals of the United States: 1. 2. 3. 4. 5. 6. 7. UNRESTRICTED DECISION MAKING ECONOMIC EFFICIENCY- Best Use of Scarce Resource ECONOMIC EQUITY ECONOMIC SECURITY FULL EMPLOYMENT PRICE STABILITY ECONOMIC GROWTH 3. Who was Adam Smith? What book did he write and what was it about? • • • • • • • Adam Smith was a Scottish philosopher who became the “father of modern economics” He introduced a new way of thinking about economic ideas He wrote the book An Inquiry Into the Nature and Causes of the Wealth of Nations which was published in 1776 One of the main ideas of this book is that free market competition is the best way to create wealth; people acting in their own self-interest will benefit the society as a whole He introduced the idea of an “invisible hand” which guides the markets Advocated a Laissez-faire (hands off) approach from the government towards the economy These ideas form the basis for the capitalistic economic system 4. Define scarcity: The condition that results from people having limited resources- anything used to produce an economic good or service and unlimited wants. 5. Define the following terms- Resource, Microeconomics, Macroeconomics, Positive economics, Normative economics • • • • Resource- anything used to produce an economic good. Microeconomics-looks at economic decisions made by individuals, households, and businesses Macroeconomics- focuses on the workings of the economy as a whole Positive economics- focuses on how things are, data, facts, numbers • Normative economics- focuses on how things ought to be; giving advice, making policy decisions, setting budgets, etc. 6. List and describe the Seven Principles of Economics • • • • • • • Scarcity forces Tradeoffs (no Free Lunch)- you are giving up one thing to get another. Every choice involves tradeoffs for someone Costs vs. Benefits- The principle tells us that people choose something when the benefits of doing something are greater than the costs Thinking at the Margin- most decisions we make involve either a little more or a little less not all or nothing Incentives Matter- costs and benefits influence our behavior, they act as an incentive Trade Makes People Better Off- by doing what we do well and trading with others for what they do well, we end up with better choices Markets Guide Trade-markets will generally do better than anyone or anything in coordinating exchanges between buyers and sellers Long Term Effects (Future Consequences)- decisions made today have consequences not only today but in the future as well; some of them will be unintended consequences 7. Define the following economic terms- costs, benefits, cost-benefit analysis, Marginal benefit, Marginal cost, incentives, data, variable, graph, economic model • • • • • • • • • • costs- are what you spend to get something (money, time, effort, etc.) benefits- are what you gain Cost benefit analysis- is a tool economists use to calculate costs and benefits Marginal Benefit- what you gain by adding one more unit of something Marginal Cost- what it costs to add one more of something Incentive- something that motivates a person to take a particular course of action; can be positive or negative Data- factual information Variable- is a quantity that can change Graph- a visual representation of the relationship between two given sets of data Economic model- a simplified representation of reality that allows economists to focus on one change at a time Unit 2 1. Define goods• Goods- physical objects produced for sale 2. Define services • Services-activities done for us by others 3. Define shortages and scarcity and explain the difference between the two: • • • Shortages- lack of something that is desired-due to fads, natural disasters, etc. Shortages are temporary; once the demand is met or the fad is over the shortage is over Scarcity will never go away; it is permanent. There will never be enough resources available to satisfy all of the wants of human beings 4. Define inputs and outputs• Inputs- the scarce resources that go into the production process • Outputs- the goods and services which are produced 5. What is the production equation? • Production equation isLand + Labor + Capital= goods and services 6. What are the factors of production? • Land, Labor, Capital are all considered factors of production-resources used to create a good or service 7. What is entrepreneurship and what is it now considered? • • Entrepreneurship- the willingness to take the risks associated with starting a business Some economists believe entrepreneurship is the fourth factor of production 8. What do economists mean when they call something land? • To economists land means all “the gifts of nature”- natural resources 9. List the three types of natural resources and describe each one: • • • Perpetual resources- widely available and in no danger of being used up; sunlight, wind. Renewable resources- resources that with careful planning, can be replaced as they are used; forests, fresh water, fish and game; most metals can be recycled for use again and again Nonrenewable resources- resources that once they are used, are gone forever; oil, coal, natural gas 10. Define labor the different types of labor- • Labor- the time and effort people devote to producing goods in exchange for wages; includes both physical labor and mental activities 