pob check writing endorsements

advertisement

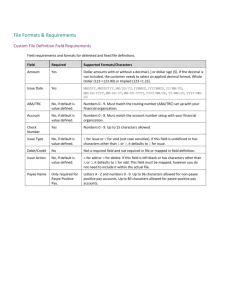

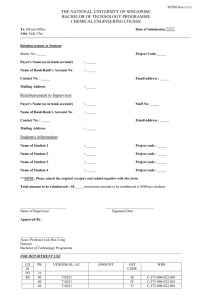

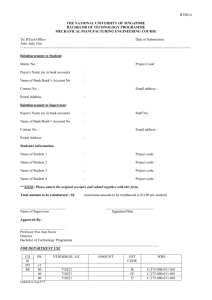

4.02 C Check Writing & Endorsements Students will understand and apply steps in writing checks & appropriately endorsing checks. Parts & Parties to a Check/Share Draft Drawer’s Name & Address Joint Account 3. Payee ABA # Check Number 2. Check Date Melanie Paige Charles Paige 619 Main Street Raleigh, NC 27601 319 2-131/1034 July 16, 2010 Pay To the Order of _____Donnie Tatum______________________$100.50 _One hundred and 50/100 ---------------------------------------------------DOLLARS 4- numeri State Credit Union 5- amount in words For _______________ Charles Paige 2131/1034:78434 234320 100.50 07-18-2010 2251 6. Memo Bank Name - Drawee 7. Drawer’s Signature Last item completed on check! MICR Banking #s Parties to a Check/Share Draft* Drawer owner of the account who signs the check Drawee bank or other financial institution that pays a check presented for payment Payee person to whom the check is written Checking accounts are a legal contract between drawer and drawee. Drawer demands action from the drawee. Examples of demands: Process check from account Accept deposits into account *Share Drafts are issued by credit unions, but process like a check. Check Writing Procedures 1. 2. 3. 4. 5. Write information in the check register first, (ensure checks are written in numerical order) Write the date the check is written. Write the payee’s name. Write in the numerical amount of the check. Write in the amount of the check in words. *Numeric and amount in words should match 6. 7. Write in the purpose of the check in memo section Sign the check using authorized signature. Keep Accurate Records! Check Register Balance To keep a continuous or running balance: Start with beginning balance , then record + deposits - checks written - debit card transactions - ATM transactions - service fees charged = Ending Balance How Do I Know the Amount in my Checking Account? Keep a Check Register or Check Stub* Continuous Balance a. Subtract checks written (or debit card transactions) from balance b. Add deposits to balance c. Keep a running balance after writing checks or making deposits *Check stub is part of check that stays in check book. Check details and a continuous “running” balance is maintained. • Check Register/stub is YOUR documentation of how much money is in your account? • What if mistakes are made? You will make corrections when you reconcile (balance) bank statement • Check Endorsements Definition: Signature of the payee on the back of a check, may include additional instructions allows the payee to cash the check, deposit the check or transfer payment of the check to someone else. Different types of endorsements: What type of endorsement should I use ? 1. Blank – to cash check 2. Restrictive – to deposit check into account, or 3. Full/special – to transfer payment of the check to someone else * Endorsement provides legal proof that the payee received the funds 7 Endorsements How should a check be endorsed? Endorser (payee who is signing) should sign the check the way it is on the front of the check and if the name is misspelled, correct the signature directly up under the first endorsement Blank Endorsements Signed with endorser’s name only (endorser is payee from front of check) Can be cashed by anyone who holds the check with a blank endorsement! Don’t use blank endorsement before you are ready to cash or deposit! Should match payee’s name X Jane Doe DO NOT WRITE BELOW THIS LINE Special/Full Endorsement Transfers payment of a check to someone else. Payee signs check , then writes “pay over to” another person Can be used to make payment on a debt Juan is payee on check Juan owes Maria money Juan transfers payment to Maria. Debt = money owed Might also endorse: Juan Delgado pay over to Maria Fernandez Full/Special Endorsement Example Transfers payment to someone else Payee signs the check over to another person to receive payment X Pay to the order of Jane Doe John Doe Who was payee on check? John Who was the check transferred to? Jane DO NOT WRITE BELOW THIS LINE 11 Restrictive Endorsement Limits use of the check so it can be deposited only to endorser’s account. Safest type of endorsement Cannot be cashed by a thief or someone who finds the check Best to use when mailing a check for deposit or when using the ATM for deposit. Stamp often used by businesses for speed and convenience