Expansionary fiscal policy

advertisement

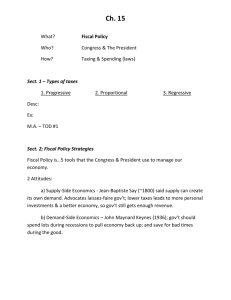

1. Explain what the federal funds rate is. 2. Why does the government use expansionary monetary policy? 3. What is cyclical asymmetry? 4. If a bank has $100,000 in deposits and a 10% reserve requirement—how much does it have to hold in reserve? 5. Draw an AS/AD graph that shows in increase in AD. Make sure to label correctly and include the equilibrium points. 6. Extra Credit—What is demand-pull inflation? Quiz Video Clip • http://www.youtube.com/watch?v=1qhJ PqyJRo8 Fiscal Policy Chapter 12 • Fiscal policy is the idea that the government can influence the economy through taxation and/or government spending • Employment Act of 1946—requires the government to use all reasonable measures to keep unemployment under control • Act established the Council of Economic Advisors (CEA)—assists the President on economic issues • Established the Joint Economic Committee (JEC) to investigate national economic problems Legislative Mandates • There are two types of fiscal policy • Discretionary—optional, government chooses to do it • Indiscretionary—occurs automatically or independent of government choice • During the first part of the chapter we are only talking about discretionary • Expansionary fiscal policy uses increased government spending or a decrease in taxes to push the economy out of recession • There are 3 tools the government can use under fiscal policy: 1. 2. 3. Increase spending Cut taxes Some combinations of the two Fiscal Policy and the AD-AS Model • If the budget is balanced, using fiscal policy will lead to a budget deficit—why? • Because an increase in spending and/or a decrease in taxes with nothing else changing means you go negative • If the government increases spending, AD will shift to the right • Be aware that the multiplier effect applies • For example if RGDP was at $490B and the government increased spending by $5B—RGDP would only increase to $495B temporarily • After the multiplier effect it would increase even more Fiscal Policy and the AD-AS Model • For example—say our marginal propensity to consume (MPC) = 0.75 • Remember the multiplier effect = 1 ÷(1-MPC) • So…1 ÷(1 – 0.75) = 4 • If our original increase in government spending was $5B and our multiplier effect is 4, what will our final increase in the economy look like • $5B ×4 = $20B Fiscal Policy and the AD-AS Model PL G $5B AS multiplier P1 This model shows an overall increase of $20B in the economy after the multiplier effect AD2 AD1 $490 $510 RGDP Fiscal Policy and the AD-AS Model • The increase to $510B would result in the economy pulling out of a recession and a decrease in unemployment that occurred during the recession because there is now money to help hire people • You can also use tax cuts to accomplish the same goals • You will have to cut taxes by more ($6.67B) to accomplish the same result because people will save (MPS) so much • The larger the MPS/smaller the MPC the more taxes you have to cut to get the same affect as raising government spending • The government could also combine these two policies to achieve results Fiscal Policy and the AD-AS Model • When demand-pull inflation occurs the government will implement contractionary fiscal policy • In this case the government cuts spending, increases taxes, or a combo of both to control inflation • IF INFLATION, THEN: • G↓ .: AD .: RGDP↓ & PL↓ .: u%↑ OR • T↑ .: DI↓ .: C↓ .: AD .: RGDP↓ & PL↓ .: u%↑ • IF UNEMPLOYMENT, THEN: • G↑ or T↓, then AD shifts causing PL and RGDP which causes u% Fiscal Policy and the AD-AS Model T $5B PL AS multiplier P1 AD2 $500 $520 This model shows an overall decrease of $20B in the economy after the multiplier effect AD1 RGDP Fiscal Policy and the AD-AS Model • There are two ways the government can get money to expand • They can borrow money (sell interest bearing bonds) but then they are competing with private companies which creates new demand and will raise interest rates—when interest raises, consumer spending will drop which will weaken the expansionary effect • The can create new money—new money will allow them to spend without immediately affecting consumption; however, it will likely cause an increase in inflation Fiscal Policy and the AD-AS Model • Demand-pull inflation calls for contractionary fiscal policy which is achieved by either: • Debt reduction—if the government has a surplus of money then inflation will occur. To offset that, they can use the surplus to pay their debts (buy back bonds). In doing so, it will drive down interest rates, drive up consumption and cause more money to circulate which minimizes the effect they were going for. • Impounding—means they let the surplus sit idle, if they aren’t put back into the economy via spending, then it will bring inflation back down Fiscal Policy and the AD-AS Model • So, which is better? Government spending increases or tax cuts… • It depends on your point of view • Democrats tend to believe that government spending should be used to deal with unmet social needs—this results in an increase in the size of the government • Republicans tend to believe that the government is too large and thus tax cuts should be used—this results in a decrease in the size of the government Fiscal Policy and the AD-AS Model • Government taxes may also be nondiscretionary— meaning that some tax increases occur naturally within the business cycle • If the GDP goes up so will the revenue made from taxes (a.k.a. sales taxes brings in more money because people buy more, or income tax revenue increases because people make more money) • Consequently, if GDP goes down “negative taxes” (transfer payments), such as welfare, unemployment, and subsidies go up • The US Tax System is a built-in stabilizer—Congress doesn’t have to change anything to react to recessions or inflations Built-In Stability Government Spending and Taxation Deficit Built-In Stability • A progressive tax will increase with GDP where T as a regressive tax will decrease Surplus when GDP rises G • The more progressive taxes are the greater the builtin stability is RGDP • A regressive tax is one that puts more of the burden on people from lower incomes • Sin tax because people from the lower class purchase those products more than upper class • A progressive tax is one that puts more of the burden on people from higher incomes • The income tax system (higher wages are taxed at a higher percentage, while lower wages are taxes at a lower percentage) • A proportional tax is neutral • Fair tax or flat tax • Built-in stabilizers cannot do all the work, fiscal or monetary policy is required to stabilize when the economy slips Built-In Stability • There are many problems when trying to enact fiscal policy • Recognition lag—how long it takes to become aware of a problem existing • Administration lag—Congress and the President are slow to act • Meanwhile, the Fed acts quickly • Operational lag—government planning (regarding spending) take a long time—building roads, etc. • You also have to include political consideration— politicians want to get reelected • They will spend more in election time to look productive, spend less after the election Problems, Criticisms, and Complications • Other problems with fiscal policy: • Future policy reversals—if the people think the tax cuts will go away, they will save more making the policy less effective • Offsetting state and local finance—when the federal government moves one direction and the state moves the other way • Crowding-Out effect • A possible side-effect of increased government spending and reduced taxes is a budget deficit which may lead to the ‘crowding-out’ of Gross Private Investment (IG) and Net Exports (XN) Problems, Criticisms, and Complications • The Crowding Out effect results in the following linkage: • G (or T ): G borrows $: Sm : i : Ig • When investments go down, instead of expanded the economy (as was hoped for in increasing spending) the overall GDP will go down • NOTE: interest sensitive consumption could go down as well • Crowding-Out results in businesses being stifled by government spending Problems, Criticisms, and Complications Crowding out Problems, Criticisms, and Complications Crowding Out