November 2012 Monthly Strategies

advertisement

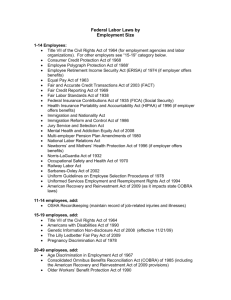

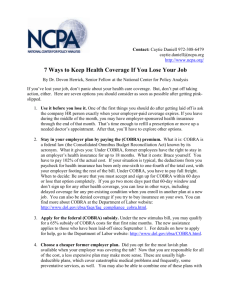

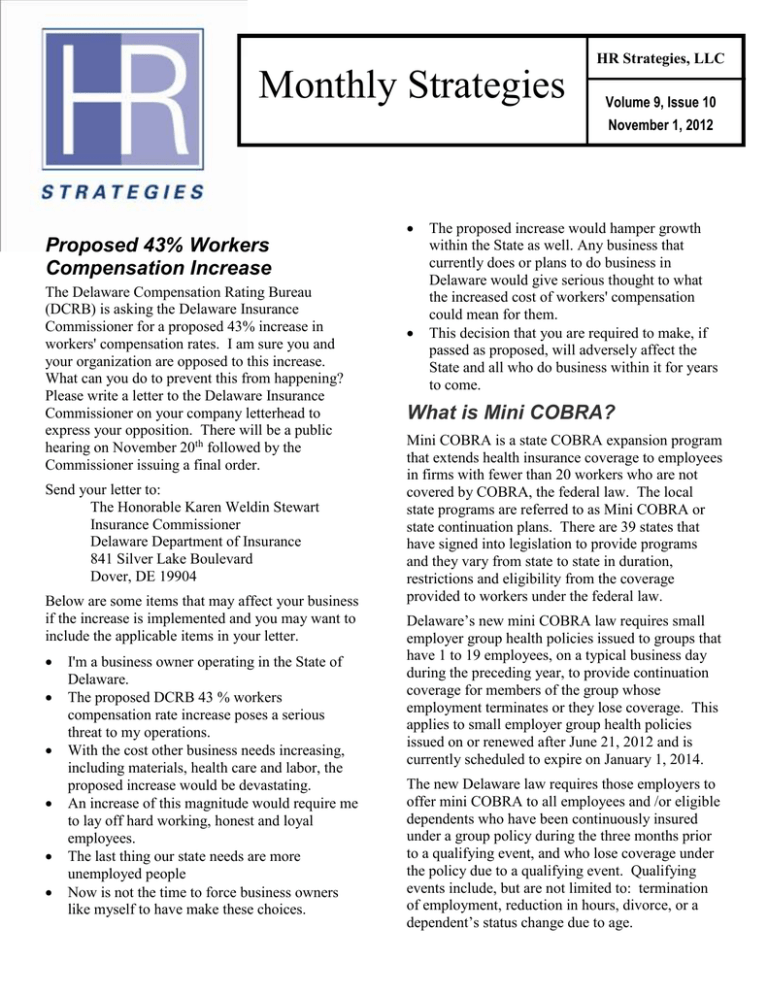

HR Strategies, LLC Monthly Strategies Proposed 43% Workers Compensation Increase The Delaware Compensation Rating Bureau (DCRB) is asking the Delaware Insurance Commissioner for a proposed 43% increase in workers' compensation rates. I am sure you and your organization are opposed to this increase. What can you do to prevent this from happening? Please write a letter to the Delaware Insurance Commissioner on your company letterhead to express your opposition. There will be a public hearing on November 20th followed by the Commissioner issuing a final order. Send your letter to: The Honorable Karen Weldin Stewart Insurance Commissioner Delaware Department of Insurance 841 Silver Lake Boulevard Dover, DE 19904 Below are some items that may affect your business if the increase is implemented and you may want to include the applicable items in your letter. I'm a business owner operating in the State of Delaware. The proposed DCRB 43 % workers compensation rate increase poses a serious threat to my operations. With the cost other business needs increasing, including materials, health care and labor, the proposed increase would be devastating. An increase of this magnitude would require me to lay off hard working, honest and loyal employees. The last thing our state needs are more unemployed people Now is not the time to force business owners like myself to have make these choices. Volume 9, Issue 10 November 1, 2012 The proposed increase would hamper growth within the State as well. Any business that currently does or plans to do business in Delaware would give serious thought to what the increased cost of workers' compensation could mean for them. This decision that you are required to make, if passed as proposed, will adversely affect the State and all who do business within it for years to come. What is Mini COBRA? Mini COBRA is a state COBRA expansion program that extends health insurance coverage to employees in firms with fewer than 20 workers who are not covered by COBRA, the federal law. The local state programs are referred to as Mini COBRA or state continuation plans. There are 39 states that have signed into legislation to provide programs and they vary from state to state in duration, restrictions and eligibility from the coverage provided to workers under the federal law. Delaware’s new mini COBRA law requires small employer group health policies issued to groups that have 1 to 19 employees, on a typical business day during the preceding year, to provide continuation coverage for members of the group whose employment terminates or they lose coverage. This applies to small employer group health policies issued on or renewed after June 21, 2012 and is currently scheduled to expire on January 1, 2014. The new Delaware law requires those employers to offer mini COBRA to all employees and /or eligible dependents who have been continuously insured under a group policy during the three months prior to a qualifying event, and who lose coverage under the policy due to a qualifying event. Qualifying events include, but are not limited to: termination of employment, reduction in hours, divorce, or a dependent’s status change due to age. Page 2 Employers will have 30 days to notify eligible employees when a qualifying event has occurred. Those employees and/or eligible dependents have 30 days from the notification date to enroll in mini COBRA. Coverage under mini COBRA may be continued to a maximum of nine (9) months or until December 31, 2013, when the mini COBRA law expires, and is contingent upon the payment of premiums and your maintenance of the group health insurance policy. Employers will be responsible for