11. Define human capital and describe its correlation with a country’s standard of living: • • Human capital-knowledge and skill that people gain from education, on-the-job training, and other experiences Correlation between human capital and standard of living is strong but correlation between natural resources and standard of living is weak 12. Who has the higher standard of living Japan or Nigeria? Why? • Japan has a higher standard of living than Nigeria because of Human Capital 13. Define financial capital and physical capital: • Financial capital- money used to invest in stocks, bonds, real estate, or businesses to produce future wealth • Physical capital- Tools, machines, and buildings used to produce goods and services 14. What are entrepreneurs and what do they provide to the economy? How are they different than business owners? • • Entrepreneurs are innovators, risk takers, strategists, and sparkplugs. They provide new ideas, energy, and enthusiasm needed to turn ideas into realities 15. How do we measure productivity? • Productivity = output/input 16. What is the goal of all producers in an economy in terms of productivity? • Resources are scarce so in order to be productive we must be efficient with the resources 17. What must everyone make because of scarcity? • • Everyone must make choices because of scarcity; individually and as a society Societies must choose to use their resources for guns (military goods) or butter (civilian goods) 18. Define opportunity cost: • Opportunity cost- is the value of the next best alternative that you would have chosen instead of the choice you made 19. Define marginal utility, law of diminishing marginal utility, negative utility: • • • Marginal utility- the extra satisfaction or pleasure you get from an increase of one additional unit of a good or service Law of diminishing marginal utility-marginal utility of something diminishes as we get more of it If you have so much that we start to not enjoy having an additional unit it can become negative utility 20. What is a PPF? • PPF- is an economic model in the form of a line graph that shows how an economy might use its resources to produce two goods 21. Define economic efficiency: • Economic efficiency- is the result of using resources in a way that produces the maximum amount of goods and services Unit 3 1. What are the three Essential Economic Questions? • • • What goods and services are to be produced? How are goods and services produced? For whom are goods and services to be produced? 2. List the different ways goods and services can be distributed: • Goods and services are distributed in a variety of ways: – Ability to pay-what we are used to – Equal distribution-U.S.S.R. – First come; first served – Distribution according to need 3. List the different economic goals of the world: • • • • • • Economic Freedom Economic efficiency Economic equity Economic growth Economic security Economic Stability 4. Define economic system: • An economic system is the way a society coordinates the production and consumption of goods and services 5. List and describe the four types of economic systems: Command-Centrally controlled, where the government makes all economic decisions (Security, Equity) Market-Consumers drive all the economic decision(Freedom, Efficiency) Traditional-Family or community based economic system that relies on custom or ritual to drive economic decisions(Stability, Security) Mixed-Consumers and the government drive all the economic decision 6. What did investors (capitalists) do during the Industrial Revolution? • Investors-capitalists- grew wealthy by accumulating capital; machines, factories, railroads. 7. Define Capitalism: • Capitalism is now the term synonymous with the free market system used during the Industrial Revolution 8. What book did Marx and Engels write in response to Capitalism? What did it advocate? • In 1848 Karl Marx and Friedrich Engels published the book The Communist Manifesto which advocated the overthrow of capitalism 9. Define socialism and communism according to Marx and Engels: • • Socialism- a political and economic philosophy that calls for property to be owned by society as a whole for the equal benefit of all Communism-(would be the final phase of socialism)- a political and economic system in which all property and wealth are owned by all members of the society. No class differences. 10. Define economic planning as it was done in the USSR: Economic planning was done by government committees of economists, production experts, and political officials who attempted to perform the function of markets 11. Define household, firm, product market, factor market , factor payments as they relate to the circular flow model of the economy: • • • • • • Household- a person or group of persons living together; Households own the factors of production Firm- an organization that uses these factors to make and sell goods or services The model uses two kinds of markets Product market- goods and services are sold by firms and purchased by households Factor market- households sell their labor, land, and capital to firms Factor payments- wages for labor, land rental, stock investments, etc. 12. What does the government need to do at a minimum in a mixed economy? • At minimum, gov’t is needed to establish the institutions that