Leverages - WordPress.com

advertisement

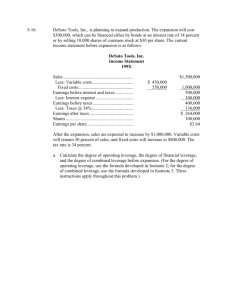

Leverages The ability to influence a system, or an environment, in a way that multiplies the outcome of one's efforts without a corresponding increase in the consumption of resources. In other words, leverage is the advantageous condition of having a relatively small amount of cost yield a relatively high level of returns. What is Leverage? Leverage is the use of fixed costs to magnify the potential return to a firm. Types of fixed costs: fixed operating costs = rent, amortization of equipment and other long-lived assets. fixed financial costs = interest costs from debt. What is Leverage? 3 types of leverage: -- Operating Leverage = the extent to which capital assets and associated fixed costs are utilized -- Financial Leverage = the amount of debt used in the capital structure (debt/equity mix) --Composite Leverage = the entire income of the concern. Balance Sheet___________________ Assets Liabilities and Equity Current Assets Debt (Loans, bonds, leases) operating (interest charges) financial leverage Capital Assets leverage (fixed charges) Equity (Shares) Operating Leverage Operating Leverage -- The use of fixed operating costs by the firm. One potential “effect” caused by the presence of operating leverage is that a change in the volume of sales results in a “more than proportional” change in operating profit (or loss). Impact of Operating Leverage on Profits (in thousands) Sales Operating Costs Fixed Variable Operating Profit FC/total costs FC/sales Firm F Firm V Firm 2F 10 11 19.5 7 2 2 7 1 2 14 3 2.5 .78 .70 .22 .18 .82 .72 Impact of Operating Leverage on Profits Now, subject each firm to a 50% increase in sales for next year. Which firm do you think will be more “sensitive” to the change in sales (i.e., show the largest percentage change in operating profit, EBIT)? [ ] Firm F; [ ] Firm V; [ ] Firm 2F. Impact of Operating Leverage on Profits (in thousands) Firm F Firm V Firm 2F 15 16.5 29.25 Sales Operating Costs Fixed 7 Variable 3 Operating Profit 5 Percentage Change 400% in EBIT* * (EBITt - EBIT t-1) / EBIT t-1 2 10.5 4 100% 14 4.5 10.75 330% Impact of Operating Leverage on Profits Firm F is the most “sensitive” firm -- for it, a 50% increase in sales leads to a 400% increase in EBIT. Our example reveals that it is a mistake to assume that the firm with the largest absolute or relative amount of fixed costs automatically shows the most dramatic effects of operating leverage. Later, we will come up with an easy way to spot the firm that is most sensitive to the presence of operating leverage. Break-Even Analysis Break-Even Analysis -- A technique for studying the relationship among fixed costs, variable costs, sales volume, and profits. Also called cost/volume/profit (C/V/P) analysis. When studying operating leverage, “profits” refers to operating profits before taxes (i.e., EBIT) and excludes debt interest and dividend payments. Break-Even Chart REVENUES AND COSTS ($ thousands) Total Revenues Profits 250 Total Costs 175 Fixed Costs 100 Losses 50 0 Variable Costs 1,000 2,000 3,000 4,000 5,000 6,000 7,000 QUANTITY PRODUCED AND SOLD Break-Even (Quantity) Point Break-Even Point -- The sales volume required so that total revenues and total costs are equal; may be in units or in sales dollars. How to find the quantity break-even point: EBIT = P(Q) - V(Q) - FC EBIT = Q(P - V) - FC P = Price per unit FC = Fixed costs V = Variable costs per unit Q = Quantity (units) produced and sold Degree of Operating Leverage (DOL) Degree of Operating Leverage -- The percentage change in a firm’s operating profit (EBIT) resulting from a 1 percent change in output (sales). DOL at Q units of output (or sales) = Percentage change in operating profit (EBIT) Percentage change in output (or sales) Computing the DOL Calculating the DOL for a single product or a single-product firm. DOLQ units = = Q (P - V) Q (P - V) - FC Q Q - QBE Computing the DOL Calculating the DOL for a multiproduct firm. DOLS dollars of sales = S - VC S - VC - FC = EBIT + FC EBIT Financial Leverage Financial Leverage -- The use of fixed financing costs by the firm. The British expression is gearing. Financial leverage is acquired by choice. Used as a means of increasing the return to common shareholders. EBIT-EPS Break-Even, or Indifference, Analysis EBIT-EPS Break-Even Analysis -- Analysis of the effect of financing alternatives on earnings per share. The break-even point is the EBIT level where EPS is the same for two (or more) alternatives. Calculate EPS for a given level of EBIT at a given financing structure. EPS = (EBIT - I) (1 - t) - Pref. Div. # of Common Shares Financial Leverage Financial Leverage -- The use of fixed financing costs by the firm. The British expression is gearing. Financial leverage is acquired by choice. Used as a means of increasing the return to common shareholders. Impact of Financial Leverage A firm is considering two plans with a view to examining their impact on earnings per share (EPS) the total funds required in assets are Rs 5,00,000. Financial plans Debt (Interest @ 10% p.a) 4,00,000 1,00,000 Equity Shares(Rs 10 each) 1,oo,ooo 4,00,000 Total Finances required 5,oo,000 5,00,000 No. of equity shares 10,000 40,000 The earnings before interest and tax are assumed as Rs. 50,000 , Rs. 75,000 , Rs. 1,25,000 . The rate of tax be taken at 50% . (1) When earnings before interest and tax (EBIT) are Rs. 50,000 plan (1) Earnings before interest and tax (EBIT ) Less : Interest on debt Earnings before tax (EBT) Less : Tax @ 50% Earnings after Interest and tax No. of equity shares Earning per