Detection of Cash Larceny Schemes

advertisement

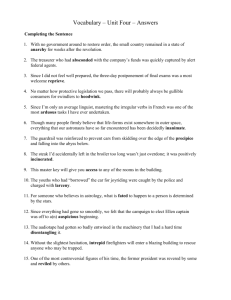

Chapter 3 Cash Larceny 1 Pop Quiz What is the difference between larceny and skimming? 2 Learning Objectives • Define cash larceny. • Understand how cash receipts schemes differ from fraudulent disbursements. • Recognize the difference between cash larceny and skimming. • Understand the relative frequency and cost of cash larceny schemes as opposed to other forms of cash misappropriations. • Identify weaknesses in internal controls as inducing factors to cash larceny schemes. • Understand how cash larceny is committed at the point of sale. 3 Learning Objectives • Discuss measures that can be used to prevent and detect cash larceny at the point of sale. • Understand and identify various methods used by fraudsters to conceal cash larceny of receivables. • Understand schemes involving cash larceny from deposits including lapping and deposits in transit. • Understand controls and procedures that can be used to prevent and detect cash larceny from bank deposits. • Be familiar with proactive audit tests that can be used to detect cash larceny schemes. 4 Larceny Of Cash on Hand From the Deposit Other 5 Cash Larceny • Intentional taking away of an employer’s cash without the consent and against the will of the employer • Fraudulent disbursements • Cash receipt schemes 6 Frequency – Cash Misappropriations 74.1% Fraud Disb 71.1% 28.2% Skimming 31.8% 23.9% Cash Larceny 8.9% 0% 10% 20% 30% 40% 2002 50% 60% 70% 80% 2004 7 Median Loss – Cash Misappropriations $125,000 Fraud Disb $100,000 $85,000 Skimming $70,000 $80,000 Cash Larceny $0 $25,000 $30,000 $60,000 2002 $90,000 $120,000 $150,000 2004 8 Dollar Loss Distribution – Cash Larceny Schemes 1.9% 1.4% 1-999 8.7% 1,000 - 9,999 12.3% 29.1% 10,000 - 49,999 22.8% 14.6% 12.9% 50,000 - 99,999 30.1% 29.2% 100,000 - 499,999 1.9% 500,000 - 999,999 6.8% 13.6% 14.6% 1,000,000 and up 0% 5% 10% 15% All Cases 20% Cash Larc 25% 30% 35% 9 Detection of Cash Larceny Schemes Internal Audit 17.0% Tip from Employee 23.8% 26.6% 23.6% 22.3% 21.3% 22.3% By Accident Internal Control 18.4% 11.7% 10.9% External Audit 4.3% Tip from Customer 7.8% 5.3% 6.2% Tip from Vendor 2.1% Anonymous Tip 5.1% 2.1% 0.9% Law Enforcement 0% 5% 10% All Cases 15% 20% 25% 30% Cash Larc 10 Perpetrators of Cash Larceny Schemes 57.3% Employee 67.8% 42.7% Manager 34.0% 13.6% 12.4% Owner 0.0% 10.0% 20.0% 30.0% All Cases 40.0% 50.0% 60.0% 70.0% Cash Larceny 11 Median Loss by Position $61,000 Employee $62,000 $71,500 Manager $140,000 $1,250,000 Owner $- $900,000 $250,000 $500,000 All Cases $750,000 $1,000,000 $1,250,000 $1,500,000 Cash Larceny 12 Size of Victim 56.0% 1-99 45.8% 19.0% 100-999 21.1% 17.2% 19.8% 1,000-9,999 10,000+ 0.0% 8.0% 13.3% 10.0% 20.0% All Cases 30.0% 40.0% 50.0% 60.0% Cash Larceny 13 Median Loss - Size of Victim $100,000 $98,000 1-99 100-999 $78,500 $161,500 $55,000 1,000-9,999 $87,500 $39,000 $105,500 10,000+ $- $25,000 $50,000 $75,000 All Cases $100,000 $125,000 $150,000 $175,000 Cash Larceny 14 Cash Larceny Schemes • Can occur under any circumstance where an employee has access to cash • At the point of sale • From incoming receivables • From the victim organization’s bank deposits 15 Larceny At The Point of Sale • It’s where the money is • Most common point of access to ready cash • Results in an imbalance between the register tape and cash drawer 16 Larceny Schemes • Theft from other registers – Using another cashier’s register or access code • Death by a thousand cuts – Stealing in small amounts over an extended period of time • Reversing transactions – Using false voids or refunds – Causes the cash register tape to balance to the cash drawer • Altering cash counts or cash register tapes • Destroying register tapes 17 Preventing and Detecting Cash Larceny at the Point of Sale • Enforce separation of duties • Independent checks over the receipting and recording of incoming cash • Upon reconciliation of cash and register tape, cash should go directly to the cashier’s office • Discrepancies should be checked especially if a pattern is identified • Periodically run reports showing discounts, returns, adjustments, and write-offs by employee, department, and location to identify unusual patterns 18 Larceny of Receivables • Theft occurs after the payment has been recorded • Force balancing – Having total control of the accounting system can overcome the problem of out-of-balance accounts – Can make unsupported entries in the books to produce a fictitious balance between receipts and ledgers • Reversing entries – Post the payment and then reverse the entry through “discounts” • Destruction of records – Destroying the records can conceal the identity of the perpetrator even though the fraud has been discovered 19 Cash Larceny From The Deposit • Whoever takes the deposit to the bank has an opportunity to steal a portion of it. • Having controls such as matching the receipted deposit slip to the originally prepared slip does not always prevent theft • Failure to reconcile the slips can foster an environment leading to theft • Lack of security over the deposit before it goes to the bank can also lead to theft 20 Cash Larceny From The Deposit • Deposit lapping – Day one’s deposit is stolen and is replaced by day two’s deposit . . . . • Deposits in transit – Carrying the missing money as a deposit in transit but never clears the bank statement 21 Preventing and Detecting – Cash Larceny From The Deposit • Separation of duties is the most important factor • All incoming revenues should be delivered to a centralized department • Compare the authenticated deposit slip with the company’s copy of the deposit slip, the remittance list, and the general ledger posting of the day’s receipts • Two copies of the bank statement should be delivered to different persons in the organization • Require that deposits be made at a night drop at the bank 22