enable the markets to function – Legal system for laws and contracts – Currency system-Federal Reserve Bank 13. Define public works• Public Works- certain goods and services that governments can provide that markets do not always provide or do not provide enough of • Dams, highways, sewer systems, bridges, etc. 14. Define transfer payments and list examples: • • Gov’t collects taxes from all and will then transfer money back to households Social security checks, welfare payments, and unemployment benefits are transfer payments 15. Define the free enterprise system: • Free enterprise system- individuals own the factors of production and make decisions about how to use those factors within the framework of the law 16. Define the following economic terms- property rights, intellectual property, patents, copyright, profits, profit motive: • • • Property rights- the rights to own land, buildings, or other goods to use or dispose of them as they choose intellectual property- creations of the mind that have commercial value Patents-gives an inventor the sole right to make, use, or sell his or her invention • • • Copyright- gives the creator of a literary or artistic work the sole right to reproduce, distribute, perform, or display the copyrighted work Profit Motive- the desire to make a profit Profit is the money earned by a business after subtracting the costs of operation Unit 4 Define the following terms: 1.Specialization- Development of skills or knowledge in one aspect of a job or field of interest 2. Division of Labor- Allocation of separate tasks to different people 3. Voluntary Exchange- Act of willingly trading one item or service for another 4. Barter- Direct exchange of goods or services without the use of money 5. Money- A generally accepted medium of exchange that can be traded for goods and services or used to pay debts 6. Economic Interdependence- Characteristic of a society in which people rely on others for most of the goods and services they want 7. Absolute Advantage- The condition that exists when someone can produce a good or service using fewer resources than someone else 8. Comparative Advantage- The condition that exists when someone can produce a good or service at a lower opportunity cost than someone else 9. Coincidence of Wants- Condition that exists when people conducting trade have the goods or services the other desires 10. Trade Barriers- Anything enacted to limit trade; tariffs, laws, etc. 11. Wealth- The total value of all the things a person owns 12. Mass Production- Large scale manufacturing 13. Commerce Clause- Article in the Constitution which grants Congress the power to regulate certain aspects of the economy Unit 5 1. Define Quantity demanded: Quantity demanded-the amount of a good or service that consumers are willing and able to pay at a specific price 2. Define Demand: Demand- the amount of a good or service that consumers are willing to buy at all prices in a given time period 3. Create a sample demand table for any product you want. Then draw the corresponding demand curve on a grid below. 4. Define the law of demand: Law of demand states that as the price of goods increase the quantity demanded decreases and vice versa 5. List the three factors that affect consumers’ spending behavior: Law of diminishing marginal utility- consumers will weigh the “utility” they will receive from each additional unit before purchasing Income effect- because of scarcity people’s incomes are limited and they must make choices (trade-offs) when deciding what to purchase Substitution effect- sometimes two different goods can satisfy the same want. These products are considered substitute goods 6. Define substitute goods and give one example: sometimes two different goods can satisfy the same want. These products are considered substitute goods. 7. What is the only thing that will effect quantity demanded? Only a change in price will effect quantity demanded 8. Define change in demand: occurs when quantities demanded increase or decrease at all prices 9. List the different demand shifters that will change demand independent of price: – Changes in income – Changes in the number of consumers – Changes in consumer tastes and preferences – Changes in consumer expectations – Changes in the price of substitute goods – Changes in the price of a complementary good 10. Define a complementary good: a product that is consumed along with some other product 11. Define quantity supplied; supply; the law of supply; and revenue: Quantity supplied- the amount of a good or service that producers are willing and able to offer for sale at a specific price Supply- the amount of a good or service that producers are willing to and able to offer for sale at all prices in a given time period Law of supply- direct relationship between price and quantity supplied; as the price goes up the quantity supplied goes up Revenue- the amount of money received in the course of doing business 12. What is the only factor that changes quantity supplied? The only factor that changes quantity supplied is price 13. List the factors that lead to a change in supply independent of price: Change in the cost of inputs Changes in the number of producers Changes in conditions due to natural disasters or international events, ex. Wars Changes in technology Changes in producer