compliance, administering this law and collecting the premiums from their employees. Similar to federal COBRA, employers may charge up to 102% of the group rate, of the insurance being continued, to help cover the cost of their administration tasks. New Hire Compliance Delaware employers of four (4) or more employees are required to: Notify employees in writing at the time of hire: 1. Rate of Pay 2. Day, hour and place of payment 3. Employer’s fringe benefits policies Notify employees in writing of any reductions in the rate of pay, and any changes in the day, hour or place of payment or benefits. Furnish each employee with a pay statement showing: 1. Amount of wages due; 2. Pay period covered by the payment; 3. Amounts of deductions (separately specified) which have been made from the wages; 4. Total number of hours worked in pay period (for employees who are paid at an hourly rate). Religious Accommodation Employers must reasonably accommodate employees' sincerely held religious beliefs or practices unless doing so would impose an undue hardship on the employer. A reasonable religious accommodation is any adjustment to the work environment that will allow the employee to practice his or her religion. Flexible scheduling, voluntary substitutions or swaps, job reassignments, lateral transfers and modifications to workplace practices, policies and/or procedures are examples Monthly Strategies of how an employer might accommodate an employee's religious beliefs. Nine Tips for Office Celebrations With the holiday season fast approaching, below are nine tips you might want to consider as you make plans: 1. Be honest with employees. Make sure your employees know your workplace substance abuse policy and that the policy addresses the use of alcoholic beverages in any work-related situation and office social function. 2. Post the policy. Use every communication vehicle to make sure your employees know the policy. Prior to an office party, use break room bulletin boards, office e-mail and paycheck envelopes to communicate your policy and concerns. 3. Reinvent the office party concept. Why have the typical office party? Try something new like an indoor carnival, group outing to an amusement park or volunteer activity with a local charity. 4. Make sure employees know when to say when. If you do serve alcohol at an office event, make sure all employees know that they are welcome to attend and have a good time, but that they are expected to act responsibly. 5. Make it the office party of choice. Make sure there are plenty of non-alcoholic beverages available. 6. Eat...and be merry! Avoid serving lots of salty, greasy or sweet foods which tend to make people thirsty. Serve foods rich in starch and protein which stay in the stomach longer and slow the absorption of alcohol in the bloodstream. 7. Designate party managers. Remind managers that even at the office party, they may need to implement the company's alcohol and substance abuse policy. 8. Arrange alternative transportation. Anticipate the need for alternative transportation for all party goers and make special transportation arrangements in advance of the party. Encourage all employees to make use of the alternative transportation if they consume any alcohol. 9. Serve none for the road. Stop serving alcohol before the party officially ends. If alcoholic beverages are provided at office social functions, state laws regarding their use and resulting legal responsibilities should be consulted and addressed. If your organization would like to learn more about the items in this newsletter, please feel free to contact Tricia Clendening at 302.376.8595 (office) or 302.373.1784 (cell) or Tricia@hrstrategies.org. Please contact us if you would like to be removed from our Monthly Strategies mailing list or if you would like for us to add someone to our mailing list.