Comparing Bertrand and Cournot Competition with Product

advertisement

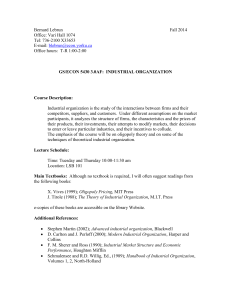

Comparing Bertrand and Cournot Competition with Product Innovation and Licensing Ray-Yun Chang, Hong Hwang and Cheng-Hau Peng To be presented at the IO Workshop The University of Tokyo April 22, 2015 Introduction • Singh and Vives (1984) show that Bertrand competition is more efficient but less profitable for firms than Cournot competition when goods are substitutes. • This standard result has drawn considerable attention and been challenged by sizeable theoretical literature. Related literature • Differentiated goods: Singh and Vives (1984, RAND), Vives (1985, JET), Cheng (1985, RAND) and Okuguchi (1987, JET). • Firm’s R&D behavior: Delbono and Denicolo (IJIO,1990), Reynolds and Isaac (ET,1992), Qiu (JET, 1997); Bonanno and Haworth(IJIO, 1998), Boone(IJIO, 2001), Symeonidis (IJIO, 2003) and Mukherjee (MS, 2011). Related literature • Spatial context: D'Aspremont and Motta (2000), Liang et al (2006, RSUE) • Number of firms: Häckner (2000, JET) Related literature • Labor union: López and Naylor (2004, EER) • Mixed oligopoly: Ghosh and Mitra (2010, EL) Motivation • Empirical evidences have shown that most of the innovations are on product innovation. • Qualcomm licensed its new wireless technology, which is a product innovation, to Motorola (Mock, 2005). • BlackBerry licensed its innovated wireless e-mail services to Nokia (Frankel 2005). • Biovail Corp. licensed from Depo Med, Inc. the rights to manufacture and market a once-daily metformin product that was undergoing Phase 3 clinical trials for Type II diabetes. Motivation • There is a common feature of the above examples: The licensor firms license its product innovation to and compete in the output market with its licensee firm. • This is the first paper that compares the relative merits of Bertrand and Cournot equilibria if one of the firms licenses its product innovation to its rival. Preview of our findings • The licensor always licenses its product innovation to the (potential) rival. • Under the product innovation licensing: 1. the optimal royalty rate under Bertrand competition is definitely higher than that under Cournot competition; 2. market output is smaller but industrial profit is higher under Bertrand than Cournot competition; 3. Bertrand competition is less socially desirable than Cournot competition. Preview of our findings • If the licensee is an incumbent firm, Cournot competition, relative to Bertrand competition, results in higher (lower) social welfare but less (more) producer surplus if the innovation is high (low). Preview of our findings • If the innovator can engage in product R&D to enhance its quality in the long run: 1. The innovator definitely does more product innovation under Bertrand competition than Cournot competition. 2. Bertrand competition becomes more socially desirable than Cournot competition if the R&D efficiency is high. Outline of this paper • Section 2 introduces our basic model, in which the licensee firm is a potential entrant, and compares the relative merits between under Corunot and Bertrand competition. • Section 3 examines the case in which the licensee firm is also an incumbent firm. • Section 4 investigates and compares the long run equilibria in which the licensor firm can carry out product R&D. • Section 5 concludes the paper. THE BASIC MODEL Model settings • Assume there are two firms in the market. Firm 1 is a licensor firm who owns a new innovation and can use it to produce product 1 to be sold in the market. Firm 1 also licenses this know-how to a rival, firm 2, who can use the innovation to produce a differentiated product (called product 2) to be sold in the same market. • The two products though developed by the same innovation, are horizontally differentiated due to different plant locations or brand names. Model settings • Following Singh and Vives (1984), the demand and the inverse demand functions for the two products are specified as follows: qi qi ( pi , p j ) a( f h) fpi hp j f h 2 2 , and pi pi ( qi , q j ) a fqi hq j , (1) for i, j 1, 2; i j, where qi and pi are the outputs for firm i, a is the price intercept and f denotes the self-price effect which greater than h , the cross-price effect. Model settings • Firm 1 licenses its product innovation to firm 2 via a two-part tariff licensing contract, i.e., an upfront fee (F) plus a per-unit royalty ( r). • Following Singh and Vives (1984), we assume the marginal costs of the two firms to be nil for simplicity. • Before licensing, firm 1 is a monopolist in the market, earning a monopoly profit ( 1M ). After licensing, the market becomes that of differentiated duopoly. Game structure • The game in question consists of