expectations 14. Define elasticity; elasticity of supply; elasticity of demand; unitary elastic supply or demand; inelastic Elasticity- a measure of the degree to which a quantity demanded or a quantity supplied changes in response to a change in the price Elasticity of demand- a measure of consumer’s sensitivity to a change in price Elasticity of supply- a measure of the sensitivity of producers to a change in price Inelastic- items that do not show a change in demand no matter the price, necessities Unitary elastic supply or demand- when the % change in price is = to the % change in quantity supplied or demanded 15. What is total revenue? Total revenue is calculated by multiplying the quantity of a good sold by the price of a good 16. List the factors that influence the elasticity of demand: Availability of substitutes Price relative to income-consumers notice changes to “big ticket” items more than lower priced items Necessities vs. luxuries Time needed to adjust to a price change 17. List the factors that influence the elasticity of supply: Supply chain- the network of people, organizations, and activities involved in supplying goods and services to consumers Availability of Inputs Mobility of Inputs Storage capacity Time needed to adjust to a price change Unit 6 1. Define market equilibriumMarket equilibrium-the point where the quantity of a good or service that consumers are willing and able to buy equals the quantity of a good/service that suppliers are willing and able to supply 2. Define equilibrium priceEquilibrium price- the price marked by the equilibrium point; also known as the “market-clearing price” 3. Define price controls and list and define the two types of price controlsPrice controls- Government placed limits on how high or how low prices in the market can go Price floor- a minimum price consumers are required to pay for a good or service. Any price below the floor is illegal Price Ceiling- a maximum price consumers may be required to pay for a good or service 4. Define Market StructureMarket structure- the organization of a particular market based mainly on the degree of competition among producers 5. What are the four main characteristics economists use to determine market structure? Number of producers- the more producers the more competition Similarity of products-more similar=more competition Ease of entry- markets that are easier to enter have more competition Control over prices- the less market power any one producer has, the more competitive the market 6. Define market powerMarket power- the ability to influence prices by increasing or decreasing the supply of goods 7. List the 4 characteristics of perfect competition: 1. Many producers and consumers 2. Identical products 3. Few restrictions in entering the market 4. Producers have no market power 8. Define commodityCommodity- a product that is exactly the same no matter who produces it; oil, grains, cotton, sugar 9. Define barriers to entryBarriers to entry- these are the obstacles that can restrict access to a market and limit competition a. Start-up costs b. Control of resources c. Technology 10. Define monopoly and list the four characteristics of a monopolyMonopoly- a market structure that has a single producer of a product of which there is no substitute 1. There is no competition; there is only one producer 2. There are no substitutes 3. High barriers to entry into the market is the main reason there is only one producer 4. Monopolies have substantial market power; they are price setters. 11. Define anti-trust laws, resource monopolies and government created monopolies: Anti-trust laws- Congress enacted anti-trust laws because they viewed certain monopolies to be harmful to the public good Resource Monopolies- exist when one producer owns or controls a key natural resource Government-created monopolies- exists when the government grants a single firm or individual the exclusive right to provide a good or service -Patents and copyrights for intellectual property -Public franchises-national parks and schools -Licenses 12. Define natural monopoly Natural monopoly- when a single firm can provide a good or service more efficiently and at a lower price than two or more firms can 13. Define economies of scaleEconomies of scale-the greater efficiency and cost savings that result from increased production 14. Define oligopoly and list the four characteristics of an oligopolyOligopoly- a market structure that is operated by a few firms that produce similar or identical products 1. Few producers- airlines, automobiles, soft drinks 2. Similar products-Coke & Pepsi, light bulbs 3. High barriers to break into the market- start-up costs, brand loyalty 4. The few firms in the market have some control over the pricing in the market 15. Define Price leadershipPrice leadership- if an oligopoly is dominated by one firm, they will set the price and the other firms will follow their lead; however this could lead to a “price war” 16. Define collusionCollusion- occurs when producers get together and make agreements on production levels and pricing 17. Define cartel- Cartel- an organization of producers established to set production and price levels for a product; OPEC 18. Define monopolistic competition and list the four characteristics of monopolistic competition: Monopolistic