ACCOUNTING POLICY: Property and equipment Property and

advertisement

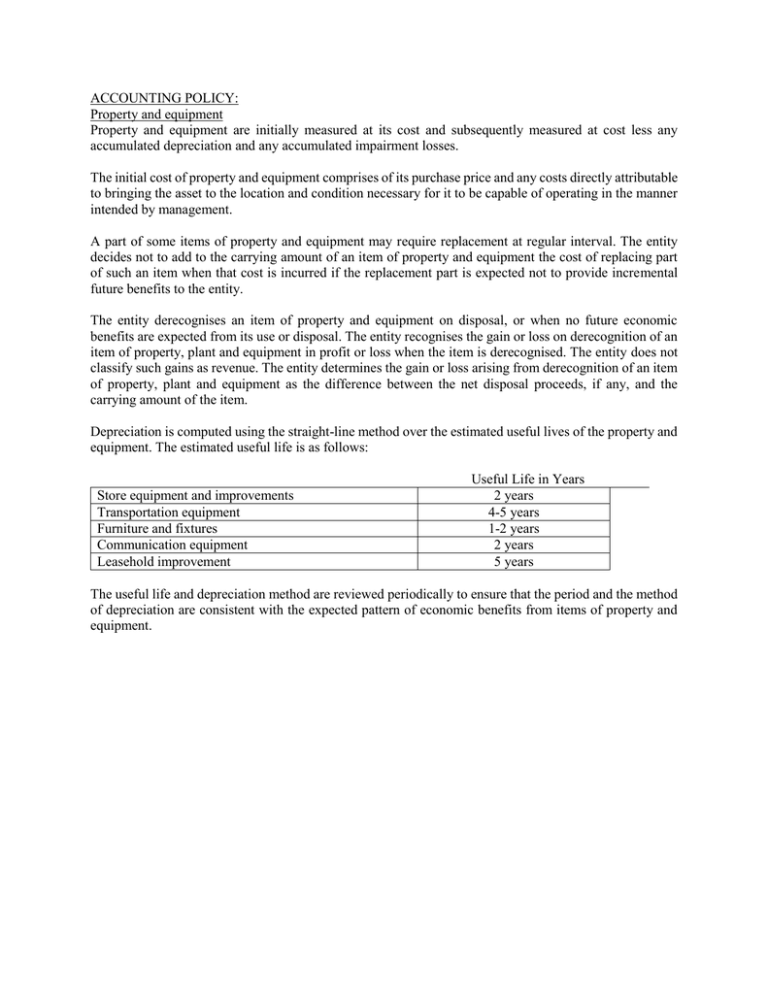

ACCOUNTING POLICY: Property and equipment Property and equipment are initially measured at its cost and subsequently measured at cost less any accumulated depreciation and any accumulated impairment losses. The initial cost of property and equipment comprises of its purchase price and any costs directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management. A part of some items of property and equipment may require replacement at regular interval. The entity decides not to add to the carrying amount of an item of property and equipment the cost of replacing part of such an item when that cost is incurred if the replacement part is expected not to provide incremental future benefits to the entity. The entity derecognises an item of property and equipment on disposal, or when no future economic benefits are expected from its use or disposal. The entity recognises the gain or loss on derecognition of an item of property, plant and equipment in profit or loss when the item is derecognised. The entity does not classify such gains as revenue. The entity determines the gain or loss arising from derecognition of an item of property, plant and equipment as the difference between the net disposal proceeds, if any, and the carrying amount of the item. Depreciation is computed using the straight-line method over the estimated useful lives of the property and equipment. The estimated useful life is as follows: Store equipment and improvements Transportation equipment Furniture and fixtures Communication equipment Leasehold improvement Useful Life in Years 2 years 4-5 years 1-2 years 2 years 5 years The useful life and depreciation method are reviewed periodically to ensure that the period and the method of depreciation are consistent with the expected pattern of economic benefits from items of property and equipment. 10. PROPERTYAND EQUIPMENT No. 4 (replacement of roof with identified original cost of roof) Property and equipment consist of the following: 2007 Building 12.31.2006 2,500,000 Additions 250,000 Derecognition (200,000) 12.31.07 2,550,000 Less Accumulated depreciation: Building 1,250,000 140,000 (100,000) 1,290,000 110,000 (100,000) 1,260,000 Net carrying amount 1,250,000 No. 5 (replacement of roof with unidentified original cost of roof) Property and equipment consist of the following: 2007 Building 12.31.2006 2,500,000 Additions 250,000 Derecognition (250,000) 12.31.07 2,500,000 Less Accumulated depreciation: Building 1,250,000 137,500 (125,000) 1,262,500 112,500 (125,000) 1,237,500 Revaluation 4,000 12.31.07 12,000 1,000 3,000 3,000 9,000 Revaluation 1,000 12.31.07 9,000 (2,000) 0 3,000 9,000 Net carrying amount 1,250,000 No. 6 (with revaluation using proportional method) Property and equipment consist of the following: 2007 Machinery 12.31.2006 8,000 Additions Less Accumulated depreciation: Machinery 2,000 Net carrying amount 6,000 (with revaluation using elimination method) Property and equipment consist of the following: 2007 Machinery 12.31.2006 8,000 Less Accumulated depreciation: Machinery 2,000 Net carrying amount 6,000 Additions No. 7 (with increase and decrease in revaluation) Property and equipment consist of the following: 2005 Equipment 12.31.2004 5,000 Additions Less Accumulated depreciation: Equipment 2,000 Net carrying amount 2006 Equipment 3,000 12.31.2005 8,000 2007 Equipment 4,000 12.31.2006 8,000 2008 Equipment 3,200 12.31.2007 8,000 1,200 4,000 (800) 4,200 4,000 2,400 Revaluation 12.31.06 8,000 800 4,800 (800) 3,200 Revaluation 12.31.07 8,000 800 5,600 (800) 2,400 Additions Less Accumulated depreciation: Equipment 5,600 Net carrying amount 800 Additions Less Accumulated depreciation: Equipment 4,800 Net carrying amount 12.31.05 8,000 Additions Less Accumulated depreciation: Equipment 4,000 Net carrying amount Revaluation 3,000 Revaluation (4,500) 12.31.08 3,500 350 (3,150) 2,800 (350) (1,350) 700 No. 8 (with decrease and increase in revaluation) Property and equipment consist of the following: 2005 Land 12.31.2004 5,000 Additions Revaluation (1,000) 12.31.05 4,000 2008 Land 12.31.2007 4,000 Additions Revaluation 1,500 12.31.08 5,500 No. 9 (with impairment) Property and equipment consist of the following: 2006 Equipment 12.31.2005 1,200,000 Additions Less Accumulated depreciation: Equipment 640,000 Net carrying amount 560,000 Impairment 12.31.06 1,200,000 72,025 199,875 911,900 72,025 199,875 288,100 11. Income tax expense and income tax payable Income tax computation Profit per books Add: Depreciation of revaluation Taxable profit Tax rate Tax due P269,491 214,164 483,655 30% 145,097