Project

advertisement

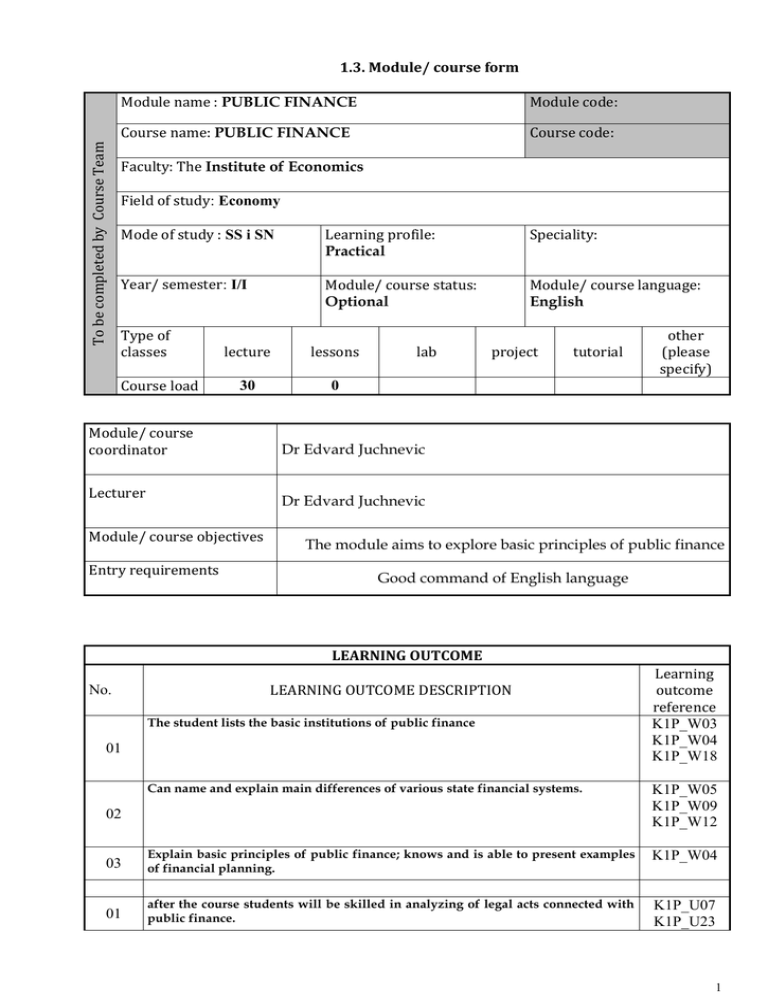

To be completed by Course Team 1.3. Module/ course form Module name : PUBLIC FINANCE Module code: Course name: PUBLIC FINANCE Course code: Faculty: The Institute of Economics Field of study: Economy Mode of study : SS i SN Learning profile: Practical Speciality: Year/ semester: I/I Module/ course status: Optional Module/ course language: English Type of classes Course load lecture lessons 30 0 Module/ course coordinator Lecturer lab project tutorial other (please specify) Dr Edvard Juchnevic Dr Edvard Juchnevic Module/ course objectives Entry requirements The module aims to explore basic principles of public finance Good command of English language LEARNING OUTCOME No. LEARNING OUTCOME DESCRIPTION The student lists the basic institutions of public finance 01 Learning outcome reference K1P_W03 K1P_W04 K1P_W18 Can name and explain main differences of various state financial systems. K1P_W05 K1P_W09 K1P_W12 03 Explain basic principles of public finance; knows and is able to present examples of financial planning. K1P_W04 01 after the course students will be skilled in analyzing of legal acts connected with public finance. K1P_U07 K1P_U23 02 1 02 will be able to use the knowledge of public finance from the perspective as a business owner and state institution’s employee 03 can use the knowledge of financial planning in business. 01 during the course students will develop their skills in cooperation with each other during the group works and problem solving tasks; also students will be able to take an active part in discussions on topics related to public finance; accept different views in solving problems related to public finance 02 03 K1P_U20 K1P_U21 K1P_U05 K1P_K01 K1P_K02 K1P_K03 K1P_K06 K1P_K16 CURRICULUM CONTENTS Lecture Introduction to public finance Macro and micro public finance Local public finance Characteristics of public revenues Allocation of resources of public goods Principles and theories of taxation Public expenditure [Procurement law] Budget deficit and public debt Deficit financing Public banking law EU Financial institutions Money and monetary law Basics of customs law Theories and new trends in the context of public finance International Finance Tutorial Lab Project A.1. To be used during lectures Basic literature Additional literature C. Kosikowski, Financial Law of EU, Warsaw 2008 Public Finance [Hardcover] Harvey Rosen (Author), Ted Gayer (Author), Publisher: McGraw-Hill/Irwin; 9 edition (September 25, 2009) A.2. To be used independently Public Finance, John E. Anderson (Author), Publisher: South-Western College Pub; 2 edition (August 17, 2011) 1. International Economics (9th Edition) [Hardcover] Paul R. Krugman 2 2. Teaching methods (Author), Maurice Obstfeld (Author), Marc Melitz (Author), Publisher: Prentice Hall; 9 edition (January 10, 2011) Public Finance and Public Policy [Hardcover] Jonathan Gruber (Author), Publisher: Worth Publishers; Fourth Edition edition (December 1, 2012) Lecture, seminar lecture, lecture with multimedia presentation on-line classes/ blended learning Learning outcome number Assessment method Multimedia presentation Solving case studies Course assessment and examination Form and terms of an exam 01,02,03 01,02,03 01,02,03 Written exam: written statement; Oral exam; multiple choice test; Solving case studies STUDENT WORKLOAD Participation in lectures Independent study of lecture topics Participation in tutorials, labs, projects and seminars Independent preparation for tutorials* Preparation of projects/essays/etc. * Preparation/ independent study for exams Participation during consultation hours Other TOTAL student workload in hours Number of ECTS credit per course unit Number of hours 30 40 0 0 15 20 0,1 0 105 4 Number of ECTS credit associated with practical classes Number of ECTS for classes that require direct participation of professors 3