Competition-is a market structure where a large number of producers provide goods that are similar but varied 1. Many producers- gas stations, hotels, restaurants 2. Product differentiation- products are different but still considered close substitutes 3. Few barriers to entry 4. Some control over prices but not much 19. List the four characteristics of non-price competition that producers in a monopolistic competition market have to use: 1. Physical characteristics- design, color, style, material, etc. 2. Service 3. Location 4. Status and image 20. Define market failureMarket failure- markets which are not perfectly competitive result in inefficient markets, this is a failure 21. Define externalityExternality- a side effect of production or consumption that has consequences for people other than the producer and consumer; “spillover” effects 22. Define public goods and give examples of themPublic goods- goods and services that are not provided by the market system because of the difficulty getting people who use them to pay for their use -Fire/Rescue, Police, Nat’l Parks, Nat’l Defense 23. Explain the free-rider problem as it pertains to public goods: Free-rider problem- firms do not provide “public goods” because they have no way to make the people who benefit from the goods pay for them Unit 7 1. What is the central bank of the US and what do they do for the USA? • The Federal Reserve is the central bank of the US which sets the monetary policy of the USA 2. Define monetary policy and reserve requirement: • • Monetary policy-control over the money supply and interest rates to dampen inflation or to stimulate growth Reserve requirement- the regulation that banks must keep a certain percentage of deposits on hand to repay depositers 3. Define fiscal policy: Fiscal policy- the government’s ability to tax and spend to get a stagnant economy going or to fight inflation 4. What did Adam Smith believe the government should do in terms of the economy? • Adam Smith believed that the government should stay out of the economy and keep taxes low 5. What event in America changed the way our government dealt with the country’s economy? • The Great Depression caused such widespread misery that people in America wanted their government to get involved to stabilize the economy 6. Who was John Maynard Keynes and what were his economic ideas? • • • Keynesian economics- the idea of British economist John Maynard Keynes This idea is that recessions and depressions are caused by a lack of buying power; put simply, people did not have money to buy stuff which leads to a downward cycle Keynes believed that the government should stimulate the economy by lowering taxes and by the government spending money to put more money in the economy 7. Describe the idea of deficit spending of Keynes. • Keynes felt that the government should borrow money to do this spending; not raise taxes to get it- this is called deficit spending 8. Who was Milton Friedman and what were his economic ideas? • • • • Milton Friedman believed that our monetary policy was the reason for the depression Too much money too fast results in inflation as consumers with more money demand goods and services faster than producers can provide them driving prices up If the money supply grows too slowly, deflation occurs and spending and investment slows down The goal of monetary policy should be to keep up with economic growth-but no faster 9. Define monetarism: • Monetarism-the idea that the money supply is the primary reason for ups and downs in the economy 10. Define stagflation: • Stagflation- when the economy is stagnant, there is high unemployment and there is high inflation at the same time 11. What policy did Paul Volker use to fight stagflation? Define that policy: • • Paul Volker (Fed Chairman and Friedman follower) decided to use a tight-money policy to help slow inflation. Tight-money policy- a slowing of the growth of the money supply (contractionary fiscal policy) 12. Describe demand side economics: • • Keynesian idea that the best way to stimulate the economy is to cut taxes across the board to put more money in everyone’s pocket & increase government spending This is expansionary fiscal policy 13. Define the multiplier effect: • Demand side economists believe in the multiplier effect- dollars spent will eventually multiply and benefit others in the economy 14. Describe supply side economics: • Supply side economists believe that the best way to deal with an economic slowdown is to stimulate overall supply by cutting taxes on businesses and high-income taxpayers The idea is that businesses and investors will use the money from their tax savings to expand production, the supply of goods and services will increase, spurring economic growth 15. What is “trickle down economics”? • “Trickle down economics”-Ronald Reagan used Supply Side economics to cut taxes on businesses and the wealthy in the early 80’s to try to grow the economy 16. List the fears people have over the National Debt and define the crowding out effect: • • • • Fear of Government bankruptcy Concern about the burden on future generations Unease about foreign owned debt Crowding out effect- happens when government borrowing drives interest rates up so high that people are no longer willing to borrow money to invest in businesses