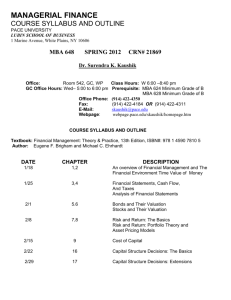

Course Catalog - Emory Goizueta Business School Intranet

advertisement