Welcome to the IABC Chapter/Region Finance Guide.

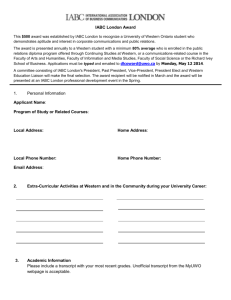

advertisement