two stages. • First stage: firm 1 chooses the optimal royalty and fixed fee and firm 2 determines whether or not to accept the licensing contract. • Second stage: the two firms compete in either Bertrand or Cournot fashion. • The sub-game perfect Nash equilibrium is solved through backward induction. • We begin our analysis by considering the Cournot regime first, followed by the Bertrand regime. THE COURNOT EQUILIBRIUM The profit functions in the output stage • The profits of firm 1 and firm 2 under the Cournot regime are specified respectively as follows: 1 p1q1 rq2 F , (2) 2 p2 r q2 F , (3) where variables with a superscript “C” indicate that they are associated with the Cournot regime. Equilibrium and comparative statics • By routine calculus, we have: 1 p p1 1 q1 0 q1 q1 , (4) 2 p p2 r 2 q2 0 . q2 q2 (5) • The second-order and the stability conditions are all satisfied. • The comparative static effects are derivable from and as follows: q r h (4 f h ) 0 , C 1 2 2 q r 2 f (4 f h ) 0. C 2 2 2 Figure 1. The reaction functions under Cournot q2 R1 C C0 R2 r r 0 C1 R2 0 D q1 r r1 The objective function in the first stage • The profits of firm 1 in the first stage can be expressed as follows: Max 1C q1C ( r ), q2C ( r ), F ( r ), r p1q1 rq2 F, r (9) s. t. r , F 0 . • We assume that the licensor firm can extract the entire rent of licensing accruing to the licensee firm. Hence, the fixed fee charged by the licensor firm is as follows: F (q1C (r), q2C (r ), r ) p2 r q2 2M p2 r q2. (8) The optimal licensing contract • By differentiating (9) with respect to r and applying the envelope theorem, we can derive the first-order condition for profit maximization as follows: q2C p2 C q1C 1 1 q2C 1 F 1 p1 C C q1 r q2 r q2 r F r r q2 r q1 r (hq r )(q C 1 C 2 r ) hq (q C 2 C 1 r )=0 . The Cournot equilibrium • The optimal royalty rate is: C C C C h [ q ( q r )+ q ( q C 1 2 2 1 r )] r 0 C (q2 r ) . (10) • In addition, by comparing the profits of firm 1 before and after licensing with Cournot competition, we can derive that 1C 1M a 2 ( f h )2 f (4 f 2 3h 2 ) 0 . (11) • Thus, product licensing necessarily occurs under Cournot. Figure 2. The equilibria under Cournot and Bertrand q2 q1 q2 B C G C* B* 0 E D q1 THE BERTRAND EQUILIBRIUM Equilibrium of the output stage • By substituting the demand functions into (1) and (2), then differentiating (1) and (2) with respect to p1 and p2 respectively, we have: 1 q q q1 p1 1 r 2 0 . p1 p1 p1 (11) 2 q q2 p2 r 2 0 . p2 p2 (12) • The comparative static effects are as follows: p1B r 3hf (4 f 2 h 2 ) 0 p2B r (2 f 2 h 2 ) (4 f 2 h 2 ) 0 Figure 3. The reaction functions under Bertrand q2 R1 r r R1 r r0 1 B B0 R2 r r0 R2 r r1 B1 0 E q1 Equilibrium in the first stage • The object function for firm 1 is specified as follows: Max 1B p1B ( r ), p2B ( r ), F ( r ), r p1q1 rq2 F , r (11) s. t. r , F 0 . • By routine calculus, we can derive that: p1B q1 p2 p2B r p2B q2 p1 p1B r 0 rB . B B q2 p1 p1 r q2 p2 p2 r (12) Equilibrium in the first stage • By comparing the profits of firm 1 before and after licensing under Bertrand competition, we can derive that: B 1 a ( f h)(h f ) 0 2 2 . f ( f h)(5h 4 f ) 2 M 1 2 2 Figure 2. The equilibria under Cournot and Bertrand q2 q1 q2 B C G C* B* 0 E D q1 Proposition 1 The licensor firm always licenses its product innovation to a potential rival. Intuition: 1. As the two products are differentiated, the market profit increases if both products are available. 2. The licensor firm can use the royalty to reduce the competition from the licensee firm and the fix fee to extract the rent accruing to the licensee firm. Comparison on the optimal royalty rates • By comparing and , we can derive that r r 4ah B C 2 f h 4 f 2 h 2 f 4f 2 +5h 2 4f 2 3h 0 . 2 Proposition 2 The optimal royalty rate under Bertrand competition is definitely higher than that under Cournot competition. Intuition: 1. The objective of firm 1 in the first stage of the game is to maximize the market profits. 2. Relative to the output which maximizes the market profit, the output under the Bertrand (Cournot) equilibrium is much too high (too high). As a result, the licensor firm would set a high (low) royalty. Comparison on the output and profit levels • By comparing the equilibrium outputs under the two regimes, it is found that 2 2 2 ah ( f h )(4 f 8 hf h ) C B Q Q 0 2 2 2 2 f (4 f 5h )(4 f 3h )( f h) . • By substituting the equilibrium outputs, prices and licensing contracts into the corresponding profits of the licensor under the two regimes, we can derive that 2 4 2 a h ( f h) B C 1 1 0. 