share (EPS) 50,000 40,000 10,000 5,000 5,000 10,000 5,000 10,000 =0.50 Paisa plan (2) 50,000 10,000 40,000 20,000 20,000 40,000 20,000 40,000 =0.50 Paisa (2) When earnings before interest and tax (EBIT) are Rs. 75,000 PLAN (1) Earnings before interest and tax (EBIT ) Less : Interest on debt Earnings before tax (EBT) Less : Tax @ 50% Earnings after Interest and tax No. of equity shares Earning per share (EPS) PLAN(2) 75,000 40,000 35,000 17,500 17,500 75,000 10,000 65,000 32,500 32,500 10,000 40,000 =1.75 =0.81 (3) When earnings before interest and tax (EBIT) are Rs. 1,25,000 PLAN(1) Earnings before interest and tax (EBIT ) Less : Interest on debt Earnings before tax (EBT) Less : Tax @ 50% Earnings after Interest and tax No. of equity shares Earning per share (EPS) PLAN(2) 1,25,000 (40,000) 85,000 (42,500) 1,25,000 (10,000) 1,15,000 (57,500) 42,500 10,000 57,500 40,000 =4.25 =1.438 Impact of Financial Leverage The financial leverage is used to magnify the shareholders earnings. It us based on the assumption that the fixed charges or cost funds can be obtained at a cost lower than the firm’s rate of return on its assets . When the difference between the assets financed by fixed cost funds and the cost of these funds are distributed to the equity stockholders , they will get additional earnings without increasing their own investment . Consequently , the Earning per share (EPS) and the rate of return on equity share capital will go up . The situation in which Earning per share (EPS) and the rate of return on equity share capital will go up , may also be reverse sometimes. if the firm acquires fixed cost funds at a higher cost than the Earnings from those assets . Degree of Financial Leverage (DFL) Degree of Financial Leverage -- The percentage change in a firm’s earnings per share (EPS) resulting from a 1 percent change in operating profit. Percentage change in DFL at earnings per share (EPS) EBIT of X = dollars Percentage change in operating profit (EBIT) Computing the DFL Calculating the DFL DFL EBIT of $X EBIT I PD t = EBIT EBIT - I - [ PD / (1 - t) ] = Earnings before interest and taxes = Interest = Preferred dividends = Corporate tax rate Variability of EPS DFLEquity = 1.00 Which financing method will have the DFLDebt = 1.25 greatest relative DFLPreferred = 1.35 variability in EPS? Preferred stock financing will lead to the greatest variability in earnings per share based on the DFL. This is due to the tax deductibility of interest on debt financing. Importance of financial leverage PLANNING OF CAPITAL STRUCTURE : A financial manager has to decide about the ratio between fixed costs funds and equity share capital. PROFIT PLANNING: EPS is effected by degree of financial leverage . If the profitability of the concern is increasing than fixed costs funds will help in increasing the availability of profits for the equity stockholders . Therefore , financial leverage is important for profit planning . Limitations of financial leverage DOUBLE- EDGED WEAPON . BENEICIAL ONLY TO COMPANIES HAVING STABILITY OF EARNINGS . INCREASES RISK AND RATE OF RETURN . RESTRICTIONS FROM FINANCIAL INSTITUIONS . Both financial and operating leverage magnify the revenue of the firm. Operating leverage affects the income which is result of production. On the other hand, the financial leverage is the result of financial decisions. The composite leverage focuses attention on the entire income of the concern. The risk factor should be properly assessed by the management before using the composite leverage. The high financial leverage may be offset against low operating leverage or vice-versa. The degree of composite leverage can be calculated as follows: Degree of composite leverage (DCL) = Percentage change in EPS Percentage Change in Sales Or, Composite leverage = Operating leverage * Financial leverage Financial Risk Financial Risk -- The added variability in earnings per share (EPS) -- plus the risk of possible insolvency -- that is induced by the use of financial leverage. Debt increases the probability of cash insolvency over an all-equity-financed firm. For example, our example firm must have EBIT of at least $100,000 to cover the interest payment. Debt also increased the variability in EPS as the DFL increased from 1.00 to 1.25. Total Firm Risk Total Firm Risk -- The variability in earnings per share (EPS). It is the sum of business plus financial risk. Total firm risk = business risk + financial risk CVEPS is a measure of relative total firm risk CVEBIT is a measure of relative business risk The difference, CVEPS - CVEBIT, is a measure of relative financial risk Degree of Total Leverage (DTL) Degree of Total Leverage -- The percentage change in a firm’s earnings per share (EPS) resulting from a 1 percent change in output (sales). DTL at Q units Percentage change in (or S dollars) of earnings per share (EPS) = output (or sales) Percentage change in output (or sales) Computing the DTL DTL Q units (or S dollars) = ( DOL Q units (or S dollars) ) x ( DFL EBIT of X dollars ) DTL S dollars = of sales DTL Q units EBIT + FC EBIT - I - [ PD / (1 - t) ] Q (P - V) = Q (P - V) - FC - I - [ PD / (1 - t) ] Summary and Conclusions Leverage refers to the use of fixed costs to magnify the profits (or losses) of a firm. Management must be aware of the level of risk assumed. Operating leverage refers to using fixed operating costs, such as lease or amortization expense. Asset side related. Financial leverage refers to the fixed financing charge such as interest cost on debt. Liability side related. Composite leverage refers to the combination of both financial and operating leverage.