Impact of Macroeconomic Announcements on Exchange Rates

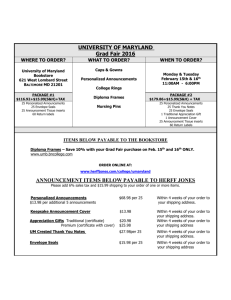

advertisement

Impact of Macroeconomic

Announcements on Exchange

Rates

BY: VIGNESH NATHAN

ADVISOR: ANDREW PATTON

Motivation

“…the disappointing [unemployment] data initially sent the Dow

Jones Industrial Average down 160 points”

-Wall Street Journal, 8/7/2011

However, the effects of a negative (or positive) announcement is

very short-lived.

“…but it recovered to end the day off 21 points to 10,653.56.”

Research Question: How influential are certain types of

macroeconomic news on asset prices, and how long-lived is their

effect?

Basic Ideology

Initial Foreign

Exchange Rate

Reactionary

Foreign

Exchange Rate

Macroeconomic

Announcement

5 minutes

5 minutes

• It is a central assumption of this study that within this 10-minute interval, the

announcement drives all foreign exchange trading and is responsible for all

resulting fluctuations in prices.

• For this precise reason, we can treat the announcement as a “natural

experiment.” This will allow me to use a relatively simple model.

Methodology

The model is incredibly simple:

Rt = α + βSt + ut

Where,

Rt is the ten minute return on the currency, given by:

Rt = ln(FXt+5min) – ln(FXt-5min)

St is the announcement surprise, given by:

St = Announcementt - Expectationt

ut is the error term.

Canadian Unemployment Rate Announcement Effects

0.01

Denotes a

depreciation of

the Canadian

dollar.

Ten Minute Return

0.005

-0.005

0

-0.004

-0.003

-0.002

-0.001

0

0.001

0.002

0.003

0.004

Denotes an

appreciation of

the Canadian

dollar.

-0.005

-0.01

-0.015

Unemployment Rate Surprise

0.005

y = 1.0193x - 0.0004

R² = 0.1697

Canadian Monthly Retail Sales Announcement Effects

0.008

0.006

0.004

Denotes a

depreciation of

the Canadian

dollar.

y = -0.1944x + 9E-05

R² = 0.47

Ten Minute Return

0.002

-0.03

0

-0.02

-0.01

0

0.01

-0.002

-0.004

-0.006

-0.008

Montly Retail Sale Rate Surprise

0.02

0.03

Denotes an

appreciation of

the Canadian

dollar.

Summary Statistics for All Announcements

A. Overall

Inflation

Unemployment

Constant

t-stat

Slope

t-stat

R-squared

#

Observations

GDP

Retail Sales

MoM, Core

MoM, Headline

YoY, Core

YoY, Headline

-0.0003731 -0.0001296

0.0000877

0.0002

0.000095

0.000179

0.0001036

0.45

0.80

0.38

0.71

0.41

-0.1944157 -0.4523274

-0.4543301

-0.440118

-0.4199538

-0.90

-0.56

1.019261 -0.4176449

3.73

-3.31

-7.65

-3.48

-3.60

-3.50

-3.25

0.1697

0.1402

0.47

0.1529

0.1623

0.1548

0.1362

70

69

68

69

69

69

69

Conclusion: Interestingly, all announcements have statistically significant effects

on the foreign exchange market.

The unemployment rate seems to be the most powerful and sought-after

announcement, with a slope that doubles that of the next most influential

announcement.

Asymmetric Response

Very widely cited phenomenon in finance, states that

foreign exchange markets respond in an unbalanced

manner to different types of surprises, either given by its

value (positive vs. negative, large vs. small) or its

environment (good times vs. bad times)

Asymmetric Response Tests

Positive Surprises

Negative Surprises

Large Surprises (St > median[abs{St}])

Small Surprises (St <= median[abs{St}])

Pre-Recession (Pre-January 2008)

Recession (Post-January 2008)

Pre-Recession, Positive

Pre-Recession, Negative

Recession, Positive

Recession, Negative

Observations – Asymmetric Response

Pre-recession announcements are significantly more

influential than those made during the recession.

“Bad news”—positive surprises of unemployment

and negative surprises of anything else—tend to have

bigger impacts than “good news”

This was true for unemployment, YoY Core/Headline inflation

Large surprises have disproportionately big effects

compared to small surprises.

For most macroeconomic announcements, small surprises

were not statistically significant.

Future

Perform the same analysis, using identical announcements, for three other

countries.

Other Countries

Australia

USD-AUD

United Kingdom

USD-GBP

United States

USD-EUR

USD-AUD

USD-GBP

USD-CAD

Troubleshooting/Questions

Asymmetric Response: How few observations is too

few?

What are the weaknesses of only using one exchange

rate to study certain currencies?

How frail is the assumption that the announcement

is the most significant driver of foreign exchange

movements over the surrounding 10-minute

interval?

Should I expand the time horizon?

Why are announcements less influential during the

recession?