2 2 2 2 f (4 f 5h )(4 f 3h )( f h) Proposition 3 With new product licensing, market output is smaller but market profit is higher under Bertrand than Cournot competition. Intuition: The higher royalty rate under Bertrand decreases the market output, increasing the market profit. Proposition 4 If the licensee is a potential entrant, Cournot competition is socially more desirable than Bertrand competition. Intuition: The market outputs are lower under Bertrand competition, leading to higher market prices and lower social welfare. PRODUCT INNOVATION AND LICENSING UNDER DUOPOLY The licensee firm is an incumbent • In this section, we assume that the licensee firm (i.e., firm 2), also being an incumbent. • Firm 2 has an incentive to acquire the technology from the licensor firm as it can raise the demand for its product. We will investigate whether our results remain robust in this context. • Before licensing, firm 2 produces a differentiated product. The demand and inverse demand functions of firm 1 and firm 2 are the same as those in , except that the price intercept of the 2 2 afh (2 f h ) b a. demand of firm 2 is b where Proposition 5 If the licensee is an incumbent firm, Cournot competition is more efficient but less profitable for firms than Bertrand competition, if the innovation level is high. The converse is true if the innovation degree is low. Intuition: 1. If is b equal to a , firm 2 has no incentive to buy the technology. Our result is the same as that in Singh and Vives (1984). 2. If b is equal to zero (i.e., there is no demand for product 2 before licensing), the model degenerates to the case with a potential entrant. 3. There exists a critical value of b, below which Bertrand competition is less socially desirable but more profitable than Cournot competition. INNOVATION AND WELFARE Endogenous innovation • In the long run, a licensor can determine its product innovation endogenously which increases the price intercept of its demand from a to a a . Thus, the demand and the inverse demand functions for the two products are re-written as follows: pi pi ( qi , q j , ; a ) a fqi hq j, and qi qi ( pi , p j ) (a )( f h) fpi hp j f 2 h2 , for i , j 1, 2; i j . Endogenous innovation • The product R&D cost function is specified by v 2, where v reflects the R&D efficiency and a higher indicates lower R&D efficiency. Game structure • The game in question now encompasses three stages. • The last two stages are the same as those in the previous section. • We need to work out only the first-stage game: Firm 1 determines its optimal product innovation. We will compare the optimal product R&D levels and the resulting welfare levels under the two competition modes. The objective functions in the first stage • In the first stage, the profit functions of firm 1 under Cournot and Bertrand competition can be specified respectively as follows: Max 1C q1C ( ), q2C ( ), r ( ), F ( ), (a fq1C hq2C )q1C rq2C F v 2 Max 1B p1B ( ), p2B ( ), r ( ), F ( ), p1B ( (a )( f h) fp1B hp2B f 2 h2 )r (a )( f h) fp2B hp1B f 2 h2 F v 2 . The optimal product investments and comparisons • The optimal product innovations under Cournot and Bertrand competition as follows: 2 2 a (8 f 8 fh h ) C 4 fv(4 f 2 3h 2 ) (8 f 2 8 fh h 2 ) 2 2 3 a (8 f 9 fh h ) B 4 fv( f h)(4 f 2 5h 2 ) (8 f 2 9 fh 2 h 3 ) • Thus, we derive that 4 32 avfh ( f h) B C 0. 2 2 2 2 2 2 2 2 3 4 fv(4 f 3h ) (8 f 8 fh h ) 4 fv( f h)(4 f 5h ) (8 f 9 fh h ) Proposition 6 • The licensor firm will do more product innovation under Bertrand than Cournot competition. This finding is contrary to that in Qiu (1997), Bonanno and Haworth (1998) and Symeonidis (2003). Qiu (1997) and Bonanno and Haworth (1998) consider costreducing R&D whereas Symeonidis (2003) considers product R&D; they all conclude that Cournot competition induces a higher R&D expenditure than Bertrand competition. Proposition 6 Intuition: 1. For a given technology, firm 1 makes more profits under Bertrand competition. This implies that the marginal benefit from product innovation is higher. 2. Given the same innovation cost function, the innovation level is necessarily higher under Bertrand than Cournot competition. Welfare comparison • We can calculate social welfare under the two regimes and derive that sw sw ()0 if v ( )v C B Proposition 7 In the long run, Bertrand competition is socially more (less) desirable than Cournot competition if the R&D efficiency is high (low). Intuition: By Proposition 6, firm 1 always invests more on innovation under Bertrand competition which benefits social welfare. If the R&D efficiency is high, this beneficial effect becomes significant, making Bertrand competition socially more desirable than Cournot competition. Summary Short run Potential Entrant Long run Duopoly Innovation levels Royalty rates Producer surplus Social welfare Potential Entrant B C r r B ps ps B B C ps B () ps C C sw sw C r r C B swC () swB r B rC ps B ps C swC () swB Thank you Comments and suggestions are welcome